Forex Trading In Canada

Forex trading in Canada operates within a well-regulated environment overseen by the Canadian Investment Regulatory Organization (CIRO), a relatively new body that carries on the duties of the Investment Industry Regulatory Organization of Canada (IIROC) and operates at the national level.

The Canadian forex market has a substantial daily trading volume, with the Canadian dollar (CAD) often traded against major currencies such as US dollar (USD), euro (EUR), and Japanese yen (JPY).

Let’s unpack the core principles of forex trading in Canada by exploring practical insights and an illustrative trade scenario.

Quick Introduction

- Canada ranks among the top 10 largest forex derivatives trading locations globally, with the average daily trading volume in its foreign exchange market estimated to reach billions of US dollars.

- The Canadian forex market sees significant activity in major currency pairs, notably the USD/CAD, reflecting Canada’s strong economic ties with key trading partners like the United States.

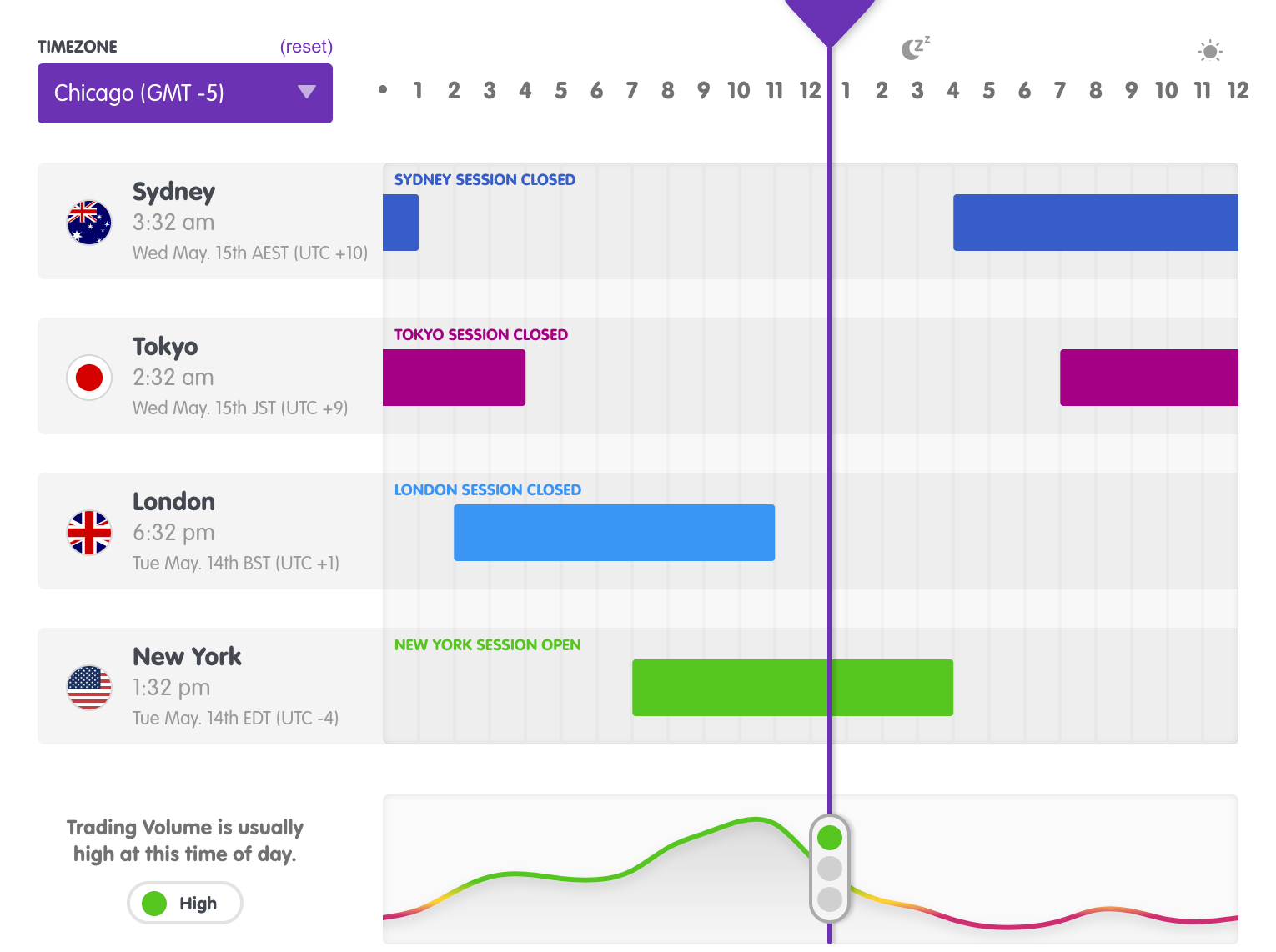

- The optimal time to day trade the Canadian dollar is often during the overlap of the North American and European trading sessions, between 8:00 am and 12:00 pm ET, exhibiting high liquidity and volatility.

Top 4 Forex Brokers In Canada

Our latest tests indicate these 4 platforms are the best for forex traders in Canada:

See all Forex Brokers in Canada

How Does Forex Trading Work In Canada?

Forex trading in Canada operates similarly to other countries, allowing you to speculate on the exchange rate fluctuations between currency pairs.

The Canadian dollar is one of the top 10 most traded currencies, though volumes have fallen behind the Chinese Yuan in recent years.

Traders in Canada typically focus on major currency pairs such as USD/CAD (US dollar/Canadian dollar), EUR/CAD (euro/Canadian dollar), and CAD/JPY (Canadian dollar/Japanese Yen).

To participate in forex trading, you need to open an account with a reputable forex broker. These brokerages offer trading platforms that allow you to execute trades, access real-time market data, and utilize various technical analysis tools.

Is Forex Trading Legal In Canada?

Forex trading in Canada is legal and regulated by the CIRO, which oversees the retail investor market and ensures compliance with regulatory standards.

The regulatory oversight of forex trading in Canada contribute to its credibility as a reputable jurisdiction for forex market participants. In fact, we consider the CIRO a ‘green-tier’ agency in line with our Regulation & Trust Rating.

In Canada, leverage restrictions in forex trading are set to protect traders from excessive risk. The maximum leverage available to retail traders in Canada is capped at 1:50 for major currency pairs, such as the USD/CAD, and 1:20 for non-major currency pairs, such as the CAD/JPY.

These leverage restrictions aim to mitigate the potential for substantial losses and safeguard the interests of retail investors when trading with borrowed funds.

Is Forex Trading Taxed In Canada?

Forex traders in Canada are subject to taxation by the Canadian Revenue Agency. All profits generated must be reported and categorized either as capital gains, self-employment income, or investment income. Similarly, losses can be reported on tax returns to offset capital gains and potentially reduce tax obligations.

However, reporting is only necessary for the net gain or loss exceeding $200 for the year. If the net amount is $200 or less, it does not constitute a capital gain or loss and does not require reporting on your income tax and benefit return.

It is therefore very important to keep accurate records of your trading activity when trading forex in Canada, including details of profits, losses, expenses, and transactions, to ensure compliance with tax requirements.

When Is The Best Time To Trade Forex In Canada?

The best time to trade the CAD is typically during the overlap of the North American and European trading sessions. This occurs in the early morning hours of the Canadian time zone, roughly between 8:00 am and 12:00 pm Eastern Time.

During this period, there tends to be increased liquidity and volatility in the forex market, particularly for currency pairs involving the Canadian dollar, such as USD/CAD or EUR/CAD.

This period not only sees heightened activity from Canadian traders but also marks the release of crucial economic data for these regions.

In addition to the overlap of the North American and European trading sessions, short-term trading opportunities for the CAD can also arise during other sessions. For instance, during the Asian trading session, which occurs overnight in Canada, there may be opportunities to trade CAD crosses with currencies such as the Japanese yen (JPY) or the Australian dollar (AUD).

While liquidity may be lower during this time compared to the major trading sessions, you can still find opportunities, especially if there are significant developments in the Asian markets that impact the CAD.

The Canadian trading session overlaps with the New York session, providing ample liquidity and opportunities for trading the CAD.However, be cautious during periods of low liquidity, such as the early morning hours, as spreads may widen and increase costs for day traders.

Example Trade

Let’s break down a day trade I executed on the USD/CAD currency pair:

Economic Event Analysis

I began by analyzing upcoming economic events that could impact the Canadian dollar (CAD), such as the release of Canada’s monthly employment report, which is a significant indicator of the country’s economic health.

If the report showed better-than-expected job gains, for example, I expected a strengthening economy and a potential rally of the CAD. Canada’s job market did in fact see employment rise, so I expected a decline in the USD/CAD.

Technical Analysis

I conducted technical analysis on the USD/CAD chart to identify potential entry and exit points.

If the currency pair was currently trading near a key support level, this would indicate a possible opportunity to initiate a short (sell) position.

Position Sizing & Risk Management

Before entering a trade, I determined my risk management measures for the day trade. I set a stop-loss order above the entry point to cap potential losses at 2% (10.9 pips) of my account balance in case the trade went against me.

Additionally, I set a take-profit order at the next key price level, to secure 30.5 pips if the trade moved in my favor.

Trade Entry

Once I identified the entry point and established risk management parameters, I executed the trade.

Using technical analysis on a 15-minute candlestick chart to confirm a break of support, I entered a short position on the USD/CAD currency pair at the market price.

Trade Exit

The trade hit my take-profit order in just 15 minutes for a gain of 30.5 pips.

Post-Trade Analysis

Once the trade was closed, I reviewed the outcome of the trade and analyzed my decision-making process. I identified any lessons learned and areas for improvement in future forex day trades.

Bottom Line

Forex trading in Canada is a thriving market with significant participation from retail and institutional traders. The country boasts a robust regulatory framework overseen by CIRO.

With access to advanced trading platforms, competitive spreads, and a wide range of currency pairs, Canadian traders can engage in forex trading with confidence, although you must adhere to taxation regulations and leverage restrictions.

To start trading currencies, open an account with a top Canadian forex broker.

Recommended Reading

Article Sources

- Canadian Investment Regulatory Organization (CIRO)

- Canada Revenue Agency (CRA) - Foreign Currencies

- Forex Market Time Zone Converter - Babypips

- Foreign Exchange Turnover Volume - Bank of International Settlements

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com