Coffee Prices Surge: Threat to Your Wallet or Trading Opportunity?

Coffee prices are soaring, driven by shrinking stockpiles, climate change, a shift toward durian farming in Vietnam, and inflationary pressures.

Arabica beans, the benchmark for futures contracts and popular in the US, account for 75% of global production, with Brazil comprising 40% of that.

Robusta, the beans favored in Europe and espressos, accounts for the other 25% and are chiefly produced in Vietnam, which cultivates around 15% of global supply.

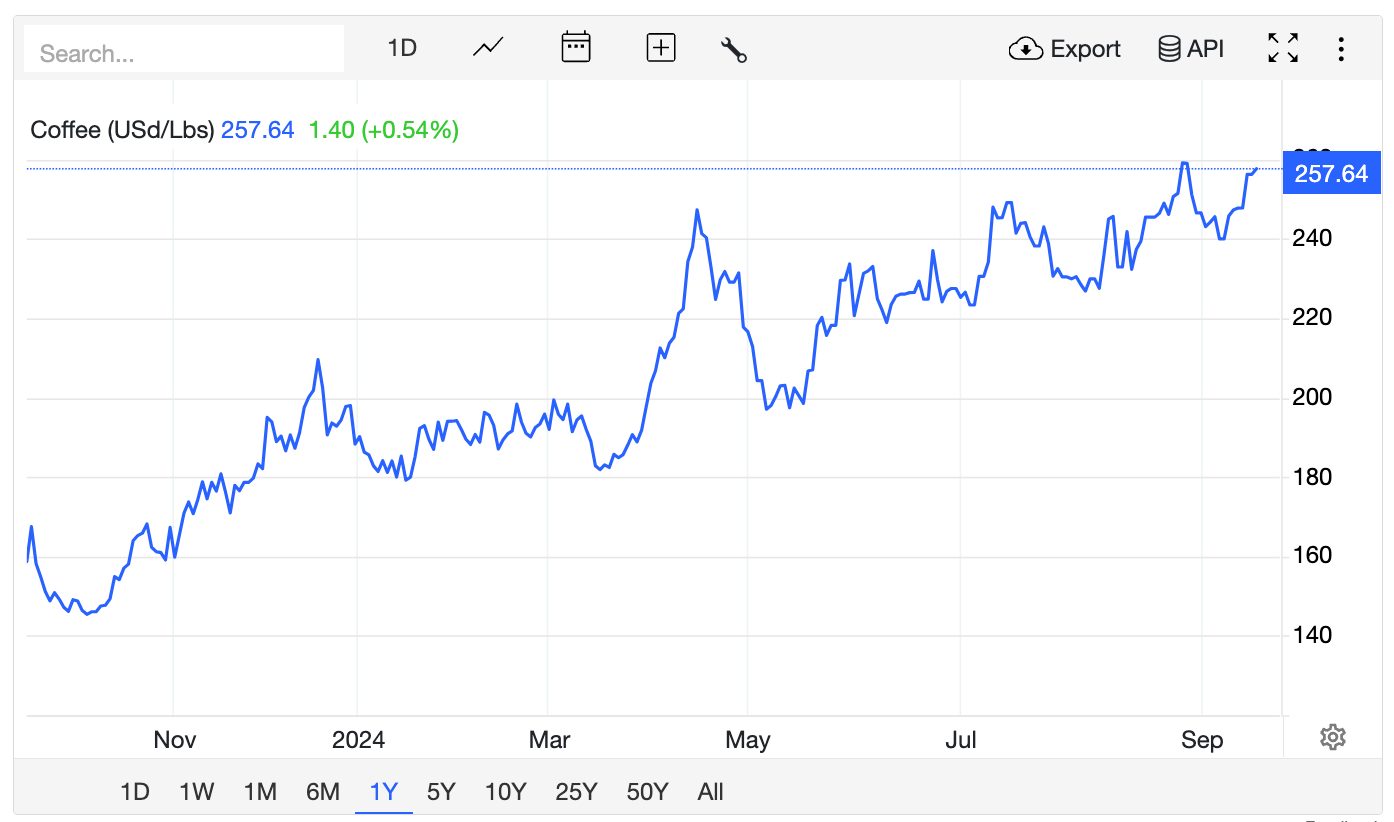

Investors interested in coffee trading are watching both Arabica and Robusta beans closely, as prices have surged 40% and 90% this year, respectively.

The big question: will this trend continue, or is a market correction looming?

Key Takeaways

- Coffee prices are nearing record highs, largely due to climate disruptions in Brazil, which is experiencing its driest weather since 1981 according to Cemaden.

- In recent years Vietnam has picked up the supply slack, but farmers have been hit by Typhoon Yagi and are replacing their Robusta crops with durian, a fruit which has proven more lucrative.

- These factors are adding volatility to the coffee futures market, leaving traders uncertain if prices will keep climbing or if a correction is on the horizon.

Roasting Trends: The New Coffee Landscape

Brazil’s coffee sector is still recovering from a 2021 frost, while Vietnam is grappling with severe drought.

Adding to the supply pressure is Vietnamese farmers favoring durian, a fruit known for its pungent aroma, which delivers five times the returns of coffee and is in high demand in China.

Consultancy Allegra Strategies, as reported by the BBC, suggests inflationary costs like rent and labor are also driving up prices, noting that coffee beans represent less than 10% of the cost of a cup.

The coming months will be crucial as coffee stocks dwindle. Brazil’s next crop could bring some short-term relief, but much depends on weather patterns.

While early rains are critical for healthy flowering, late rains in October could trigger further concerns that extend to next year’s yields.

Current forecasts suggest little rainfall for the rest of the month.

Bottom Line

Coffee traders are dealing with major market volatility. Will these rising costs continue, leading to pricier cups of coffee, or will the market stabilize?

In the near term, traders must closely monitor developments in Brazil and Vietnam, with large price swings bringing both opportunities and risks.

In the long term, the global coffee market faces ongoing uncertainty as climate change threatens land once suitable for coffee production, potentially driving prices even higher.

You can trade coffee at leading brokers IG, AvaTrade, and IC Markets.

Trading coffee is high-risk – you could lose any money you invest.