Forex Trading in Cyprus

The forex market in Cyprus has become a significant hub for trading, primarily due to its favorable tax incentives, with the absence of capital gains tax for individuals trading on a part-time basis.

Forex brokers also benefit from a corporate tax waiver on profits earned from transactions involving clients outside of Cyprus, making it an appealing location for brokerage companies.

This guide explores the fundamentals of forex trading in Cyprus by providing practical insights and a sample trade scenario.

Quick Introduction

- Cyprus is renowned for its robust regulatory environment with the Cyprus Securities & Exchange Commission (CySEC) among the most well-known regulators in Europe.

- The attractive tax setup, high concentration of online brokers, and the availability of advanced tools contribute to a vibrant and accessible forex market in Cyprus.

- Retail forex traders in Cyprus typically pay personal income tax, which is applied progressively based on your total annual income (up to 35% for income over €100,000).

Top 4 Forex Brokers in Cyprus

Our hands-on tests show these 4 trading platforms are best for forex traders in Cyprus:

See all Forex Brokers in Cyprus

How Does Forex Trading Work In Cyprus?

Forex trading in Cyprus involves the buying and selling of currency pairs in the foreign exchange market, such as EUR/USD (euro/US dollar), to profit from price fluctuations.

To start trading currencies online in Cyprus, you’ll need to:

- Open an account with a brokerage – we recommend choosing a CySEC-regulated broker.

- Deposit funds – consider selecting a broker with a EUR account to cut conversion fees.

- Execute trades – your brokerage will provide a desktop app, mobile app, or web-based platform (or a selection of all three).

Is Forex Trading Legal In Cyprus?

Forex trading is legal in Cyprus, with a stringent and well-defined regulatory framework overseen by the Cyprus Securities and Exchange Commission (CySEC).

All forex firms operating in the country must comply with strict regulatory standards to protect investors and maintain market integrity. This includes requirements such as obtaining an operating license, maintaining capital reserves, and segregating client funds from company money.

In Cyprus, the maximum leverage for forex trading is typically capped at 1:30 for major currency pairs. The maximum leverage is usually lower for non-major currency pairs, around 1:20.

I’m reassured to see this limit is in line with European Securities and Markets Authority (ESMA), Australian Securities & Investments Commission (ASIC), and Financial Conduct Authority (FCA) regulations aimed at protecting retail investors by reducing their risk exposure.

Is Forex Trading Taxed In Cyprus?

Forex trading is taxed in Cyprus, with the specific tax obligations varying based on whether you are an individual or a corporate entity or classified as a professional trader.

For individual traders, profits from forex trading are generally subject to personal income tax, which is applied progressively based on total annual income (up to 35% for income over €100,000).

However, unlike most European countries, individuals do not have to pay capital gains or VAT (value-added tax) on trading profits.

Professional traders and corporate entities, on the other hand, face different tax regulations. Professional traders may be subject to higher tax rates, as their earnings from forex trading are considered business income.

Interestingly, corporate entities are subject to a relatively low corporate tax rate of 12.5% on their net profits, and income from dividends is tax-free.

When Is The Best Time To Trade Forex In Cyprus?

The optimal timing for trading currencies in Cyprus typically aligns with periods of high market liquidity and activity.

Generally, the best times to trade forex in Cyprus are during the early European session (approximately 09:00 to 11:00 Cyprus time) and the overlap with the US session (approximately 14:00 to 18:00 Cyprus time).

These times offer increased trading volume and volatility, providing more opportunities for profitable currency trades.

However, individual preferences and day trading strategies may vary depending on the currency pairs traded, so it’s important to assess personal goals and risk tolerance when determining the best time to trade.

Example Trade

To offer practical insights into forex trading in Cyprus, let me outline the steps I took to execute a day trade on the EUR/USD currency pair:

Event Background

I focused on a US Non-Farm Payrolls (NFP) report, which is released on the first Friday of the month by the US Bureau of Labor Statistics. This report provides insights into the US labor market during the previous month in all non-agricultural businesses.

Market Analysis

Before the NFP release, I analyzed various factors influencing the EUR/USD, such as recent economic data and central bank statements. I assessed market sentiment, technical indicators, and key support and resistance levels.

Interpretation Of Data

On NFP release day, I watched the actual employment figures compared to consensus forecasts. Strong data could boost the US dollar, while weak data might weaken it, causing volatility in the EUR/USD.

The readings were lower than expected (175k versus 243k jobs), so I anticipating an upward (bullish) move on the EUR/USD.

Trade Entry

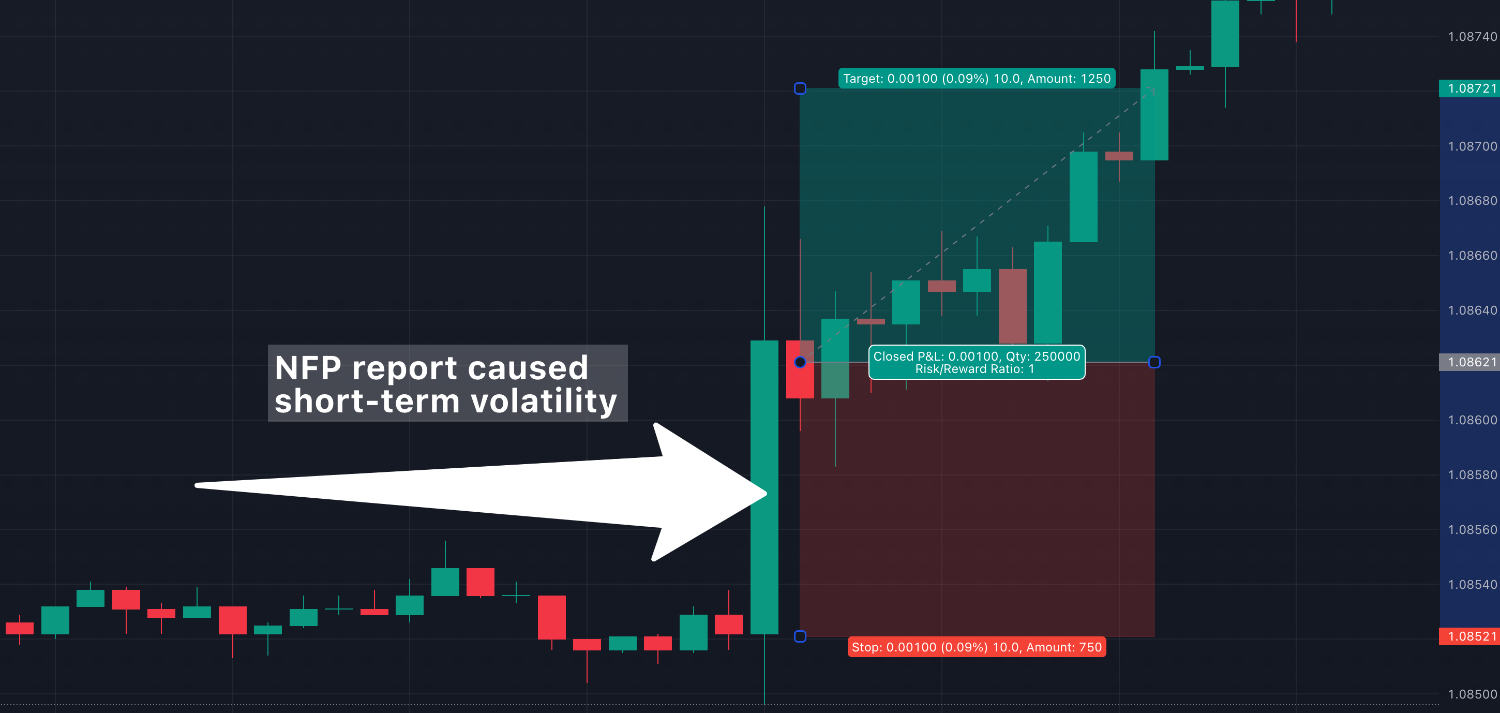

As the NFP data was released, I observed initial market reactions by looking at the EUR/USD price action on a 1-minute chart. There was a large 15-pip move on the first 1-minute candle following the announcement. As I was confident my analysis was correct, I entered a long position.

Trade Exit

NFP announcements can cause a lot of short-term volatility, so after entering the trade I set a take-profit target of 10 pips. I also set a stop-loss at 10 pips, for a 1:1 risk-to-reward ratio trade (risking 10 pips to make 10 pips).

I usually set profit targets based on technical levels or use a trailing stop-loss order to secure profits as the trade moves in my favor, but due to the volatility of an NFP announcement, I wanted to be out of the trade for a quick profit in case the price suddenly reversed. On this occasion, my trade took just 10 minutes to hit my 10-pip target.

Post-Trade Analysis

Once the forex trade closed, I reviewed my performance and the trade outcome. I assessed whether I followed my plan, evaluated my decision-making process, and learned from the experience to enhance my trading strategies in the future.

Bottom Line

Forex trading in Cyprus offers several advantages, including favorable tax policies, proximity to major financial centers. There is also a huge pool of forex brokers in Cyprus.

However, you should carefully consider factors such as regulation, licensing, fees, and customer support before engaging in forex trading in Cyprus.

Recommended Reading

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com