US Consumer Spending Sees First Decline In 2 Years

- This topic has 1 reply, 1 voice, and was last updated 4 days ago by .

-

Topic

-

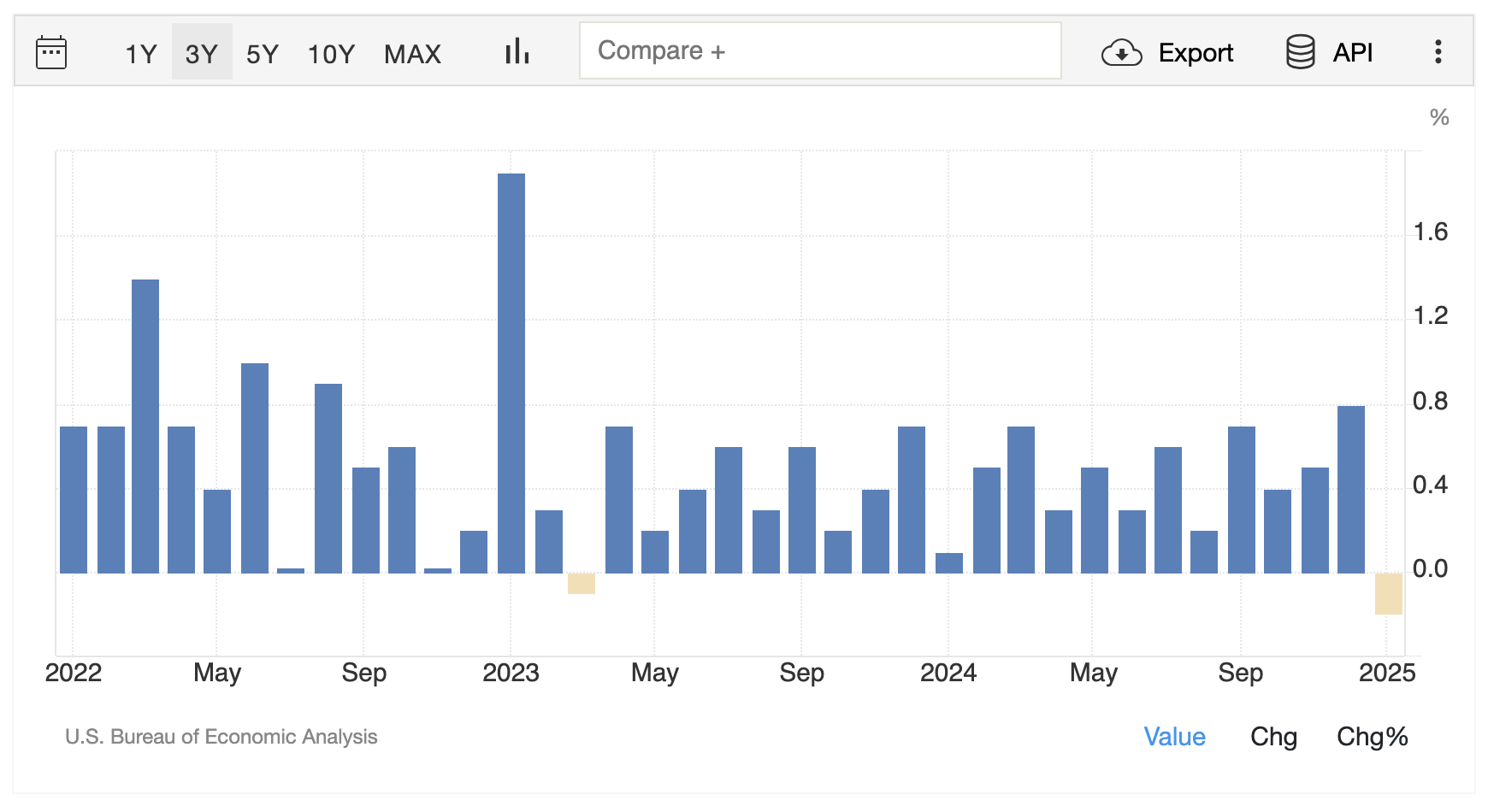

Personal consumption expenditures (PCE) in the United States experienced a notable decline of 0.2% month-on-month in January 2025, marking a significant shift from the upwardly revised 0.8% increase observed in December.

This downturn, which fell short of market expectations for a 0.1% gain, represents the first decrease in consumer spending since March 2023.

The primary driver behind this decline was a substantial drop in spending on goods, which fell by 1.2% compared to a 1.2% increase in December.

Particularly noteworthy was the plunge in durable goods spending, which decreased by 3.0%, largely attributed to a sharp reduction in automobile purchases.

This contrasts starkly with the 1.3% increase seen in December. Nondurable goods spending also edged down by 0.2%, a reversal from the 1.2% growth in the previous month.

While services spending continued to grow, it did so at a more modest pace of 0.3%, decelerating from the 0.7% increase recorded in December.

This slowdown in services consumption, combined with the decline in goods spending, paints a picture of broader consumer caution.

Several factors likely contributed to this unexpected downturn in consumer spending.

Severe weather conditions across much of the United States in January may have significantly impacted retail activity and consumer behaviour.

The potential implementation of tariffs, as suggested by the Trump administration, could have led to consumer uncertainty and a pullback in discretionary spending.

Additionally, post-holiday spending fatigue, coupled with concerns about inflation and economic stability, may have prompted consumers to tighten their purse strings.

Despite this decline, personal income increased by 0.9% in January, and the personal saving rate rose to 4.6%.

This suggests that while consumers have pulled back on spending, they may be building up savings, potentially as a buffer against economic uncertainty.

As we move further into 2025, it will be crucial to monitor whether this decline in consumer spending is a temporary blip or the beginning of a more prolonged trend, especially given the complex interplay of economic factors at play.

The coming months will provide valuable insights into consumer behaviour and its implications for the broader economic landscape.

Source: Trading Economics