Best Day Trading Platforms and Brokers in Cyprus 2025

With a growing, euro-based economy and oversight from a highly active regulator, the Cyprus Securities and Exchange Commission (CySEC), interest in online trading is high among Cypriots.

We’ve listed the best day trading platforms in Cyprus following extensive tests. Many of these platforms cater specifically to active Cypriot traders with EUR accounts and access to the Cyprus Stock Exchange (CSE) or securities from across Europe and further afield.

Top 6 Platforms For Day Trading In Cyprus

Following our hands-on analysis of hundreds of online brokers, these 6 platforms continue to excel for short-term traders in Cyprus:

This is why we think these brokers are the best in this category in 2025:

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

- XM - XM is a globally recognized forex and CFD broker with 10+ million clients in 190+ countries. Since 2009, this trusted broker has been delivering low trading fees across its growing roster of 1000+ instruments. It’s also highly regulated, including by ASIC and CySEC and offers a comprehensive MetaTrader experience.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

- LiteForex Europe - LiteForex Europe is a CFD broker established in 2008 and authorized by the CySEC. The brokerage offers forex, commodities and indices via the MT4 and MT5 platforms. Spreads are ultra tight on ECN accounts and leverage is available up to 1:30 in line with EU regulations. LiteForex also offers a rich education centre for new day traders and social trading capabilities.

- FOREX.com - Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

- eToro - eToro is a top-rated multi-asset platform which offers trading services in thousands of CFDs, stocks and cryptoassets. Launched in 2007, the brand has millions of active traders globally and is authorized by tier one regulators, including the FCA and CySEC. The brand is particularly popular for its comprehensive social trading platform. Cryptoasset investing is highly volatile and unregulated in the UK and some EU countries. No consumer protection. Tax on profits may apply. 51% of retail CFD accounts lose money.

Best Day Trading Platforms and Brokers in Cyprus 2025 Comparison

| Broker | CySEC Regulated | EUR Account | Minimum Deposit | Markets | Platforms | Leverage |

|---|---|---|---|---|---|---|

| AvaTrade | ✔ | ✔ | $100 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade | 1:30 (Retail) 1:400 (Pro) |

| XM | ✔ | ✔ | $5 | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies | MT4, MT5, TradingCentral | 1:30 |

| Pepperstone | ✔ | ✔ | $0 | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower | 1:30 (Retail), 1:500 (Pro) |

| LiteForex Europe | ✔ | ✔ | $50 | CFDs, Forex, Indices, Commodities | MT4, MT5 | 1:30 |

| FOREX.com | ✔ | ✔ | $100 | Forex, CFDs, Stocks, Indices, Commodities, Futures, Options, Crypto | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral | 1:30 |

| eToro | ✔ | ✔ | $50 | CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs | eToro Web, CopyTrader, TradingCentral | 1:30 |

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

- AvaTrade continues to enhance its suite of products, recently through AvaFutures, providing an alternative vehicle to speculate on over 35 markets with low day trading margins.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

Cons

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | ASIC, CySEC, DFSA, IFSC |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM’s customer support has delivered over years of testing, with 24/5 assistance in 25 languages, response times of <2 minutes and now a growing Telegram channel.

- XM’s Zero account is ideal for day trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, and no requotes or rejections.

- XM stands out for its commitment to trader education, with a wealth of well-presented resources, including webinars, tutorials, and even real-time trading sessions through XM Live.

Cons

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

- Although trusted and generally well-regulated, the XM global entity is registered with the weak IFSC regulator and UK clients are no longer accepted, reducing its market reach.

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Pepperstone has greatly improved the deposit and withdrawal experience in recent years, adding Apple Pay and Google Pay in 2025, as well as PIX and SPEI for clients in Brazil and Mexico in 2024.

- Award-winning customer support is available via telephone, email or live chat with response times of <5 minutes during testing.

- There’s support for a range of industry-leading charting platforms including MT4, MT5, TradingView, and cTrader, catering to various short-term trading styles, including algo trading.

Cons

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers such as eToro, with no option to invest in real coins.

LiteForex Europe

"LiteForex is a good option for active day traders with variable spreads from 0.0 pips, daily analysis and high-quality training guides. The forex copy system also lets you duplicate the positions of experienced traders."

William Berg, Reviewer

LiteForex Europe Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Indices, Commodities |

| Regulator | CySEC, AFM |

| Platforms | MT4, MT5 |

| Minimum Deposit | $50 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 |

| Account Currencies | USD, EUR, GBP, CHF |

Pros

- Low $50 minimum deposit makes LiteForex accessible for beginners

- LiteForex has been established for 15+ years and is regulated by a trusted regulator, CySEC

- A proprietary copy trading system is available which allows you to copy other trading patterns

Cons

- Fees are fairly high, with spreads starting from 2.0 pips in the Classic account and $10 forex commissions in the ECN account

- Cryptocurrency trading is not offered

- The range of day trading markets is limited compared to alternatives, with no share CFDs offered

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Bonus Offer | 20% Welcome Bonus Up To $5000 |

|---|---|

| Demo Account | Yes |

| Instruments | Forex, CFDs, Stocks, Indices, Commodities, Futures, Options, Crypto |

| Regulator | NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA |

| Platforms | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- Alongside a choice of leading platforms, FOREX.com offers a superb suite of supplementary tools including Trading Central research, SMART Signals pattern scanner, trading signals, and strategy builders.

Cons

- Despite increasing its range of instruments, FOREX.com's product portfolio is still limited to forex and CFDs, so there are no options to invest in real stocks, real ETFs or real cryptocurrencies.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

eToro

"eToro's social trading platform leads the pack with a terrific user experience and active community chat that can help beginners find opportunities. There are also competitive fees on thousands of CFDs and real stocks, plus excellent rewards for experienced strategy providers."

Christian Harris, Reviewer

eToro Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs |

| Regulator | FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF |

| Platforms | eToro Web, CopyTrader, TradingCentral |

| Minimum Deposit | $50 |

| Minimum Trade | $10 |

| Leverage | 1:30 |

| Account Currencies | USD, EUR, GBP |

Pros

- eToro has finally introduced EUR and GBP accounts, cutting conversion fees and providing a trading experience more tailored to local needs.

- eToro picked up second place in DayTrading.com's 'Best Crypto Broker' for 2025 with its huge range of tokens, reliable service and competitive fees.

- There's a comprehensive online training academy with accessible resources, from bitesize articles to comprehensive courses.

Cons

- There are no guaranteed stop loss orders which would be a useful risk management feature for beginners.

- There are limited contact methods aside from the in-platform live chat.

- There is a $30 minimum withdrawal amount and a $5 fee, which will affect novices with low capital.

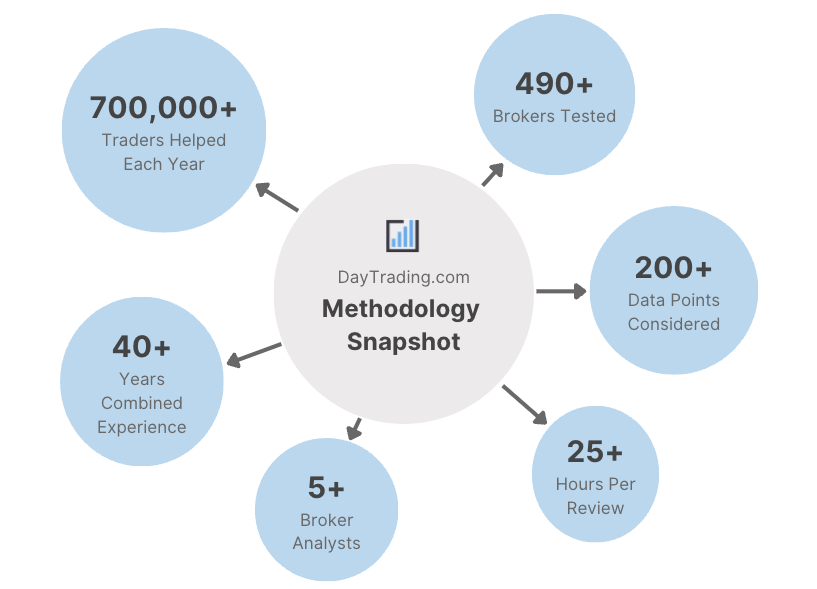

Methodology

To find the best day trading brokers in Cyprus, we examined our directory of 223 online platforms, pinpointed all those that accept Cypriot traders, and ranked them by their overall score.

Our ratings combine 100+ data points with findings from our hands-on evaluations in key areas:

- We made sure each broker accepts Cypriot day traders.

- We only recommended brokers that are CySEC-regulated.

- We favored brokers with competitive day trading fees.

- We prioritized brokers with a range of financial markets.

- We focused on brokers with powerful charting platforms.

- We ensured each broker offers clear requirements for leverage trading .

- We investigated each broker’s order execution quality.

- We checked that each broker offers an accessible minimum deposit.

How To Choose A Day Trading Broker In Cyprus

After thousands of hours testing platforms, we’ve learned there are several factors to consider when choosing a broker for day trading:

Trust & Regulation

Brokers with a strong industry reputation and authorization from a trusted regulator maintain a secure trading environment, helping to protect investors from trading scams.

For example, in 2023, Cyprus police warned investors of a telephone scam where fraudsters impersonated representatives from the local watchdog, the Cyprus Securities and Exchange Commission (CySEC).

As a ‘green tier’ regulator, the CySEC flags fraudulent activities, enforces legal action where appropriate and administers robust safeguarding measures.

Notably for short-term traders, these include negative balance protection so you can’t lose more than your balance and limiting leverage for retail traders to 1:30, capping potential losses.

- AvaTrade remains a top pick for Cypriot investors with authorization from the CySEC (among other green tier licenses) and a stellar reputation since 2006. Day traders can also feel assured of robust protections, particularly AvaProtect, which insures losses up to $1 million.

Day Trading Fees

Day trading involves making frequent transactions, so competitive pricing is key to keeping costs down.

The top brokers offer narrow spreads on markets that will be of interest to traders in Cyprus, such as EUR/USD and, where applicable, low commission fees.

Non-trading fees can also impact profit margins, so we look for charges on deposits and/or withdrawals.

With that said, it’s important to consider the overall service provided, since higher fees may be justified in return for superior tools. For example, you might get live economic updates from the European Central Bank which could impact the euro’s value.

- Pepperstone consistently stands out for its excellent pricing for active traders, including raw spreads from 0.0 on EUR/USD and 2.0 on the Euro Currency Index. You also get access to AutoChartist, a market-leading technical analysis tool that identifies chart patterns on assets like the Eurostoxx 50.

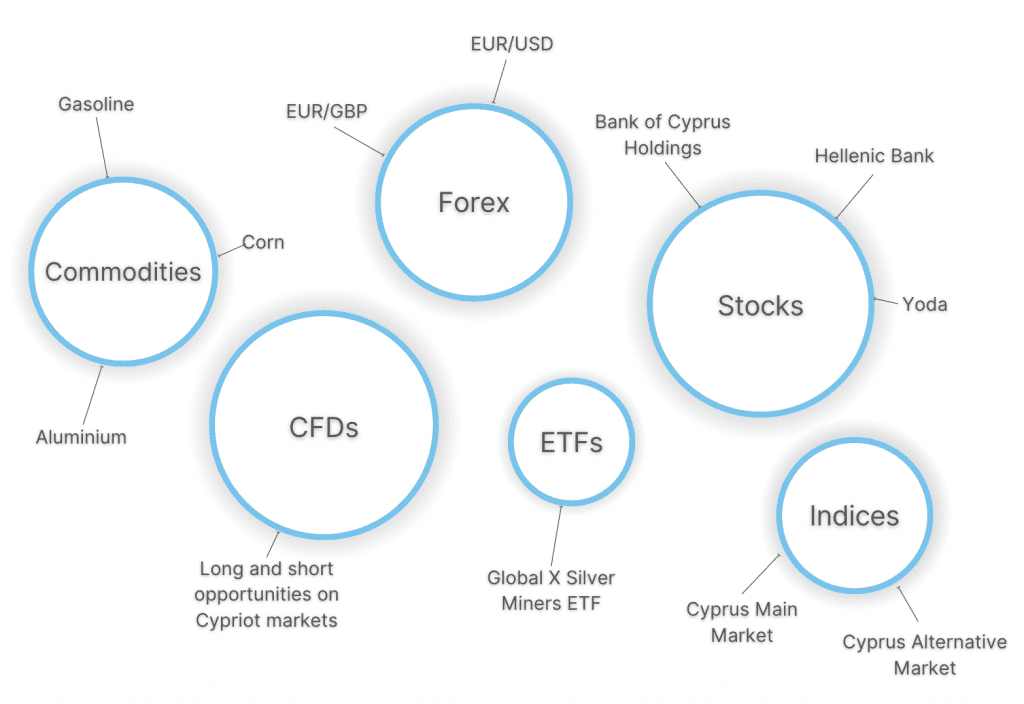

Market Coverage

Day traders often want access to a wide range of markets, enabling them to build a diverse portfolio.

Many of our recommended platforms offer a broad range of local markets, including major, minor and exotic EUR currency pairs and notable export and import commodities in Cyprus, such as gasoline and corn.

While Cypriot stocks are not widely offered, our tests show many brokers allow you to explore a range of popular European stocks and indices which you can conveniently trade in Euros.

- IG offers some of the best opportunities for Cypriot traders, with a vast range of 17000+ markets including EUR currency pairs and popular local stocks like Bank of Cyprus. Unusually, you can also trade out of hours, including weekend markets like EUR/USD.

Platforms & Tools

A powerful charting platform is crucial for technical analysis – a popular approach to identifying short-term trading opportunities.

The best brokers offer a range of platforms to suit different experience levels and requirements, with MetaTrader 4 and MetaTrader 5 being the most widely available.

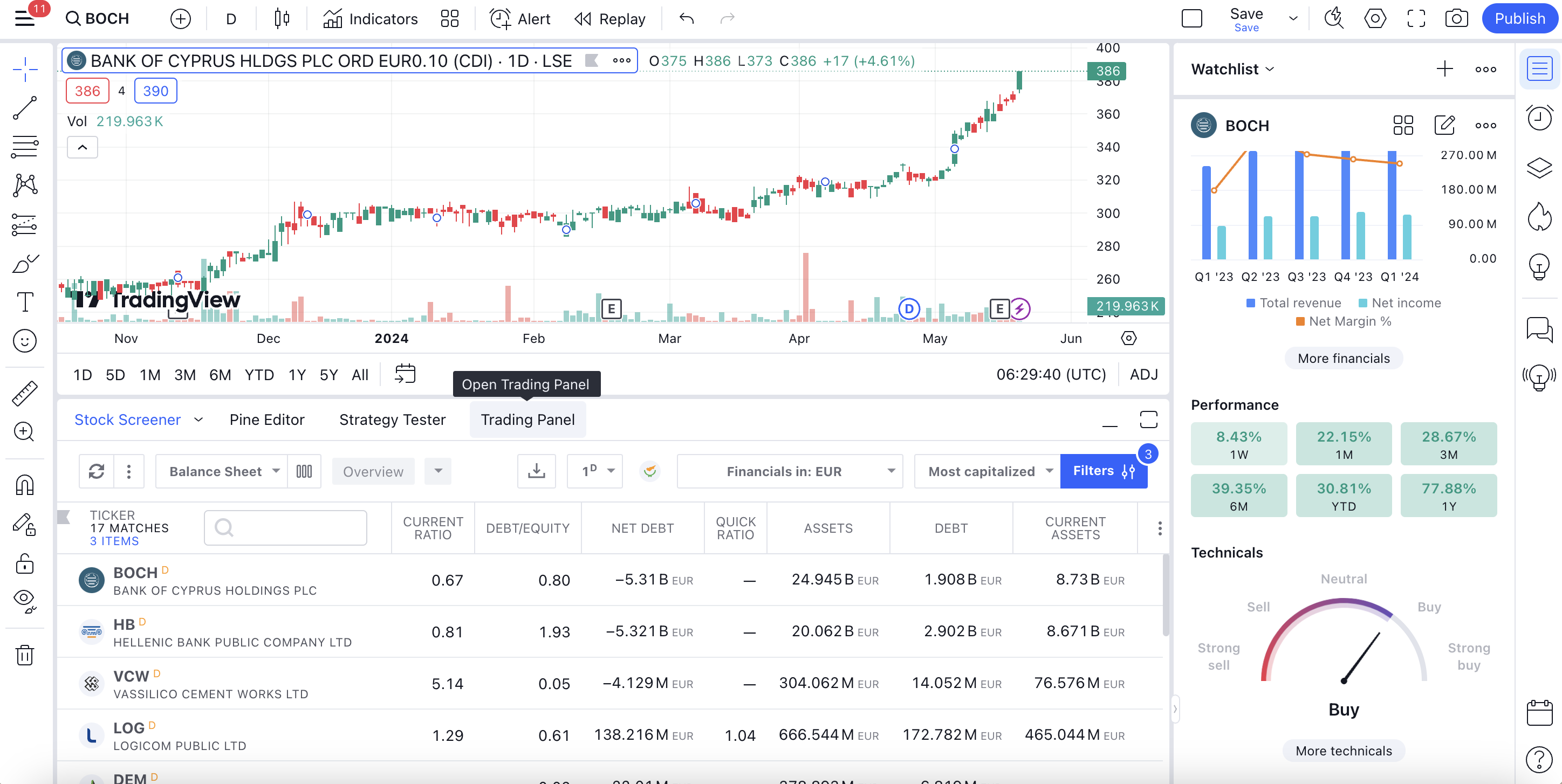

I enjoy using the sleeker workspaces provided by cTrader and TradingView – the former being a great option for experienced traders with coding expertise, and the latter offering the best user-friendly solution for newer traders in my opinion.I especially appreciate TradingView’s highly intuitive workspace which I can fully customize to view Bank of Cyprus data, alongside an integrated news feed, earnings reports and market sentiment.

- Vantage delivers a superb range of platforms catering to various needs, including MT4, MT5, TradingView and a proprietary solution, ProTrader. There’s also a great copy trading platform for aspiring traders, as well as the DupliTrade automated trading solution. It has something for everyone.

Execution Quality

The best day trading brokers offer fast and reliable order execution, which is especially important for fast-paced strategies like scalping and algo trading.

Optimum conditions require fast speeds, ideally meeting our benchmark of <100 milliseconds, as well as minimal delays and price slippage. This will help you lock in desired prices and move quickly in and out of positions when trading volatile securities, such as the Cyprus Cement PCL.

- FOREX.com provides excellent execution for active traders, with speeds hitting around 50 milliseconds on major assets. It has also reported that 43.83% of orders were executed at a better price than the requested price.

Leverage & Margin

Leveraged trading gives you greater exposure than your initial budget would otherwise allow, making it very popular with active traders. However, day traders need to understand margin requirements before opening leveraged positions.

For example, let’s say I want to trade shares in Bank of Cyprus with leverage of 1:5, and I speculate that the bank will announce a strong Q1 in their latest earnings report.If my prediction is correct, my potential gains from a €500 deposit would multiply 5x, to €2500.

That said, so too would my losses if I’m wrong, underscoring the importance of risk management and tools like stop-loss orders which can help limit losses.

- Deriv offers leverage up to 1:30 on major currency pairs like EUR/USD, in line with Cyprus’ requirements, alongside a useful margin calculator making it easy to understand the required outlay. The brand also stands out by offering multipliers up to x30 where you can’t lose more than your original stake – appealing to newer traders.

Account Funding

Our investigations into 223 brokers show most day trading platforms allow you to open an account for less than €250, though some stand out with no minimum deposit – ideal for budget traders.

It’s worth considering a broker that offers convenient and locally supported payment methods in Cyprus. For example, according to findings by Online Solutions, PayPal remains one of the most popular options among Cypriots.

FAQ

Who Regulates Day Trading Platforms In Cyprus?

The Cyprus Securities and Exchange Commission (CySEC) is a ‘green tier’ regulator responsible for licensing day trading brokers in Cyprus.

Among other EU authorities, which can accept Cypriot traders through the EU passporting scheme, it sets the standard for safeguarding measures that protect retail traders.

Which Is The Best Broker That Accepts Day Traders In Cyprus?

Use our list of the best day trading platforms in Cyprus to find a suitable firm.

If you’re looking for domestic markets, for example, IG offers notable Cypriot stocks and EUR currency pairs among thousands of other global opportunities. It’s also got some of the best research and education resources I’ve seen, tailored to all experience levels.

Recommended Reading

Article Sources

- Cyprus Economy Expected To Grow In 2024 - European Commission

- Cyprus Stock Exchange (CSE)

- Cyprus Telephone Scam - Finance Magnates

- Cyprus Securities and Exchange Commission (CySEC)

- European Central Bank (ECB)

- Bank of Cyprus Holdings

- Payment Methods Cyprus - Online Solutions

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com