Forex Trading in China

As the second biggest economy worldwide, China plays a major role in the global forex market, offering currency traders opportunities to capitalize on the volatility of the renminbi, also known as the yuan.

The latest data from the Bank of International Settlements (BIS) reveals that the average daily turnover of forex trades in the country totalled $153 billion in 2022, up 12.5% from $136 billion in 2019.

Let’s explore forex trading in China and look at a trade example on the country’s currency.

Quick Introduction

- The Chinese yuan is represented by two different symbols, CNY and CNH. CNY is traded within Mainland China, while CNH is traded outside Mainland China. CNY is tightly controlled by the People’s Bank of China, whereas CNH trades freely based on market conditions.

- The forex market in China is heavily regulated by the People’s Bank of China (PBoC), which sets the (CNY) daily exchange rate against other currencies. The State Administration of Foreign Exchange (SAFE) sets rules for forex transactions.

- The PBoC holds over $3 trillion worth of foreign exchange reserves, the highest in the world. Understanding the PBoC’s reserve levels could provide insights into global investment trends and potential trading opportunities.

Top 4 Forex Brokers in China

Based on our latest tests, these 4 platforms that accept Chinese traders are superior:

How Does Forex Trading Work?

Forex trading in China involves buying and selling currency pairs, such as USD/CNY, to profit from market price fluctuations.

To start day trading currencies online, you’ll need to:

- Open an account with a forex broker. Trading firms should be authorized by the appropriate Chinese regulators, such as the the China Securities Regulatory Commission (CSRC) and the State Administration of Foreign Exchange (SAFE). It’s vital you follow the latest rules from China’s financial bodies as they relate to forex trading.

- Deposit yuan to your account. Once you have verified your account, which may require a copy of your Resident Identity Card, you can load your trading account. Keep in mind that Chinese residents have annual quotas for dealing in foreign currency.

- Execute currency trades. Your broker will provide a desktop, web terminal, or forex app. With authorized brokers serving Chinese traders, leverage is normally capped at 1:10 for foreign exchange assets, limiting possible returns.

Is Forex Trading legal in China?

Forex trading is legal but heavily regulated in China – much more so than most countries – under rules stipulated by SAFE and the PBoC.

Trading currencies online is only allowed via avenues like authorized local brokers, overseas forex platforms, and the China Foreign Exchange Trade System (CFETS).

With a fast-evolving economy and financial regulations, it’s essential to keep abreast of the latest developments from China’s regulators, either through their websites or increasingly via social media channels, such as China’s version of Twitter, Weibo.

Is Forex Trading Taxed in China?

Forex trading may incur tax payments in line with regulations from the State Taxation Administration (STA).

- Personal income tax is normally applied with the amount payable based on China’s progressive tax system where rates range from 3% to 45%.

- Although less common, capital gains from the sale of FX assets may be subject to rates from 0% to 20% and vary depending on factors such as the holding period and the taxpayer’s residency status.

Given the complexities of China’s tax system, I recommend consulting a professional who can provide guidance on your individual circumstances to ensure you don’t fall foul of your obligations.

Optimal Trading Times

The sessions that arguably provide the best trading conditions with high liquidity, significant volatility and competitive pricing for Chinese forex traders are:

- Onshore yuan (CNY): 9:30am to 3:30pm CST (China Standard Time). These are the most active trading hours for the onshore CNY, with the PBoC typically fixing the daily reference rate for the yuan at about 9:15am CST, which can result in increasing trading activity and market volatility.

- Offshore yuan (CNH): 8:00am to 12:00pm CST (China Standard Time). The Asian session, notably the early hours, is important for CNH trading due to active trading in Hong Kong, a major offshore center that trades CNH. 3:00pm to 12:00am CST (European session) and 8:00pm to 5:00am CST (US session) are also noteworthy with European financial hubs like London trading yuan and significant US economic releases that can influence the value of CNH.

Example FX Trade

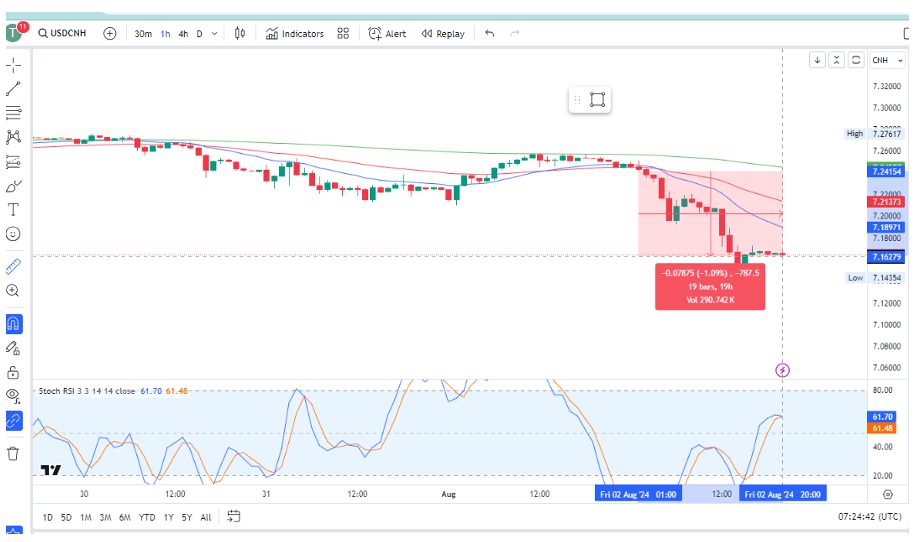

Here’s an example of a USD/CNH short-day trade I executed on the one-hour chart to show you how forex trading can work in practice…

Technical Analysis and Trade Entry

With price action breaking through the 20 and 50-day moving averages on the daily, 4-hour, and 1-hour time frames, I waited for the first bearish candle to close on the 1-hour chart before entering at 7.23801.

I set my exit target at 7.16583, corresponding to an established level on the daily time frame that had been tested many times before.

Risk Management

Rule number one for any experienced trader is to protect your account.

I always calculate the appropriate position size based on my risk management rules, never risking more than 1% of my account balance and setting a stop-loss order to manage potential losses.

Trade Exit

After monitoring my currency trade closely and paying attention to established levels on the 1hr, 4hr, and daily timeframes, I set a take profit order, allowed my trade to play out as planned, and exited at 7.16583.

Post Trade Analysis

A quick analysis of my trading plan and whether I had followed my strategy helped me review my performance, note any lessons learned, and determine how to tweak my strategy for future trades.

Bottom Line

Although strictly regulated, forex trading in China continues to grow in a fast-changing regulatory environment. Given the size of its economy and 1.4 billion population, China is set to be a core growth market for international forex brokers and retail traders.

Many firms offer competitive spreads and low fees, adding to the attraction of FX trading in China. However, when considering risk management, keep in mind that the yuan/renminbi is a volatile currency and you could lose your entire investment.

Recommended Reading

Article Sources

- People's Bank of China (PBoC)

- State Administration of Foreign Exchange (SAFE)

- China Securities Regulatory Commission (CSRC)

- Bank of International Settlements (BIS)

- State Taxation Administration (STA)

- China Foreign Exchange Reserves - Trading Economics

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com