Capitalcore Review 2025

Awards

- Best Binary Broker Runner Up 2025 - DayTrading.com

Pros

- Capitalcore has added binary options trading on 30+ currency pairs, metals and crypto with one-click trading and payouts up to 95%.

- The Capitalcore platform provides comprehensive charting tools and a wide range of 150+ technical indicators, ideal for detailed market analysis.

- While a relative newcomer to binary options space, its transparent, accessible service earned it runner up in DayTrading.com's 2025 'Best Binary Broker' award.

Cons

- Capitalcore is not regulated by major financial authorities and has an unproven reputation, raising concerns about the safety of client funds.

- The web platform was inconsistent during testing, with occasional technical glitches that meant the trading platform wouldn’t load.

- Platform support is limited to proprietary software, so there's no integration with the market-leading MetaTrader or cTrader, which offer built-in economic news and support automated trading.

Capitalcore Review

This Capitalcore review examines the day trading experience. We’ve combined real-world testing with extensive research from our database of 224 brokers to provide insights into how Capitalcore compares to the competition.

Regulation & Trust

3.3 / 5Capitalcore is not a trusted broker, with authorization from one ‘red-tier’ regulator and a short track record dating back to 2019.

Capitalcore is a registered trade name of Capitalcore LLC in Saint Vincent and the Grenadines, with company number 1608. It is regulated by International Financial Services Authentication (IFSA) with the code XM321B27.

Consider brokers regulated by reputable, ‘green-tier’ bodies like the FCA (Financial Conduct Authority) and ASIC (Australian Securities and Investments Commission). These regulatory agencies enforce strict guidelines designed to safeguard your assets.

| Capitalcore | World Forex | Dukascopy | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | IFSA | SVGFSA | FINMA, JFSA, FCMC |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

3.8 / 5Live Accounts

Capitalcore offers a variety of account options to suit different trading needs and experience levels.

The good news is that all four account types allow you to trade forex pairs, stocks, metals, and indices. All accounts support scalping and hedging, but the tiered accounts cater to different traders’ needs.

The Classic account’s entry point boasts a low minimum deposit of $10, making it ideal for beginners to explore the platform without a significant financial commitment. As you progress and your comfort level increases, you can consider upgrading to Silver, Gold, or VIP accounts.

These require higher minimum deposits ($1,000, $1,500, and $2,500, respectively) but may unlock additional features or benefits such as leverage (up to 1:2000), stop-out (10% minimum), and margin call (20% minimum) levels, spreads (down to 0.3 pips), maximum live accounts (up to 50), and access to free VPS.

The lack of PAMM (Percentage Allocation Management Module) accounts may deter money managers, especially when they are readily available at alternatives like Vantage.

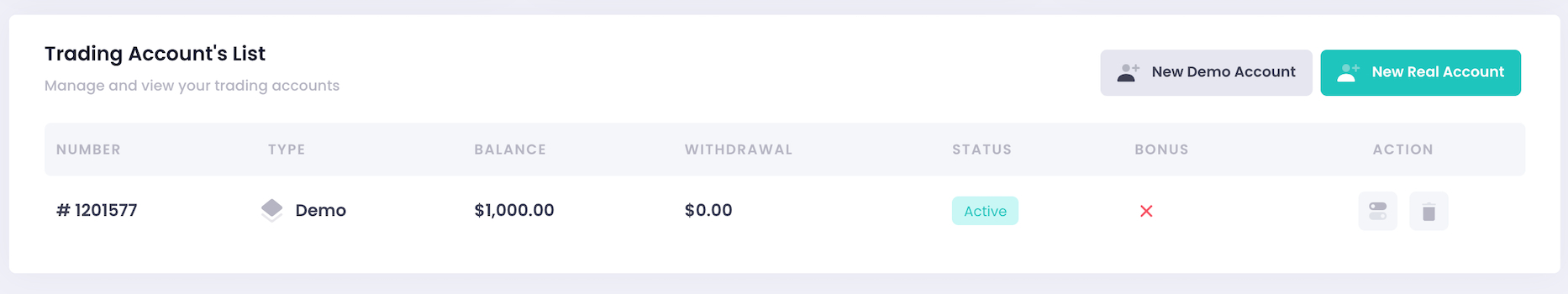

Demo Accounts

Unlike the majority of brokers we’ve evaluated, Capitalcore’s demo accounts have unrestricted time limits and have proven valuable tools.

They allowed me to experiment with various instruments and leverage levels for forex strategies. This hands-on experience helped me build confidence in the platform and Capitalcore as a broker before risking real capital in the live market.

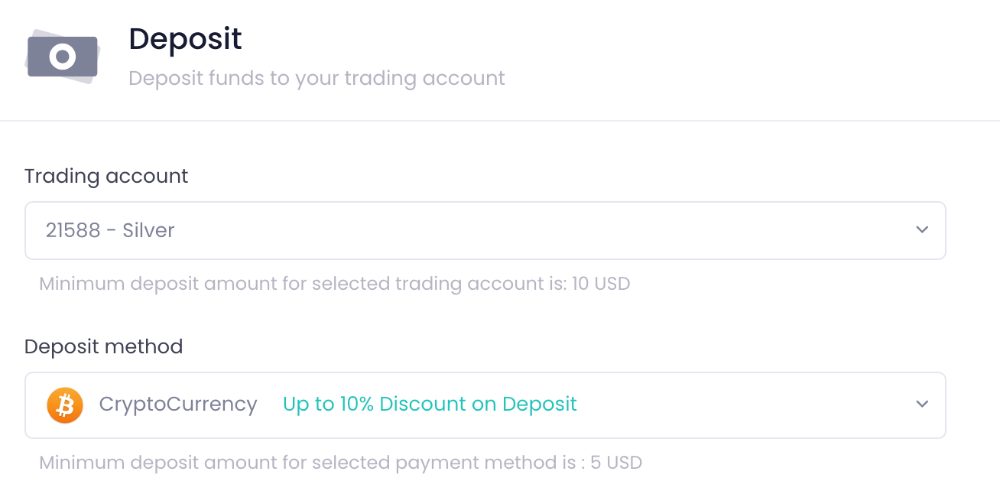

Deposits & Withdrawals

Capitalcore offers a practical selection of deposit options, which should help ensure a smooth and efficient experience regardless of location.

Whether you prefer traditional options like Visa, Mastercard, PerfectMoney, or PayPal, or the convenience of cryptocurrencies like Bitcoin and Ethereum, you’re likely to find a suitable way to fund your trading account.

The minimum deposit varies depending on payment methods, from $1 to $50. All deposits are converted to USD to trade, as Capitalcore doesn’t offer a choice of base account currencies like most other brokers.

IC Markets, by comparison, allows traders to open an account in one of 10 supported base currencies: USD, AUD, EUR, GBP, SGD, NZD, JPY, CHF, HKD, or CAD.

Like some other offshore brokers trying to entice traders from around the globe, Capitalcore offers a 40% bonus on each deposit, regardless of account type. However, we do not recommend choosing a broker based on their trading promotions, many of which are prohibited in heavily regulated jurisdictions, such as the EU and UK.

| Capitalcore | World Forex | Dukascopy | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Mastercard, PayPal, Perfect Money, Visa | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Google Wallet, Mastercard, Perfect Money, Visa, Volet, Wire Transfer | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer |

| Minimum Deposit | $10 | $1 | $100 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

3.8 / 5Capitalcore primarily offers a small selection of conventional trading assets, including major currency pairs, prominent stock indices, key cryptocurrency pairings, and a limited number of other CFDs. There are no real stocks or real ETFs.

As a comparison, eToro offers a more extensive range of cryptocurrencies, while IG and FOREX.com provide more comprehensive coverage of global markets, including stocks, ETFs, and bonds.

Capitalcore lets you trade six major cryptocurrencies, but through CFDs. This means you don’t own the underlying coins themselves, and you’re speculating on price movements without actually owning the asset.

The broker also improved its investment offering in 2025 with the introduction of binary trading on 30+ forex pairs, metals and crypto.

Designed for short-term trading, contracts span from 1 minute to 1 hour, with stake sizes ranging from $1 to $10,000, catering to a range of traders.

Capitalcore’s leverage options, notably the maximum forex leverage of 1:2000, are significantly higher than many regulators consider appropriate. In comparison, major forex markets in Europe and Australia typically allow maximum leverage of 1:30, while Canada and the US limit it to 1:50.

This vast difference highlights the potential risks associated with trading on Capitalcore, as higher leverage can magnify losses and gains.

Capitalcore also lacks a proprietary copy trading service, which may be a drawback for beginner traders, and they don’t offer interest payments on unused cash reserves.

Consider eToro if you’re interested in earning interest on cash sitting in your account, as they offer returns of up to 5.3% annually, plus a market-leading social trading service which I use myself.

| Capitalcore | World Forex | Dukascopy | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | Forex, Metals, Stocks, Cryptos, Futures Indices, Binary Options | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Margin Trading | Yes | Yes | Yes |

| Leverage | 1:2000 | 1:1000 | 1:200 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

3 / 5Capitalcore tailors its trading costs (spreads) to your account type. For instance, the AUD/NZD pair starts with a broader spread of 5.5 pips on the Classic and Silver accounts. If you upgrade to a Gold account, the spread narrows to 3 pips, and it goes even lower at 1.5 pips for VIP accounts.

Higher tiers can offer more cost-effective trading, which is particularly advantageous for scalping small price movements. Capitalcore also doesn’t charge commissions on any instrument or account.

Still, its spreads are generally wider than market leaders, notably IC Markets, which will be a key consideration for many active traders.

I was amazed to discover Capitalcore don’t charge swap fees, no matter how long you hold a trade open – a first in my years of online trading.

Capitalcore doesn’t charge for deposits, but there is a 1% charge when adding funds using PerfectMoney. While PayPal is an option, withdrawals using this method incur a 5% fee. Consider using an alternative method for cost-effective transactions.

Cryptocurrencies also incur a network fee when withdrawing. So, it would help to consider how you deposit and withdraw because funds are returned to the original deposit method in the same currency.

| Capitalcore | World Forex | Dukascopy | |

|---|---|---|---|

| Fees & Costs Rating | |||

| EUR/USD Spread | 0.4 | From 0.6 | 0.1 |

| FTSE Spread | 25 | NA | 100 |

| Oil Spread | NA | NA | 0.1 |

| Stock Spread | 1.5 (Apple) | From 0.03 | 0.1 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

3.8 / 5Capitalcore offers two variations of its proprietary platform to accommodate different trader preferences. Both platforms (WebTrader and Pro Platform) are user-friendly and easy to learn, making them ideal for beginners.

Still, experienced traders might find them lacking in advanced features compared to platforms like MetaTrader 4 or cTrader, and it’s rare to find a broker that doesn’t offer either of these popular third-party solutions.

While I’m not a fan of MetaTrader, many traders might be disappointed that the platform isn’t supported because it’s widely used and provides advanced charting and analysis tools (including EAs) for more experienced traders.

Nonetheless, Capitalcore has done a great job with its charting platform. Powered by TradingView, WebTrader is sleek and uncluttered and makes trading on a desktop or mobile device effortless, accompanied by more than 100 technical indicators and drawing tools.

The Pro Platform version strips away WebTrader’s interface to provide a more ‘vanilla’ TradingView experience. There are no additional tools, so it’s purely a personal presence, whichever interface you prefer. I favor the WebTrader interface.

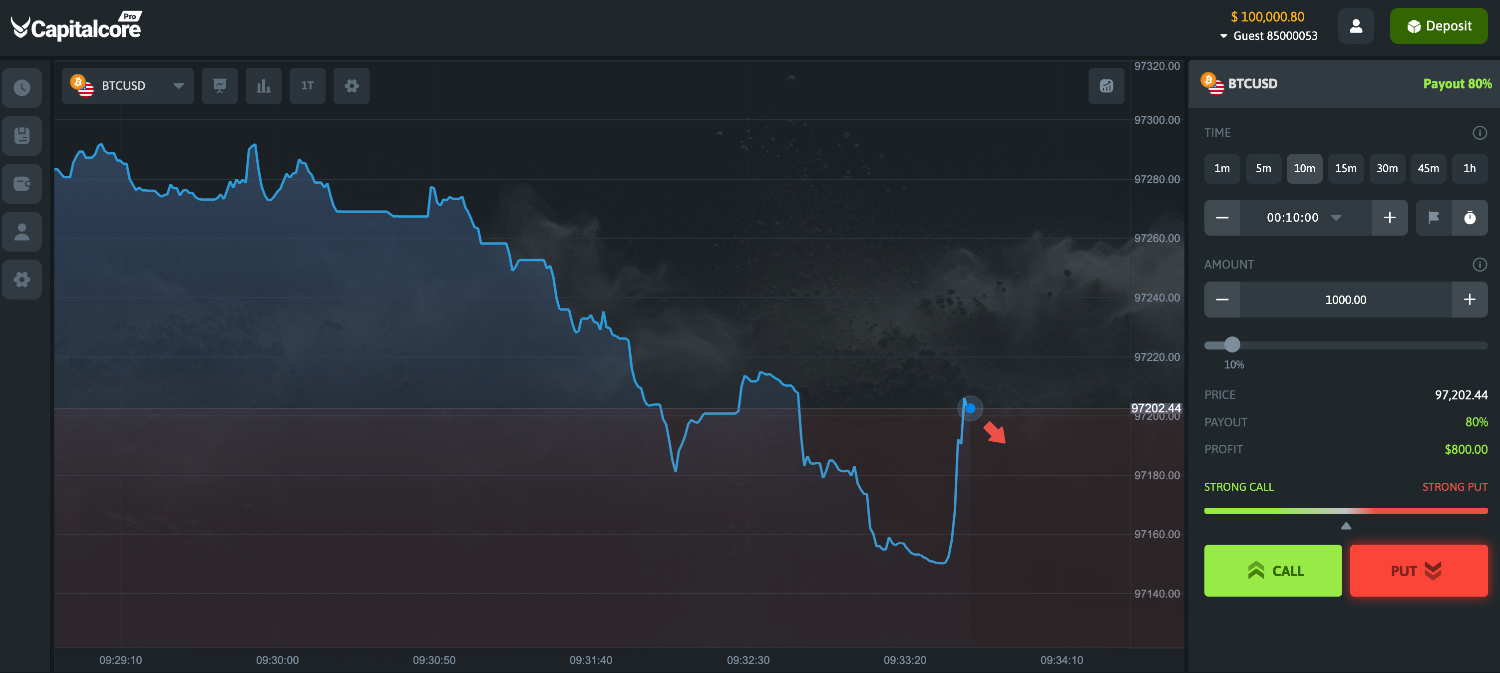

We also retested the platform after it introduced binary options trading and it’s a breeze to place ‘Put’ and ‘Call’ trades at the click of a button.

Active traders will appreciate the four chart types (area, candle, hollow, OHLC) with timeframes ranging from 1 tick to 1 day, while the order panel to the right allows you to change the position size and eye potential returns at a glance.

A minor gripe: Clicking to enable the ‘Background’ just overlays a sort of mist to the chart which adds nothing from a trading perspective or the user experience.

| Capitalcore | World Forex | Dukascopy | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | WebTrader, Pro | MT4, MT5 | JForex, MT4, MT5 |

| Mobile App | iOS, Android + Web Browser | iOS & Android | |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

2.5 / 5Capitalcore focuses solely on order execution, which means they don’t offer some of the bells and whistles found at other brokers, notably IG, which has a comprehensive suite of research features.

You won’t find real-time news feeds, integrated economic calendars with market impact highlights, or direct access to research and analysis from trusted sources at Capitalcore.

This need for integrated information tools might make it trickier to stay on top of market developments and inform your day trading choices.

And while some brokers compensate for a lack of in-house research by partnering with established providers like Trading Central or Autochartist, Capitalcore disappointingly lacks these features. That said, they have updated their ‘Market News’ blog with interesting technical and market analysis.

| Capitalcore | World Forex | Dukascopy | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

3.5 / 5Capitalcore offers a tiny library of written resources for forex trading beginners. These resources cover the basics, such as ‘What is forex trading?’ and ‘Coins vs. Tokens.’ In addition, they provide a useful glossary of terms and a frequently asked questions section.

Absolute beginners will appreciate the effort, but these basic educational resources are lacking compared to leading brokers CMC Markets and eToro, which provide extensive educational resources, including webinars, tutorials, and market analysis, to help you make informed decisions.

| Capitalcore | World Forex | Dukascopy | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

3.5 / 5Capitalcore provides 24/7 customer support through various channels, including live chat, email, ticket system, and phone (not localized), in case you have any questions about your whole experience with Capitalcore, from registration to withdrawal.

When testing the trading platform, I had many questions, and the live chat support was always fast to respond and very knowledgeable. When a staff member couldn’t answer me immediately, they emailed me a reply later.

I also liked that I could access the support ticket system and live chat from my client dashboard rather than having to go to the broker’s main website. However, Capitalcore should also display contact phone numbers in the dashboard for completeness.

One area for improvement is the social media links on the broker’s website, which don’t all open active channels. Capitalcore should address this immediately because dead links and empty social media channels harm the brand image.

| Capitalcore | World Forex | Dukascopy | |

|---|---|---|---|

| Customer Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Trade With Capitalcore?

Capitalcore offers a solid trading platform with competitive features, making it a viable option for many traders, especially those with small accounts.

After adding binaries, it’s also suitable if you want to place straightforward trades on a user-friendly web-accessible platform with fixed payouts and losses capped to your stake.

However, compared to more established brokers, Capitalcore needs to improve in areas like regulation and educational resources.

FAQ

Is Capitalcore Legit Or A Scam?

Capitalcore is a legitimate trading platform but they are not regulated by major financial authorities, which raises concerns about oversight and security. While they offer responsive support, traders should exercise caution and conduct thorough research before committing funds.

Is Capitalcore A Regulated Broker?

‘Capitalcore LLC’ known as Capitalcore, is a company registered in Saint Vincent and the Grenadines. IFSA regulates it with the regulatory code XM321B27.

Operating without regulatory oversight from any major financial authority carries significant risk, and your funds may not be protected in case of unforeseen circumstances, such as when the broker is facing financial difficulties.

Is Capitalcore Suitable For Beginners?

Capitalcore offers a user-friendly interface and multiple account types, including those with lower minimum deposits, making it suitable for beginners. However, the lack of regulatory oversight and comprehensive educational resources may pose risks for new traders.

Does Capitalcore Offer Low Fees?

Capitalcore offers modest spreads. The exact fee structure can vary based on the account type, but generally, spreads are transparent. Capitalcore’s major benefits are low minimum account deposits, and no commission or swap fees applied to any instruments.

Is Capitalcore A Good Broker For Day Trading?

Capitalcore offers an intuitive and easy-to-navigate platform, which is beneficial for day traders who need to execute trades quickly and efficiently. The platform also provides advanced charting tools and a range of technical indicators. No commission across all instruments should appeal to high-frequency traders.

Still, there is a narrow selection of instruments, which could limit opportunities for diversification and trading strategies.

Top 3 Alternatives to Capitalcore

Compare Capitalcore with the top 3 similar brokers that accept traders from your location.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- AZAforex – Established in 2016, AZAforex is an offshore broker offering short-term trading on 235+ global financial markets, including through binary options with payouts of up to 90%. Three accounts (Start, Pro and VIP) offer unique features, but all provide access to the broker’s Mobius Trader 7 platform, which has benefited from performance upgrades over the years.

Capitalcore Comparison Table

| Capitalcore | World Forex | Dukascopy | AZAforex | |

|---|---|---|---|---|

| Rating | 3.9 | 4 | 3.6 | 3.4 |

| Markets | Forex, Metals, Stocks, Cryptos, Futures Indices, Binary Options | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Binary Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $10 | $1 | $100 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.0001 Lots |

| Regulators | IFSA | SVGFSA | FINMA, JFSA, FCMC | GLOFSA |

| Bonus | 40% Deposit Bonus up to $2,500 | 100% Deposit Bonus | 10% Equity Bonus | 25% Crypto Deposit Bonus, 120% Loyalty Bonus, 30% Spread Rebate |

| Education | No | No | Yes | No |

| Platforms | WebTrader, Pro | MT4, MT5 | JForex, MT4, MT5 | Mobius Trader 7 |

| Leverage | 1:2000 | 1:1000 | 1:200 | 1:1000 |

| Payment Methods | 8 | 10 | 11 | 14 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | World Forex Review |

Dukascopy Review |

AZAforex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Capitalcore and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Capitalcore | World Forex | Dukascopy | AZAforex | |

|---|---|---|---|---|

| Binary Options | Yes | Yes | Yes | Yes |

| Expiry Times | 1 minute – 1 hour | 1 minute – 7 days | 3 minutes – 1 day | 30 seconds – 1 day |

| Ladder Options | No | No | No | No |

| Boundary Options | No | No | No | No |

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | Yes | No | No | No |

| Options | No | No | No | No |

| ETFs | No | No | Yes | No |

| Bonds | No | No | Yes | No |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | Yes | Yes |

Capitalcore vs Other Brokers

Compare Capitalcore with any other broker by selecting the other broker below.

Customer Reviews

4.8 / 5This average customer rating is based on 4 Capitalcore customer reviews submitted by our visitors.

If you have traded with Capitalcore we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Capitalcore

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Available in United States

Available in United States

Binary payouts are good and in most cases they are higher than other brokers. I need more assets to be added and the rest is great for them as a binary platform.

The trading platform is awesome for me, also there are loads of trading assets, I can only work with them, no need to other brokers. Spreads are fixed and the platform is easy to use. All good for me.

Their platform is getting better and better now it does the job for me and the leverage is rare. happy to work with them.

The platform is smooth; I do not use EAs too much, but lack of the ability to use them is a turn-off!

Support is really helpful and is available all the time.