CMC Markets Introduces New Share Basket CFDs

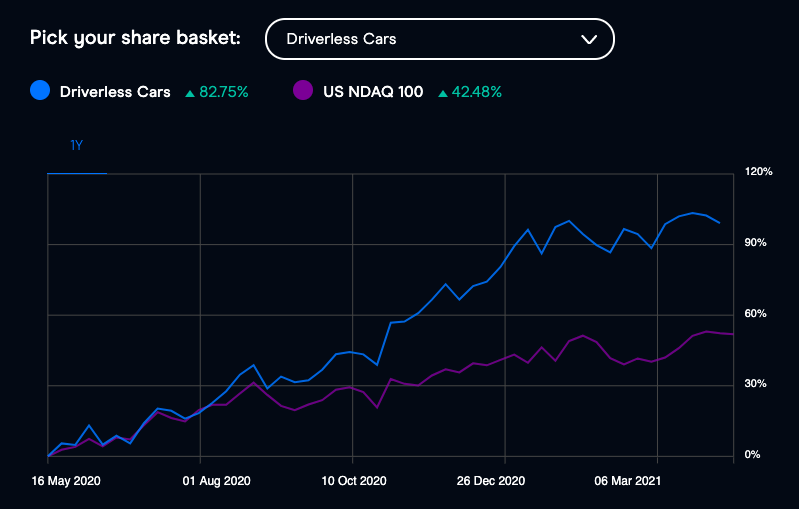

CMC Markets has released an innovative new product that picks stocks using the Relative Rotation Graphs algorithm. The signature share baskets allow traders to follow a particular trading strategy while diversifying their existing portfolio.

How It Works

CMC Markets announced the initial selection of share baskets will use Relative Rotation Graphs. The algorithm homes in on shares with positive momentum when compared to their benchmark indices. Stocks will be selected from benchmark equity indices in the US, UK, Australia, Hong Kong and Germany. The sophisticated algorithm will also backtest the performance of selected stocks.

CMC Markets has made it easy to find a basket that suits your trading style. You can select from a list of categories, view component stocks, and track recent performance in a few clicks.

New products like this offer traders additional flexibility and another way to speculate on popular financial markets. Because they’re easy to understand and low maintenance, they’re also a good option for beginners.

CMC Markets’ Head of Growth, Ed Gotham, had this to say of the latest product “We have developed these unique signature share baskets in conjunction with recognized market experts to allow our clients to follow a specific trading methodology.”

About CMC Markets

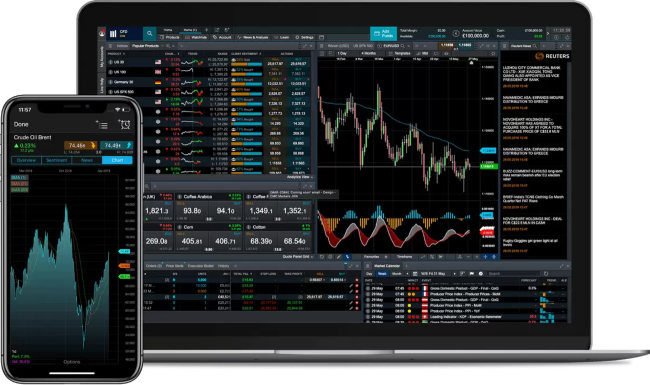

CMC Markets is a London-headquartered forex and CFD broker with over 80,000 active clients worldwide. Over 9,500 instruments are available on their web-accessible trading platform, including 60+ indices, 9,000+ shares and ETFs, plus 300+ currency pairs.

Multilingual support is offered alongside a host of educational tools and a downloadable mobile app. Live trading accounts can be funded using wire transfers, debit and credit cards, plus e-wallets, with 10 popular currencies accepted.

CMC Markets is well-known in the retail trading space, offering sophisticated trading tools and a competitive fee structure. The latest addition of signature share baskets offers account holders another way to grow trading portfolios using automated algorithms.