Budget Breaker: Swissquote Adds Fractional Shares

Swissquote has introduced fractional shares, allowing users to allocate funds to the cent, making assets with high unit prices accessible to traders with less capital.

Key Takeaways

- Trade fractions of shares like AAPL, ETFs like FTSE-All World, cryptos like Bitcoin, or Swissquote’s Themes like Battery Industry.

- Choose exactly how much you want to invest with competitive and upfront trading fees starting from CHF 3.

- When cumulated fractions total a full unit, they convert into actual shares, granting full ownership rights. Until then, you’ll earn dividends based on your fractional stake.

You can start trading fractional shares in three straightforward steps:

- Head to your account settings under ‘Trade Mask’

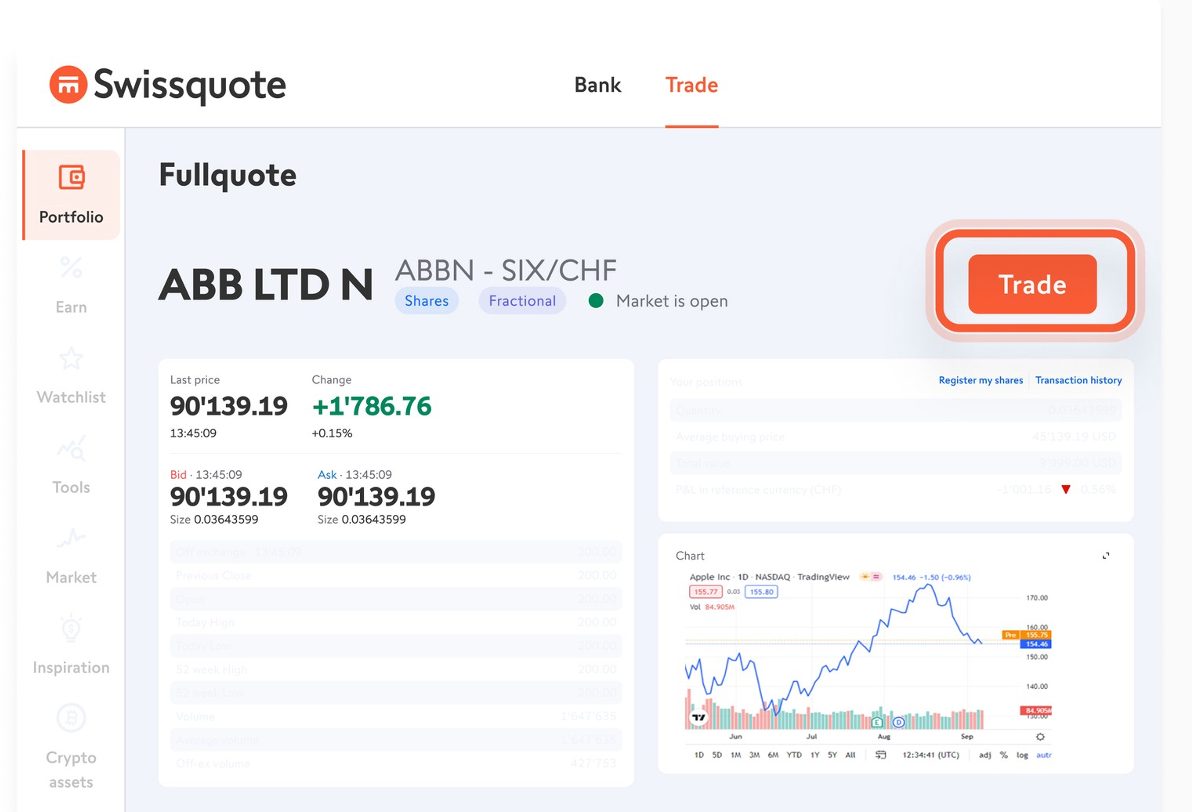

- Find an eligible instrument and press ‘Trade’

- Input how much you want to trade and click ‘Prepare order’

Activating fractional shares also gives you access to Swissquote’s Saving Plans. These allow you to set up automatic, recurring investments where you decide the amount and frequency.

Trading in smaller amounts remains risky – you could lose any money you invest.

About Swissquote

Swissquote is a long-standing broker, established in 1996 and listed on the Swiss Stock Exchange since 2000.

Active traders can deal in a huge suite of forex, stocks, funds, bonds, cryptos, CFDs and ETFs, alongside the broker’s exclusive products like Swiss DOTS and Yield Boosters. In total, Swissquote offers more than 3 million products.

The broker offers its own intuitive web platform and mobile app in addition to MT4 and MT5.

New traders can choose between a range of accounts catering to different trading styles, with minimum deposits starting from $0.