Coinbase Launches Nano XRP Futures For Retail Traders

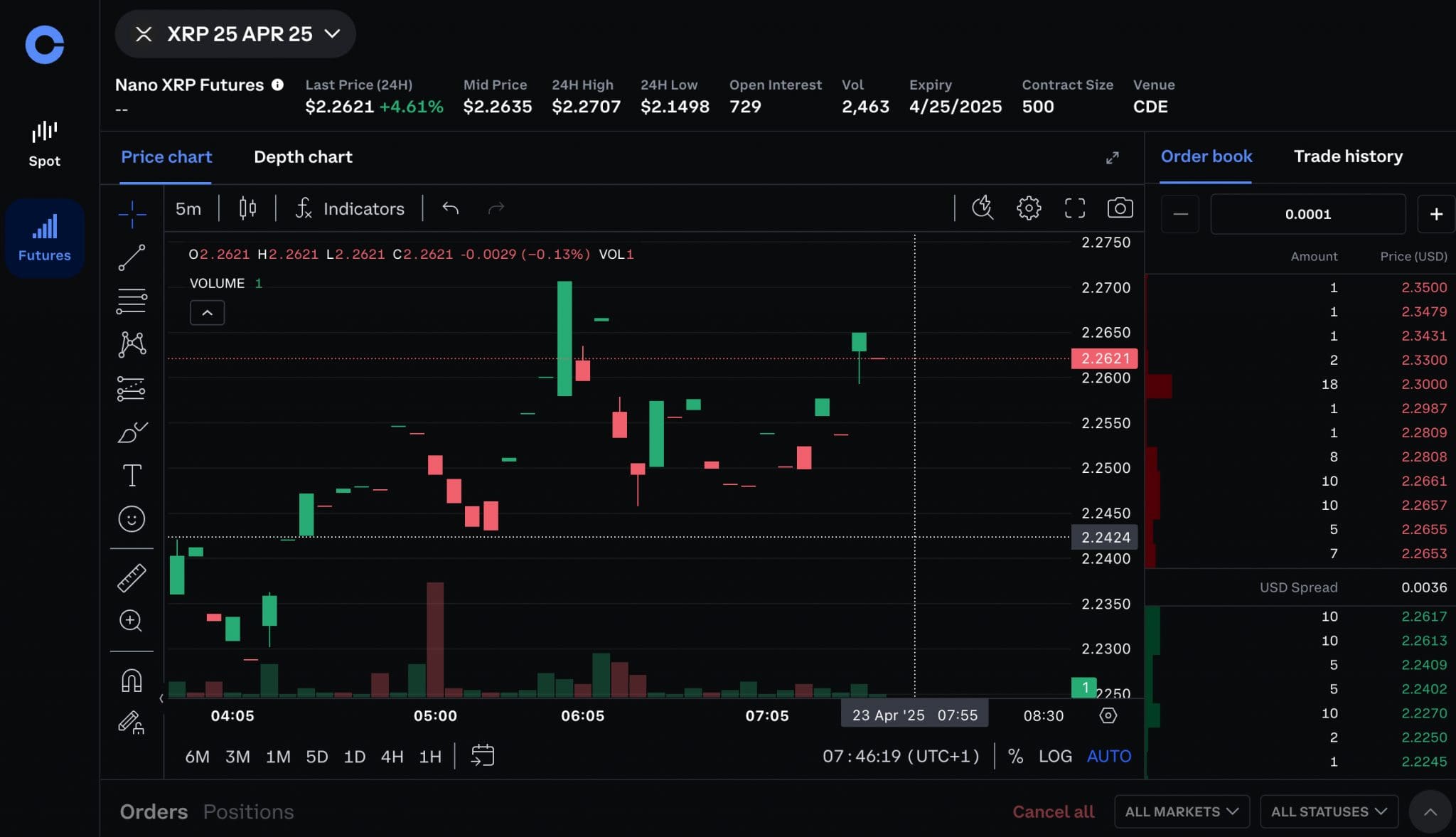

Coinbase has expanded its suite of regulated futures offerings with the addition of nano Ripple (XRP) futures.

These new contracts offer retail traders a more accessible way to trade, hedge, or diversify their exposure to XRP.

This launch brings the total number of crypto futures on Coinbase Advanced to 18, covering a mix of digital assets, metals, and energy products.

Key Takeaways

- Nano XRP futures now available, with each contract sized at 500 XRP

- Suitable for retail traders looking to manage risk or speculate on XRP

- Trade with leverage and go long or short based on market sentiment

- Integrated with Coinbase Advanced’s user-friendly interface

Trading cryptocurrency is high-risk – you could lose any money you invest.

Futures Available

In addition to XRP, Coinbase offers nano futures contracts for assets like Bitcoin (1/100th BTC), Ethereum (1/10th ETH), Solana (5 SOL), and Polkadot (100 DOT), as well as full-sized and micro contracts for assets such as Dogecoin, Litecoin, Gold, and Silver.

Coinbase’s futures products are regulated through Coinbase Financial Markets, a member of the National Futures Association (NFA) in the US. While the NFA provides oversight, it does not regulate spot crypto markets or exchanges.

For those new to futures trading, Coinbase offers a comprehensive learning hub with resources to understand contract sizing, margin trading, and risk strategies.

About Coinbase

Coinbase is one of the largest and most trusted cryptocurrency platforms, providing tools for trading, investing, and managing digital assets.

Standing out for its focus on security, compliance, and user experience, Coinbase serves both retail and institutional clients across a wide range of financial products.

New traders can open a Coinbase account with a $0 minimum deposit.