Day Trading in Denmark

Excellent digital infrastructure and growing interest in online investing make Denmark a vibrant venue for day trading. And Danes can do this with confidence thanks to strong protections from the Danish Financial Supervisory Authority (DFSA).

This guide will tell you all you need to know to start day trading in Denmark – including how to set up a broker account, when to send in your tax returns – and provide an example of a short-term trade in action.

Quick Introduction

- Day trading in Denmark follows rules laid down by the Danish Financial Supervisory Authority (DFSA), a ‘green-tier’ regulator under our Regulation & Trust Rating, meaning that traders can expect a good level of protection.

- Shares are chiefly traded on the Nasdaq Copenhagen stock exchange, which is part of the Nasdaq Nordic group of exchanges. Danish stocks can be traded between the hours of 9:00 and 17:00 Central European Time (CET).

- Profits from short-term trades must be declared to the Danish Tax Agency, with income tax of between 8% and 52.07% potentially payable on earnings.

Top 4 Brokers In Denmark

Our latest tests point to these 4 trading platforms being the best for day traders in Denmark:

All Day Trading Platforms in Denmark

What Is Day Trading?

Day traders in Denmark have the chance to trade a broad variety of assets, including stocks, commodities, cryptocurrencies, and derivatives (like contracts for difference (CFDs) and futures). Forex trading in Denmark is particularly big, providing access to currency pairs like USD/DKK.

There are around 130 shares that trade on the Nasdaq Copenhagen exchange, some of which are large multinationals like pharmaceuticals developer Novo Nordisk, shipping operator Maersk, and wind turbine manufacturer Vestas Wind Systems.

Nasdaq Copenhagen is part of the Nasdaq Nordic and Baltics collective, which also comprises the national stock exchanges of Sweden, Finland, Iceland, Lithuania, Latvia and Estonia. Traders can deal shares here as well as a range of other financial instruments.

Is Day Trading Legal In Denmark?

Yes. Regulations governing financial markets are imposed by the Danish Financial Supervisory Authority (DFSA), also known as Finanstilsynet. It is responsible for ensuring the transparency, efficiency and credibility of Denmark’s broader financial system, and for providing protections for active traders.

As Denmark is a member of the European Economic Area (EEA), the DFSA works in conjunction with the European Securities and Markets Association (ESMA), a body tasked with promoting stable and orderly financial markets across the European Union (EU) and a handful of other European nations.

This means day trading in Denmark is subject to rules laid down in the Markets in Financial Instruments Directive II (MiFID II) of 2018. Regulations include limiting leverage for certain asset classes (like forex); imposing negative balance protection on brokers to limit trader losses; and ensuring that financial products are fairly marketed with clear and accurate fee information.

Traders can also use brokers who are authorized in Denmark as well as other parts of the EEA. This concept is known as passporting, and it allows financial services providers in one member state to do business in another constituent country without requiring additional authorization from a local regulator.

I recommend checking if a brokerage is approved to operate in Denmark using the search facility on the DFSA’s website. This would be my first port of call when choosing which platform to day trade with.

How Is Day Trading Taxed In Denmark?

The profits that day traders make are usually subject to income tax. They must be declared to the Danish Tax Agency (Skattestyrelsen), the body responsible for implementing Denmark’s tax rules and collecting taxes.

Traders are subject to a progressive tax system where the amount of tax payable increases according to earnings. The rate of income tax ranges between 8% and 52.07%, more details on which can be found here.

How To Start Day Trading

Day traders need to complete a few simple steps to begin trading financial markets in Denmark:

- Choose a brokerage. First, investors need to check that the broker they’re considering is authorized to provide trading services in Denmark. Once this is ticked off, a trader can narrow down the list according to their personal preferences. Things to think about include trading costs, the functionality of the dealing platform, trade execution speeds, and educational guides and other tools the broker may provide.

- Open an account. Having identified a top day trading broker in Denmark, you’ll have to register your details with them to start trading. To open an account the company will require documentation such as proof of identification and proof of address, with MitID serving as the country’s electronic ID (eID).

- Deposit money. Once you’ve completed the paperwork, you may receive approval to begin trading within a matter of moments. However, you won’t be able to start real-world trading until you deposit some money. This is typically done via a wire transfer or through a debit card like the Danish Dankort.

A Trade In Action

So what might a short-term trade look like? Here I’ll run through a hypothetical example of how I could make money trading shares on the Nasdaq Copenhagen.

The Set-Up

My plan is to go long on Danske Bank stock by buying shares in the company. More specifically, I’m betting that the European Central Bank (ECB), which sets monetary policy across all 27 EU nations, will raise interest rates more substantially than most economists have been predicting.

If I’m right, banking stocks like Danske Bank could rise in value. This is because their net interest margins (NIMs) – which measures the difference between the interest they receive from borrowers, and what they pay out to savers – receive a boost from higher interest rates.

Denmark maintains a fixed exchange rate against the euro. As a consequence, any action by the ECB is likely to be mirrored later on by the Danmarks Nationalbank, the country’s own central bank.

The market seems to have priced in a 0.25% rate hike. After some careful research, I’ve decided that a 0.5% interest rate rise looks far more likely. In this scenario, bank shares across the EU could head northwards.

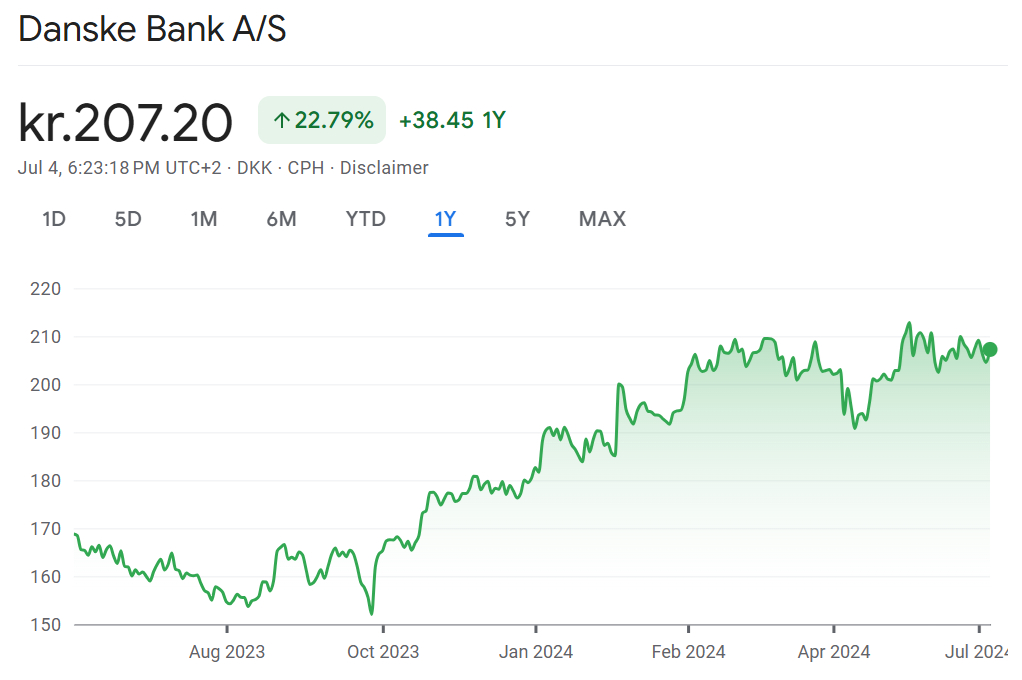

To finish off my research, I look at the price and volume charts for Danske Bank shares. Conducting technical analysis to identify chart patterns, trends and indicators (like support and resistance levels and moving averages) can give me a better understanding of potential market movements and the scale of any price changes.

The Trade

Having finished my preparation, the next step is to place the trade. The ECB is due to make its rate announcement at 14:15 CET, so I punch my orders into my trading platform a few minutes beforehand.

I find that Danske Bank shares are trading at 207.22 krone. My plan is to manage risk by using two separate instruments:

- A ‘take profit’ instruction set at 208.05 krone. If the stock rises to this level, my position will automatically close, thus sealing a chunky profit for me.

- A ‘stop loss’ order established at 206.92. If the stock falls to this level for any reason, my position will again extinguish, in turn reducing any losses I may incur.

Shortly afterwards, the ECB makes its interest rate announcement. This shows that policymakers have raised their benchmark by half a percentage point, as I’d predicted. Within a few minutes my ‘take profit’ order is triggered, and I’ve made a profit of 83 øre for each share I purchased.

Bottom Line

Day traders in Denmark can trade a wide range of financial instruments online with confidence. The country’s exceptional technical infrastructure ensures minimal connectivity issues, while stringent regulation by the DFSA mitigates the risk of fraudulent activities.

However, traders should remain vigilant against potential scams and use a trusted day trading platform in Denmark. And regardless of where they do business, individuals should only ever trade with funds that they can afford to lose.

Recommended Reading

Article Sources

- Danish Financial Supervisory Authority (DFSA)

- Nasdaq Nordic

- Trading Hours – Nasdaq Nordic

- June Statistics report from the Nasdaq Nordic and Baltic markets – Nasdaq Nordic

- European Economic Area (EEA) - Eurostat

- European Securities and Markets Association (ESMA)

- MiFID II - ESMA

- What Is ‘Passporting’ And Why Does It Matter? – UK Finance

- Denmark – Individual – Taxes on Personal Income - PwC

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com