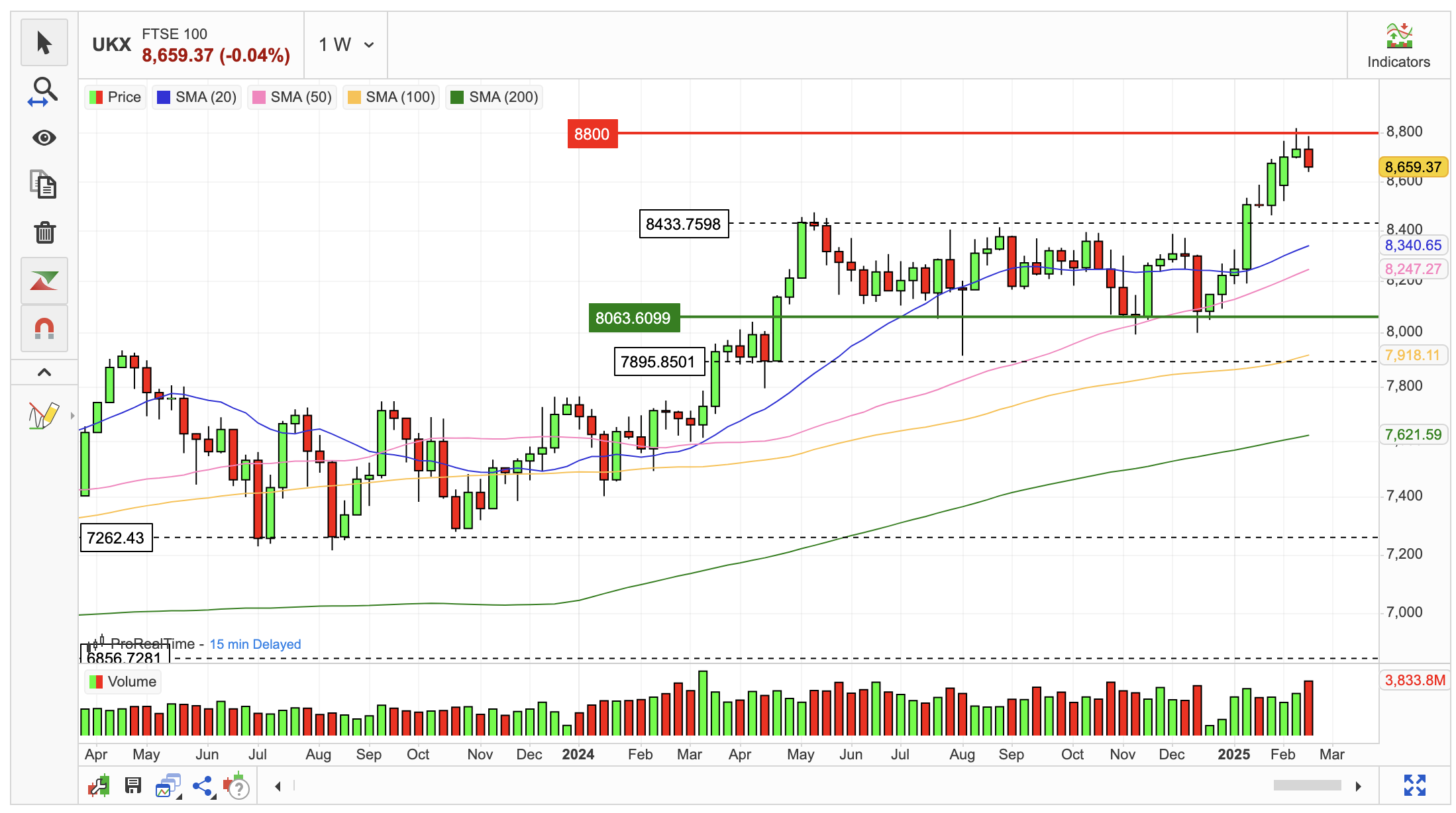

FTSE 100 Experienced Biggest Weekly Decline Of 2025

- This topic has 1 reply, 1 voice, and was last updated 2 weeks ago by .

-

Topic

-

The FTSE 100 concluded Friday’s trading session with minimal movement, as strong UK consumer spending data for January was offset by growing concerns over rising unemployment.

The index finished the day at 8,659 points, down by 0.04%.

Consumer spending in January 2025 showed a robust increase of 1.9% year-on-year, marking the highest uplift since March 2024.

This surge was driven by both essential and non-essential spending, with the latter growing by 2.7%.

The strong performance was partly attributed to January’s stormy weather, which boosted spending on takeaways and streaming services as consumers stayed indoors.

However, the positive consumer spending data was counterbalanced by signs of a slowdown in business activity.

The S&P Global UK Manufacturing PMI for February fell to 46.4, indicating a sharp contraction in the manufacturing sector and missing market expectations.

This decline suggests that companies are cutting jobs, with employment falling to its lowest level since 2020.

Banking stocks were among the top performers, with Natwest rising 3.07% and Standard Chartered gaining 3.16%.

These gains were likely driven by strong earnings reports and the anticipation of potential rate cuts by the Bank of England later in the year.

Conversely, gold miners such as Endeavour Mining experienced losses, with the stock falling 2.44%. This decline may be linked to fluctuations in gold prices and broader market uncertainties.

Looking ahead, traders are recalibrating their expectations for Bank of England rate cuts.

While a 25 basis point cut is widely expected at the next meeting on February 6th, the path for future cuts remains uncertain.

Market consensus currently suggests three additional 0.25% cuts in 2025, potentially leaving the interest rate at 3.75% by year-end.

Despite Friday’s marginal gain, the FTSE 100 recorded its worst weekly performance of the year, declining by nearly 1%.

This downturn reflects ongoing concerns about economic growth and persistent inflation, which continue to shape investor sentiment in the UK market.

Sources: Trading Economics, MarketScreener