Tesla’s Second-Worst Month Ever: Stock Falls 28%

- This topic has 2 replies, 1 voice, and was last updated 4 days ago by .

-

Topic

-

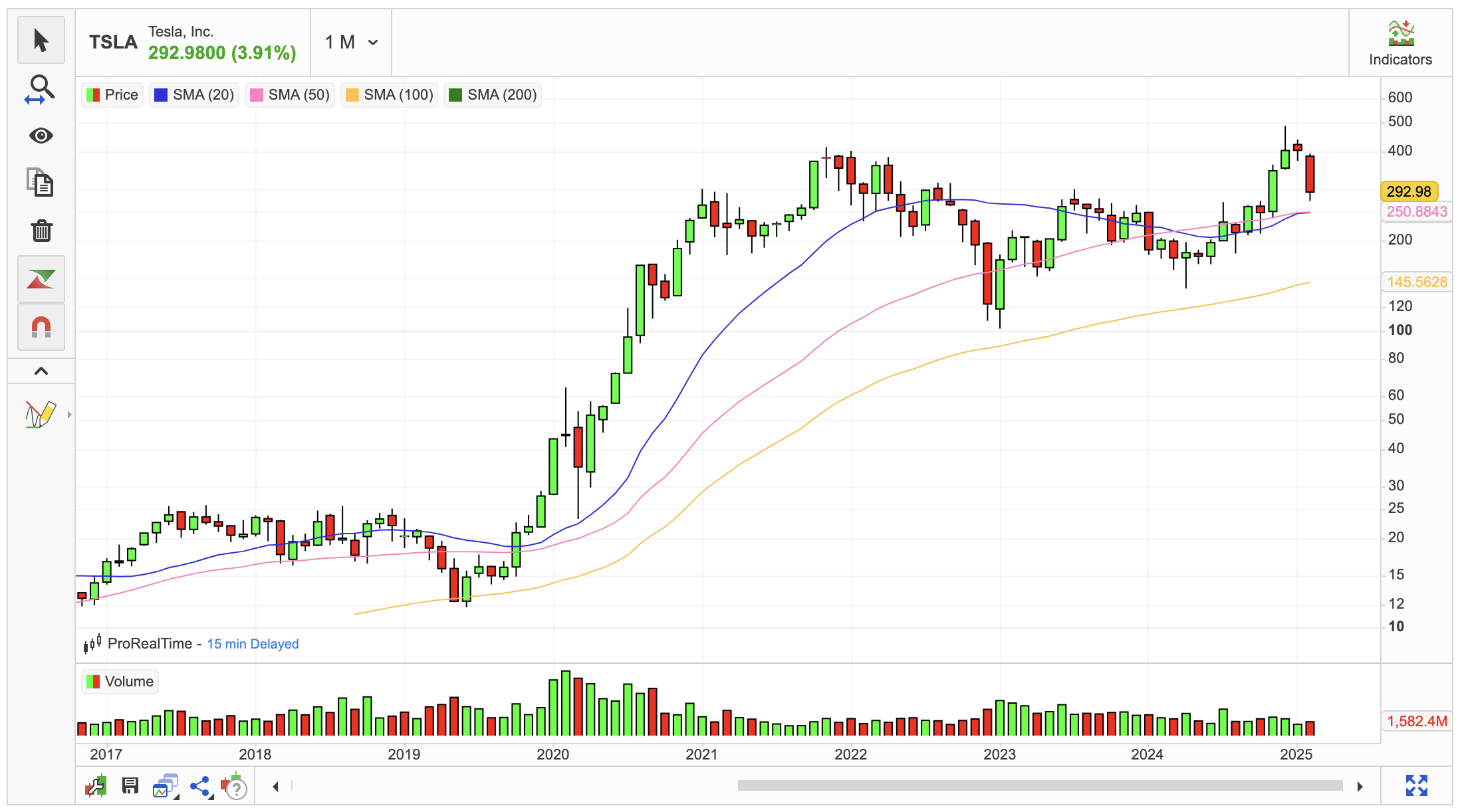

Tesla experienced a tumultuous February 2025, with its stock plummeting nearly 28%, marking its second-worst monthly performance on record.

This significant decline was surpassed only by the 37% drop in December 2022.

The sharp downturn has nearly erased all of Tesla’s post-election gains, with shares falling almost 40% from their December peak of $479.86.

Despite the broader electric vehicle (EV) market showing robust growth, with overall EV sales in Europe surging by 37.3%, Tesla’s performance has been notably weak.

In January 2025, Tesla registered only 9,945 vehicles in Europe, a stark contrast to the 18,161 units registered in the same period last year.

This trend continued into February, with Tesla’s sales in France plunging 26% year-over-year, following a 63% drop in January.

Several factors have contributed to Tesla’s struggles.

Production limitations have been a significant issue, as the redesign of Tesla’s best-selling Model Y has temporarily paused manufacturing, constraining supply and impacting overall sales.

Additionally, the emergence of new competitors, particularly from Chinese EV manufacturers, has intensified pressure on Tesla’s market share.

CEO Elon Musk’s political engagements have also stirred controversy, potentially affecting consumer sentiment.

His endorsement of Germany’s Alternative for Germany (AfD) party and his close ties to the Trump administration have raised concerns among some potential buyers.

Furthermore, the possibility of Trump rolling back EV incentives in the United States has created uncertainty in the market, with analysts like Morgan Stanley’s Adam Jonas noting that “Trump 2.0 opposition to EV incentives has hit 2025 volume expectations”.

As Tesla navigates these challenges, investors are closely watching two key factors for potential recovery.

The upcoming Q1 2025 delivery numbers will be crucial, as analysts are divided on Tesla’s performance.

Some forecast deliveries could fall below 400,000 units, a threshold not breached since Q3 2022.

FactSet’s consensus estimate suggests Tesla will sell 2.07 million vehicles in 2025, representing a 16% increase from 2024.

The introduction of a more accessible Tesla model could also potentially reinvigorate sales and attract a broader consumer base. This new model is seen as a strategic move to regain market share and boost sales momentum.

The company’s ability to address production challenges, navigate political controversies, and successfully launch new models will be crucial in determining its performance for the remainder of 2025.

Sources: eToro, MarketScreener