Darwinex Review 2024

Darwinex Review

Darwinex is a broker and asset manager with a growing online community of self-directed forex traders and strategy investors. In this broker review, we’ll explore the unique trading features, plus everything you need to know about ECN spreads, fees and leverage. Find out if you should login to Darwinex today.

Darwinex Details

Darwinex was originally launched in 2012 under Tradeslide Trading Tech Limited. The company is based in London and is authorised and regulated by the Financial Conduct Authority (FCA) in the United Kingdom.

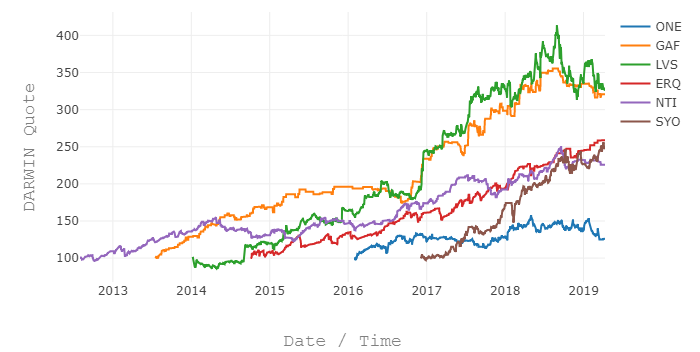

The broker has seen rapid growth in recent years, with over 40 employees serving over 3,000 clients across 80 countries. In 2017, the broker tripled its revenue after the success of its own alpha asset, the DARWIN (Dynamic and Risk Weighted Investments).

Darwinex also offers trading on forex, indices, commodities, US stocks and cryptocurrencies on DMA platforms including MT4 and MT5, plus FIX API technology.

Trading Platforms

DARWIN API

The brand offers proprietary software developed by Darwinex Labs, the broker’s Quant team.

The API software is used solely for copy-trading DARWIN assets on the broker’s proprietary marketplace, the DARWIN Exchange. DARWIN API allows investors to buy and sell winning strategies, using algorithmic technology. Investors can backtest assets or portfolios, recruit trading robots, build custom statistical indicators and access analytical toolkits and historical data.

MetaTrader 4

For classic self-directed trading on forex and CFDs, Darwinex offers the downloadable MT4 platform, a highly sophisticated software with advanced charting capabilities and automation.

Traders get access to dozens of analytical tools and indicators for technical analysis, a full set of pending orders, an updated news feed and live pricing. The platform also supports algorithmic robot trading through the use of expert advisors.

MetaTrader 5

Darwinex also offers the MT5 platform, which provides an enhanced trading experience for seasoned traders. Users can access a wider range of indicators and tools, advanced order types and execution modes, 21 time intervals, Depth of Market (DOM) and an economic calendar.

The MetaTrader platforms are available for download once account registration is complete.

Algorithmic Trading Plugins

Darwinex also offers engineered auxiliary libraries to complement the MetaTrader and FIX API platforms, including the ZeroMQ to MetaTrader and Zorro to MetaTrader bridging solutions.

These allow traders to implement non-MQL strategies such as Python and Java, for traders considering alternative programming methods for trading robots. Users can also enhance their trading strategy with the Tick Data feature or reduce latency in the MetaTrader platforms with a VPS service.

Markets

Darwinex offers over 300 tradable instruments, including 41 forex pairs from majors to exotics, 10 popular indices, including the FTSE 100, plus over 230 USA stocks on NASDAQ and NYSE exchanges. There’s also 5 crypto coins available, including Bitcoin and Ripple, as well as 4 commodities: gold, silver, natural gas and crude oil. The company also offers HFDs, a synthetic asset that mirrors the performance of its provider – HighFive.

In addition, the broker acts as a hedge fund and asset management company, where traders can build portfolios and invest in over 2,000 liquid alpha strategies called DARWINS.

Trading Fees

For self-directed trading, live spreads are around 0.3 pips for EUR/USD and 0.7 points for FTSE 100. Gold was around 0.21 points and crude oil at 0.03 points. Overall, these prices are competitive when compared to the likes of Oanda and XTB.

The FX commission per 1 contract order is 2.5 currency units. Index commissions range from 0.275 to 2.75 currency units and all stocks are charged at 0.02 USD per contract. Swap rates are also charged on overnight positions.

For DARWIN investing, traders pay a 1.2% commission per annum on invested equity and a 20% performance fee if you make money with a DARWIN. Providers then earn 15% and Darwinex earns 5% of the performance fees.

Leverage

The maximum leverage available is 1:30 for major forex pairs. Minor pairs can be leveraged up to 1:20 and commodities up to 1:10. Margin requirements for each instrument are indicated in the product specifications on the website.

Mobile Apps

The Darwinex Investor proprietary mobile app allows users to replicate individual traders or diversify their investment into multiple strategies. These strategies can be listed in the form of DARWINS. Live performance is disclosed in real-time on the app, where traders can fully manage their portfolio whilst on the move.

The platform comes in 4 languages and is available for download onto iOS and Android devices.

Self-directed traders can also access forex and CFD products on the not to dissimilar MetaTrader mobile apps. The apps include a suite of advanced features and capabilities which have been expertly adapted for use on any smartphone device. Traders can manage their trades, analyse charts and keep track of the markets all from the palm of their hand.

The MetaTrader apps come in over 20 languages and can be installed from the App Store or Google Play.

Funding Methods

Deposits

Accounts can be funded in EUR, USD or GBP via bank transfer, bank cards and e-payment services such as Trustly and Skrill. The minimum deposit required (after the initial 500) is 100 currency units. Darwinex only charges commissions on Skrill deposits, at 0.5%. Card payments and Skrill are processed immediately, whilst Trustly can take up to 1 business day. Bank transfers can take up to 3 days.

Withdrawals

Darwinex does not charge their own fees but does pass on any applicable withdrawal costs to the trader. These include 1.2% on cards and Skrill (minimum 2 currency units) and 3.5 EUR or GBP on Trustly. The minimum withdrawal amount is 10 currency units. Bank transfer fees vary depending on the bank. All withdrawal methods take 1-3 business days to process.

Note, PayPal is not accepted.

Demo Account

You can open a practice account in the MT4 and Darwinex platforms without risking any real capital. Demo accounts are a great way for experienced traders to polish their trading strategies. Investor demo accounts are loaded with a $10,000 virtual investment and do not expire.

Darwinex Deals

Darwinex is regulated by the FCA, a top-tier financial regulator which employs rigid standards, including restrictions on trading bonuses and promotions.

With that said, the broker’s DarwinIA capital allocation for investing acts as a monthly contest, where the first 120 DARWINS in each month’s final ranking receive a capital allocation (from a total of 7.5 million Euros per month). You can find details of the DarwinIA on the website.

Regulation Review

Tradeslide Trading Tech Limited (Darwinex) is regulated by the Financial Conduct Authority (FCA) in the United Kingdom, under license number 586466.

Darwinex is a member of the Financial Services Compensation Scheme, which covers investor money up to £85,000 per claim, in the event of insolvency. The company also provides free supplementary insurance which covers up to £500,000 for eligible clients.

In addition, the brokerage complies with other regulation requirements, including segregating client and investor money as well as providing negative balance protection.

Additional Features

Darwinex provides some education in the form of training and tutorial videos, which can be found within the proprietary platform. The dashboard also provides copy-trading research, which sorts and ranks thousands of strategies.

There’s also a blog section, Darwinex Ideas, containing Darwinex Lab and product updates, interviews from Hall of Fame investors and general market news. There’s also a community forum with guidance and discussions on trending topics, such as divergence.

Account Types

Darwinex offers the live trading account (for self-directed trading on MetaTrader) or the investor account (for copy-trade investors of DARWIN). Professional accounts are also available for eligible clients.

The minimum contract size is 0.01 lots, with tight interbank spreads from 0.0 pips and commissions starting at $1.5 per order. The margin call is 100%. Top traders also get discounted talent-linked pricing based on the broker’s proprietary algorithm, D-Score.

DARWIN investors can create their own portfolio of liquid alpha strategies, with a pool of over 2,000 to choose from. Traders get access to the proprietary dashboard with risk management tools using Darwin API technology.

Note that Darwinex does not offer any PAMM accounts or Islamic swap-free accounts.

Benefits

In this review, we found several good reasons to trade with Darwinex:

- Darwin Exchange platform with copy-trading

- MetaTrader 4 and MetaTrader 5 platforms

- Plugins & trading signals

- MT4 Python

Drawbacks

When you take Darwinex vs Pepperstone, ICMarkets, eToro and ZuluTrade, we did find some drawbacks:

- US traders not accepted

- 500 initial deposit

- Only US stocks

- No futures

Trading Hours

The MetaTrader server is based on the New York time zone and runs from Sunday at 17:05 to Friday at 16:55 for forex. Most indices run from Sunday at 18:00 to Friday at 16:55 (NY time) and commodities from 18:00 on Sunday to 16:55 on Friday. Stocks are open from Monday at 09:31 to Friday at 15:59 (NY time).

Customer Support

Customer support can be reached via email, at info@darwinex.com or via their contact number, +44 20 3769 1554. The broker doesn’t currently offer a live chat service, which is a little surprising given the emphasis on technology and customer service.

The broker’s head office is located at Level 39, 1 Canada Square, Canary Wharf, London E14 5AB, United Kingdom.

Safety & Security

The MetaTrader platforms employ the highest standards of security to safeguard client data, including Secure Sockets Layer encryption as well as two-factor authentication (2FA). Darwinex servers are also X-connected to liquidity providers at the London Equinix LD4 Data Centre.

Darwinex Verdict

Darwinex is a good broker for traders with experience in social copy trading and FIX API. Top traders can benefit from discounted fees, whilst DARWIN investors can discover winning strategies on the Darwinex Exchange. However, some beginners may need to find alternatives if the minimum deposit of $500 is too high.

Top 3 Alternatives to Darwinex

Compare Darwinex with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Darwinex Comparison Table

| Darwinex | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 2.5 | 4.7 | 4.3 | 4 |

| Markets | Forex, CFDs, indices, shares, commodities, cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $500 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SVGFSA |

| Bonus | – | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4, MT5 | Web, ProRealTime, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:30 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 5 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Darwinex and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Darwinex | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

Darwinex vs Other Brokers

Compare Darwinex with any other broker by selecting the other broker below.

FAQ

What is the maximum leverage at Darwinex?

The max leverage available at Darwinex is 1:30 on major forex pairs. For minor pairs, you can leverage up to 1:20 and commodities can be leveraged up to 1:10.

What funding methods are available at Darwinex?

Funding is available via bank transfer, credit/debit cards and e-payment services such as Trustly and Skrill. PayPal deposits are not available.

Does Darwinex offer a no deposit bonus?

As per FCA regulations, Darwinex does not offer any no deposit bonus deals or other promotions.

How do I open an account at Darwinex?

You can open a trader or investor account by clicking the Sign Up button at the top of the website. The broker will take you through some steps to set up your credentials, before asking you to confirm your identity.

How does Darwinex work?

You open an account by registering on the broker’s website. You then fund your account and download the platform before you can start trading on the range of assets and markets.

What is the difference between the MT4 demo and MT4 live Darwinex account?

Prices, spreads and commissions are the same in the MT4 demo as in the MT4 live account. The main difference is slippage, which occurs in live accounts where trades are executed on the market. Slippage is therefore the difference between the price you expect and the price you get.

Customer Reviews

There are no customer reviews of Darwinex yet, will you be the first to help fellow traders decide if they should trade with Darwinex or not?