Coinbase Review 2025

Pros

- As a Nasdaq-listed company, Coinbase follows strict financial regulations, with licensing across the US, UK, and Europe. Security includes FDIC insurance for USD balances (up to $250,000) and two-factor authentication (2FA).

- Coinbase supports 240+ cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and more recently listed altcoins like $Trump, giving early access to emerging tokens.

- Coinbase Advanced bolstered its leveraged trading offering with two new futures products ion 2025: Natural Gas (NGS) - 1,000 MMBtu per contract with up to 11x leverage, and Cardano (ADA) futures - 1,000 ADA per contract with up to 5x leverage.

Cons

- There are woeful research tools; Advanced Trade has TradingView charts but lacks features like news feeds, economic calendars, and AI market insights.

- Frustrating customer support during testing, with most help options hidden behind login, making it tough for locked-out users or non-account holders to get assistance.

- High crypto fees based on tests, especially compared to competitors like Kraken and BitMEX, and notably on the standard dealing platform.

Coinbase Review

Note! If you intend to day trade cryptocurrency, you don’t necessarily want to own actual coins. It can be cheaper and more efficient to trade price movements using derivatives, where you can also leverage the results.

Learn how in our cryptocurrency day trading guide.

Regulation & Trust

3.5 / 5Established in June 2012, Coinbase is one of the most trusted cryptocurrency exchanges. However, given the high-risk nature of crypto firms (think FTX) – it’s less trusted than many ‘traditional’ brokerages.

In April 2021, it became a publicly traded company through a direct listing on the Nasdaq (COIN), marking a significant milestone in the cryptocurrency industry’s mainstream acceptance and requiring a high degree of financial transparency on the part of Coinbase.

Now operating across more than 100 countries, Coinbase complies with a range of regulatory requirements to ensure the security and legality of its services.

Below is a list of some of the key regulatory bodies overseeing Coinbase’s operations in various jurisdictions:

- US: Registered as a Money Services Business (MSB) by the Financial Crimes Enforcement Network (FinCEN).

- UK: CB Payments Limited is authorized by the Financial Conduct Authority under the Electronic Money Regulations 2011 (reference number 900635) to issue electronic money.

- EU: Registered by the Central Bank of Ireland as a Virtual Asset Service Provider (VASP), the Dutch Central Bank (De Nederlandsche Bank) for crypto services, the Bank of Spain to offer its full suite of products and services to retail and institutional users, and the Organismo Agenti e Mediatori (OAM) in Italy to provide crypto services.

- Singapore: Coinbase Singapore PTE. LTD holds approval from the Monetary Authority of Singapore (MAS) under the Payment Services Act to provide digital payment token services.

As a publicly traded company in the US, Coinbase provides all clients with access to its financial reports, which include information on how funds are managed and held.

Customer assets are maintained on a one-to-one basis, ensuring that funds are available at all times, 24/7, 365 days a year.

For non-US-based customers, Coinbase holds client funds as cash in custodial accounts. This money is held separately from Coinbase’s operating funds, meaning the exchange will not use these to cover expenses or other corporate purposes.

US customer funds are also held as cash in pooled custodial accounts by banks with FDIC insurance. This means all US dollar deposits stored in USD wallets with Coinbase are fully insured by the Federal Deposit Insurance Corporation (FDIC) up to a maximum of $250,000 per individual.

Despite this security, Coinbase has been the target of several security attacks, including phishing, social engineering, and phone-based attacks.

| Coinbase | Interactive Brokers | Gemini | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | FinCEN, FCA, CBoI, MAS, OAM, DNB, BdE | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NYDFS, MAS, FCA |

| Crypto Reserves | No | No | Yes |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

4.3 / 5Coinbase offers many account types and services tailored to different user needs, including retail investors.

The choice can be confusing, so here’s a breakdown of the main accounts for individual traders:

- Coinbase: A user-friendly platform for buying, selling, and storing over 240 cryptocurrencies with basic trading features and higher debit/credit card transaction fees.

- Wallet: A self-custody wallet allowing you to securely store, manage, and transfer your crypto and NFTs with complete control over private keys.

- One: A premium subscription account ($29.99 p/m) offering zero trading fees, priority customer support, and account protection with a one-time reimbursement of up to $1 million for security breaches.

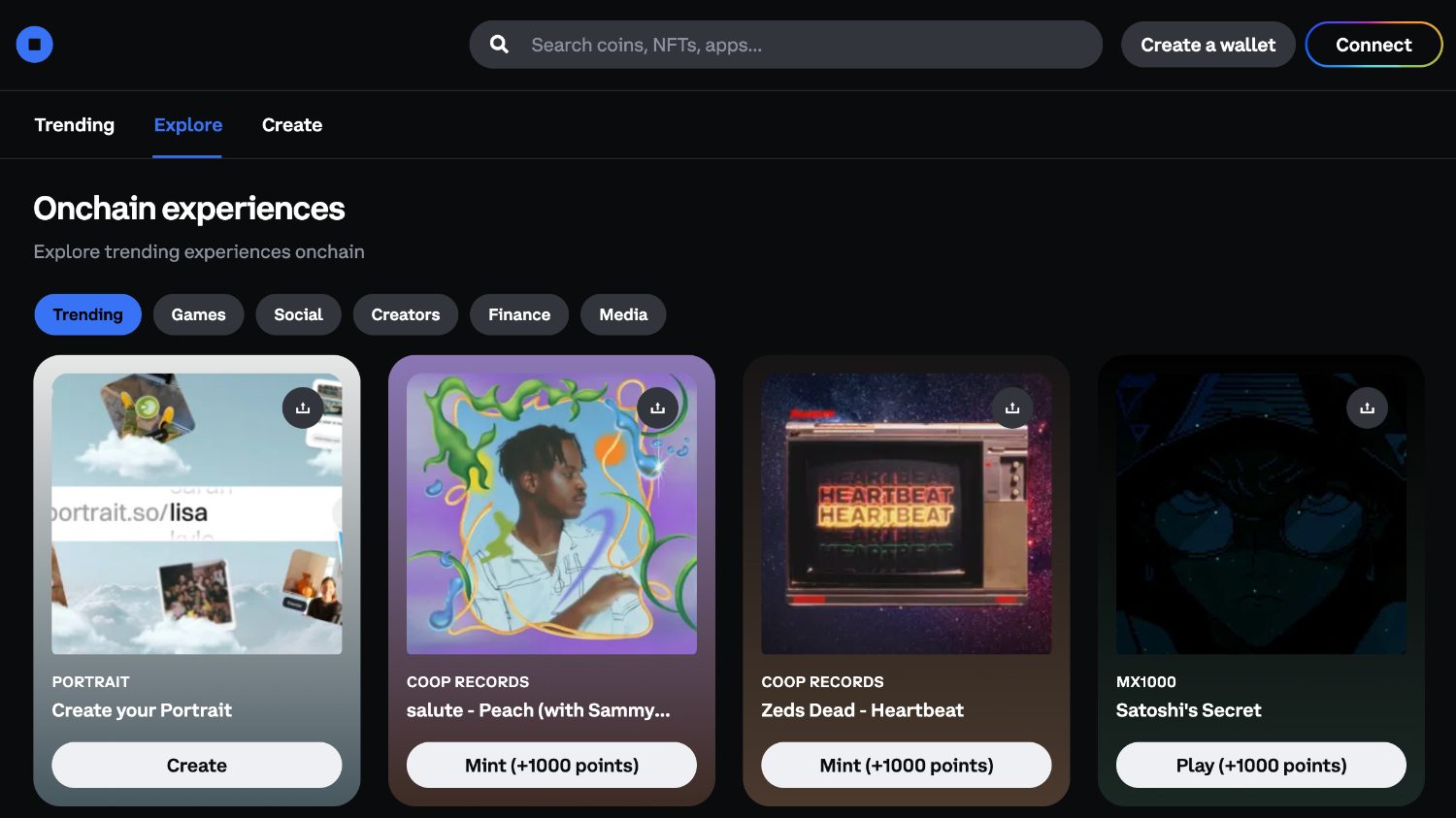

- NFT: A marketplace to create, buy, and sell NFTs, integrated with the Coinbase platform to access digital collectibles.

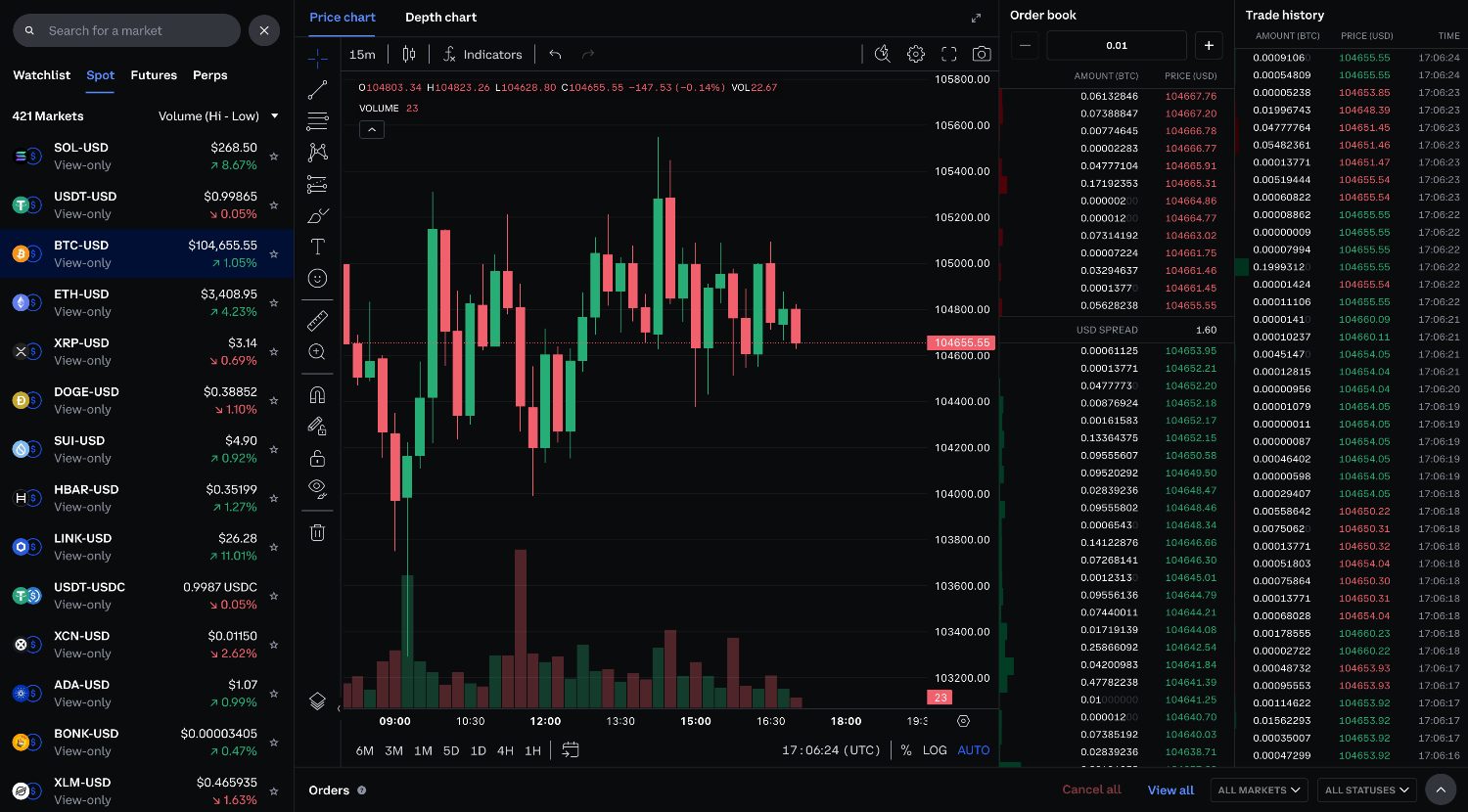

- Advanced Trade: Replaced Coinbase Pro in 2022 for active traders, offering lower fees, advanced charting tools, multiple order types, and full API access for algorithmic trading.

I found opening a Coinbase account straightforward. I needed to provide personal information such as my name, email address, phone number, and proof of identity (government-issued ID) to comply with Know Your Customer (KYC) regulations.Unlike some other crypto exchanges that allow anonymity, Coinbase requires complete verification. I had to get fully verified before accessing my client area and exploring the trading platforms. Luckily, the process only took a few minutes but it was still frustrating.

Demo Accounts

Like many crypto exchanges, although still irritating, Coinbase does not offer demo accounts, so I could not practice trading crypto without risking my real money.

Some ‘traditional’ platforms like eToro and Trading 212 offer simulated crypto trading environments for those looking to practice without risk.

Deposits & Withdrawals

Coinbase facilitates deposits and withdrawals utilizing a practical range of payment methods:

- Bank Transfers: You can transfer funds from your bank account to Coinbase. Typically takes 1-3 business days.

- Debit Cards/Credit Cards: This option allows instant deposits using Visa or Mastercard. Higher fees apply (usually around 3.99%).

- E-wallets: Choice depends on your region, allowing instant deposits using Apple Pay, Google Pay, Maya, Mercado Pago, and others.

- Stablecoins: Allows direct transfers of USDT, USDC, and others, into the platform via blockchain networks.

Depositing funds into my Coinbase account was simple. I linked my bank account, selected the deposit method, and the Bacs transfer arrived within a few days. Using my debit card for an instant deposit was faster but came with a higher fee.

When withdrawing, I transferred funds back to my bank via Bacs, which took about three business days, while a debit card withdrawal was a little quicker at two business days.

| Coinbase | Interactive Brokers | Gemini | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Apple Pay, Credit Card, Debit Card, Google Wallet, Mastercard, Visa, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | ACH Transfer, Bitcoin Payments, Credit Card, Etana, Ethereum Payments, Mastercard, PayPal, Silvergate Bank Transfer, Visa, Wire Transfer |

| Minimum Deposit | $0 | $0 | $0 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

4.3 / 5Coinbase lets you buy, sell, and trade real cryptocurrencies rather than trading derivatives like crypto CFDs. This differs from some traditional brokerage platforms, which only offer exposure to crypto prices through derivatives rather than direct ownership of digital assets.

When you purchase crypto on Coinbase, you own the digital assets, which can be stored in your Coinbase account, transferred to a private wallet like Coinbase Wallet or other external wallets, or staked to earn rewards.

- Cryptocurrencies: Coinbase supports 240+ digital assets, including major coins like Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and Ripple (XRP), as well as a variety of altcoins and emerging tokens like Dogecoin (DOGE) and added in 2025, OFFICIAL TRUMP (TRUMP).

- Stablecoins: You can trade popular stablecoins, such as Tether (USDT) and Dai (DAI), which are pegged to the US dollar to reduce volatility.

- Fiat-To-Crypto Markets: Coinbase allows trading between cryptocurrencies and fiat currencies like USD, EUR, GBP, and others. It also supports direct bank deposits, debit/credit cards, and PayPal transactions.

- Crypto-To-Crypto Trading Pairs: Advanced Trade users can access crypto-to-crypto trading pairs, such as BTC/ETH, SOL/USDT, and ADA/USDC, with market, limit, and stop orders available.

- Staking & Yield Earning Assets: You can stake select cryptocurrencies, including Ethereum 2.0 (ETH), Cosmos (ATOM), Tezos (XTZ), and Solana (SOL), to earn passive income, though Coinbase takes a commission from staking rewards.

- NFTs & Web3 Assets: Through Coinbase NFT Marketplace, you can buy, sell, and store Ethereum-based NFTs. Additionally, Coinbase Wallet enables interaction with decentralized applications (DApps) and DeFi protocols.

- Institutional & OTC Trading: Coinbase Prime offers over-the-counter (OTC) trading for high-net-worth individuals and institutions, allowing the execution of large block trades with minimal market impact.

Coinbase also regularly brings out now assets for trading. For example, 2025 saw Coinbase Advanced expand its offering with two new futures products: Natural Gas (NGS) futures – 1,000 MMBtu per contract with up to 11x leverage, and Cardano (ADA) futures – 1,000 ADA per contract with up to 5x leverage, letting traders explore energy market moves and altcoin momentum.

These asset offerings make Coinbase a versatile platform, though it focuses almost exclusively on crypto trading (coins and pairs) without access to increasingly popular markets like crypto ETFs.

| Coinbase | Interactive Brokers | Gemini | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Crypto Lending | Yes | No | Yes |

| Crypto Mining | No | No | No |

| Crypto Staking | Yes | No | Yes |

| Margin Trading | No | Yes | No |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

3.5 / 5Coinbase offers a relatively well-regulated platform for buying, selling, and trading cryptocurrencies, but its fees are not the lowest based on our investigations.

Yet while some exchanges provide lower-cost alternatives, Coinbase’s pricing reflects its strong security measures and compliance with regulatory standards.

The standard Coinbase platform has a complex fee structure, which tends to be more expensive than the Advanced Trade platform.

In addition to a spread of 0.50% on both cryptocurrency purchases and sales – subject to market fluctuations – Coinbase also applies a ‘Coinbase Fee.’ This fee varies depending on the transaction size. For example, if you transact between $10 and $25, a fee of up to $2.99 will be charged.

Furthermore, Coinbase levies a conversion margin of up to 2% for exchanging one cryptocurrency for another.

On the other hand, Advanced Trade utilizes a maker-taker fee model for trading. Taker fees depend on the total USD trading volume over 30 days and are calculated based on the price tier you fall under when the order is placed.

For instance, within a tier ranging from $50,000 to $100,000 in volume, a taker fee of 0.25% applies, while a maker fee is reduced to 0.15%.

Fiat deposits and withdrawals also incur fees, including a $10 fee for depositing USD via wire transfer and a $25 fee when withdrawing the same way.

For users who prioritize safety, regulatory oversight, and ease of use, the slightly higher fees may be a worthwhile trade-off for the added peace of mind and reliability that Coinbase provides.

| Coinbase | Interactive Brokers | Gemini | |

|---|---|---|---|

| Fees & Costs Rating | |||

| Crypto Spread | 0.5% - 1% (BTC) | 0.12%-0.18% | Transaction fee from $0.99 |

| Inactivity Fee | $0 | $0 | |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

3.8 / 5Coinbase offers several trading platforms tailored to different user needs:

- Coinbase: This standard platform provides the starting point and lets you buy and sell cryptocurrencies. I find the TradingView-powered interface very intuitive and easy to use via a web browser or mobile app, making it an excellent choice for those new to crypto trading. You can monitor price movements over multiple time frames, including 1 hour, 24 hours, 1 week, and 1 year, to analyze market trends before making transactions.

- Advanced Trade: Formerly Coinbase Pro, Advanced Trade is designed for active and experienced traders who need access to advanced tools, lower fees, and enhanced charting capabilities. I prefer it to the standard platform because it gives me more control over my trades with the market and limits and stops orders. Another advantage of Advanced Trade is its maker-taker fee model, which provides significant cost savings over the standard platform. Additionally, Advanced Trade integrates with industry-leading APIs, so you can build custom trading bots and automate transactions.

- Wallet: This self-custody solution lets you store private keys and control your funds fully. It supports thousands of cryptocurrencies and Ethereum-based NFTs while providing compatibility with decentralized apps (DApps) for DeFi, staking, and web3 activities. The wallet is accessible through a mobile app and browser extension.

- NFT: For those interested in digital collectibles, the Web3 marketplace lets you buy, sell, and discover Ethereum-based NFTs. I’ve been pleased to find it charges no transaction fees beyond standard Ethereum gas fees and integrates seamlessly with Coinbase Wallet and other self-custody wallets. The marketplace also includes social features that allow you to follow creators and showcase your NFT collections.

| Coinbase | Interactive Brokers | Gemini | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | Coinbase, Advanced Trade, Wallet, NFT | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | ActiveTrader, AlgoTrader, TradingView |

| Mobile App | iOS & Android | iOS & Android | iOS & Android |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

2.3 / 5Unlike many leading crypto brokers like eToro that offer dedicated research tools such as economic calendars, daily market analysis, real-time news feeds, sentiment analysis, and trading signals, Coinbase does not provide a comprehensive suite of research tools for traders.

While Coinbase lacks built-in research tools, it provides market insights through its YouTube channel (@coinbase). Some videos cover macroeconomic topics that impact the crypto space, such as inflation and regulatory developments, which I watch to stay informed about industry shifts.

However, the research-focused content is not very frequent. To improve, Coinbase could introduce regular market update videos, expert commentary on price movements, and technical analysis breakdowns of major cryptocurrencies.

Live Q&A sessions or interactive discussions on market trends would help traders make more informed decisions.

Additionally, integrating sentiment analysis tools and AI-driven market forecasts could help to make more informed decisions.

| Coinbase | Interactive Brokers | Gemini | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

3.8 / 5Coinbase provides a few educational tools to help beginner traders understand cryptocurrency and blockchain technology:

- Coinbase Learn: A structured learning hub that offers beginner-friendly guides, in-depth articles, and video tutorials covering topics like how to buy and sell crypto, blockchain fundamentals, and risk management. The platform regularly updates its content to reflect industry trends and regulatory changes, helping to ensure you stay informed.

- Coinbase Earn: An interactive program that allows you to earn small amounts of cryptocurrency by watching short educational videos and completing quizzes. This initiative introduces new projects and tokens while providing practical incentives for learning. However, the availability of these earning opportunities varies, and you may find the rewards underwhelming.

- YouTube: Coinbase also offers educational content through its YouTube channel (@coinbase), where you can find video tutorials, market insights, and explainers on cryptocurrency trends. The videos cover basic crypto concepts and more advanced discussions on blockchain technology and Web3. This visual learning format provides an accessible way for beginners to grasp complex topics. However, the content could be expanded with more in-depth trading tutorials and regular market analysis to cater to a broader audience.

While Coinbase’s educational tools are helpful, there are areas for improvement. Regularly updating Coinbase Earn with new content would keep me more engaged and provide more learning opportunities.

Expanding educational resources to include more advanced topics on technical analysis and trading strategies could help beginners progress beyond the basics.

Additionally, integrating interactive tools that you can find at category leader IG, notably courses, more regular live webinars, and adding demo accounts, would make learning more engaging and hands-on.

| Coinbase | Interactive Brokers | Gemini | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

2.5 / 5Coinbase provides several support options to assist its clients:

- Help Center: A comprehensive resource covering account management, payment methods, and security. Content includes written articles and video tutorials.

- Live Chat: Registered users can only engage in real-time conversations with support agents for immediate assistance.

- Phone: 24/7 telephone support is available in certain jurisdictions, including the US, Canada, UK, and Ireland. For the rest of Europe, hours are 09:00-18:00 local time. A callback service is also available.

- Email: For various concerns, you can contact ‘support@coinbase.com’, although Coinbase doesn’t make finding this email address easy on its website.

- Social Media: The official Coinbase accounts on X and Facebook offer updates and respond to user inquiries.

While Coinbase provides multiple self-service resources, expanding contact options for unregistered and locked-out users would improve accessibility.

I find it infuriating that you cannot contact customer support via live chat without having an account.This made it extremely difficult for me to log into my account when I couldn’t access my Coinbase Authenticator app. I had to phone customer support and wait 3 hours for a call back to help me log in.

In this instance, I was advised to set up another trading account as nothing could be done to help me!

| Coinbase | Interactive Brokers | Gemini | |

|---|---|---|---|

| Customer Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Trade With Coinbase?

Whether you should trade with Coinbase compared to other crypto exchanges like Kraken or BitMEX depends on your priorities.

Coinbase is not a bad choice for beginners due to its easy-to-use interface, strong security, and regulatory compliance, but it has higher fees.

If you value security, Coinbase is a solid choice, but if you’re focused on lower fees or a simplified trading experience (especially on mobile devices), Kraken or BitMEX may be better options.

FAQ

Is Coinbase Legit Or A Scam?

Coinbase is a legitimate and well-established cryptocurrency exchange publicly traded on the Nasdaq under the ticker ‘COIN’.

It is licensed and regulated in multiple jurisdictions, including the US, UK, and Europe, and complies with strict financial and security standards.

The platform has robust security measures, including FDIC insurance for US dollar balances and cold storage for most crypto assets.

Coinbase is a trustworthy platform, not a scam.

Still, it remains a relatively young exchange operating in an extremely high-risk space, so caution is required.

Is Coinbase Suitable For Beginners?

Coinbase can be well-suited for beginners, but there are easier and more intuitive ways to buy, sell, and store cryptocurrencies. There’s also no crypto copy trading service to help beginner traders learn different strategies.

The platform provides educational resources, including Coinbase Learn and Coinbase Earn, which can help new users understand crypto while earning small rewards.

However, beginners should be aware of Coinbase’s relatively high fees compared to other platforms. As they gain experience, they may want to explore Coinbase’s Advanced Trade platform for lower-cost transactions.

Top 3 Alternatives to Coinbase

Compare Coinbase with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Gemini – Gemini is a cryptocurrency exchange set up in 2014 by the Winklevoss brothers, known for their early involvement in Facebook. The exchange is among the world’s 20 largest and most popular. Gemini clients can trade and stake 110+ cryptocurrencies, with derivatives trading available in some jurisdictions, an advanced proprietary platform and additional features including an NFT marketplace.

- Kraken – Kraken is a leading cryptocurrency exchange with a proprietary trading terminal and a list of 220+ tradeable crypto tokens. Up to 1:5 leverage is available with stable rollover fees on spot crypto trading and up to 1:50 on futures. The exchange also supports crypto staking and has an interactive NFT marketplace.

Coinbase Comparison Table

| Coinbase | Interactive Brokers | Gemini | Kraken | |

|---|---|---|---|---|

| Rating | 3.5 | 4.3 | 3.8 | 3.9 |

| Markets | Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Cryptos | Cryptos |

| Demo Account | No | Yes | No | Yes |

| Minimum Deposit | $0 | $0 | $0 | $10 |

| Minimum Trade | $2 | $100 | 0.00001 BTC | Variable |

| Regulators | FinCEN, FCA, CBoI, MAS, OAM, DNB, BdE | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NYDFS, MAS, FCA | FCA, FinCEN, FINTRAC, AUSTRAC, FSA |

| Bonus | – | – | – | Lower fees when trading volume exceeds $50,000 in 30 days |

| Education | No | Yes | Yes | Yes |

| Platforms | Coinbase, Advanced Trade, Wallet, NFT | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | ActiveTrader, AlgoTrader, TradingView | AlgoTrader, Quantower |

| Leverage | – | 1:50 | – | – |

| Payment Methods | 7 | 6 | 10 | 6 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Gemini Review |

Kraken Review |

Compare Trading Instruments

Compare the markets and instruments offered by Coinbase and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Coinbase | Interactive Brokers | Gemini | Kraken | |

|---|---|---|---|---|

| CFD | No | Yes | No | No |

| Forex | No | Yes | No | No |

| Stocks | No | Yes | No | No |

| Commodities | No | Yes | No | No |

| Oil | No | No | No | No |

| Gold | No | Yes | No | No |

| Copper | No | No | No | No |

| Silver | No | No | No | No |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | No | Yes |

| Options | No | Yes | No | No |

| ETFs | No | Yes | No | No |

| Bonds | No | Yes | No | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | No | No |

Coinbase vs Other Brokers

Compare Coinbase with any other broker by selecting the other broker below.

The most popular Coinbase comparisons:

- Plus500 vs Coinbase

- Pionex vs Coinbase

- Luno vs Coinbase

- Coinbase vs OKX

- Coinbase vs Swissquote

- Coinbase vs Pocket Option

- Forex.com vs Coinbase

- Bybit vs Coinbase

- Revolut vs Coinbase

- Coinbase vs Fidelity

- Nexo vs Coinbase

Article Sources

- Coinbase

- Coinbase - Nasdaq

- CB Payments Ltd - FCA

- Coinbase Singapore PTE Ltd

- Social Engineering - A Coinbase Case Study

- Coinbase - YouTube

- Coinbase - X

- Coinbase - Facebook

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Coinbase yet, will you be the first to help fellow traders decide if they should trade with Coinbase or not?