CopyRack Review 2025

Pros

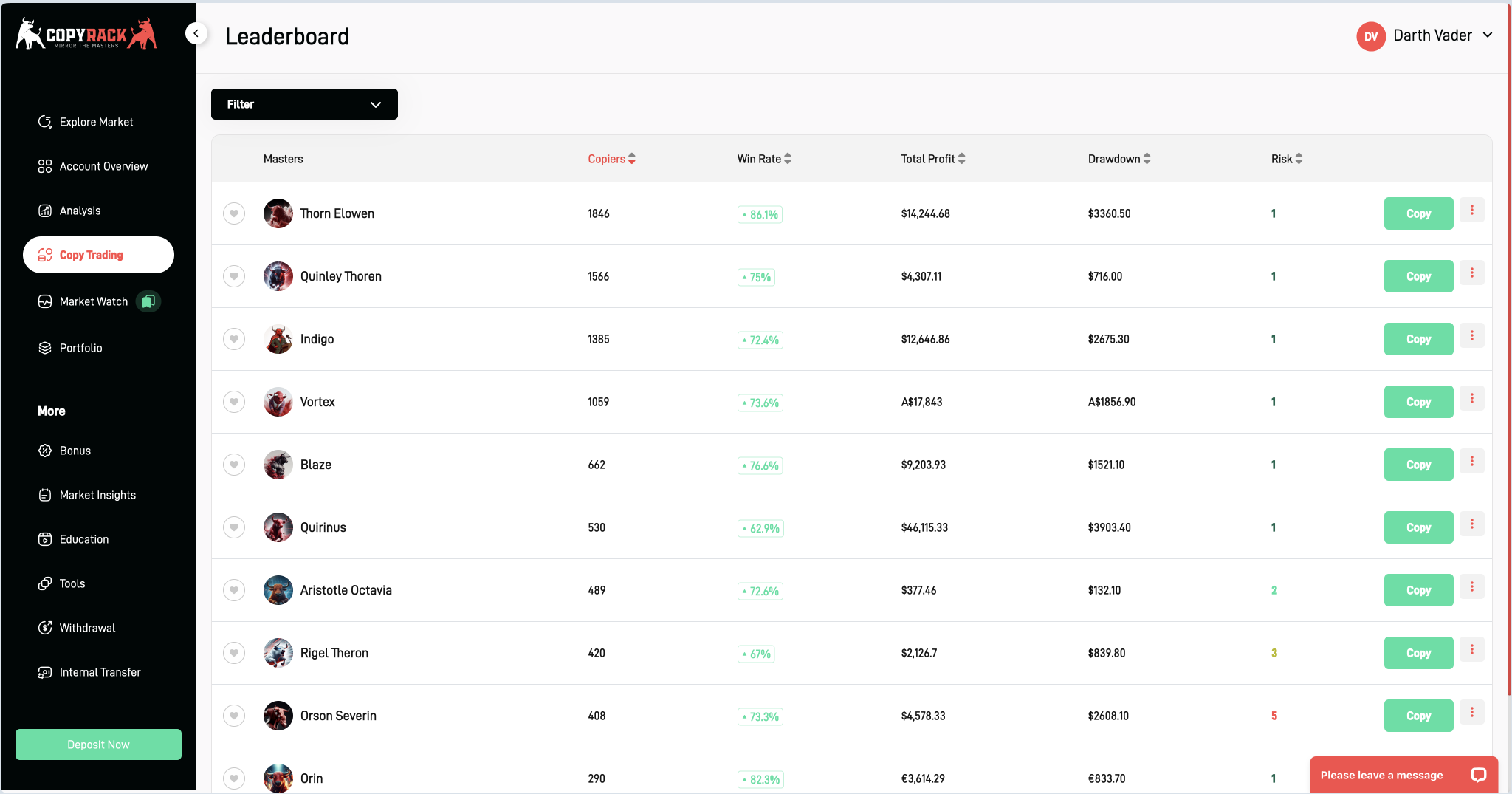

- The CR-Pro platform allows easy replication of master traders’ positions. You can browse profiles, check metrics like win rates, drawdowns, and risk scores, and allocate funds to follow strategies. During testing, the interface felt smooth and intuitive though a little slow.

- The platform allows you to monitor trades as they happen. Also, you can adjust open trades by setting custom stop-loss and take-profit levels, offering flexibility when copying strategies. However, making adjustments could affect the accuracy of the copy trading.

- CopyRack supports seven major cryptos, including Bitcoin, Ethereum, and Tether, for deposits and withdrawals. The transaction process is fast and private, making it convenient for traders who prefer decentralized finance.

Cons

- CopyRack still does not operate under the supervision of a recognized financial authority. Trading with an unregulated platform means you have no formal protections against fraudulent activities, unfair trading practices, or unexpected platform shutdowns.

- The customer support needs work with live chat unavailable during testing and slow email responses, which may deter beginner traders and those dealing in around-the-clock markets like crypto.

- CopyRack does not offer a structured educational section for beginner traders, unlike many established platforms such as eToro. While there are short 'Edutainment' videos on essential topics, the platform lacks in-depth tutorials, webinars, or interactive courses.

CopyRack Review

We put CopyRack, an emerging copy trading platform, through its paces. Our hands-on tests involved using the platform: we followed master traders, copied their positions, and evaluated the platform’s overall performance.

Beyond the user experience, we delved into its legitimacy by investigating the company’s history, scrutinizing its regulatory oversight, and comparing our findings against leading copy trading platforms.

Let’s dig into our findings:

Regulation & Trust

1.5 / 5Launched in 2024 from the Seychelles and lacking oversight from a ‘green tier’ regulator in DayTrading.com’s Regulation & Trust Rating, CopyRack has yet to establish a strong level of trust.

Red flags from our investigations include a lack of transparency about ownership and operations, unverified high-profit claims, insufficient risk disclosures, and the absence of information about trading conditions such as spreads, leverage, and fees.

Notably, CopyRack is not regulated by any recognized financial authority such as the Cyprus Securities and Exchange Commission (CySEC) or even the Seychelles Financial Services Authority (FSA), which poses substantial risks as you lack any legal protection in cases of fraud or security breaches.

Alternatively, eToro is regulated in multiple jurisdictions, and popular copy trading-only services like DupliTrade are provided by regulated broker partners only.

| CopyRack | eToro | ZuluTrade | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF | HCMC in EU, FSA in Japan, FSC in Mauritius, FSCA in South Africa | |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

3 / 5Getting Started

CopyRack offers two types of services: manual trading and copy trading. The platform lets you replicate the trades of other traders, known as ‘masters.’

To begin with, I created an account on the website. This took me only seconds, as I only had to provide my name, email address, and phone number.The lack of regulation means CopyRack isn’t obliged to onboard clients with Know Your Customer (KYC) verification, which expedites the process.

Once registered, I found my client area well presented and easy to navigate, making it easy to explore the list of available master traders on the Leaderboard.

Each master has a profile detailing their trading strategy, the number of active copiers (there is no mention of all-time copiers), and the minimum investment needed to copy the strategy.

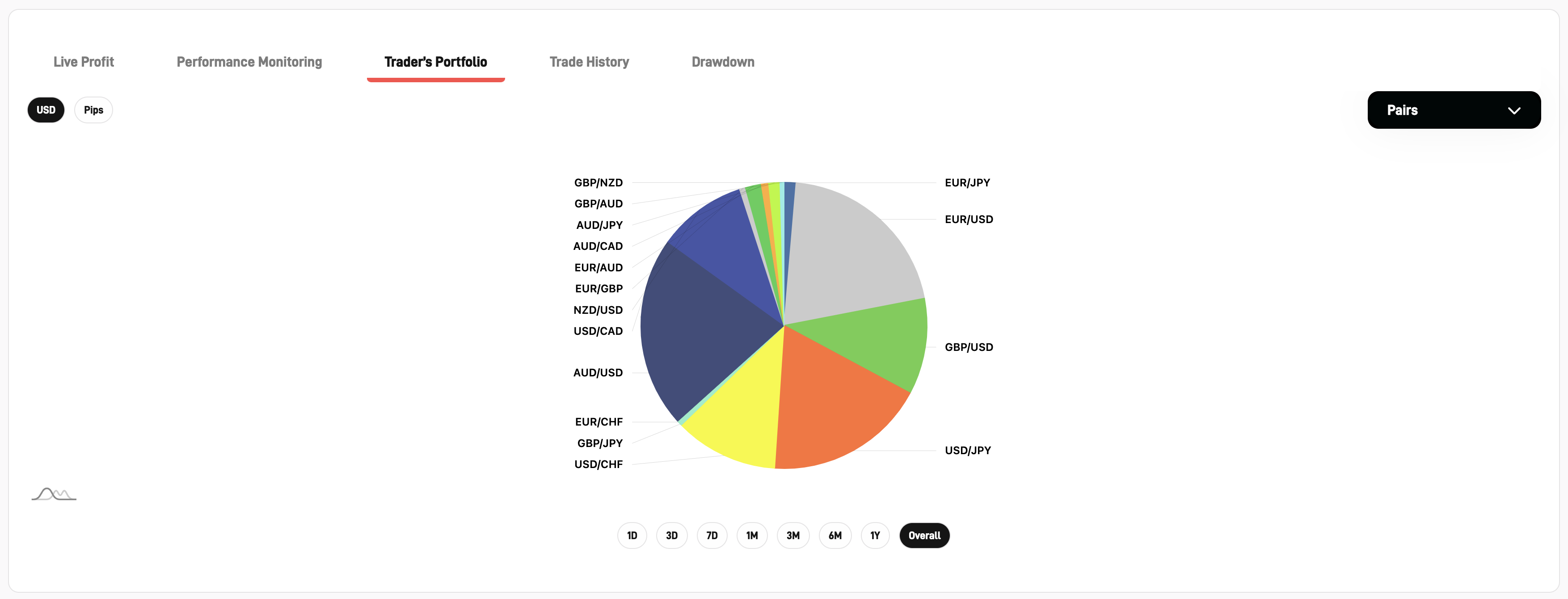

Performance statistics and trade history are also clearly presented to help you better understand a strategy. These include total profit, win rate percentage, average trade profit (%), drawdown (USD and pips), portfolio of traded assets, average trade time, maximum number of open trades, total number of trades, and risk score.

However, one metric that is missing and that would help users better judge risk themselves is the total assets under management (AUM).

Still, I like that I can filter strategies based on assets traded, should I want to copy a strategy that trades specific markets like forex or indices.

After choosing a master trader, you can allocate a percentage of your funds to mirror a provider’s trades automatically. You can also edit open trades on the CR-Pro platform by adding a trailing stop loss, taking profit levels, or even closing the trade.

I like how the platform provides real-time updates, like ZuluTrade, allowing me to monitor the trades being executed on my behalf. However, I miss a social feed where I can interact directly with the strategy provider.

Demo Accounts

CopyRack’s demo accounts let you practice manual and copy trading strategies without risking real money, making them an obvious starting point for beginners.

Manually opened within the client area, this virtual account provides a risk-free environment for you to become familiar with the trading tools and experiment with diverse trading approaches. It helps you refine your own skills and better understand copy strategies before transitioning to live trading.

The demo account is integrated into CopyRack’s proprietary CR-Pro platform, which allows you to manually copy trade simultaneously. In other words, all your copy trades are shown alongside your manual trades.

This is an unusual approach, and I had to be careful not to alter my copy trades instead of my manual trades.

Deposits & Withdrawals

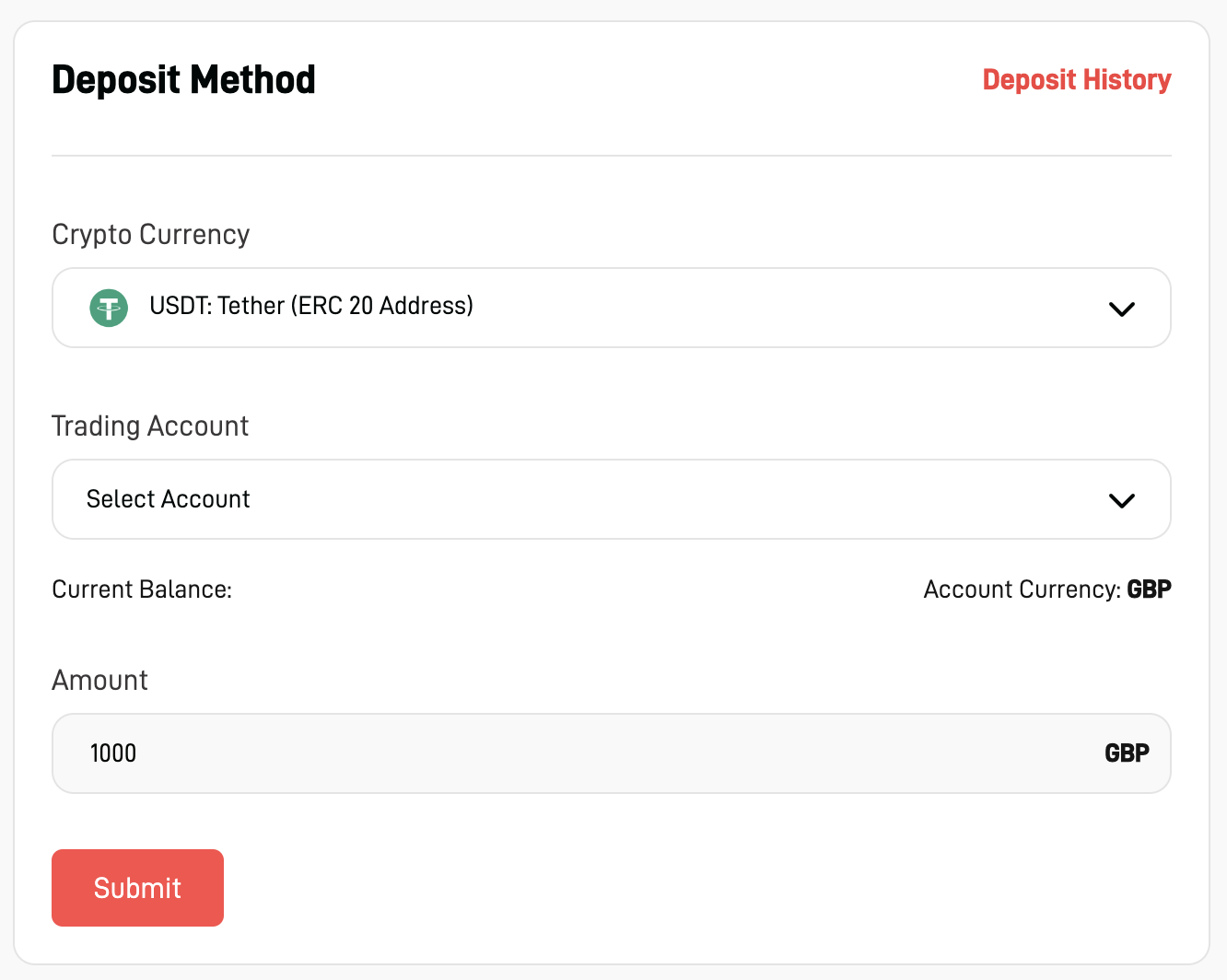

CopyRack supports deposits and withdrawals exclusively through seven types of cryptocurrencies, allowing for fast, decentralized, and anonymous transactions.

The minimum deposit amount is $100, but there is no minimum withdrawal amount. No document verification is required, either, making the process private.

The main advantage of crypto-only transactions is speed – unlike traditional banking methods, deposits and withdrawals are often processed within minutes or hours.

Lower transaction fees, financial privacy, and bypassing banking restrictions make this method appealing to traders. However, the lack of regulation and security protections means you must be cautious, as transactions are irreversible.

Additionally, the volatility of some cryptocurrencies could impact the value of deposits and withdrawals, and many beginners will likely find crypto transactions less accessible than traditional payment methods like wire transfers and debit cards.

I typically find using USDT the most practical solution. You can see the process I followed to fund my CopyRack account with the digital currency below.

Supported cryptocurrencies:

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Ethereum (ETH)

- Litecoin (LTC)

- Dogecoin (DOGE)

- Tether (USDT – ERC20)

- USD Coin (USDC)

| CopyRack | eToro | ZuluTrade | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Bitcoin Payments, Ethereum Payments | Debit Card, iDeal, Klarna, Neteller, Przelewy24, Rapid Transfer, Skrill, Sofort, Swift, Trustly, Visa, Wire Transfer | Bitcoin Payments, PayPal, Wire Transfer |

| Minimum Deposit | $100 | $100 | Broker Dependant |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

2.3 / 5CopyRack’s range of instruments is extremely low compared to traditional brokers like eToro, which also supports manual trading and copy trading.

That said, the platform does include some of the most popular assets:

- Forex: Trade 15+ major currency pairs including EUR/USD, GBP/USD and GBP/JPY. No exotic pairs are available.

- Commodities: Engage in trading 4+ commodities, including gold, silver, natural gas and crude oil.

- Indices: 8+ global stock indices let you speculate on the performance of major markets like the FTSE 100, S&P 500, and Nikkei 225.

- Cryptocurrencies: Speculate on 4+ cryptocurrencies including Bitcoin, Ethereum, Litecoin and Bitcoin Cash.

| CopyRack | eToro | ZuluTrade | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Forex, Indices, Commodities | Stocks, ETFs, Options, Crypto | CFDs; Forex, Stocks, Cryptos, Commodities, Indices |

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:500 | 1:30 EU | Broker Dependent |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

3.5 / 5CopyRack’s fee structure is designed to be transparent and competitive for both manual and copy traders.

Here’s an overview of the costs involved:

- Spreads: When trading manually, your primary cost is the spread – the difference between the bid and ask prices. CopyRack offers competitive spreads from 0.0 pips across various asset classes and a $4 commission (per $100,000), though exact details vary by instrument.

- Overnight Fees (Swap Rates): Swap fees may apply if you hold positions overnight. These charges depend on the instrument and prevailing market conditions and can either be a cost or a credit to your account. Day traders can avoid overnight charges.

- Proportional Trading Costs: While there are no extra fees for copying strategies, you will still incur the exact trading costs as the traders you follow, including spreads and any applicable swap fees. These costs are applied proportionally based on your investment size relative to the master trader’s positions.

- Performance Fees: CopyRack does not charge performance fees for copying traders, unlike most copy trading platforms we’ve evaluated. This means you can follow traders without worrying about additional deductions from your profits.

| CopyRack | eToro | ZuluTrade | |

|---|---|---|---|

| Fees & Costs Rating | |||

| Inactivity Fee | $20 | $10 | |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

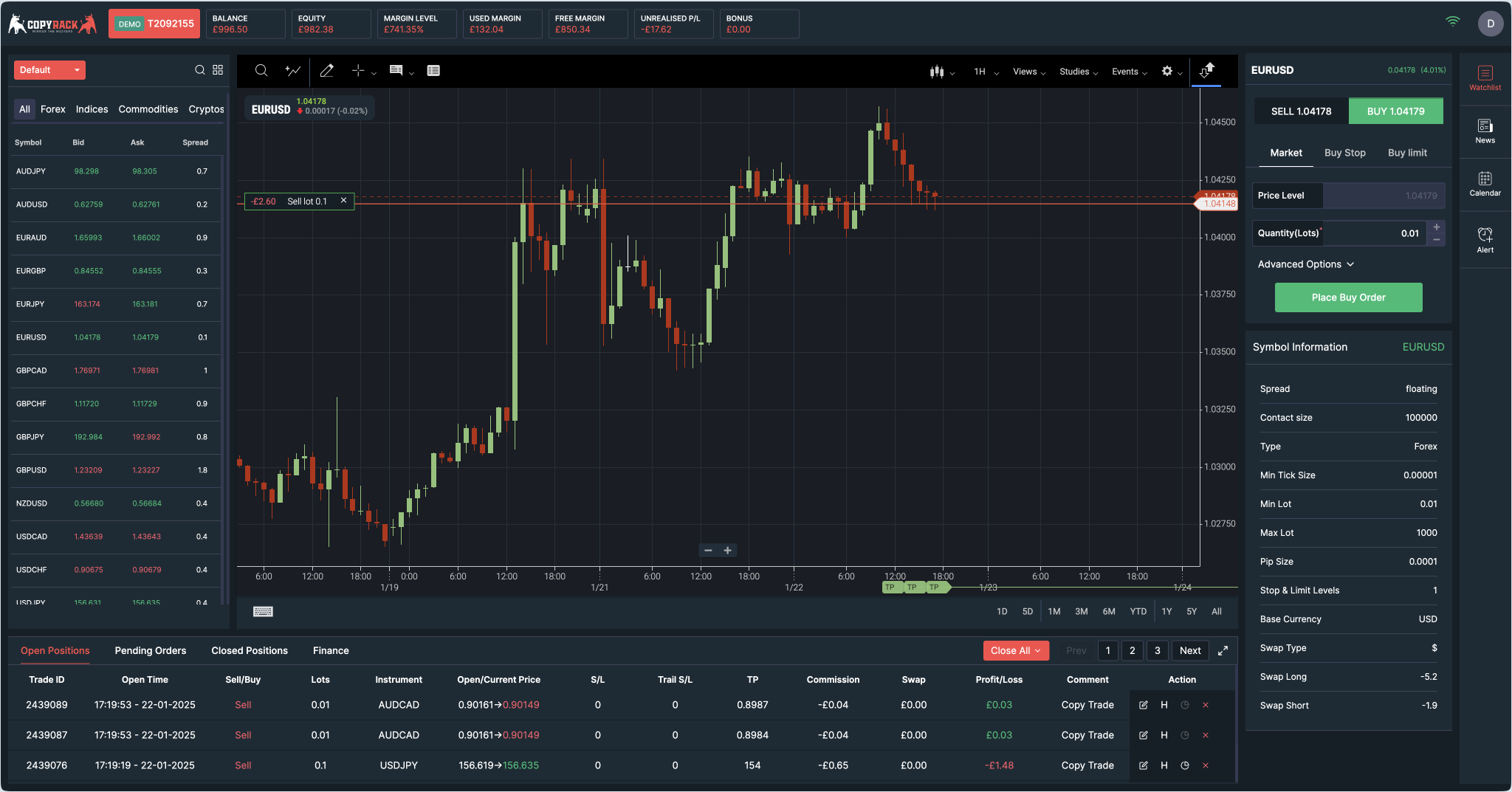

3.3 / 5CopyRack supports only one trading platform, CR-Pro, which was intuitive during testing but lacks in the tooling department.

Key features of the proprietary CR-Pro platform include a single ECN account type, a choice of five base account currencies (USD, EUR, CAD, AUD and GBP), variable spreads from 0.0 pips, leverage up to 1:500 on certain instruments, and micro lot (0.01) trading.

Other features include:

- Integrated Copy Trading: CR-Pro seamlessly incorporates copy trading functionalities, allowing you to mirror the trades of other traders directly within the platform. This integration simplifies the process, enabling you to manage copy trading activities without additional tools or platforms.

- User-Friendly Interface: The platform boasts an intuitive and clean interface, but I’ve found it can be a little slow at times and isn’t customizable. The layout is thoughtfully organized, however, providing easy access to essential features such as market watchlists, trading charts, and account management tools.

- Multi-Device Accessibility: The web-based CR-Pro is accessible across various devices without installation. However, there are no dedicated mobile apps or a downloadable native desktop app, which may be a drawback for high-frequency traders who prefer low-latency desktop software.

- Limited Advanced Charting Tools: While CR-Pro provides basic charting capabilities, it lacks more advanced analytical tools in specialized trading platforms such as TradingView and cTrader. If you rely on in-depth technical analysis, you may find the available indicators and drawing tools insufficient for your needs.

- Lack Of Social Trading Features: While copy trading is integrated, CR-Pro does not offer an interactive social trading community or trader chatrooms, available at the likes of eToro, which could improve collaboration and strategy-sharing.

| CopyRack | eToro | ZuluTrade | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | CR-Pro, AutoChartist | eToro Web, CopyTrader, TradingCentral | X Open Hub, Match-Trader, MT4, MT5, ActTrader |

| Mobile App | iOS & Android | iOS & Android | |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

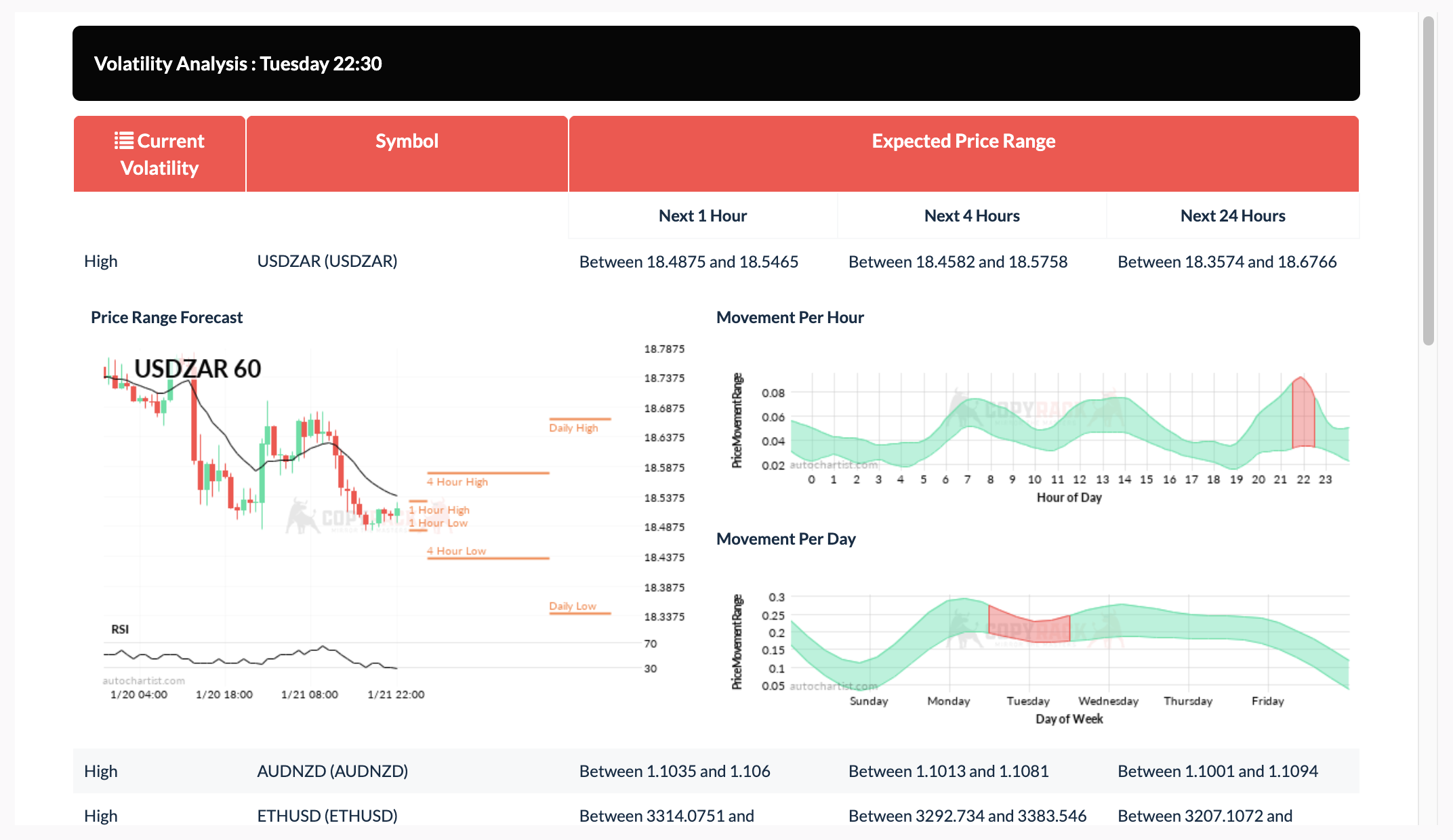

3.5 / 5CopyRack offers a suite of research tools designed to assist traders in making informed decisions.

Here’s an overview of the tools available during our latest tests:

- Economic Calendar: The economic calendar, supported by Autochartist, helps you stay updated on the latest high-impact global financial news. The calendar is easy enough to read (both on the website and within the CR-Pro trading platform), but there aren’t any filters to focus on specific regions or importance, so it’s not the most intuitive calendar for planning trades around significant economic announcements.

- Trading Calculator: The trading calculator is a useful tool that can help assess potential profit, loss, and costs associated with a trade based on criteria like instrument, lot size, and trade duration to help plan trades more effectively.

- Market Insights: CopyRack provides market news from third-party sources, including FX Street and Forex Live to keep you informed. I like that another news feed is built into the CR-Pro trading platform, so I don’t miss any significant economic news.

- Autochartist: Autochartist is a third-party technical analysis tool that analyzes financial data to generate valuable trading signals, helping you to identify potential market opportunities. It also includes volatility analysis, showing a selected instrument’s expected price range movement. Unfortunately, unlike platforms like cTrader Copy, Autochartist isn’t integrated into the CR-Pro trading platform for ease of use.

While these tools are helpful, CopyRack does not offer in-house market analysis. Adding in-house research reports, expert commentary, or daily market analysis and trading signals could enhance the platform’s value for traders.

I’d also like Autochartist tools integrated into the CR-Pro trading platform so I don’t have to keep visiting my CopyRack client area.

| CopyRack | eToro | ZuluTrade | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

2.5 / 5CopyRack does not feature dedicated educational materials, as the platform primarily focuses on facilitating copy trading.

However, within the client area are a handful of ‘Edutainment’ videos that cover essential topics like ‘Why Trade Forex’ and ‘Trading Psychology’. There’s also a brief overview of popular indicators and chart patterns.

If you’re new to trading, a lack of comprehensive educational resources may limit your ability to fully understand trading strategies, risk management, and market analysis. A notable gap filled by alternatives like eToro.

To enhance its educational materials, CopyRack could introduce a dedicated education section on its website featuring in-depth articles, tutorials, and structured courses covering various aspects of trading.

Additionally, hosting webinars and interactive sessions with experienced traders or financial experts would allow new traders to gain deeper insights into strategies and market dynamics.

At the very least, there needs to be a glossary of trading terms to help beginners familiarize themselves with industry jargon.

| CopyRack | eToro | ZuluTrade | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

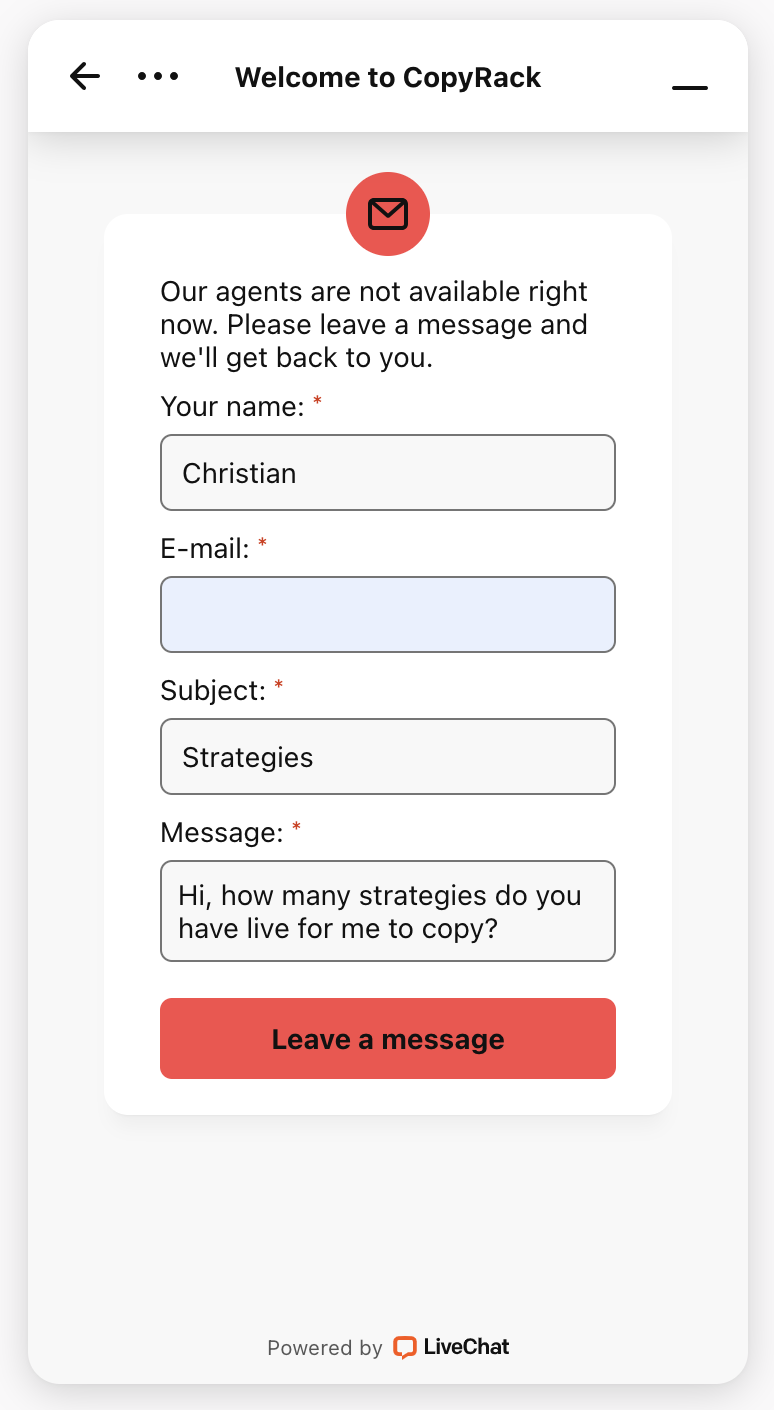

Customer Support

2.5 / 5CopyRack offers several multilingual customer support options:

- Live Chat: Allegedly available 24/5, allowing you to receive real-time assistance during business days, but I failed to reach any live agent during testing.

- Email: You can email ‘contactus@copyrack.com’ with inquiries or issues.

- Online Form: You can submit queries through an online contact form for support requests.

- Feedback Form: A feedback form lets you share your experiences and suggest improvements.

- Social Media: The official CopyRack accounts on Facebook, Instagram, X, LinkedIn, YouTube and Discord offer updates and respond to user inquiries.

CopyRack’s customer support could be improved in several ways.

Extending support hours to 24/7 would better accommodate users across different time zones, particularly those who trade crypto outside standard business hours. Adding a phone option is essential for urgent enquiries.

Additionally, while CopyRack claims to offer support in 16 languages, ensuring that all support channels are consistently staffed with multilingual agents would enhance the user experience.

For instance, the live chat was unavailable while I tested the platform, so I had to rely on email communications, which were also desperately slow.

Another area for improvement is the Help Center, which could be expanded with more detailed FAQs, video tutorials, and troubleshooting guides to allow users to find solutions independently.

| CopyRack | eToro | ZuluTrade | |

|---|---|---|---|

| Customer Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Trade With CopyRack?

Overall, our experience with CopyRack after hands-on tests was reasonable. It provides a user-friendly interface – albeit slow at times – and a range of valuable features to support manual and copy trading.

However, compared to alternatives like eToro and ZuluTrade, the platform feels underdeveloped, underused, and undersupported.

It’s also important to note that while CopyRack facilitates the replication of trades, the platform does not guarantee profits, and copy-trading always carries inherent risks. Therefore, exercise caution and only invest funds you can afford to lose.

FAQ

Is CopyRack Legit Or A Scam?

CopyRack is a fledgling copy trading platform that enables you to replicate the trades of more experienced traders. With such a limited track record, it’s difficult to assess the platform’s long-term stability or the performance of the strategy providers.

CopyRack’s website lacks clear information about its ownership, physical office locations, and regulatory compliance. This absence of transparency is a common characteristic of potentially fraudulent platforms.

Given these factors, it’s sensible to exercise caution. You should conduct thorough research and consider choosing established, regulated trading platforms with transparency and a verifiable track record.

Is CopyRack Suitable For Beginners?

CopyRack is a well-presented platform that provides an intuitive experience for manual and copy trading.

However, while CopyRack’s copy trading model may seem appealing to beginners, the platform lacks comprehensive educational and research materials, which are crucial for new traders trying to understand market dynamics, risk management, and trading strategies.

Without access to in-depth tutorials, market analysis, or structured learning resources, beginners may struggle to make informed trading decisions or fully grasp the risks of copy trading.

This gap in educational support can leave inexperienced users overly reliant on master traders without understanding the reasoning behind their trades, potentially leading to poor investment outcomes.

Top 3 Alternatives to CopyRack

Compare CopyRack with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- AZAforex – Established in 2016, AZAforex is an offshore broker offering short-term trading on 235+ global financial markets, including through binary options with payouts of up to 90%. Three accounts (Start, Pro and VIP) offer unique features, but all provide access to the broker’s Mobius Trader 7 platform, which has benefited from performance upgrades over the years.

CopyRack Comparison Table

| CopyRack | Interactive Brokers | Dukascopy | AZAforex | |

|---|---|---|---|---|

| Rating | 2.8 | 4.3 | 3.6 | 3.4 |

| Markets | CFDs, Forex, Indices, Commodities | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Binary Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $100 | $1 |

| Minimum Trade | 0.01 | $100 | 0.01 Lots | 0.0001 Lots |

| Regulators | – | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | GLOFSA |

| Bonus | – | – | 10% Equity Bonus | 25% Crypto Deposit Bonus, 120% Loyalty Bonus, 30% Spread Rebate |

| Education | No | Yes | Yes | No |

| Platforms | CR-Pro, AutoChartist | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | Mobius Trader 7 |

| Leverage | 1:500 | 1:50 | 1:200 | 1:1000 |

| Payment Methods | 2 | 6 | 11 | 14 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

AZAforex Review |

Compare Trading Instruments

Compare the markets and instruments offered by CopyRack and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| CopyRack | Interactive Brokers | Dukascopy | AZAforex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | Yes | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | Yes | Yes |

CopyRack vs Other Brokers

Compare CopyRack with any other broker by selecting the other broker below.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of CopyRack yet, will you be the first to help fellow traders decide if they should trade with CopyRack or not?