Day Trading in Cyprus

Cyprus, with a GDP of approximately $32.23 billion, offers a diversified economy that includes thriving sectors such as tourism, shipping, and financial services, presenting exciting opportunities for day traders.

It also sports a favorable tax regime and a huge network of international banking facilities, while the Central Bank of Cyprus maintains a robust financial system, adhering to EU directives, ensuring a fair trading environment.

With this guide, fast-track your success in Cyprus’s thriving online trading market.

Quick Introduction

- Day trading is overseen by the Cyprus Securities & Exchange Commission (CySEC), a ‘green tier’ regulator that provides valuable safeguards, such as the Investor Compensation Fund (ICF), which insures client funds up to €20,000 in the event of broker insolvency.

- Cyprus boasts its own stock exchange, the Cyprus Stock Exchange (CSE), founded in 1996 and headquartered in Nicosia. It facilitates trading in stocks, bonds, and other securities.

- Short-term traders benefit from a tax-friendly environment. While you pay personal income tax on profits, unlike most of Europe, you’re exempt from capital gains on trading profits.

Top 4 Brokers In Cyprus

Our latest tests reveal these 4 trading platforms as standout choices for active Cypriot traders:

All Day Trading Platforms in Cyprus

What Is Day Trading?

Day trading is a high-speed, high-risk game where traders buy and sell securities like stocks within a single day, aiming to capitalize on fleeting price fluctuations.

Intraday trading opportunities in the country reflect its economic strength with diverse instruments: CSE-listed stocks (e.g., Cyprus Cement), and essential export commodities, like oil, iron, and copper.

Forex trading in Cyprus is also huge, providing opportunities to speculate on currency pairs like the EUR/USD.

Is Day Trading Legal In Cyprus?

Cyprus welcomes day traders with a clear and rigorous regulatory framework managed by the CySEC.

All brokers in Cyprus must adhere to strict standards to ensure investor protection and market stability. This includes obtaining a license, maintaining sufficient financial reserves, and keeping client funds separate from company funds.

Additionally, Cyprus has implemented leverage limits, typically capped at 1:30. Leverage is a tool that allows you to control a large position with a smaller amount of capital.

How To Start Day Trading

Day trading is high-octane, but mastering the basics is your launchpad to success. Here’s what you need to prepare yourself:

- Building a secure foundation begins with choosing a broker authorized to operate in Cyprus either through the CySEC or the EU’s passporting regime. This puts your financial safety first, empowering you to focus on refining your day trading strategies.

- Finding a top day trading broker in Cyprus streamlines your account opening. The verification process is usually a breeze, typically requiring your Cypriot identity card (Κυπριακή ταυτότητα) and a recent bill for residency confirmation. Once approved, funding your account is easy with options like wire transfers, debit cards, or even innovative mobile wallets like the Greece-based Viva Wallet.

- Cypriot markets brim with options for active traders. Stock traders can speculate on large-cap companies Salamis Tours and Kew. Meanwhile, currency traders can capitalize on fluctuations in Cyprus’s official currency with popular forex pairs like EUR/AUD and EUR/JPY.

Example Trade

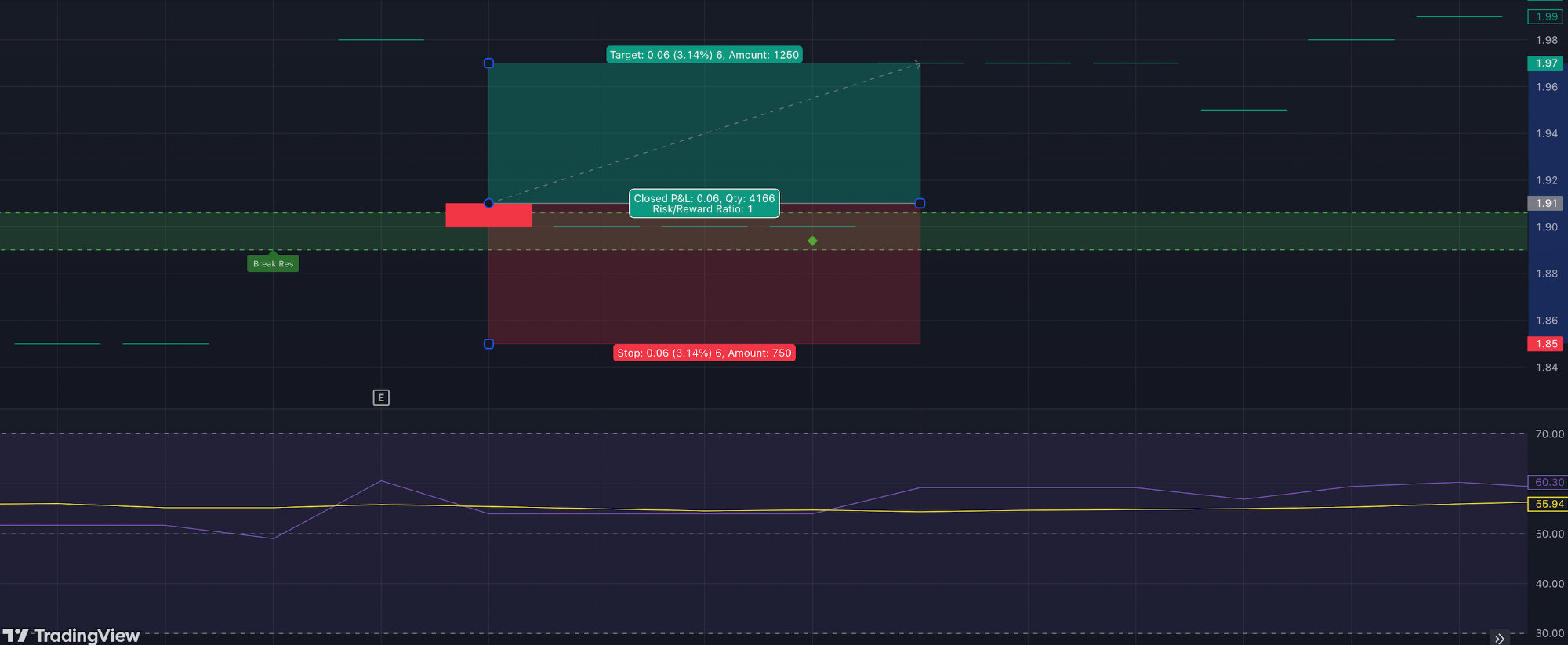

To understand how short-term trading works in practice, let’s explore a scenario involving CSE-listed Atlantic Insurance, one of Cyprus’s leading general insurance companies.

Event Background

Company earnings reports are a great opportunity for day traders because they present a chance for increased volatility and the potential for quick profits (or losses).

Anticipating the impact of Atlantic Insurance’s earnings release, I prepared for an unpredictable market reaction. Earnings reports don’t always predict future performance so a company might beat expectations but still have a weak outlook, leading to a short-lived price increase.

Data Analysis

Before the market opened, I thoroughly analyzed Atlantic Insurance’s stock (ATL) on the CSE.

The previous day’s closing price was €1.82 per share. I examined the stock’s recent performance and noticed it had been trading within a range of €1.78 to €2.00 over the past month.

The Relative Strength Index (RSI) was around 60, indicating the stock was not overbought.

In the earnings report, the company announced a net income of €12.78 million, compared to €6.01 million a year ago. Basic earnings per share from continuing operations were also higher, at €0.3283 compared to €0.1542. This was a bullish sentiment.

Trade Entry

Based on my analysis and the positive news from the company event, I decided to enter a long position. As soon as the market opened, I closely monitored the stock’s movement. Within the first 30 minutes, Atlantic Insurance’s stock dropped.

It also dropped for the entire trading session and closed at €1.90, so my long position ended up down 0.5%.

I set a take profit at €1.97 (+3.14% ROI) and a stop-loss order at €1.85 (-3.14% ROI) for a 1:1 risk/reward, and decided to keep the position open because the news was positive.

Trade Exit

The stock continued to consolidate. Thankfully, the price rallied and hit my take profit level.

Patience in this trade helped me to make an informed decision and manage risk effectively.

How Is Day Trading Taxed In Cyprus?

Cyprus has one of the most attractive tax regimes in Europe. Your specific tax obligations vary depending on whether you are an individual, a corporate entity, or a professional trader.

For individual traders, profits from online trading are generally subject to personal income tax, which is applied progressively based on total annual income (up to 35% for income over €100,000).

Bottom Line

Cyprus beckons active traders with many advantages: robust infrastructure, a tax-friendly environment, and strong regulations. Cyprus’s appeal is further amplified by the presence of the CSE and the watchful eye of the CySEC.

To get started, choose a top-rated day trading platform in Cyprus.

Recommended Reading

Article Sources

- Central Bank of Cyprus

- Cyprus Securities and Exchange Commission (CySEC)

- Cyprus Stock Exchange (CSE)

- Investor Compensation Fund (ICF)

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com