Day Trading in Switzerland

With a highly developed financial sector and strong economy, Switzerland is home to a large community of day traders. Individuals can deal from a wide range of assets, and thanks to a low tax economy they can get a better return than in most other European countries.

This guide explains how day trading in Switzerland works, including how to begin dealing in the markets and the protections that you can expect. It also provides a hypothetical example of a short-term Swiss stock trade.

Quick Introduction

- Strict regulation and favourable tax rules make day trading popular in Switzerland, with investors typically paying a maximum 11.5% rate of tax.

- Share investors can trade equities on the SIX Swiss Exchange between the hours of 09:00 Central European Time (CET) and 17:30.

- Financial markets are closely regulated by the Financial Market Supervisory Authority (FINMA), a ‘green-tier’ regulator in line with DayTrading.com’s Regulation & Trust Rating.

Top 4 Brokers In Switzerland

These 4 day trading platforms excel for active traders in Switzerland following our latest tests:

All Day Trading Platforms in Switzerland

What Is Day Trading?

Whether it’s with stocks, bonds or commodities – or more volatile and risky assets like cryptocurrencies and derivatives – day trading is a hugely popular activity in Switzerland. Forex trading in Switzerland is particularly big business, owing to the franc’s status as a safe haven currency.

Share trading takes place on the SIX Swiss Exchange, which is Europe’s third-largest stock exchange. Traders can also deal in other financial instruments here, including cryptocurrency-backed exchange-traded products (ETPs) which were launched in 2018.

Is Day Trading Legal In Switzerland?

Yes. Short-term trading is legal and tightly regulated by the independent Financial Market Supervisory Authority (FINMA).

The organization is, in its own words, “responsible for ensuring that Switzerland’s financial markets function effectively.”

To safeguard the financial system and protect investors, FINMA sets regulations, scrutinises financial services businesses, and executes enforcement action if necessary. It also issues licences for institutions to do business.

The Financial Services Act (FinSA), which was introduced in 2020, is the chief piece of legislation that protects financial services customers.

To align Swiss regulations with those of the European Union (EU), the act requires companies to provide transparent and detailed information about their products, including risks and costs. Other requirements are that companies must handle client orders carefully, and perform suitability assessments for their products.

Traders should check that the brokerage they choose is FINMA registered before submitting personal data or depositing funds.The regulator’s website includes a search facility that allows me to check whether a firm is licenced. FINMA also publishes a warning list of companies that have been trading without authorization.

How Is Day Trading Taxed In Switzerland?

Traders’ earnings are not subject to capital gains tax in the country. However, those who deal in financial markets for a living must pay income tax on any profits they make.

Switzerland’s three tiers of government mean that its tax system is highly complex. At the federal level, tax matters are administered by the Federal Tax Administration (FDA). However, individuals also pay cantonal and municipal taxes.

The country’s multi-tiered tax system means that average tax rates can’t be calculated. However, individuals pay at a progressive rate according to their earnings, up to a maximum of 11.5% at the federal level. Individuals should consult with a tax expert to get an accurate picture of their tax liabilities.

How To Start Day Trading

Day traders can set themselves up to begin trading in just a few hours. The process comprises three main steps:

- Selecting a top trading platform in Switzerland. Important things to consider include the trading platform, fees, the levels of available leverage, and the quality of the brokerage’s customer service. Also consider the financial instruments you want to use. For example, CFD trading in Switzerland is popular for its leveraged trading opportunities but is high-risk, especially for beginners.

- Establishing an account. The next step is to actually open an account. You’ll need to provide personal information – including proof of identification and address – and may be asked additional questions concerning your investing style and experience.

- Depositing funds. Finally, you’ll need to park some capital in your new account to trade with. This can usually be done through a wire transfer, an online payments provider (such as PayPal), or a debit card (like the Swiss PostFinance Card).

A Trade In Action

Let’s consider how a short-term trade might look in the real world. In the following example, I’ll buy shares in a popular blue-chip company that trades on the SMI.

The Background

My plan is to make a profit by trading shares in ABB (Asea Brown Boveri) following the release of US growth figures. I’m expecting the Swiss business to rise in value, so I take a long position by buying a stake in the company.

ABB provides engineering services across the globe, including in the US. In fact, it makes just over a quarter of sales from customers in the States, meaning it is highly sensitive to economic conditions there.

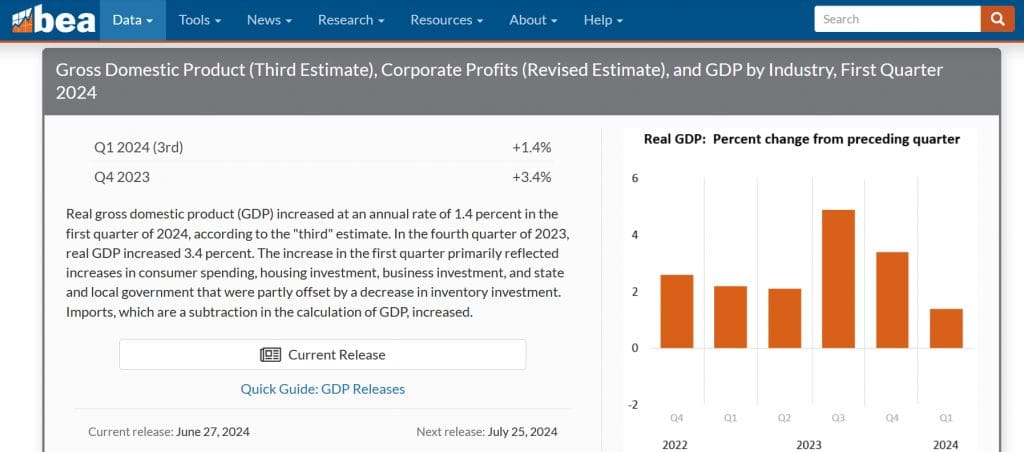

My expectation is that GDP figures from the Bureau of Economic Analysis (BEA) will show expansion of 0.5% in the last quarter. This is ahead of the 0.4% that broader financial markets appear to have priced in, and could lead to a rise in the value of cyclical stocks like ABB.

Before placing my trade, I carry out some technical analysis on ABB shares. Short-term trading is highly influenced by the charts, and so identifying patterns, trends and indicators can give me a better idea of where asset prices might be heading. The Trade

At this point I’ll be ready to place the trade. I’ll do so by placing two separate orders to help me manage risk: a ‘take profit’ instruction, and a ‘stop loss’ order.

With a take profit order, I specify a level at which the trade will automatically close if ABB shares rise to a certain price. The stop loss, working in the opposite way, will allow me to exit automatically if the engineer unexpectedly drops to a specified level.

The time is 14:25 CET, five minutes before the BEA is due to release those GBP numbers. At this time, ABB shares are trading at 51.34 Swiss francs (CHF) apiece. So I decide to set my ‘take profit’ and ‘stop loss’ orders at 51.93 francs and 51.01 francs respectively.

Five minutes later, those US growth numbers are released, leading to a rise in ABB’s share price. They show a 0.6% rise in quarterly GDP, higher than I’d expected, which in turn bolsters risk appetite across global financial markets.

After 20 minutes, my ‘take profit’ order on ABB shares is triggered, my position is closed, and I’ve walked away with a profit of 0.59 francs for each share I bought.

Bottom Line

Low taxes and a huge financial services industry make Switzerland a natural venue for active day trading. Combined with strict regulations from FINMA, investors can go about their business in confidence.

Having said that, fraudulent parties still operate in the Swiss financial sector, and traders should be vigilant to avoid them. You should always check that a broker is authorized to trade before opening an account.

To get started, use our pick of the best day trading brokers in Switzerland.

Recommended Reading

Article Sources

- SIX Swiss Exchange

- Financial Market Supervisory Authority (FINMA)

- Federal Tax Administration

- PostFinance Card

- Bureau of Economic Analysis (BEA)

- Financial Services Act (FinSA)

- Authorisation – gaining entry to the financial market - FINMA

- Public warnings issued by FINMA - FINMA

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com