Best CFD Trading Platforms and Brokers in Germany 2026

We’ve identified the best CFD trading platforms and brokers in Germany. Every CFD broker recommended is trusted by our industry experts and active traders and accepts German traders.

Top 6 CFD Trading Platforms in Germany

Following our comprehensive testing of 140 brokers, these 6 platforms continue to stand out as the best for CFD traders in Germany:

-

1

Eightcap71% of retail traders lose money when trading CFDs

Eightcap71% of retail traders lose money when trading CFDs -

2

XM

XM -

3

AvaTrade

AvaTrade -

4

IC Trading

IC Trading -

5

Pepperstone72.6% of retail investor accounts lose money when trading CFDs

Pepperstone72.6% of retail investor accounts lose money when trading CFDs -

6

Trade Nation

Trade Nation

Here is a summary of why we recommend these brokers in February 2026:

- Eightcap - Eightcap offers a wide range of trading options with 800+ CFDs across stocks, indices, bonds, commodities, and cryptocurrencies (depending on location), with leverage up to 1:30/1:500. It excels in its tools, notably the AI-enabled economic calendar covering 25+ countries with impact filters (high, medium, low). However, its commodities offering, particularly in softs like cotton and wheat, as well as the limited precious metal and energy assets, is its weakest area.

- XM - XM delivers for CFD traders with flexible leverage and a huge range of markets, including bespoke thematic indices for exposure to popular sectors like artificial intelligence. The MT4/MT5 platforms are also fast and dependable while a free VPS is available to qualifying XM traders running algo trading strategies.

- AvaTrade - AvaTrade's 1250+ leveraged CFD products span a wide range of asset classes including stocks, indices, commodities, bonds, crypto, and ETFs. What we love is that you can speculate on rising and falling prices in the broker’s feature-rich web and mobile platforms with market-leading research tools to help you discover short-term trading opportunities.

- IC Trading - IC Trading specializes in CFD trading with over 2,250 tradable assets spanning sought-after markets including forex, commodities, indices, stocks, and bonds. Utilizing deep liquidity and cutting-edge bridge technology, the broker provides excellent trading conditions for short-term traders looking for leveraged derivatives.

- Pepperstone - Pepperstone maintains its position as one of the fastest and most dependable CFD brokers during our latest round of testing. With execution speeds averaging around 30ms and an outstanding fill rate of 99.90%, the broker ensures a seamless trading experience without requotes or dealing desk interference. It also provides ample trading opportunities across over 1,300 assets.

- Trade Nation - Trade leveraged CFDs on over 1000 assets with low-cost spreads. You can also take advantage of the broker's integrated signals to help you determine when to enter and exit positions.

Best CFD Trading Platforms and Brokers in Germany 2026 Comparison

| Broker | CFD Trading | EUR Account | Minimum Deposit | Markets | Platforms | Leverage |

|---|---|---|---|---|---|---|

| Eightcap | ✔ | ✔ | $100 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | MT4, MT5, TradingView | 1:30 |

| XM | ✔ | ✔ | $5 | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies | MT4, MT5, TradingCentral | 1:30 |

| AvaTrade | ✔ | ✔ | $100 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade | 1:30 (Retail) 1:400 (Pro) |

| IC Trading | ✔ | ✔ | $200 | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures | MT4, MT5, cTrader, AutoChartist, TradingCentral | 1:500 |

| Pepperstone | ✔ | ✔ | $0 | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower | 1:30 (Retail), 1:500 (Pro) |

| Trade Nation | ✔ | ✔ | $0 | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) | MT4 | 1:500 (entity dependent) |

Eightcap

"Eightcap delivers in every area for day traders with a growing selection of charting platforms, education via Labs, and AI-powered tools. Now sporting 120+ crypto CFDs, it's also become a stand-out choice for crypto trading, winning our 'Best Crypto Broker' award two years in a row."

Christian Harris, Reviewer

Eightcap Quick Facts

| FTSE Spread | 1.2 |

|---|---|

| GBPUSD Spread | 0.1 |

| Stocks Spread | 0.03 (Apple Inc) |

| Leverage | 1:30 |

| Regulator | ASIC, FCA, CySEC, SCB |

| Platforms | MT4, MT5, TradingView |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SGD |

Pros

- Having excelled across all key areas for day traders, Eightcap outperformed every competitor to win our 'Best Overall Broker' award for 2024, also securing our 'Best Crypto Broker' title for 2025 and 'Best TradingView Broker' for 2025.

- With tight spreads from 0 pips, low commission fees, and high leverage up to 1:500 for certain clients, Eightcap provides cost-effective and flexible trading conditions that can accommodate an array of strategies, including day trading and scalping.

- Eightcap stands out with a selection of powerful trading tools and resources, including MT4 and MT5, and more recently the 100-million strong social trading network TradingView.

Cons

- The demo account expires after 30 days and can only be extended upon request - a notable inconvenience compared to the likes of XM with its unlimited demo mode.

- Despite a useful library of educational guides and e-books in Labs, Eightcap still trails IG’s comprehensive toolkit for aspiring traders with its dedicated IG Academy app and 18 course categories.

- Eightcap needs to continue bolstering its suite of 800+ instruments to match category leaders like Blackbull Markets with its 26,000+ assets, featuring a particularly weak selection of commodities.

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| FTSE Spread | 1.4 |

|---|---|

| GBPUSD Spread | 0.8 |

| Stocks Spread | 0.002 |

| Leverage | 1:30 |

| Regulator | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius |

| Platforms | MT4, MT5, TradingCentral |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM’s Zero account is ideal for day trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, and no requotes or rejections.

- XM stands out for its commitment to trader education, with a wealth of well-presented resources, including webinars, tutorials, and even real-time trading sessions through XM Live.

- XM has rolled out platform upgrades with integrated TradingView charts and an XM AI assistant, delivering faster execution, smarter analysis, and a sleeker, more intuitive trading experience.

Cons

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

- Although trusted and generally well-regulated, the XM global entity is registered with weak regulators like FSC Belize and UK clients are no longer accepted, reducing its market reach.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| FTSE Spread | 0.5 |

|---|---|

| GBPUSD Spread | 1.5 |

| Stocks Spread | 0.13 |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

Cons

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

IC Trading

"With superior execution speeds averaging 40 milliseconds, deep liquidity, and powerful charting software, IC Trading delivers an optimal trading environment tailored for scalpers, day traders, and algorithmic traders. "

Christian Harris, Reviewer

IC Trading Quick Facts

| FTSE Spread | 2.133 |

|---|---|

| GBPUSD Spread | 0.23 |

| Stocks Spread | Variable |

| Leverage | 1:500 |

| Regulator | FSC |

| Platforms | MT4, MT5, cTrader, AutoChartist, TradingCentral |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Trading offers unusual flexibility in its accounts, enabling traders to open up to 10 live and 20 demo accounts, meaning you can run separate profiles for different activities, such as manual trading and algo trading.

- Trading Central and Autochartist are valuable tools for in-depth technical summaries and actionable trading ideas and are accessible from within the account area or the cTrader platform.

- The simplified and digital account opening process saves time and effort, allowing traders to start trading sooner without extensive paperwork, taking just minutes during testing.

Cons

- Unlike IC Markets, IC Trading does not support social trading through the group’s IC Social app or the third-party copy trading platform ZuluTrade.

- Despite being part of the trusted IC Markets group, IC Trading is authorized by a weak regulator - the FSC of Mauritius, with limited financial transparency and regulatory safeguards.

- The educational resources are greatly in need of improvement, unless you navigate to the IC Markets website, posing a limitation for beginners in search of a comprehensive learning journey, especially compared to category leaders like eToro.

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| FTSE Spread | 1.0 |

|---|---|

| GBPUSD Spread | 0.4 |

| Stocks Spread | 0.02 |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- There’s support for a range of industry-leading charting platforms including MT4, MT5, TradingView, and cTrader, catering to various short-term trading styles, including algo trading.

- Award-winning customer support is available via telephone, email or live chat with response times of <5 minutes during testing.

- Pepperstone boasts impressive execution speeds, averaging around 30ms, facilitating fast order processing and execution that’s ideal for day trading.

Cons

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers who focus on this area, with no option to invest in real coins.

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

Trade Nation

"Trade Nation is a good choice for newer traders looking for a wide range of financial markets on a user-friendly platform. There is no minimum deposit, free funding options and strong education."

William Berg, Reviewer

Trade Nation Quick Facts

| FTSE Spread | From 0.4 |

|---|---|

| GBPUSD Spread | From 0.6 |

| Stocks Spread | Variable |

| Leverage | 1:500 (entity dependent) |

| Regulator | FCA, ASIC, FSCA, SCB, FSA |

| Platforms | MT4 |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, SEK, NOK, DKK |

Pros

- There is a low minimum deposit for beginners

- Full range of investments via leveraged CFDs for long and short opportunities

- A choice of trading platforms and apps, including MT4, make the brand a good fit for savvy traders

Cons

- Fewer legal protections with offshore entity

How We Chose The Best CFD Trading Platforms In Germany

To identify the best CFD trading platforms in Germany, we took all the brokers in our 140-strong database, pinpointed those that accept traders from Germany, and then sorted them using their overarching rating, which considers key components for CFD traders:

Trust

Only CFD trading platforms we trust, after verifying their regulatory credentials, track record, and the observations of our hands-on testers made our top list.

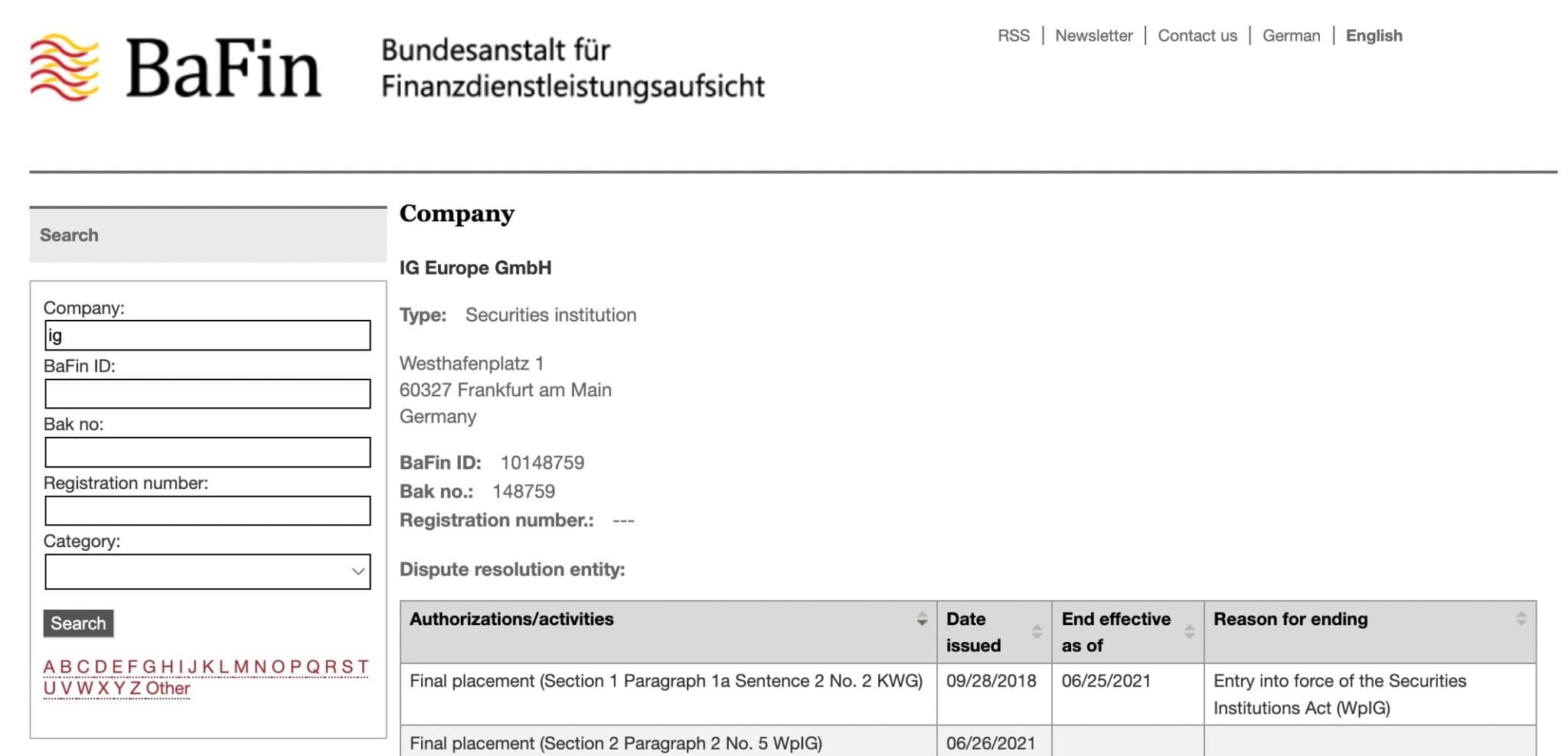

For German investors, choosing a CFD broker regulated by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) will often provide the best safeguards.

That said, CFD providers not directly overseen by the BaFin are still permitted to accept German traders via the EU passporting scheme, allowing them to operate with authorization from their domestic regulator.

The BaFin is a ‘Green-Tier’ regulator that’s stepped up its oversight of CFD providers in recent years. Its General Administrative Act of 2019 introduced restrictions that mandated CFD brokers in Germany must satisfy 5 requirements:

- Leverage limits, varying depending on the underlying asset.

- Negative balance protection so you can’t lose more than your deposit.

- CFD positions closed out when the initial margin is 50% of the original margin.

- Clear risk warnings that articulate the potential for loss.

- A ban on providing trading bonuses.

- IG is a BaFin-regulated CFD broker, deemed our ‘safest’, with 50+ years experience, 13 regulatory licenses, and a clean record based on our experts’ real-money trading experiences over years.

Leverage Trading

Only CFD brokers with transparent leverage and margin requirements made our shortlist.

Leverage is a critical component of CFD trading, allowing you to multiply your buying power and trading results in return for an outlay, known as ‘margin’.

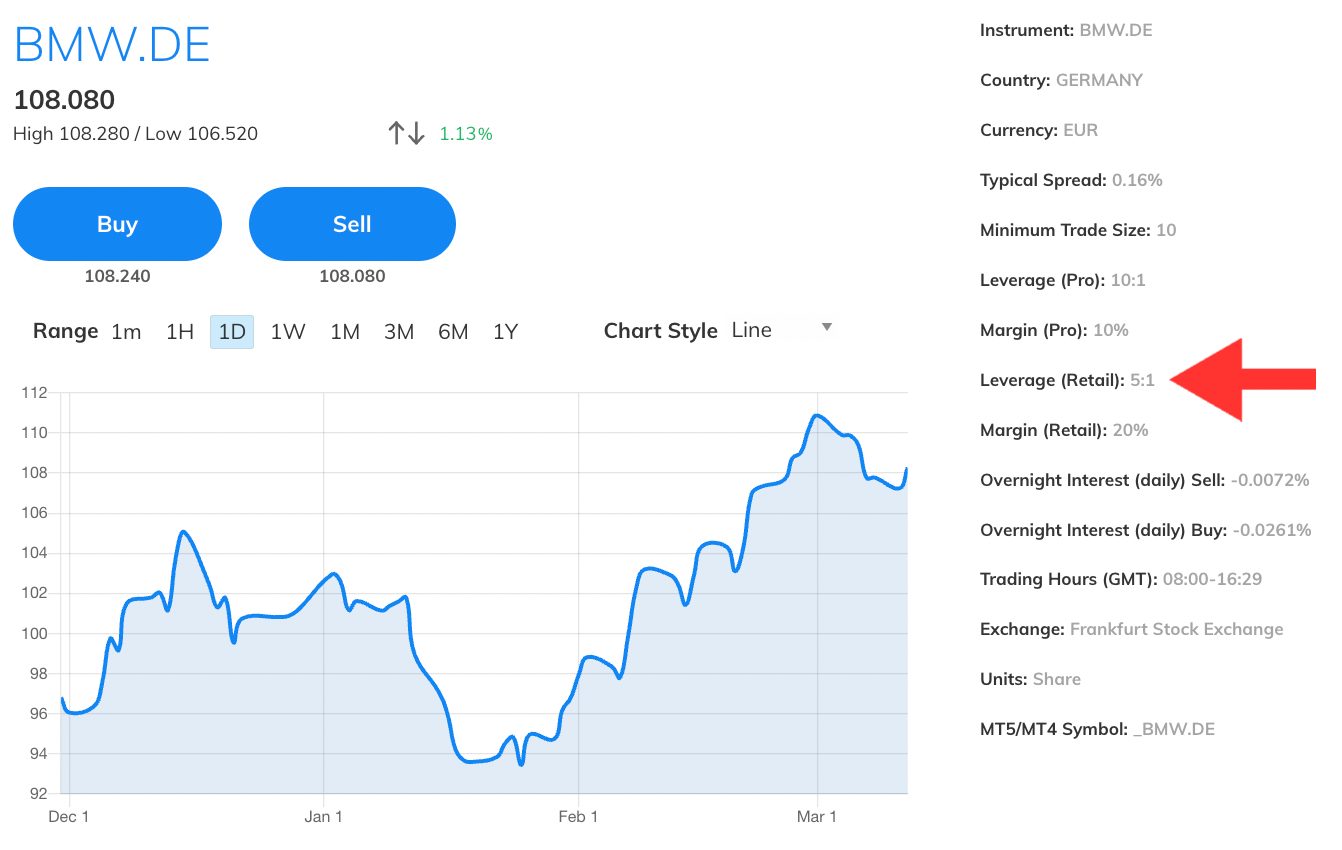

Let’s say I believe the share price of Bayerische Motoren Werke AG (BMW: FRA) is going to rise in the short term as the sale of its electric vehicles surpasses industry forecasts. A CFD provider offering me 1:5 leverage would allow me to multiply my €1,000 outlay by 5, giving me €5,000 in trading power.

The BaFin, in line with other regulators in Europe, requires authorized CFD brokers to provide leverage up to a maximum of:

- 1:30 on major currency pairs, e.g. EUR/USD

- 1:20 for minor currency pairs, e.g. EUR/GBP and major stock indices, e.g. the DAX

- 1:10 on commodities aside from gold, e.g. silver and non-major stock indices, e.g. the BIST

- 1:5 for shares, e.g. German equities

- 1:2 for cryptocurrencies, e.g. Bitcoin

- AvaTrade is one of the best CFD brokers with leverage up to 1:30 for German traders. It also stands out for its bespoke risk management tool, AvaProtect, which insures against large losses.

Trading Markets

Only CFD brokers that provide access to popular markets made our list of recommended firms.

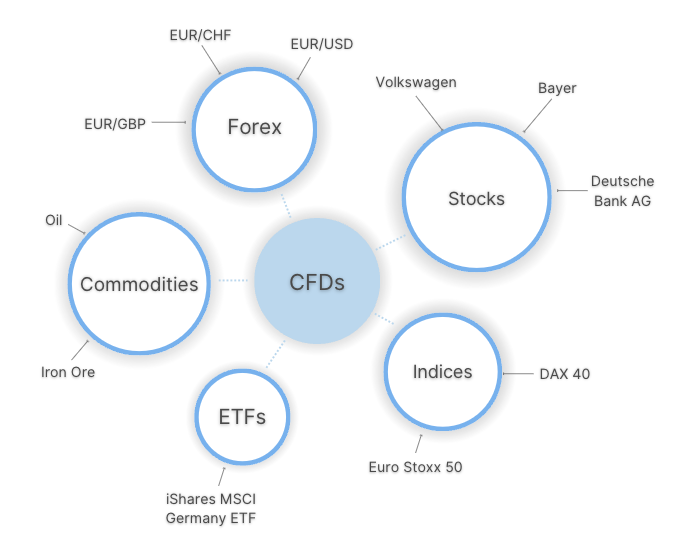

After years of using CFD trading platforms that accept German traders, we’ve observed that the top providers facilitate access to stocks, indices, forex, commodities and cryptocurrencies.

This provides short-term traders, including day traders, with ample opportunities to speculate on rising and falling prices across various regions, economies and sectors.

- Pepperstone shines with its excellent selection of CFDs spanning German markets, including the EUR/USD, German equities, the DAX index, plus funds like the iShares MSCI Germany ETF.

CFD Trading Fees

Only providers with competitive CFD trading fees, an assessment we make by regularly logging and analyzing charges on key markets, made our pick.

Low fees, notably spreads and /or commissions, are critical for day traders using CFDs, as a large volume of transaction costs can cut into profits.

That said, our years in the CFD trading industry have shown it’s important to balance pricing with tools, order executions, and research features.

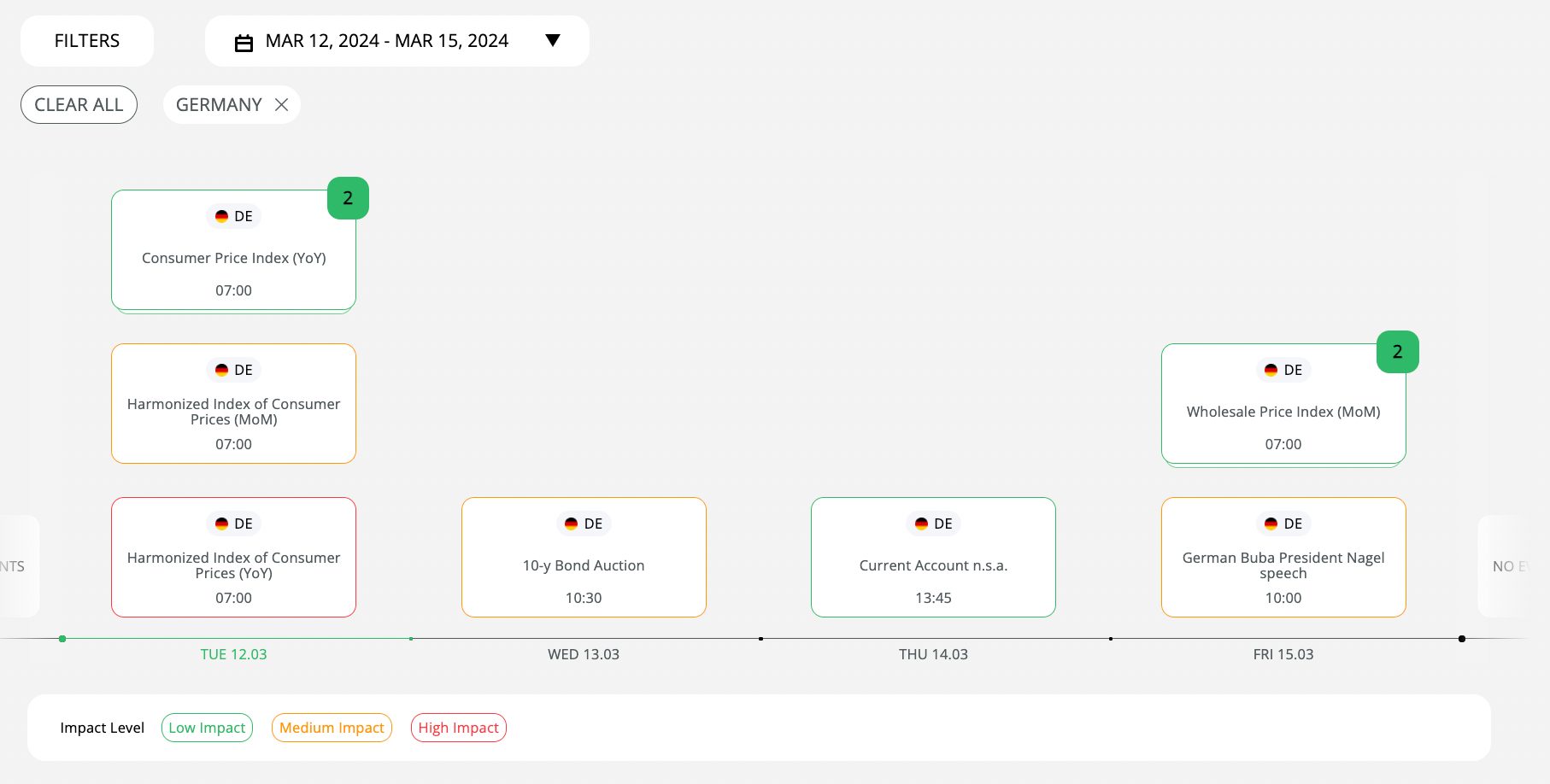

For example, it may be worth paying more for CFD brokers that provide analyst insights into events that will affect equities listed on the Frankfurt Stock Exchange or economic calendars that track major announcements from Germany’s central bank, the Deutsche Bundesbank.

- Eightcap excels for its low CFD trading fees with spreads from 0.0, plus its AI economic calendar that lets you filter by German events and helpfully assigns a low, medium and high impact rating.

Charting Platforms

Only firms with user-friendly and powerful CFD trading platforms, following our extensive testing, made our recommendations.

The MetaTrader suite, MT4 and MT5, are still the most widely available charting platforms at CFD providers in Germany. Yet, with their clunky design and increasing competition from alternatives like cTrader and TradingView, users have more choices than ever.

These third-party platforms excel for their charting packages, featuring dozens of indicators and various timeframes for experienced short-term traders.

However, newer CFD traders may benefit from more modern, web-accessible CFD platforms designed in-house. After testing a long row of platforms, we’re finding these can sport a more intuitive design and user-friendly workspace for beginners.

- AvaTrade consistently delivers in the platform department. It offers the MetaTrader package, as well as proprietary software with a genuinely intuitive look and feel, plus integrated pattern recognition tools and real-time sentiment data.

Account Funding

Only CFD brokers with secure, affordable and accessible payment methods made our selection.

We know from first-hand experience using CFD trading platforms that convenient funding can make for a smooth experience, while withdrawal issues and high charges can be extremely frustrating.

Analysis from Rapyd shows that e-wallets are increasingly favored by Germans, while bank cards are experiencing a decline. PayPal is the most popular e-wallet, though Sofort and Giropay also make the list of the 10 most used online payment methods.

- eToro accepts CFD traders in Germany with a low $10 minimum deposit and supports popular payment methods, including PayPal, Sofort and debit cards. Our experts have also personally traded on the eToro platform for years with no withdrawal issues.

FAQ

Who Regulates CFD Trading Platforms And Brokers In Germany?

The Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin), also known as the Federal Financial Supervisory Authority, regulates CFD trading platforms and brokers operating in Germany.

The BaFin is a trusted regulator that requires authorized CFD brokers to provide various safeguards to retail investors, notably negative balance protection, leverage limits and clear risk warnings.

However, CFD trading platforms without direct BaFin authorization can also provide services to German traders through the EU passporting scheme, which enables operations throughout the EU with their home regulator’s endorsement.

How Much Money Do I Need To Open A CFD Trading Account In Germany?

After evaluating 140 brokers, we’ve found you usually need between €0 and €250 to start trading CFDs in Germany.

Having said that, Pepperstone stands out with its €0 minimum deposit, making it an excellent option for German CFD traders with less starting capital.

Recommended Reading

Article Sources

- Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin)

- BaFin General Administrative Act 23 July 2019 - Restrictions on CFDs

- BaFin Broker Checker

- Frankfurt Stock Exchange

- Frankfurt Stock Exchange - BMW Shares

- Deutsche Bundesbank

- Rapyd Payment Trends In Germany

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com