CFD Trading in Denmark

Denmark’s thriving economy and high standard of living make it an attractive hub for traders. With over 5.9 million people and a strong innovation and tech culture, more Danes are trading contracts for difference (CFDs).

In this beginner’s guide to CFD trading in Denmark, we explore how the country’s regulations and economy make it an ideal place to deal CFDs, while offering insights into the risks to help you navigate this market.

Quick Introduction

- Unlike stocks, where you acquire ownership in a company, such as Novo Nordisk, CFDs enable leveraging positions, with higher potential risks and rewards for a small cash deposit.

- CFD trading in Denmark is overseen by the Danish Financial Supervisory Authority (DFSA), a ‘green-tier’ regulator under DayTrading.com’s Regulation & Trust Rating, meaning that you can expect good protection, notably retail leverage limits of 1:30.

- Profits from CFD trading are generally considered capital gains tax by the Danish Tax Agency (Skattestyrelsen), ranging from 27% to 42%, depending on your income bracket.

Best CFD Brokers in Denmark

Through extensive tests, we've pinpointed these 4 platforms as the top picks for CFD traders in Denmark:

How Does CFD Trading Work?

CFDs differ from traditional assets like stocks and cryptocurrencies because they are derivative products, allowing you to speculate on price movements without owning the underlying asset.

You enter into a contract with a broker to exchange the difference in the price of an underlying asset between the opening and closing of a trade. It’s fast-paced, high-risk and popular with short-term traders.

This dynamic trading method can provide access to a range of Danish, European and global markets, including:

- Danish stocks on the Nasdaq Copenhagen (formerly known as the Copenhagen Stock Exchange)

- Danish currency pairs like the DKK/USD and DKK/EUR and majors like USD/EUR and USD/JPY

- Commodities like wheat given the country’s prominent agricultural sector

- Index CFDs like OMX Copenhagen 25 and the US S&P 500

It’s important to remember that CFD trading incurs costs like spreads, commissions, and overnight fees (if you don’t day trade).These trading fees tend to be higher on less liquid financial instruments like DKK currency pairs, which may impact the profitability of trading strategies.

Is CFD Trading Legal In Denmark?

CFD trading is legal in Denmark and is governed by a comprehensive regulatory framework established by the Danish Financial Supervisory Authority (DFSA), ensuring that brokers comply with EU regulations and local laws to protect traders.

As a member of the European Union, Denmark follows guidelines set by the European Securities and Markets Authority (ESMA). These guidelines include:

- Leverage Restrictions: Retail traders can leverage up to 1:30 for major currency pairs, 1:20 for non-major pairs and indices, and 1:10 for commodities. This is to protect investors from excessive risk.

- Negative Balance Protection: Brokers must implement negative balance protection that prevents clients from losing more than their initial investment, ensuring that retail traders cannot incur debt beyond their trading capital.

- Investor Protection: Brokers must provide clear information regarding the risks associated with CFD trading, including potential losses due to leverage. They must also maintain client funds in segregated accounts to protect investors’ capital.

The DFSA frequently warns investors about the risks associated with CFD trading, emphasizing the potential for significant financial losses, mainly due to high leverage.

They advise you to fully understand the risks before engaging in CFD trading:

- Restrictions on Marketing: In line with ESMA regulations, there are restrictions on how brokers can market CFD products to retail investors. This includes prohibiting misleading advertisements that downplay the risks involved in trading CFDs.

- Ongoing Monitoring: The DFSA actively monitors the market for unregulated brokers and fraudulent schemes. They have warned against non-compliant brokers operating without the necessary licenses and licenses.

- Education Initiatives: The DFSA promotes financial literacy among consumers, helping you understand the complexities and risks of trading leveraged products like CFDs.

Is CFD Trading Taxed In Denmark?

In Denmark, profits from CFD trading are subject to taxation, with different rules applying to casual investors and professional traders.

Non-professional traders are liable to pay 27% on the first DKK 61,000 on the total income from shares and 42% on the shares over DKK 61,000.

Losses can be deducted against capital gains from financial investments like stocks or CFDs.

For professional traders, CFD profits are treated as business income and are subject to higher income tax rates of up to 52%, depending on overall earnings and local tax brackets.

The Danish Tax Agency (Skattestyrelsen) requires accurate reporting of CFD trades, including profits and losses.

A CFD Trade In Action

Let’s explore a hypothetical scenario where I day trade healthcare giant Novo Nordisk (NVO), Denmark’s largest company with a market cap of over $500 billion.

I’m using CFDs so I don’t have to buy shares directly and so that I can leverage my potential returns with a small outlay.

Event Background

Novo Nordisk released its quarterly earnings report.

The manufacturer of the weight-loss drug Wegovy and the diabetes medication Ozempic reported a 31% increase in sales when measured in Danish kroner and a 36% increase at constant exchange rates, reaching a total of 232.3 billion kroner ($33.71 billion).

Full-year operating profit surged by 37% in kroner and by 44% at constant exchange rates, reaching 102.6 billion kroner. As a result, Novo Nordisk hit $500 billion in market value, making it Europe’s largest company by market capitalization.

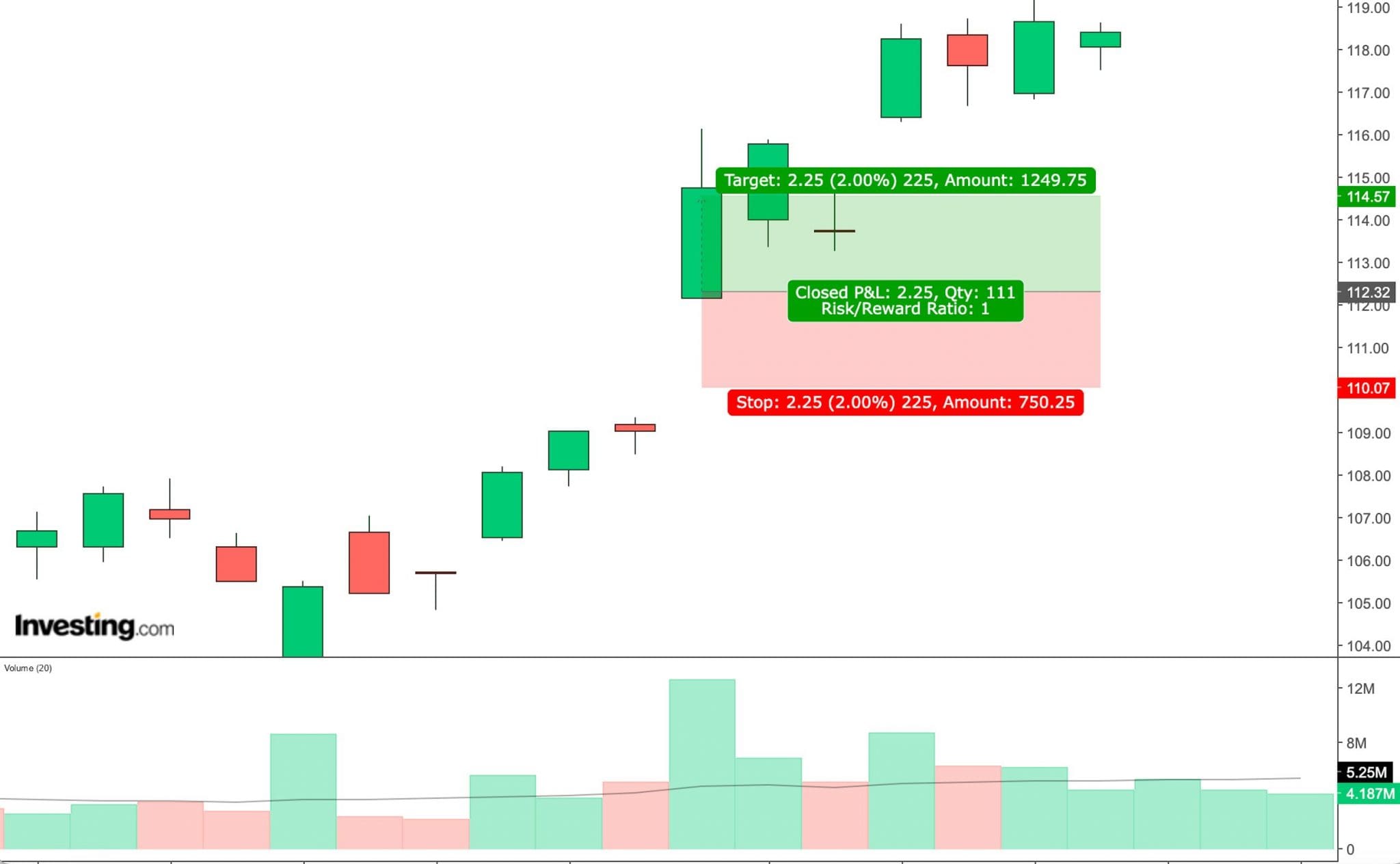

Trade Entry & Exit

Positive earnings reports generally have a bullish impact on a company’s stock price.

I noticed the stock price began to react positively in pre-market trading. By the time the Danish market opened, NVO shares had already gapped up by 2.50%, indicating strong bullish momentum.

I decided to open a long (buy) position as I expected the stock to rise further throughout the trading day.

After entering a long position, I set a stop-loss order at 2.00% below my entry point to protect against sudden market reversals. I also put a take-profit order at 2.00% above the current price, targeting a quick gain based on the positive sentiment for a 1:1 risk/reward trade.

I monitored the stock during the trading day, watching it steadily climb as more traders bought into the momentum. The stock reached my take-profit target toward the end of the European trading session.

My position automatically closed at this point, locking in a solid profit. The total process from trade entry to exit took around 6 hours. The stock continued to rise throughout the session before closing the day with a 3.50% increase.

Bottom Line

In Denmark, CFD trading is legal and regulated, ensuring a transparent trading environment. As part of the EU, Denmark also adheres to ESMA regulations, which include limits on leverage and negative balance protection to safeguard retail traders from excessive risk.

However, before day trading CFDs, you must choose a regulated broker, be aware of the costs involved – such as spreads and commissions – and ensure you comply with tax obligations on profits.

Risk management, proper education, and regulatory compliance are also essential. And never risk more than you can afford to lose.

To start trading CFDs, visit DayTrading.com’s selection of the top CFD day trading platforms.

Recommended Reading

Article Sources

- Denmark Population - Macrotrends

- Danish Financial Supervisory Authority (DFSA)

- European Securities and Markets Authority (ESMA)

- Nasdaq Copenhagen

- Danish Tax Agency (Skattestyrelsen)

- CFD Provider Warning - DFSA

- Financial Services Awareness - DFSA

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com