Japanese Yen Hits 5-Month High, US Recession Fears Boost Safe-Haven Demand

- This topic has 2 replies, 1 voice, and was last updated 2 days ago by .

-

Topic

-

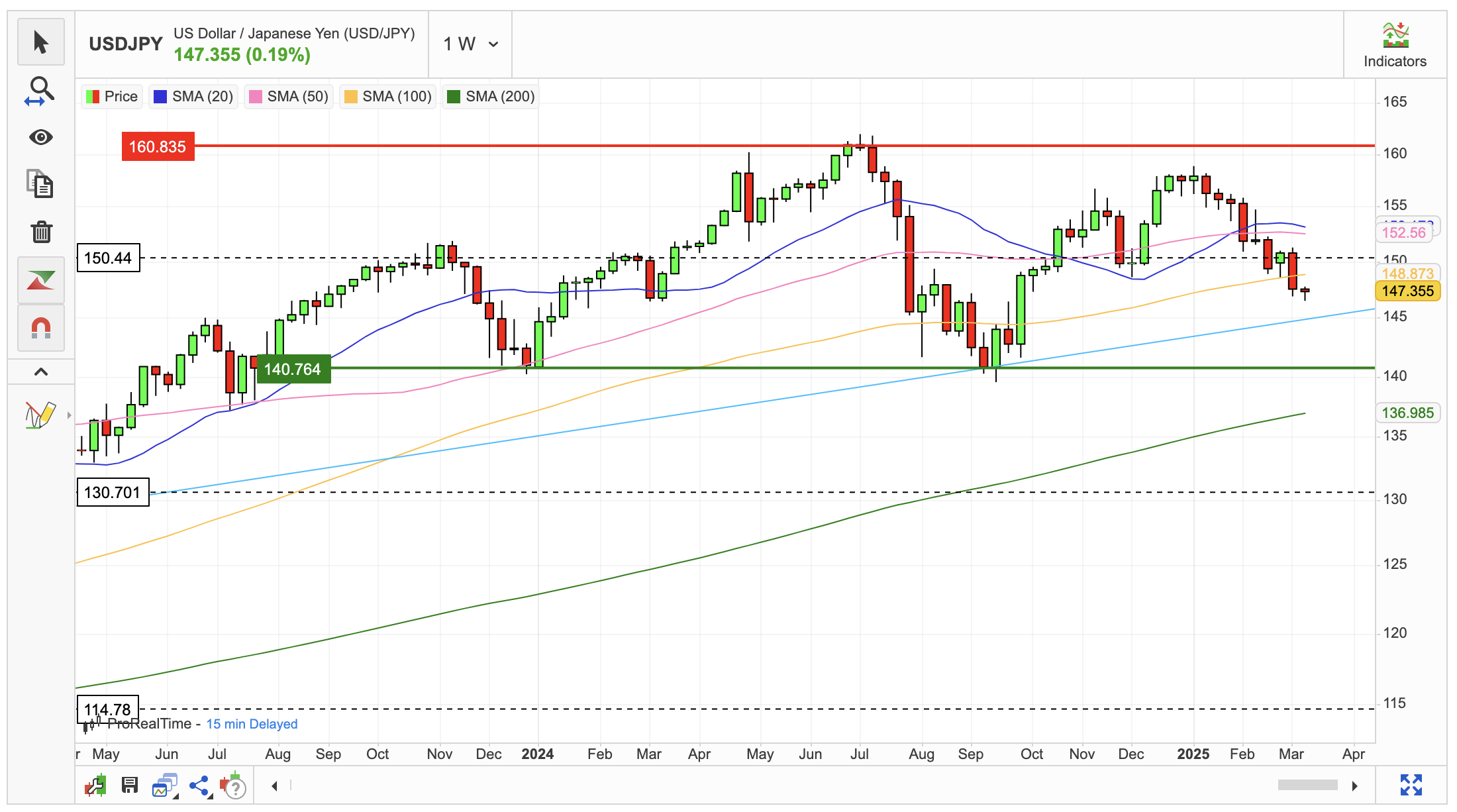

The Japanese yen surged to around 147 per dollar on Tuesday, hitting a five-month high as escalating fears of a US recession drove investors toward safe-haven assets.

This rally in the yen reflects growing unease over the economic outlook, particularly as US President Donald Trump’s trade policies and recent government shake-ups continue to unsettle global markets.

Trump’s reluctance to dismiss the possibility of a recession has only added to the uncertainty, fuelling demand for traditionally stable currencies like the yen.

In Japan, the economic backdrop has also played a role in the yen’s strength.

Revised fourth-quarter GDP data revealed that annualised growth slowed to 2.2%, down from an initial estimate of 2.8%, primarily due to weaker-than-expected private consumption.

This slowdown highlights the challenges facing Japan’s domestic economy, even as external factors like the trade war and US economic instability weigh on sentiment.

Despite these concerns, the Bank of Japan (BoJ) is widely expected to maintain its current interest rates at its March policy meeting.

However, analysts anticipate further rate hikes later in the year as part of the central bank’s broader strategy to normalise monetary policy.

This expectation has bolstered the yen’s appeal, as higher rates could increase returns on yen-denominated assets.

The BoJ’s cautious approach reflects its balancing act between supporting economic growth and addressing inflationary pressures.

Meanwhile, the yen’s sharp appreciation has drawn attention from Japanese officials.

Finance Minister Shunichi Kato warned that excessive foreign exchange volatility can have tangible effects on everyday life, particularly through its impact on import costs and consumer prices.

His comments underscore the broader economic implications of currency fluctuations, especially in a country heavily reliant on imports for key goods.

The yen’s strength also comes amid ongoing trade tensions between the US and Japan, with uncertainty over whether Japan will be exempt from Trump’s tariffs adding another layer of complexity to the economic relationship.

As the US dollar weakens in response to growing recession fears, the yen’s role as a safe-haven currency is likely to remain prominent, particularly if global economic uncertainty persists.