CMC Markets Expands After-Hours Trading On 80+ US Stocks

Starting Monday 17 March 2025, CMC Markets facilitates post-market trading on over 80 prominent stocks, providing an additional four-hour window after US exchanges close.

This comes after it introduced extended hours trading on the ‘magnificent 7 stocks’, which we reported on in January.

Key Takeaways

- Pre-market and post-market trading is now available on 87 popular US shares at CMC, including Amazon, Apple and Nvidia.

- Trade on breaking news and earnings reports and manage positions when the regular markets are closed.

- Order types and execution remain the same at CMC, though lower trading limits may lead to wider spreads.

Extended Hours Trading: Opportunities & Risks

Extended hours trading allows traders to buy and sell stocks outside of regular market hours, including pre-market and post-market sessions, providing greater flexibility to react to news and global events.

Yet while it offers opportunities to capitalize on price movements and hedge positions, it also comes with risks such as lower liquidity, wider spreads, and increased volatility due to reduced market participation.

As a result, a detailed trading plan and sensible approach to risk management are required.

About CMC Markets

CMC Markets is a leading online trading provider, scooping DayTrading.com’s ‘Best Trading App’ award in recent years.

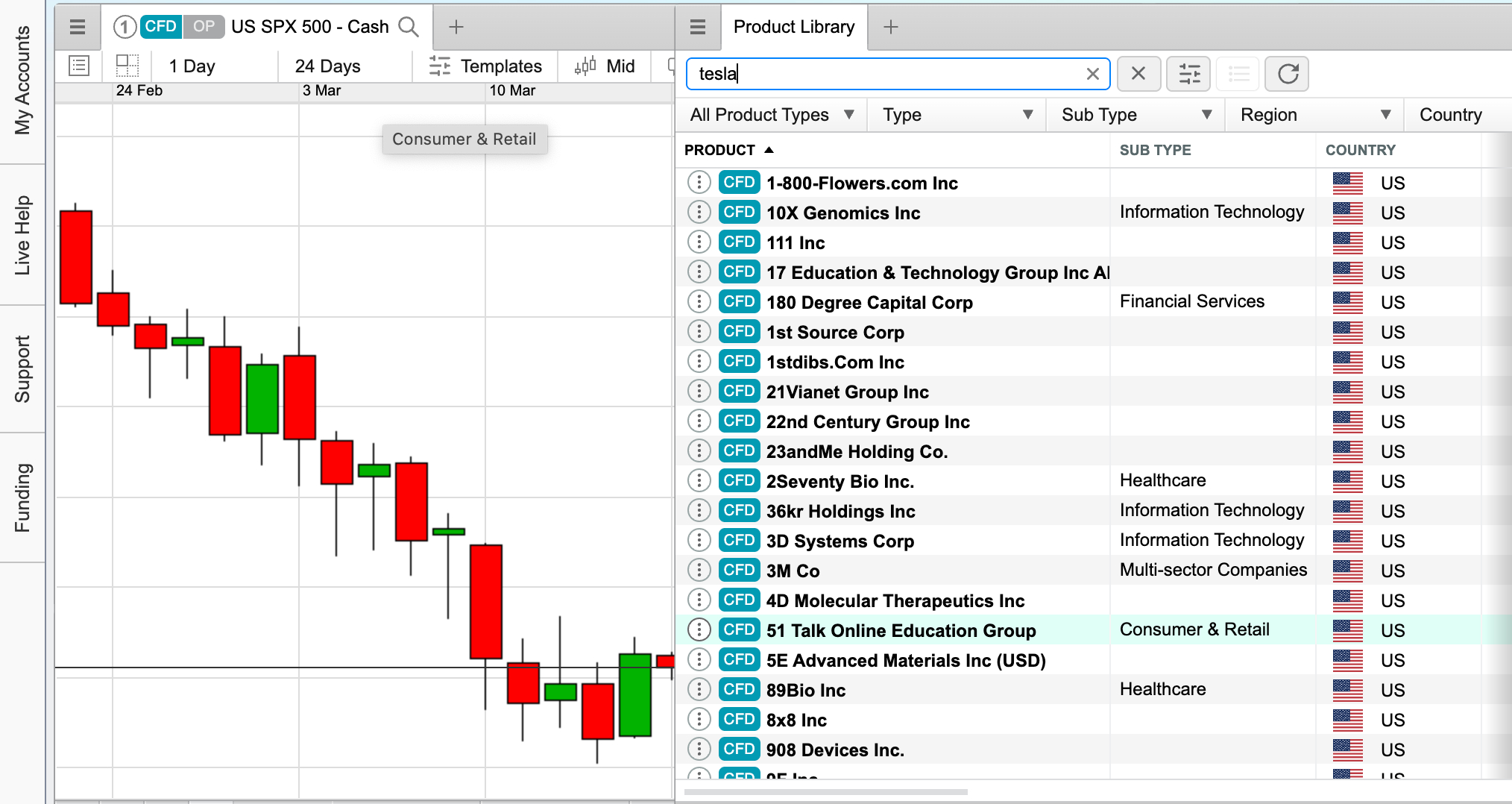

It offers over 12,000 instruments spanning CFDs, forex, indices, commodities, and more on its user-friendly web platform and the popular MT4 software.

The company is regulated by top-tier financial authorities, including the FCA and ASIC, while its listing on the London Stock Exchange demonstrates a high degree of financial transparency.

New traders can open a CMC Markets account with no minimum deposit.