Best Unregulated Crypto Brokers in 2025

Crypto remains the wild west of the trading world, with many brokers operating without regulatory oversight. Unlicensed platforms can be attractive, streamlining account opening with fewer compliance barriers, providing high leverage up to 200x on the likes of Bitcoin, and sometimes offering a larger suite of volatile cryptos.

However, unregulated platforms come with huge risks, notably zero protection if your broker goes bankrupt, which we saw when Cryptopia went under, while also leaving you open to scams like notorious ‘Pig Butchering’ schemes, which have cost investors millions. That’s why we mainly recommend regulated brokers.

For those willing to take the risk, discover DayTrading.com’s best unregulated crypto platforms. Each broker and exchange has been tested by our experts, many of whom trade or hold cryptocurrencies in their portfolios.

Top 6 Unregulated Crypto Brokers

Based on our latest evaluations, these 6 unauthorized brokers stand out as the best for trading cryptocurrency:

-

1

UpholdTerms Apply. Cryptoassets are highly volatile. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

UpholdTerms Apply. Cryptoassets are highly volatile. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. -

2

Plexytrade

Plexytrade -

3

Nexo

Nexo -

4

Binarium

Binarium -

5

Videforex

Videforex -

6

RaceOption

RaceOption

Here is a summary of why we recommend these brokers in April 2025:

- Uphold - You can buy and sell 250+ crypto assets with fiat currencies or in crypto pairs using the straightforward mobile app or through Uphold's browser-based account homepage. This is significantly more than many rivals. You can also earn up to 16% APY by staking one or more out of 32 valid tokens, or send tokens to an external wallet.

- Plexytrade - Plexytrade lets traders capitalize on the inherent volatility of the cryptocurrency market by offering leveraged trading on 5 popular cryptocurrencies, including Bitcoin. However, the threadbare offering of digital tokens seriously trails leading brokers like Eightcap with its 100+ crypto derivatives.

- Nexo - Nexo offers trading on an impressive suite of around 70 tokens, including Bitcoin. Digital assets can be bought, sold and swapped directly on the exchange or traded in over 500 pairs. Digital assets can also be used as collateral for fiat loans or used to generate passive income with the ‘smart staking’ tool or from interest earned via peer-to-peer loans.

- Binarium - Trade binary options on three Bitcoin pairs – BTC/USD, BTC/GBP and BTC/EUR – with flexible contract lengths. Simply bet whether the price of the asset will rise or fall.

- Videforex - Traders can speculate on crypto prices in pairs with USD and CNY through binary options and CFDs. The range of digital currencies is fairly narrow vs alternatives but major tokens like Bitcoin are available.

- RaceOption - Trade popular crypto CFDs with leverage up to 1:30 and utilize convenient crypto funding in Bitcoin, Ethereum or other altcoins. You can also enjoy fully flexible, 24/7 crypto trading at home or on the go. Cryptos are paired with USD and CNY.

Best Unregulated Crypto Brokers in 2025 Comparison

| Broker | Crypto Spread | Platforms | Minimum Deposit | Crypto Staking | Crypto Mining |

|---|---|---|---|---|---|

| Uphold | Up to 1.5% | Desktop Platform, Mobile App | $0 | ✔ | ✘ |

| Plexytrade | 1.1 | MT4, MT5 | $50 | ✘ | ✘ |

| Nexo | N/A | Nexo Pro | $10 | ✔ | ✘ |

| Binarium | N/A | Own | $5 | ✘ | ✘ |

| Videforex | Floating | TradingView | $250 | ✘ | ✘ |

| RaceOption | Variable | TradingView | $250 | ✘ | ✘ |

Uphold

"Uphold remains a top choice for crypto investors looking for a one-stop-shop solution to accessing the markets. There are over 250 tokens to buy, sell and trade through flexible platform options."

William Berg, Reviewer

Uphold Quick Facts

| Coins | BTC, BTCO, AAVE, ALCX, DYDX, INH, XYO, API3, GHST, LSK, AUDIO, GLMR, NMR, CAKE, GODS, REQ, CHR, TRB, DAO, ROOK, XRP, ETH, BAT, ADA, ALGO, ATOM, AVAX, AXS, BCH, BAL, BTG, CSPR, COMP, CRV, DASH, DCR, DGB, DOGE, DOT, EGLD and many more |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | Up to 1.5% |

| Crypto Lending | No |

| Crypto Staking | Yes |

| Platforms | Desktop Platform, Mobile App |

| Minimum Deposit | $0 |

| Account Currencies | USD, EUR, GBP |

Pros

- Uphold continues to remain ahead of the industry, often being one of the first platforms to list new crypto tokens

- Fees are competitive based on tests, with 26 underlying platforms helping to source the best prices

- UK users can get the Uphold card with up to 2% cashback in XRP

Cons

- Uphold operates with limited regulatory oversight

- Customer service is slow based on tests, with limited contact options

- There is a 2.49% fee if you want to use debit or credit cards

Plexytrade

"Plexytrade is a newcomer in the brokerage scene with attention-grabbing features like 1:2000 leverage, zero spreads on select instruments and fast execution speeds of less than 46 milliseconds. However, the absence of regulation is a significant concern, while the non-existent research and educational tools place it far behind industry frontrunners."

Christian Harris, Reviewer

Plexytrade Quick Facts

| Bonus Offer | 120% Cash Welcome Bonus |

|---|---|

| Coins | BTC, ETH, LTC, SOL, XRP |

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | 1.1 |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | MT4, MT5 |

| Minimum Deposit | $50 |

| Account Currencies | USD, EUR |

Pros

- Despite lacking regulation, Plexytrade provides negative balance protection and reinforces safety protocols by holding client funds in segregated accounts.

- US residents are accepted as clients, distinguishing Plexytrade as one of the rare offshore brokers that cater to US-based traders.

- Plexytrade accommodates a range of trading methods and short-term strategies, including scalping, hedging, and automated trading.

Cons

- Deposits and withdrawals are exclusively facilitated through cryptocurrencies, as Plexytrade does not support bank cards, bank wire transfers, or e-wallets.

- With around 100 instruments, Plexytrade restricts the flexibility of investors who prefer to trade across various assets, especially compared to Blackbull with its 26,000 securities.

- There are no research and educational materials, falling short of alternatives like IG, while access to the economic calendar is restricted to clients with balances of $500.

Nexo

"Nexo gives crypto traders the capability to trade, invest, lend and borrow digital assets in one place, and it’s especially good for its credit functions that pay out very high yields to lenders. However, its fees are relatively high and many day traders will prefer a more tightly regulated crypto broker."

Michael MacKenzie, Reviewer

Nexo Quick Facts

| Bonus Offer | Loyalty scheme with various bonuses, plus referral program and bonus paid to lenders on credit line |

|---|---|

| Coins | BTC, ETH, NEXO, USDT, USDC, AXS, RUNE, MATIC, DOT, APE, AVAX, KSM, ATOM, FTM, NEAR, BNB, ADA, SOL, XRP, LTC, LINK, BCH, TRX, XLM, EOS, PAXG, UNI, DOGE, MANA, SAND, GALA, SUSHI, AAVE, CRV, MKR, 1INCH, DAI, USDP, TUSD |

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | N/A |

| Crypto Lending | Yes |

| Crypto Staking | Yes |

| Platforms | Nexo Pro |

| Minimum Deposit | $10 |

| Account Currencies | USD, EUR, GBP |

Pros

- Traders can access perpetual futures to open long or short positions on crypto assets, increasing strategic opportunities

- Value-add tools integrated into the trading platform including social media analysis and newsfeeds by asset

- Reputable crypto exchange that has been in business since 2018 and has taken some steps toward regulation

Cons

- High maker/taker fees mean day traders will pay more to trade derivatives than they would at rival exchanges like Binance

- Although Nexo has registered with some reputable watchdogs, it is riskier to trade with than established crypto brokers like AvaTrade and Vantage

- The range of tokens is extensive compared to most crypto brokers but still much smaller than similar crypto exchanges like Kraken

Binarium

"Binarium has been designed with simplicity in mind, featuring a fast, fully digital sign-up process and an intuitive platform and app with 4 chart types and 12 indicators. With binaries spanning 5 minutes to 3 months, it caters to short- and medium-term traders."

William Berg, Reviewer

Binarium Quick Facts

| Coins | BTC |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | N/A |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | Own |

| Minimum Deposit | $5 |

| Account Currencies | USD, EUR, AUD, RUB |

Pros

- Binarium claims to segregate client funds with EU banks, meaning traders’ money should not be misused and providing an important layer of protection, which is especially relevant given its offshore status.

- The $10,000 demo account, deposit-doubling welcome bonus, smooth sign-up, and 24/7 support make for an attractive onboarding experience.

- Binarium has the best education centre we’ve seen amongst binary options brands, complete with information on core topics like trading basics and account options, plus professional video guides to using the platform.

Cons

- Payouts of up to 80% are on the low side of binary options platforms based on our evaluations, which may deter traders looking for the possible best returns, though you can get back up to 15% of losing trades.

- Despite being operational since 2012, Binarium is an unregulated broker with limited transparency on its website, raising safety concerns and potentially putting your capital at risk.

- Binarium has some way to go to match the investment offering of binary firms like Quotex, with a particularly weak selection of around 20 currencies and 3 cryptocurrencies.

Videforex

"Videforex will serve traders looking for a no-frills, easy-to-use platform to speculate on the direction of popular financial markets through binaries. With a sign-up process that takes a matter of minutes and a web-accessible platform, getting started is a breeze. "

William Berg, Reviewer

Videforex Quick Facts

| Bonus Offer | 20% to 200% Deposit Bonus |

|---|---|

| Coins | BTC, ETH, QUANT, UNI, SOL, BNB, DOGE, XRP, XMR, MATIC, USDT |

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | Floating |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | TradingView |

| Minimum Deposit | $250 |

| Account Currencies | USD, EUR, GBP, AUD, RUB |

Pros

- Videforex regularly runs trading contests, offering practice opportunities and cash prizes to beginners and experienced traders, with position sizes from just ¢0.01.

- Videforex is one of the few brokers with 24/7 multilingual video support, providing comprehensive assistance for active traders.

- Traders can earn up to 98% payouts on 100+ assets with the broker’s binary options, bringing it in line with competitors like IQCent.

Cons

- Videforex lacks authorization from a trusted regulator, meaning traders may receive little to zero safeguards like segregated client accounts.

- The absence of any educational tools is a serious drawback for newer traders who can find blogs, videos and live trading sessions at category leaders.

- The client terminal needs improvements based on our latest tests, sporting sometimes slow and unresponsive widgets which could dampen the experience for day traders.

RaceOption

"RaceOption will appeal to investors looking for a feature-rich binary options trading experience with regular contests, account-based perks, and copy trading. The catch is its unregulated status, with little to zero investor protections available based on our investigations."

William Berg, Reviewer

RaceOption Quick Facts

| Bonus Offer | 20% - 200% Deposit Bonus |

|---|---|

| Coins | BTC |

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | Variable |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | TradingView |

| Minimum Deposit | $250 |

| Account Currencies | USD, EUR, GBP, AUD, RUB |

Pros

- Payouts on popular underlying assets like EUR/USD can reach 95%, beating out most alternatives based on our evaluations, and increasing potential returns, while the first 3 trades are risk-free in Silver and Gold accounts.

- RaceOption is in the less than 1% of brokers that offers video chat, available 24/7 in multiple languages, although the knowledge of agents about trading and regulatory issues needs improvement from our direct experience.

- RaceOption makes account funding a breeze with fee-free and near-instant deposits via bank cards and cryptos, plus guaranteed withdrawals processing within 1 hour.

Cons

- RaceOption is one of the only brokers not to offer a demo account, which when considered alongside the absence of education, makes this broker a poor choice for beginners.

- While still affordable for many retail investors, the $250 minimum deposit raises the entry barrier, especially compared to Deriv and World Forex who are designed for budget traders.

- RaceOption is an unregulated, high-risk broker that doesn’t provide investor compensation or legal recourse options should you run into trading or withdrawal issues.

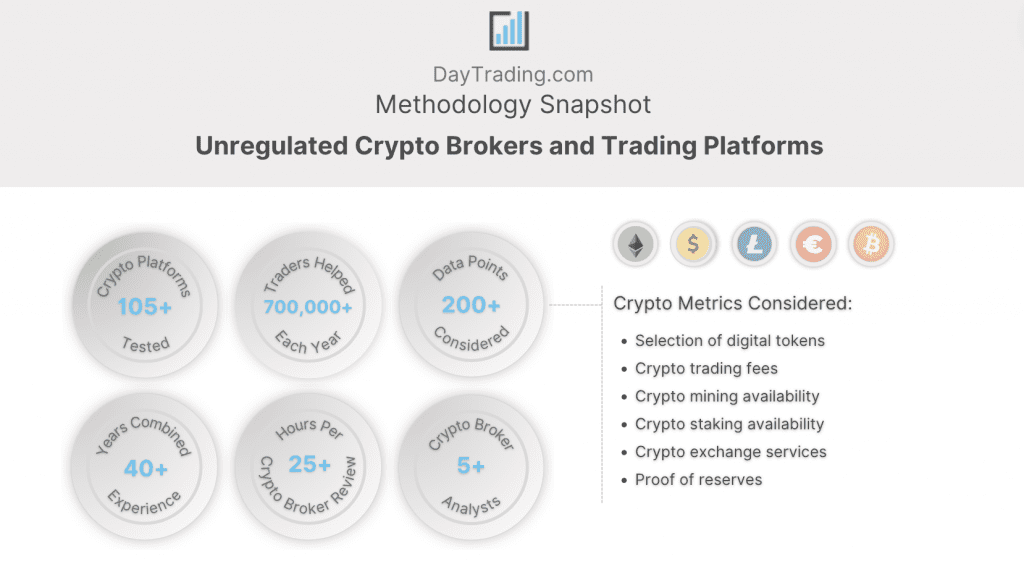

Our Methodology

To identify the top unlicensed crypto brokers, we followed three steps:

- We searched our database of over 105 crypto brokers, exchanges and trading platforms.

- We identified all those that are not regulated by a financial authority anywhere in the world.

- We sorted the unlicensed crypto providers by their rating, blending hard data with personal testing insights.

Choosing A Non-Regulated Crypto Trading Platform

Choosing the ‘right’ platform will depend on your individual requirements. However, we’ve pooled our years of experience and hundreds of hours evaluating unlicensed crypto providers to draw your attention to what we believe are the key considerations:

Trust

Find a brokerage you can trust.

This is the hardest part as unregulated crypto brokerages and exchanges won’t offer the same level of protection as providers authorized by regulators recognized in DayTrading.com’s Regulation and Trust Rating.

You may forfeit financial protections like compensation in the event of insolvency, which can be up to €20,000 in the EU, up to £85,000 in the UK, and up to $500,000 in the US.

This is significant given the number of crypto firms that have gone under (MT. Gox in 2014, Cryptopia in 2019, Celsius Network and FTX in 2022, to name but a few), with $8 billion in customer assets lost through FTX alone.

You may also lose negative balance protection, which could prevent your account from falling below zero, and you effectively becoming indebted to your brokerage, if say the price of Bitcoin quickly moves against you – something that’s very possible given the highly volatile nature of cryptocurrencies.

Still, there are hallmarks of a trustworthy crypto firm:

- A long history with a large client base

- A clean record with no regulatory fines

- Speedy, reliable support for any crypto trading issues

- Excellent reviews from other cryptocurrency traders and industry experts

- Uphold is the most trustworthy unlicensed crypto provider we’ve tested. It’s been in business since 2015, has 7+ million clients, uses two-factor authentication, and maintains proof of reserves. Despite its unregulated crypto activities, Uphold’s other trading products are authorized by respected bodies like the UK’s FCA.

Cryptocurrencies

Choose a provider with the cryptos you want to trade, whether that’s Bitcoin, Ethereum, Ripple or lesser-known tokens.

You can check this by exploring the broker’s website before signing up for a live account or through a demo account (offered by most top firms).

A word of warning: Without the oversight of regulators, these companies are more likely to provide cryptocurrencies that could be poorly researched or even part of dodgy schemes, increasing the risks if tokens turn out to be scams or plummet in value.

- PrimeXBT’s selection of 100+ crypto products, including CFDs and futures, provides more trading opportunities than the vast majority of unlicensed providers we’ve examined. Alongside major tokens like Bitcoin and Ethereum, you can trade lesser-known altcoins like Tezor and Filecoin.

Tools

Select a broker with user-friendly tools that you need to trade cryptocurrencies, whether that’s a desktop client or a crypto trading app.

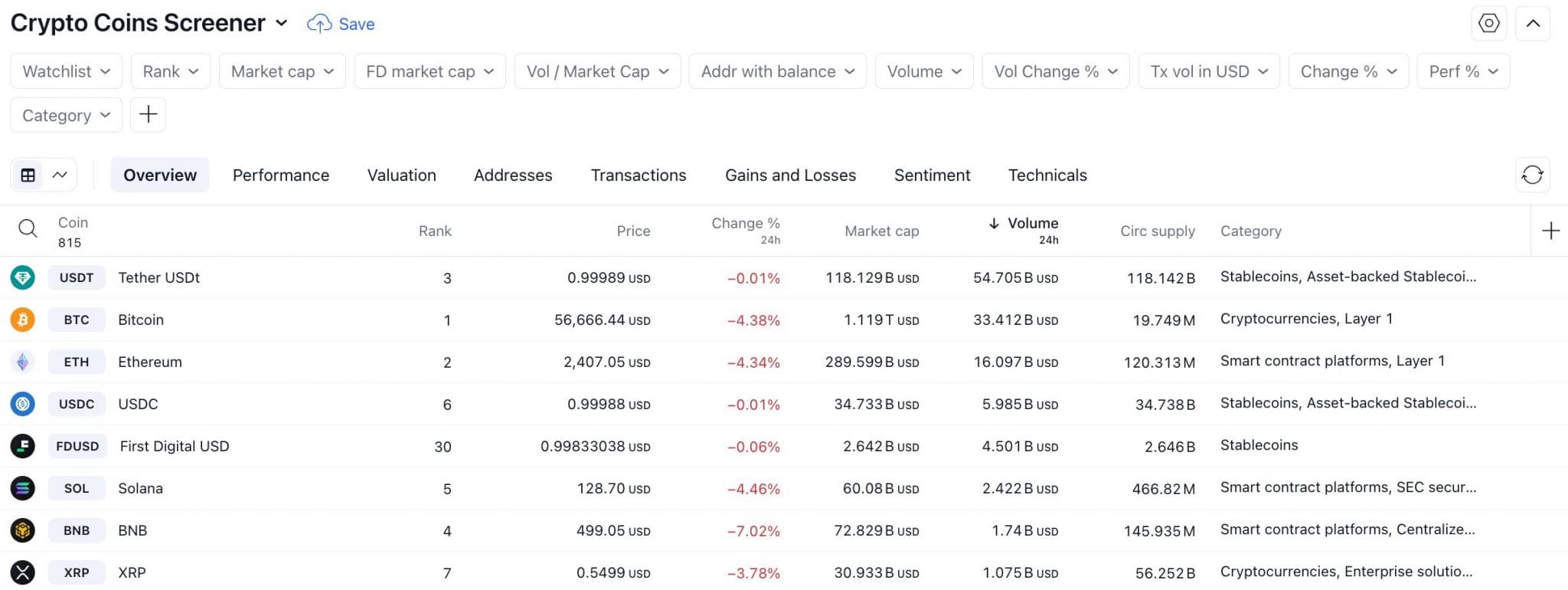

For day traders, an excellent charting package with a choice of charts, timeframes, indicators and drawing tools will be important.

You’ll find this if you opt for third-party solutions like MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader and increasingly TradingView (which offers a slick crypto screener that you can filter by market cap, volume, social media sentiment and more).

However, our tests have found a slim platform selection at most unregulated crypto brokers.

In addition, the quality of the in-house terminals provided by unlicensed brokers can be poor. We’ve seen technical glitches, ugly interfaces and sparse technical tools for analyzing crypto markets, which can make for an extremely frustrating trading experience.

- Plexytrade delivers a reliable crypto trading environment to suit traders at all levels, with MT4 and MT5 available on desktop, web and mobile apps. Both solutions offer a terrific range of technical analysis tools for short-term crypto trading, plus a fast, stable workspace.

Trading Conditions

Pick a platform with transparent, competitive crypto transaction fees, which can mount up for active traders.

Importantly, we’ve seen many unlicensed crypto trading platforms offer ‘commission-free’ trading but levy higher costs elsewhere, such as deposit/withdrawal charges and access to premium market research and insights.

Unregulated crypto brokers also tend to offer high leverage of 1:200+, significantly more than the 1:2 available in tightly regulated jurisdictions like the EU and UK. But this greatly increases the risks of thumping losses so risk management is essential.

- Bitfinex is a great choice for those looking to buy, sell and trade cryptocurrencies, with transparent 0.10% maker fees and 0.20% taker fees. These drop to 0.02% and 0.065% for derivative transactions. You can also access competitive leverage up to 1:10. Additionally, you can deposit in cryptos for a smooth experience.

Customer Support

Choose a broker with reliable support who can answer your crypto trading queries quickly and efficiently.

However, be prepared to forego access to multilingual 24/7 support, local helplines or account managers. Our support experiences at unlicensed crypto brokers have been poor nearly across the board.

Our questions have been met with slow responses, frustrating chatbots, and agents who have a limited understanding of the crypto products on their platforms, which could be particularly problematic for beginners.

- Nexo’s customer support performed noticeably better during our tests than most other unlicensed cryptocurrency brokers, with fast and helpful responses through its 24/7 live chat. There’s also email assistance as well as active Telegram and Reddit chatrooms for those seeking community support.

Bottom Line

Unauthorized cryptocurrency trading brokers can be alluring for those looking for near-instant account opening, highly leveraged trading opportunities, trading bonuses, and access to niche, lesser-known digital tokens.

To find the right provider for you, see DayTrading.com’s pick of the top unregulated crypto trading platforms.

Unlicensed crypto firms are extremely risky. Most of the unregulated brokers we’ve evaluated do not provide investor protection and have limited transparency about trading conditions. You could lose your investment.

FAQ

Is It Safe To Trade Cryptocurrencies Through An Unregulated Broker?

No. Trading cryptocurrencies with an unlicensed broker will never be safe. Non-regulated crypto brokers are not subject to the same oversight nor offer the same level of financial protection as regulated firms, leaving your funds and personal data at risk.

Learn about the safest ways to trade crypto.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com