Forex Trading in Switzerland

Switzerland is a prime location for forex trading, largely due to the high liquidity of the Swiss franc (CHF). Ranked as the fifth most liquid currency globally – following the US dollar (USD), euro (EUR), Japanese yen (JPY), and British pound sterling (GBP) – the Swiss franc enhances Switzerland’s appeal as a forex trading hub.

This guide will explore the regulatory environment, optimal trading times, and an example of a typical forex day trade in Switzerland.

Key Takeaways

- Data from the Bank of International Settlements (BIS) shows that the average daily turnover of forex trades in Switzerland totalled $350 billion in 2022. This represents a 32.6% rise from figures recorded in 2019.

- The overlap between the European and US markets, from approximately 14:00 to 18:00 (CET), sees increased liquidity and volatility, offering short-term forex trading opportunities.

- Forex trading is regulated by the Swiss Financial Market Supervisory Authority (FINMA), ensuring that the foreign exchange market operates with high levels of transparency, security, and fairness.

Top 4 Forex Brokers in Switzerland

Our personal tests indicate these 4 trading platforms are the best for forex traders in Switzerland:

How Does Forex Trading Work in Switzerland?

Forex trading in Switzerland involves buying and selling currency pairs, such as USD/CHF and EUR/CHF, with the aim of profiting from price fluctuations.

To start trading currencies online, you need to:

- Open an account with a forex broker – preferably one regulated by FINMA.

- Deposit funds – opt for a CHF trading account to cut conversion fees.

- Execute trades – your broker will provide a trading platform, either desktop-based, web-based, or via a forex app.

Is Forex Trading Legal in Switzerland?

Switzerland has a well-regulated forex market, clearly establishing the legality of online currency trading for its residents.

The regulatory framework in Switzerland is built on several comprehensive laws. The Banking Act requires forex brokers to secure a banking license, ensuring they meet specific standards.

The Financial Institutions Act provides protection for traders’ investments, and the Act on Financial Market Infrastructures promotes transparency in forex exchange operations.

Using a FINMA-regulated broker can significantly minimize systemic risks, allowing forex traders to focus on improving their short-term trading strategies and performance.

Is Forex Trading Taxed in Switzerland?

In Switzerland, profits from forex trading are generally subject to income tax for individual traders, taxed at progressive federal and cantonal rates based on residency.

The absence of capital gains tax makes forex trading particularly attractive for part-time retail traders looking to supplement their income.

When Is the Best Time to Trade Forex in Switzerland?

Forex trading is available 24 hours a day, five days a week. However, trading activity and market volatility vary throughout the day.

Less popular currency pairs have wider spreads during quieter periods and narrower spreads during active times. Many Swiss traders focus on pairs like EUR/CHF and USD/CHF, which maintain consistently tight spreads.

The most active trading sessions typically occur during the overlap of major financial centers, especially when both the European and US markets are open. This overlap, from approximately 14:00 to 18:00 (CET), often sees increased trading volume and volatility, providing more forex day trading opportunities.

Example Forex Trade

Event Background

The Swiss National Bank (SNB) was set to announce its latest monetary policy decision, including updates on interest rates and insights into the Swiss economy.

As a day trader, I recognized the potential impact on the CHF and planned to capitalize on any short-term trading opportunities.

Market Analysis

Before the SNB announcement, I analyzed the USD/CHF pair, reviewing recent price movements, key support and resistance levels, and market sentiment indicators like RSI and MACD.

Interpretation of Data

The SNB unexpectedly lowered the interest rate by 25 basis points to 1.5% from 1.75%. This decision was likely to weaken the CHF relative to the USD, as lower interest rates tend to decrease a currency’s value.

Trade Entry

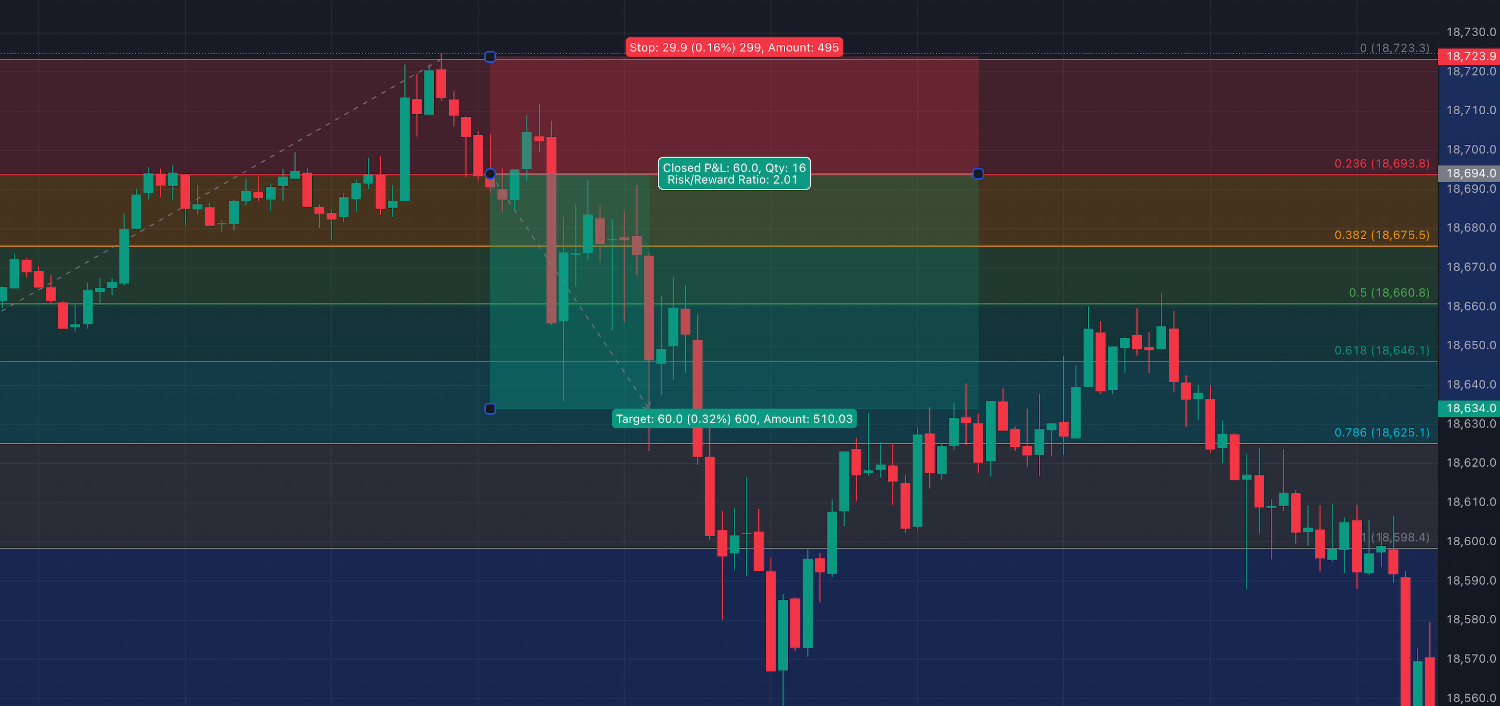

After the SNB announcement and market reaction analysis, I entered the trade based on predefined criteria (2% risk management). Instead of placing a market order, I waited and watched the price action.

The CHF initially strengthened, but I anticipated a pullback due to the lowering of the interest rate. Once the US trading session started and a pullback began, I entered the trade, setting a 1:2 risk-to-reward ratio (risking 30 pips to make 60 pips).

Trade Exit

I monitored the trade closely, tracking price movements and emerging news. With predetermined take-profit and stop-loss levels in place, I allowed the trade to unfold without concern for significant market changes. My analysis was correct, and the trade reached the take-profit target in 1 hour and 5 minutes.

Post-Trade Analysis

At the end of the trading day, I assessed my performance by reviewing adherence to my trading plan, evaluating the trade outcome, and identifying lessons learned.

I considered the impact of the SNB announcement and thought of ways to refine my strategy for future trades.

This type of analysis will help you to become a better trader as you will be able to adapt to evolving market conditions.

Bottom Line

Switzerland’s reputation for precision, security, and financial excellence extends into forex trading. The Swiss approach to forex trading emphasizes reliability and high standards, offering a robust framework for successful currency trading activities.

When choosing a forex brokerage, prioritize factors such as regulatory compliance, trading conditions, platform quality, asset variety, and customer support.

Recommended Reading

Article Sources

- Banking Act - FINMA

- Act on Financial Market Infrastructures - FINMA

- Financial Institutions Act - FINMA

- European Central Bank (ECB)

- Swiss Financial Market Supervisory Authority (FINMA)

- Taxes on personal income - PWC

- Forex market time zone converter - Babypips

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com