Decentraland

With many investors looking towards the metaverse for trading opportunities, Decentraland and its crypto token MANA have found themselves in the spotlight. This guide introduces Decentraland, a metaverse built on the Ethereum blockchain.

Decentraland (MANA) is a high-risk investment. The altcoin has experienced significant volatility, falling more than 90% from its all-time high.

If you do want to speculate on Decentraland, you may want to consider CFD crypto trading. These leveraged derivatives allow investors to go long or short on MANA without taking ownership of the underlying token. They are also available at reputable brokers, including XTB & Axi.

What Is Decentraland?

Decentraland is a decentralized virtual world built on the Ethereum blockchain that was founded in 2015 by Esteban Ordano and Ari Meilich.

The project raised over $25 million in its initial coin offering (ICO) in August 2017, and it launched its beta version in December 2019.

In Decetentraland’s metaverse, much of the gameplay revolves around MANA and LAND. The MANA crypto token and LAND NFTs are also where the investment potential lies within Decentraland. We explore these in more detail below.

The project is run by the Decentraland Foundation, a non-profit organization that oversees the development of the project and the Decentraland Autonomous Organization (DAO), a decentralized body that governs the metaverse.

How Does Decentraland Work?

Decentraland is a free-to-play virtual reality platform that allows users to create, experience, and monetize their own content on plots of virtual land (LAND) which are traded as NFTs between players.

Users can access Decentraland via the web or the iOS app and can customize their avatars to represent themselves in the virtual world.

The project aims to provide a truly decentralized metaverse where users have complete control over their digital assets and can interact with each other in a virtual world.

Decentraland’s gameplay revolves around exploration, socializing with other users, and interacting with the content created by the community.

Despite the significant hype and funding, by the end of 2022, Decentraland had just 8,000 active users per day, though this spikes during regular online events such as music festivals and job fairs.

What Is MANA?

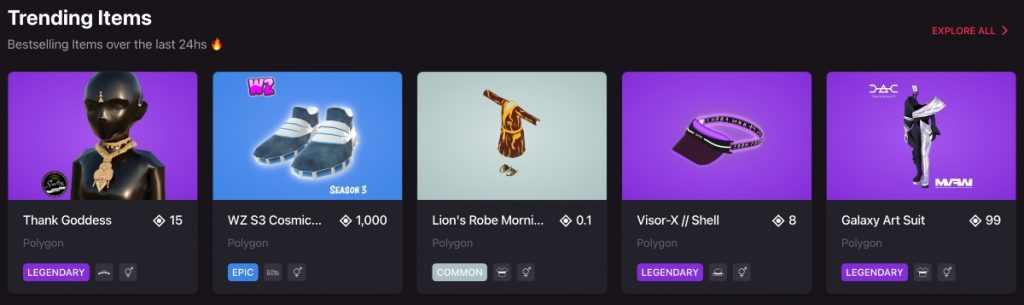

MANA is the cryptocurrency used within the Decentraland platform. It serves as the in-game currency for trading virtual land and collectable in-game items, playing mini-games within the metaverse and paying transaction fees on the platform.

In addition to its use as a currency, MANA also has governance and voting capacity within the Decentraland community. MANA holders can vote on proposals related to the platform’s development and governance through a Decentralized Autonomous Organization (DAO) structure.

MANA can also be staked within the platform, or on centralised crypto exchanges such as Binance and Coinbase, to earn rewards of up to 5% APY through the Decentraland engine. Staking MANA also allows users to participate in the governance of the platform and earn rewards in the form of more MANA.

Users can earn MANA by participating in various activities within the platform, such as creating and selling virtual items or hosting events. MANA can also be purchased on various cryptocurrency exchanges or within the Decentraland marketplace.

MANA Price

The Decentraland crypto token MANA hit its all-time high (ATH) on 25th November 2021 at $5.90.

At the time of writing, the token has fallen around 90% from this value. This significant volatility demonstrates the risk of investing in Decentraland.

What Is LAND?

Decentraland’s virtual world is divided into 90,601 segments of LAND that are represented as unique, non-fungible tokens (NFTs) on the Ethereum blockchain.

Each LAND token represents a specific 16m x 16m (256 square meters) area of virtual land within the metaverse that users can buy, sell, and build on.

Users can buy LAND directly from Decentraland’s Marketplace using MANA or participate in Decentraland’s community-driven events and competitions to win LAND.

For those with a bullish future outlook for the project, LAND arguably offers investment potential.

Without the often significant maintenance or building costs of the traditional real estate market, many investors have purchased LAND with the hopes of a substantial appreciation in value if the platform grows. Alternatively, LAND can be leased out to stores and events to earn passive income.

LAND at desirable coordinates, known as districts within the game, can be highly valuable. Shortly before the all-time high of MANA in November 2021, a parcel of LAND sold for $2.43 million.

LAND can also be monetized by charging visitors for access, selling virtual products or running mini-games within a location. An example of this is the Decentral Games Ice Poker games, where players gamble with MANA to win prizes such as collectable items and MANA prizes.

Game Features Explained

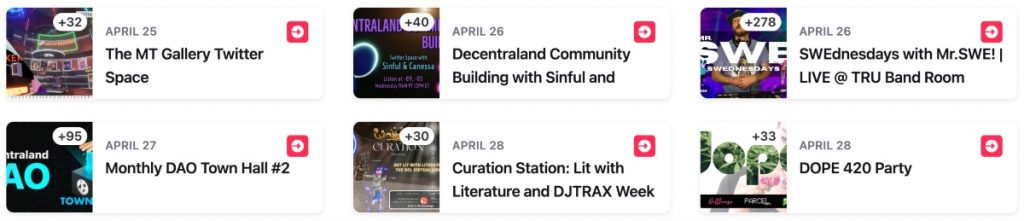

Decentraland offers a range of gaming features and events for its users to participate in, from fashion shows to music festivals to sports events. Notable examples include:

Casinos & Gambling

Decentraland features virtual casinos where players can gamble with MANA and other virtual currencies on popular games such as poker, blackjack and roulette.

These can be a source of income for the most popular operators, with the Decentral Games casino racking up over $7.5 million in margin during late 2021.

Events & News

Decentraland hosts a variety of events, with the Metaverse Music Festival in 2022 a good example. This festival featured virtual performances from a range of musicians including Ozzy Osbourne, Dillon Francis and Soulja Boy.

Decentraland has also hosted other events such as job fairs and fashion shows and a live showing of the Australian Open tennis tournament in 2022. Major brands and companies have also invested in Decentraland, with Adidas and Gucci hosting virtual events and exhibitions in the metaverse.

Virtual Stores

Decentraland allows users to create and operate their own virtual stores, providing an opportunity for entrepreneurs to showcase and sell their digital products. Companies that have opened virtual stores include brands such as Acura, DKNY, and Samsung.

In addition to the traditional brick-and-mortar style stores, users can also create popup shops and showrooms for limited-time promotions or product releases. These virtual stores can be fully customized, allowing sellers to create a unique shopping experience for their customers.

These stores can be operated with MANA tokens, allowing for a seamless and secure payment system. Virtual stores have become a popular feature in Decentraland, with many users taking advantage of the platform to sell their digital art, clothing, and other virtual goods.

Theme Parks & Amusements

There is a range of theme parks and amusements within Decentraland. These range from traditional theme park rides, such as rollercoasters, to interactive exhibits and immersive experiences.

However, even when playing with VR, these are underwhelming at best – laughable at worst. While there is plenty of potential within the idea of virtual theme parks, there is a transformative improvement required before these can compete with other VR games.

What Influences The Price Of MANA?

The price of MANA, Decentraland’s native cryptocurrency, is influenced by various factors. Many investors want to know how high can Decentraland go, and while nobody can say for sure, here are some of the key factors that could move its value:

Investments

Historically, the price of MANA has reacted wildly to significant investments, both in terms of financial power and large brands buying into the metaverse or specifically Decentraland.

A good example of the effect of a significant financial investment is the $5.90 all-time high of MANA in November 2021 following the sale of a parcel of LAND for $2.43 million.

The early 2023 announcement of Apple’s development of a mixed-reality headset also caused a huge surge in the value of MANA, with gains of 73% in one week associated with the announcement from the tech giant.

Gameplay Functionality

Decentraland’s success (and the value of MANA) is closely tied to the platform’s gameplay functionality, including the quality and variety of games, events, and experiences available to users.

At the moment, Decentraland falls short, as despite several high-profile brand partnerships and events, the actual gameplay leaves much to be desired. Players have criticised the game for unwieldy controls, poor performance, decades-old graphics and repetitive content.

There is much for the developers to work on before Decentraland convinces a mainstream audience it is worth their time.

Competitors’ Performance

Decentraland has several prominent existing competitors, with more companies expected to make solid metaverse offerings in the future once the technology has evolved. Currently, major competitors include Axie Infinity and Sandbox.

As outlined in the previous section, the often buggy and repetitive gameplay is one of its main criticisms. Developers that can create a fresh, seamless and exciting metaverse offering may relegate Decentraland to a niche and wipe out much of the value of MANA.

Active Playerbase

The size and activity of the active user base can also have an impact on the price of MANA.

As more users participate in the platform, demand for LAND and MANA may increase, leading to a potential increase in price. Conversely, if user activity declines, it may lead to a decrease in demand for MANA.

Market Sentiment

The overall sentiment surrounding the broader crypto market may also impact the price of MANA – for more popular digital currencies, the market often moves in a parallel direction.

If the overall crypto market is experiencing a period of growth, it could lead to increased demand for MANA as a crypto asset. Conversely, if the market experiences a drop or scare, it could lead to a drop in MANA price, such as when the coin’s value dropped over 35% following the FTX collapse in late 2022.

Reasons To Invest

So, is Decentraland a good investment? Here are some of the main reasons supporting investment in MANA or LAND NFTs:

Growth Potential

Decentraland is part of the larger trend towards the metaverse as a virtual reality world where users can interact with each other and exchange digital assets. As the concept gains more mainstream adoption, Decentraland is well-positioned to be a major player in the industry.

As a result, some analysts have made high long-term price predictions for MANA as more people discover and invest in the metaverse.

Volatility

Like many cryptocurrencies, MANA is highly volatile, with frequent fluctuations in price based on several factors such as metaverse technology developments and competitor performance.

While this can be a risk for investors, it also presents an opportunity for traders to make profits through buying and selling at the right times. For example, Decentraland gained over 70% in a week on positive metaverse-related market sentiment after Apple teased an upcoming mixed reality device in early 2023.

Corporate Investment

Another reason to trade Decentraland is investments from major firms such as JP Morgan, Samsung, and Atari. This is a signal of confidence in the project and its growth potential.

Other brands, such as Apple and Adidas, have also shown interest in the metaverse, which could lead to further investment in Decentraland and increased mainstream adoption.

Governance

MANA holders can contribute to the Decentraland DAO and participate in the decision-making process for the future of the project.

This gives investors a voice and a say in how the project evolves. By holding MANA, investors can have a direct impact on the direction of Decentraland.

Passive Income

Decentraland offers several ways to potentially earn passive income, including staking MANA, running a metaverse business or renting out LAND.

By staking MANA, investors can earn rewards in the form of more MANA tokens.

Running a business in Decentraland, such as a virtual store or casino, can generate revenue from user interactions.

Renting out LAND to other users can also provide a source of income.

Reasons Not To Invest

Despite the perceived advantages, there are some key reasons not to invest in MANA or LAND (though short-sellers may see these as profit-making opportunities):

Poor Gameplay

Despite the potential, the gameplay experience is lacking for many users. Lag, poorly designed controls, bugs, and shoddy graphics can all contribute to a frustrating and unenjoyable experience.

Many users have also voiced complaints about the limitations of the Decentraland Builder.

Low Player Base

Despite hitting impressive peak numbers during events, the overall number of active users is fairly low compared to other online gaming and metaverse platforms.

In late 2022, Decentraland had around 8,000 active users per day, with few venturing out of the most popular spots and regions. Outside of these established sites, there is little potential for MANA generation for LAND owners.

Gimmicky Concepts

Much of the content has little to no value aside from novelty. Concepts such as Decentraland houses and theme parks have no genuine current application to users, which is perhaps why the active player base is so low.

Competition

Decentraland faces competition from both current and potential future competitors in the metaverse and gaming space. Established players such as Sandbox and Axie Infinity could take center stage in the metaverse and leave Decentraland behind.

Negative Metaverse Sentiment

Despite the growing interest and investment in the Metaverse, there is still skepticism and uncertainty around the technology. Meta’s teaser in October 2021, for example, generated mixed reactions from the public and investors, with shares in META dropping by as much as 25% following the reveal.

In its current state, Metaverse technology is expensive, with Meta’s VR headset the Quest Pro costing as much as $1,499 at release, and also limited, with very little to do in the various concepts that exist.

How To Trade Decentraland

When speculating on Decentraland assets, investors have a choice between LAND, the NFTs that allow ownership of space within the game, or MANA, the project’s governance token and game currency.

How To Trade LAND

For those bullish on the future of Decentraland, one way to invest is by purchasing LAND.

Create A Digital Wallet

When trading NFTs and cryptocurrencies, a digital wallet is required. To buy or trade LAND, you need to set up a wallet that supports Ethereum and ERC-20 tokens, so that MANA is supported.

Examples of this are MetaMask, the Coinbase Wallet and GameStop Wallet.

Purchase MANA

Before buying LAND, you need to buy MANA, which is the primary currency used in Decentraland.

You can purchase MANA from various cryptocurrency exchanges like Binance, Coinbase, or Kraken.

Add MANA To Your Wallet

Next, investors need to transfer their MANA tokens to their wallets. While potentially intimidating for beginners, most exchanges will have helpful how-to guides for this process.

We suggest doing a small “test” transfer before moving across large quantities of tokens to help safeguard against mistakes that could cause irreversible losses.

Browse Listings

NFTs like LAND are traded on online marketplaces such as OpenSea and the Decentraland marketplace. Use these platforms to browse LAND to buy or to rent – each offering will have a bid or buy now price in MANA and a location and plot size.

Make An Offer

If your bid or purchase is successful, your Land NFT should appear in your connected wallet within the next few minutes.

How To Trade MANA

As MANA is a crypto coin rather than an NFT, there are more trading options compared with LAND.

Investors can choose between directly purchasing MANA, investing in a MANA ETF like the Grayscale Decentraland trust ETF, short selling MANA or staking the tokens for passive income rewards.

Alternatively, traders can go long or short on MANA using crypto CFDs. Available at online brokers with a track record in traditional asset classes, these derivatives enable users to speculate on the price of MANA without buying or storing the token. This can help reduce the risks associated with crypto exchanges, which have a history of financial mismanagement, scams and bankruptcy.

Is Decentraland Dead?

Not yet. Decentraland is one of the most popular iterations of the metaverse, with huge sums paid for desirable plots of in-game real estate. Significant price volatility may also provide opportunities for traders.

However, the current technology and gameplay do not offer much for the player outside of novelty and special events. Decentraland also faces stiff competition from alternatives like Axie Infinity and Sandbox. Add in the risk of scams, and extreme caution is advised when considering investment and trading opportunities.

FAQs

How Many Users Are In Decentraland?

The Decentraland Foundation claimed that as of late 2022, there were around 8,000 daily active users. However, there has been ample speculation around these figures, with some critics claiming the numbers to be substantially lower.

Is Decentraland Free To Play?

Yes, Decentraland is free-to-play. However, to engage in some in-game activities such as casino tournaments or entry to specific buildings, players must spend MANA tokens – Decentraland’s in-game currency and DAO governance token.

Is Decentraland A Metaverse?

While there is no singular, agreed-upon definition of the metaverse, most would agree that Decentraland falls under this category.

What Is The Best Wallet For Decentraland?

To store and trade MANA and LAND within the context of the Decentraland game, investors must have a wallet that supports Ethereum and ERC-20 tokens. Popular solutions are MetaMask, the Coinbase Wallet and the GameStop Wallet.

Can You Make Money In Decentraland?

It is possible to earn MANA in Decentraland through various means. One way is by staking MANA, which can earn a return through network consensus and governance. Another way is by trading LAND, which can appreciate in value as demand for virtual real estate grows. In addition, players can generate income by renting out their LAND or creating monetized content within the game.

Alternatively, investors can speculate on Decentraland using crypto CFDs. These leveraged derivatives, available at credible brokers, allow individuals to bet on rising and falling prices without buying and storing MANA. Both XTB and Axi offer CFDs on Decentraland (MANA).

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com