Day Trading For Beginners

Day trading has risen in popularity as beginners look to replicate the success of established financial institutions. But what actually is day trading, and is it profitable for new traders?

In this guide to day trading for beginners, we explain how it works and share our tips for getting started, from strategies for dummies to managing risk.

Also, don’t miss the day trading community where beginners can ask questions and learn from our experts and other day traders.

Quick Introduction

- Day trading is the process of opening and closing trades within a single trading day.

- The aim is to profit from short-term price fluctuations in popular markets, such as stocks, forex, commodities and crypto.

- Day trading is high risk because it involves frequent, fast-paced trades in volatile markets, where small price movements can lead to significant losses.

- Successful day traders have a strategy, often informed by technical analysis, that helps identify potential trades.

- Day traders typically use leverage to multiply their buying power and potential returns (or losses).

- The top brokers for day traders offer a beginner-friendly environment with easy-to-use platforms, excellent education, and a low minimum deposit.

Best Day Trading Brokers For Beginners

These are the top 4 brokers for new day traders :

Top List of Best Brokers For Beginners

Download our Day Trading For Beginners PDF.

Day Trading Basics

Day trading 101 – day traders open and close multiple positions in a session to generate profits from short-term market movements. Importantly, positions are not normally held overnight.

Day trading strategies can be applied to most financial markets, though they are particularly prevalent in forex and stocks.

Whilst day trading is often marketed as a ‘get rich quick’ scheme, it requires commitment, both in time and capital.

Day trading is risky for traders of all experience levels, but particularly for beginners. It requires a good understanding of how markets work and why strategies can turn a profit.

Aspiring day traders must carefully choose entry and exit points while employing effective risk management techniques to preserve their capital.

The Best Markets For Beginners

Day traders have access to multiple markets and ways to speculate on price movements:

Stocks

If you are S&P 500 day trading, you will be buying and selling the shares of companies, such as Meta and Apple.

Fractional shares are also worth considering for budding day traders. A fractional stock is a portion of a full share, allowing you to invest in companies that you may not otherwise be able to afford. You can take less risk, focusing on percentage returns while building up your trading capital.

Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. They have, however, been shown to be great for long-term trading.

Forex

In the day trading forex market, you will be trading currencies, such as the Euro (EUR), US Dollar (USD) and British Pound (GBP).

Trading forex is particularly popular with beginners owing to the significant liquidity, which means you can quickly and easily open and close trades.

CFDs (contracts for difference), are also available on forex, as well as other asset classes. These derivative instruments allow you to go long or short and magnify your buying power and possible returns through leverage.

Cryptocurrency

Another growing area of interest in the day trading world is cryptocurrency. Day trading with Bitcoin, Litecoin, Ethereum and other altcoins is an expanding business.

With lots of volatility, increasing trade volumes and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue for new investors.

Commodities

Commodities have long been popular with day traders. You can take positions on the price of precious metals like gold, silver and copper, as well as energies like oil and natural gas.

Soft commodities also offer decent liquidity and volatility, including sugar, corn and coffee.

A useful pointer when you begin day trading is to focus on one market.

Mastering one market – be it forex, stocks, or crypto – before spreading your wings can help you focus your efforts, gain a deeper understanding of specific market dynamics, and build confidence, potentially reducing costly mistakes.

Binary Options

A high-risk alternative that has proven popular with aspiring day traders is binary options. Users simply have to decide whether the price of a security will rise or fall within a specified time. Get it right and you earn a fixed payout. Get it wrong and you lose your stake.

Binaries are available on a range of popular markets and contracts can last from just 5 seconds, providing plenty of opportunities throughout the trading day.

When To Trade

Most successful day traders don’t open and close positions all day. Instead, they focus their efforts on periods that present the most opportunity, generally offering significant volume and volatility.

For example, when intraday trading stocks, the first couple of hours after the markets open and the last hour before they close, tend to see the most price action.

Of course, how long you trade for and when will ultimately depend on your strategy, but the key takeaway is that you don’t need to be glued to your computer all day.

Many professionals recommend only actively trading for between two and three hours each day.

Strategy Considerations

When you start day trading, a key part of the learning curve is developing a strategy. Fortunately, there are several techniques and approaches you can take:

Patterns & Technical Analysis

Day trading chart patterns paint a clear picture of trading activity for today which helps you to decipher individuals’ motivations. They could highlight S&P day trading signals for example, such as volatility, which may help you predict future price movements.

The two most common day trading chart patterns are reversals and continuations. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise.

Understanding these trading patterns, as well as ‘triangles’, ‘head and shoulders’, ‘cup and handle’, ‘wedges’ and plenty more, will all make you better informed when it comes to employing your trading strategies.

The MetaTrader 4 platform, offered by many beginner-friendly day trading brokers and sites is a great place to begin for charting.

Equipped with 30 built-in indicators, more than 2,000 free custom indicators, plus 700 paid options, the user-friendly terminal has plenty for newbies to test out. MetaQuotes also offers a host of video tutorials and tips for those getting to grips with the platform.

Alternatively, some leading brands, such as eToro, offer in-house web-based platforms with simple interfaces, straightforward navigation, and just the key charts, indicators and drawing tools. Many beginners prefer these modern and clutter-free terminals.

Momentum Trading

Following a straightforward trend is a good place to start when you are learning how to day trade.

A momentum strategy can involve trading on news releases, such as Facebook changing its name to Meta and investing in the Metaverse.

A momentum trader could buy on the announcement, or in anticipation of the announcement, and ride the trend until it exhibits signs of reversal.

Another option is to fade the price surge. Here, the aim is to identify when trading volumes will start to decrease.

Scalping

Scalping is a popular intraday trading strategy. It involves exploiting small price gaps created by the bid-ask spread. Traders essentially close a position as soon as the trade becomes profitable, accumulating many small gains over the course of the trading day.

Scalping is particularly popular in forex markets, where there is usually substantial volume and volatility. However, due to the fast-paced nature of scalping, fast execution speeds and reliable trading software are required.

Is Day Trading Right For Me?

Day trading isn’t for everyone. It’s important to weigh your objectives, risk tolerance and lifestyle against other trading styles like swing trading and long-term trading:

Risk Management

How to manage risk is an essential lesson when you start learning how to day trade. Before putting money on the line, you should have an approach to risk management.

Ask yourself: how much exposure are you willing to take on a single trade or over one trading session?

One sensible risk management technique is to limit the amount of capital invested in a single trade. Experienced traders often set that limit between 1% and 2%. This ensures that even in a run of bad losses, your total trading capital won’t be wiped out.

Limit orders and stop losses are also effective for curbing losses, both when you are learning to day trade and as an experienced investor. These pending orders are essentially pre-determined points at which your platform will automatically buy or sell an asset.

Let’s say the price of Tesla, which you bought for $1,050, is falling. A stop loss at $950 would automatically sell the share once the $950 price point is hit, capping your losses at $100, minus any fees.

A free demo account, offered by many of the top brokers, is an excellent place to refine risk management techniques before putting capital on the line.

How To Start Day Trading

Now that you understand the basics, follow these steps to get started day trading:

1. Choose A Broker

When you start day trading, you use a broker who will execute your trades on the market. The broker you choose is an important decision.

The best brokers for beginners are easy-to-use and provide a variety of educational materials and research tools to encourage learning.

2. Open An Account

Part of your day trading setup will involve choosing a trading account. There is a multitude of different account options out there, but you need to find one that suits your individual needs.

- Cash account – Day trading with a cash account (also known as without margin), will allow you to only trade the capital you have in your account. This limits your potential profits, but it also prevents you from losing more than you can afford.

- Margin account – This type of account allows you to borrow money from your broker. This will enable you to bolster your potential profits, but also comes with the risk of greater losses and rules to follow. If you want to start day trading with no minimum this isn’t the option for you. Most brokerage firms will insist you lay down a minimum investment before you can start trading on margin. You can also experience a margin call, where your broker demands a greater deposit to cover potential losses.

Once you have chosen a suitable broker that’s good for beginners, register for a live account and deposit funds. Remember, if you do not feel ready to start day trading on live markets, make use of a free demo account.

3. Make A Trade

When you have identified a suitable opportunity, choose from an instant or pending order and follow the on-screen instructions on your software to open a position.

Remember, if you are day trading, you may want to place both long and short positions, depending on your market prediction for the day.

Financial markets can move rapidly, so make use of any news streaming services and charting tools to monitor the day’s activity. Once you have reached your desired profit target (or loss threshold), exit your positions.

It is worth keeping in mind that positions generally need to be closed by the end of the trading day to avoid overnight holding fees.

Watch our video guide to getting started day trading for beginners:

Tips For Beginners

As part of this day trading tutorial, our experts have listed their top tips for new day traders:

Start Small

Beginners starting out day trading may want to focus on a particular asset to start with.

If you’re interested in stocks, concentrate on a particular industry, such as renewable energy, or even a particular company or two, such as JP Morgan.

Focusing your research will help you get up to speed with company news, historical financial performance, upcoming investment plans, and more. All of which can make it easier to identify and capitalize on opportunities.

Use The Right Tools

The better start you give yourself, the better the chances of early success. That means when you’re sitting at your desk, staring at your monitors with hands dancing across your keyboard, you’re looking at the best sources of information.

That means having the best trading platform for your Mac or PC laptop/desktop, having a fast and reliable asset scanner and live stream, and software that won’t crash at a pivotal moment.

Stay Calm

A profitable day trading strategy won’t lead to consistent gains without discipline. When you start day trading, controlling your emotions and preventing them from influencing decisions is key.

Of course, nobody is immune to pressure and sharp market fluctuations can be stressful. The key is sticking to your plan.

Use stop losses and limit orders, and when your strategy does need refining, make changes at the end of the trading session when you have had the opportunity to analyze the day’s events with a level head.

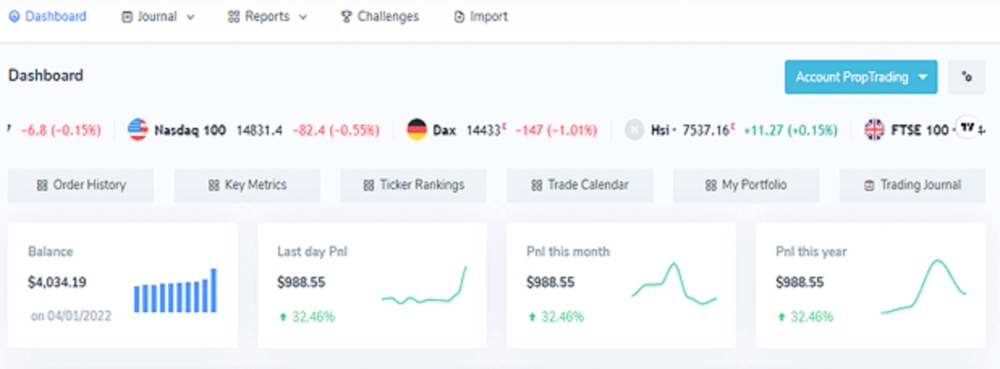

Keep A Journal

When you are new to day trading, a useful tip is to maintain a journal of all the positions opened and subsequently closed during the day.

It is worth including information on the time and size of entry and exit positions, the direction of trades, plus respective profits and losses.

This will help you analyze your performance and update your day trading strategy as needed.

Understand Trading Psychology

If you want to start day trading as a career you have to master your emotions. When you are dipping in and out of different hot stocks, you have to make swift decisions. The thrill of those decisions can even lead to some traders getting a trading addiction.

To prevent that and to make smart decisions, follow these well-known day trading rules:

- Controlling fear – Even the supposedly best stocks can start plummeting. Fear then sets in and many investors liquidate their holdings. Now whilst they prevent losses, they also wave goodbye to potential gains. Recognizing that fear is a natural reaction will allow you to maintain focus and react rationally.

- ‘Pigs get slaughtered’ – When you’re in a winning position, knowing when to get out before you get whipsawed or blown out of your position isn’t easy. Tackling your own greed is a hurdle, but one you must overcome. Refer back to our ‘Risk Management’ section above for tools that can help here.

Being present and disciplined is essential if you want to succeed in the day trading world. Recognizing your own psychological pitfalls and separating your emotions is imperative.

Be Realistic

The movies may have made it look easy, but don’t be fooled. Even the day trading gurus in college put in the hours. You won’t be invited to join that hedge fund after reading just one Bitcoin guide.

You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works.

Mistakes New Day Traders Make

These are five of the biggest mistakes we see new day traders make — and they could be costing you more than just money:

- No Trading Plan — Trading without a structured plan is like setting out without a map. Without clear rules for entries, exits, and risk management, emotions take control — and emotional trading is expensive.

- Overtrading — More trades don’t mean more profits. Overtrading or taking oversized positions usually leads to burnout and bigger losses. In trading, less can be more.

- Chasing Losses — “Just one more trade and I’ll recover.” If that sounds familiar, be careful: revenge trading rarely works and usually deepens the damage. Take a step back and protect your capital.

- Ignoring Market Conditions — The market moves whether you’re ready or not. Ignoring trends, news, or wider market factors can leave you badly exposed. Stay informed.

- Emotional Trading — Fear, greed, impatience — these are the silent threats to every trader’s account. The best traders learn to stay calm, disciplined, and neutral.

Nail these basics, and you’ll already be ahead of most beginners.

Education

A good day trading education can save costly errors. It can feel overwhelming when newbies start day trading, with an extensive range of charts, pricing structures and platform options to get your head around.

Fortunately, there are a number of excellent resources aimed at new day traders:

Books

The best day trading books for beginners keep things simple, offering step-by-step guides and explaining key concepts. Some of the top books are available to buy on Amazon and eBooks can often be accessed as PDF downloads or read for free on Kindles.

Some of our favorite books for newer day traders are:

- A Beginner’s Guide To Day Trading Online by Toni Turner

- How To Day Trade For A Living: A Beginner’s Guide To Trading Tools and Tactics, Money Management, Discipline and Trading Psychology by Andrew Aziz

- Day Trading For Beginners & Dummies: How To Be Your Own Boss by Glenn Nora

- Day Trading For Dummies by Ann C Logue

These books are particularly good if you are planning to start day trading in the UK, US, Canada and Europe. Some are available as eBooks and audiobooks too. However, there are also other good options for day traders based in India, Australia, the Philippines, and beyond.

Note, many of the best day trading books, courses and videos are also available in Hindi, Tamil and Telugu.

Videos & Courses

Day trading strategy videos and webinars are also useful. Fortunately, free courses for intraday traders starting out are frequently uploaded to YouTube.

Profitable traders, like Ross Cameron from Warrior Trading, post videos of their verified trades on their channel.

Audio Learning

As well as buying books and taking online courses, there are a plethora of other resources available.

Audiobooks and podcasts, for example, are a great way for beginners to learn about day trading while on the go, at the gym or on the school run.

Forums

Some people learn best from online forums such as Reddit and Quora.

As a beginner getting started day trading you can often feel lonely so an interactive community where you can exchange ideas and discuss new opportunities, such as the latest emerging cryptocurrency, can prove valuable.

Taxes

Before you start day trading, it is also important to understand any tax requirements in your local jurisdictions.

For example, in the UK the HMRC are known to approach day trading activities from three different angles:

- Speculative/similar to gambling activities – Day trading profits would likely be totally free from income tax, business tax, and capital gains tax.

- Substantial self-employed trading activity – Likely to be subject to business tax.

- Significant activities of a private investor – Gains and losses would fall under the remit of the capital gains tax regime. Paying just business tax would be highly illegal and open you up to serious financial penalties.

Due to the fluctuations in day trading activity, you could fall into any three categories over the course of a couple of years. Although you don’t need a license, it is important you rigorously monitor your trades, seek tax advice, and stay within laws and regulations when filing your tax returns.

Terminology

Learn the day trading lingo and vocabulary and you will unlock the door to a whole host of trading secrets. Below we have collated the essential basic jargon, to create an easy-to-understand day trading glossary.

General

- Leverage rate – This is the rate your broker will multiply your deposit by, giving you buying power.

- Automated trading – Automated trading systems are programs that will automatically enter and exit trades based on a pre-programmed set of rules and criteria. They are also known as algorithmic trading systems, trading robots, or just bots.

- Initial Public Offering (IPO) – This is when a company sells a fixed number of shares to the market to raise capital.

- Float – This is how many shares are available to trade. If a company releases 10,000 shares in the initial IPO, the float would be 10,000.

- Beta – This numeric value measures the fluctuation of a stock against changes in the market.

- Penny Stocks – These are any stocks trading below $5 a share.

- Profit/Loss ratio – Based on a percentage basis, this is the measure of a system’s ability to generate profit instead of loss.

- Entry points – This is the point at which you buy and enter your position.

- Exit points – This is the point at which you sell and exit your position.

- Bull/Bullish – If you take a bullish position day trading you expect the stock to go up.

- Bear/Bearish – If you take a bearish position you expect the stock to go down.

- Market trends – This is the general direction a security is heading over a given time frame.

- Hotkeys – These pre-programmed keys allow you to enter and exit trades rapidly, making them ideal if you need to exit a losing position as soon as possible.

Charts, Graphs, Patterns & Strategy

- Support level – This is the level where the demand is strong enough that it prevents the decline in price past it.

- Resistance level – This is the level where the demand is strong enough that selling the security will eradicate the increase in price.

- Moving Averages – They provide you with vital buy and sell signals. Whilst they won’t tell you in advance if a change is imminent, they will confirm if an existing trend is still in motion. Use them correctly and you can tap into a potentially profitable trend.

- Relative Strength Index (RSI) – Used to compare gains and losses over a specific period, it will measure the speed and change of the price movements of a security. In other words, it gives an evaluation of the strength of a security’s recent price performance. Day trading tip – this index will help you identify oversold and overbought conditions in the trading of an asset, enabling you to steer clear of potential pitfalls.

- Moving Average Convergence Divergence (MACD) – This technical indicator calculates the difference between an instrument’s two exponential moving averages. Using MACD can offer you straightforward buy and sell trading signals, making it popular amongst beginners.

- Bollinger Bands – They measure the ‘high’ and ‘low’ of a price in relation to previous trades. They can help with pattern recognition and enable you to arrive at systematic trading decisions.

- Vix – This ticker symbol for the Chicago Board Options Exchange (CBOE), shows the expected volatility over the next 30 days.

- Stochastics – Stochastic is the point of the current price in relation to a price range over time. The method aims to predict when prices are going to turn by comparing the closing price of a security to its price range.

If you stumble across a word or phrase that leaves you scratching your head, refer back to this day trading dictionary and chances are you’ll get a quick and easy explanation.

Bottom Line

Day trading requires patience. Beginners should not expect to make huge profits from day one.

Fortunately, aspiring day traders can make use of the range of resources available online, from free demo accounts to educational materials, market research, our tutorials, and copy trading.

We also recommend signing up with a broker that caters to beginner day traders.

FAQs

Is Day Trading Suitable For Beginners?

Every trader has to start somewhere, including day traders. With that said, intraday trading is difficult, so novice investors should be prepared for a steep learning curve. Take the time to research and understand the financial markets that you are interested in and develop a suitable strategy before investing money.

What Do I Need To Start Day Trading?

Beginners need very few tools to start day trading. On the hardware side, a computer and a trusty internet connection are all that is required. The online broker you sign-up with will provide the trading software needed to monitor the markets and execute positions.

How Much Money Do Day Traders Make?

The short answer is that it varies. Veterans can make substantial sums while absolute beginners may generate limited extra income on top of their current jobs. It is also worth remembering that profits and losses fluctuate so it is important to focus on long-term results rather than returns on a particular day.

Should Beginners Take A Day Trading Course First?

Day trading courses can be a valuable tool for beginners. The best providers detail suitable strategies, explain risk management techniques and provide insights into particular markets, such as forex, stocks, cryptos or futures. An excellent range of free and paid-for courses are now available online, including at Warrior Trading, Bear Bull Traders, and Udemy.

What Are The Best Day Trading Apps For Beginners?

A mobile day trading application is a great way to implement strategies while on the move. The eToro app, in particular, is great for newbies as you only need $50 to start trading on stocks, commodities, indices and forex markets.

Another good option is AvaTrade, which has a beginner-friendly app plus an academy aimed at novice traders.

See our list of best brokers for beginners for more recommendations. Also see the page on the best trading apps.

Is Day Trading Worth It?

Day trading can be worth it, but mainly for people who treat it like a long-term craft rather than a quick way to make money. That means newer traders need to journal trades, find and know their edge, and stick to rules even when it’s boring.

For many, the reality is mixed financial results, high stress and emotional strain, which is why some beginners move to slower styles like swing trading, finding that the experience, discipline and self-knowledge gained were valuable, even if the day-trading grind itself wasn’t a great long-term fit.

Recommended Reading

Article Sources

- How To Day Trade: A Detailed Guide To Day Trading Strategies, Risk Management, And Trader Psychology by Ross Cameron

- Day Trading: A Guide For Beginners To Day Trade Stocks With Simple Strategies, Money Management Techniques And Psychology Tactics; Learn To Be A Trader For A Living by Matthew Carter

- Day Trading Strategies: The Complete Guide by Andrew Elder

- The Elusive Quest For Preserved Quantities In Financial Time Series: Making A Case For Intraday Trading Strategies by William Krivan

- US SEC Margin Rules For Day Trading

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com