Trade Tensions Escalate: Markets Plunge

- This topic has 1 reply, 1 voice, and was last updated 1 week ago by .

-

Topic

-

Global financial markets experienced significant turbulence on Monday as President Donald Trump’s administration implemented extensive tariffs on imports from Canada, Mexico, and China.

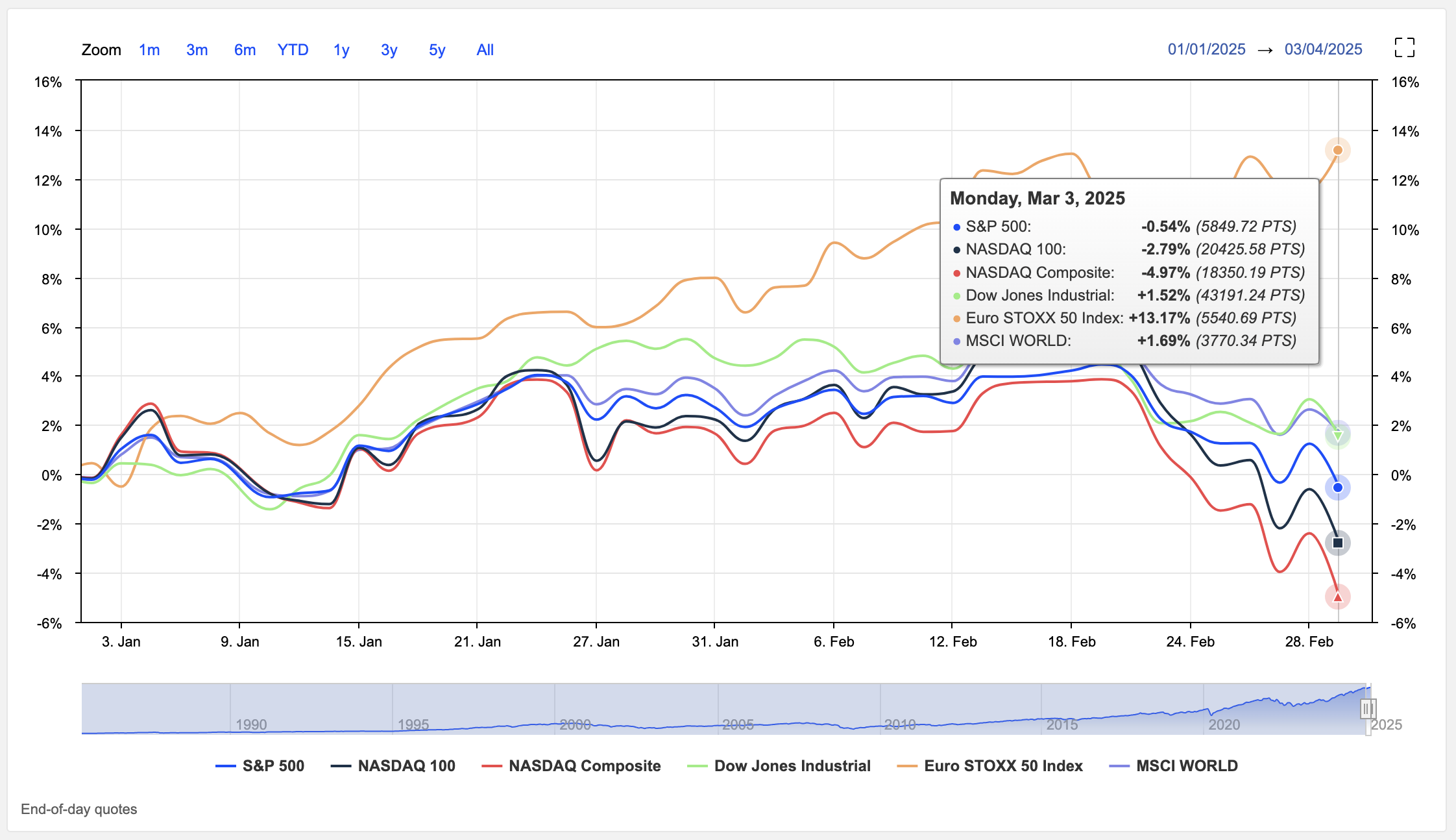

The Dow Jones Industrial Average plummeted nearly 700 points, or about 1.5%, while the S&P 500 tumbled nearly 2%, and the tech-heavy Nasdaq fell 2.5%.

This sharp decline reflects growing investor concerns about the potential economic impact of these tariffs and the risk of escalating trade tensions.

The new tariffs, which took effect at 12:01 a.m. EST on Tuesday, impose a 25% tax on imports from Canada and Mexico, along with an increase in tariffs on Chinese goods to 20%.

These measures affect approximately $2.2 trillion in annual bilateral trade, targeting the United States’ primary trading partners, which collectively represent over 30% of the nation’s total trade volume.

The automotive industry is particularly vulnerable to these tariffs, as US manufacturing plants heavily rely on components sourced from Canada and Mexico.

Ford CEO Jim Farley warned that a 25% tariff across the Mexican and Canadian borders could create a significant challenge for the US auto industry.

Analysts at Bernstein Research have determined that Detroit-based automakers may face greater susceptibility compared to their international counterparts.

Beyond the auto sector, these tariffs are expected to impact a wide range of industries and consumer goods.

The US imported $38.5 billion in agricultural goods from Mexico in 2023, including more than $3 billion worth of fresh fruits and vegetables.

With Mexico accounting for roughly 90% of avocados consumed in the US last year, consumers may see price increases for various produce items.

The energy sector is also likely to feel the effects, as Mexico and Canada account for 70% of US crude oil imports, a key input for the nation’s gasoline supply. This could potentially lead to higher fuel prices for consumers.

In response to these tariffs, both Canada and Mexico have announced retaliatory measures.

Canadian Prime Minister Justin Trudeau indicated that Ottawa would impose 25% tariffs on $120 billion worth of imports from the US, with an additional $86.2 billion targeted if Trump’s tariffs remain in effect after 21 days.

Similarly, China has swiftly announced its own retaliatory measures, including tariffs of 10-15% on specific US imports starting March 10, along with new export limitations on designated American companies.

The implementation of these tariffs fulfils one of President Trump’s campaign promises to reshape America’s trade relationships.

While the administration argues that these measures will incentivise manufacturers to establish production facilities within the United States, critics warn of potential disruptions to supply chains, strained diplomatic ties, and increased costs for American consumers and producers.

As markets digest these developments, investors should remain cautious.

While the current market downturn may present dip-buying opportunities for some, the potential for further turbulence remains high.

The long-term implications of these tariffs on global trade, inflation, and economic growth are yet to be fully understood, and ongoing volatility in financial markets is likely as the situation unfolds.

Sources: eToro, MarketScreener