Best Brokers For Women In 2025

With more women interested in trading, brokers are stepping up to offer services specifically designed for them. In particular, trading is gaining traction among Generation Z women, with 71% of this group investing.

However, females face unique financial challenges that separate them from men. Issues like the gender pay gap, longer life expectancies, and planning for a baby can all play significant roles in their investment strategies.

As a result, women typically want more user-friendly trading platforms, female-centric education, engaging communities, and long-term investing services to secure their financial futures. 52% of women also prefer investing in stocks that have a positive environmental, social or governance (ESG) impact.

Explore our selection of the best brokers for women – hand-picked by female investment enthusiasts. Our recommended platforms excel in areas that matter most to women traders:

- Female-focused trading products and services

- Tailored resources and investing communities

- User-friendly and accessible platforms

- Personalized advice and support

Best Brokers For Women In 2025

Following our rigorous tests, these 5 trading platforms emerged as the leading options for female traders:

- IG: Female-tailored investment education. Safest, regulated brokerage. Smart Portfolios with ESG assets.

- eToro: Intuitive, engaging platform. Gen-Z-friendly education. World-class social trading network.

- Interactive Brokers: Superb IB Academy. Unlimited investment advice. Responsible investment products.

- CMC Markets: Terrific investment apps. Best-in-class research and education. 12,000+ markets.

- Ellevest: Specifically built for female investors. Human investment support. Strong ESG focus.

Comparison of Top Brokers For Women

| IG | eToro | Interactive Brokers | CMC Markets | Ellevest | |

|---|---|---|---|---|---|

| Education For Women | Yes | Yes | Yes | Yes | Yes |

| ESG Products | Yes | Yes | Yes | Yes | Yes |

| Investment Offering | Forex, CFDs, Real Stocks, Options, Futures, Crypto, Spread Betting | Forex, CFDs, Real Stocks, Futures, Crypto, Smart Portfolios, NFTs | Forex, CFDs, Real Stocks, Options, Futures, Funds, Bonds, Crypto | Forex, CFDs, Real Stocks, Treasuries, Custom Indices, Spread Betting | Real Stocks & ETFs |

| Platforms | Web, ProRealTime, L2 Dealer, MT4 | eToro Web, CopyTrader | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, AlgoTrader, OmniTrade | CMC Web, MT4, CMC Invest App | Ellevest App |

| Regulators | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA | FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA | SEC, FINRA |

| Minimum Deposit | $0 | $50 | $0 | $0 | $0 |

1. IG

Why We Chose It

IG offers the full package for female investors, notably award-winning platforms that cater to both short-term and long-term trading strategies, including MetaTrader 4 (MT4) and ProRealTime.

IG is also one of the most trusted trading brands globally, established in 1974, authorized by 7+ ‘green-tier’ regulators, and used for real-money trading by several of our team.

Additionally, IG supports an almost unbeaten array of 17,000+ markets covering a variety of sectors including ESG initiatives.

Pros

- Female traders prioritize finding a secure, well-regulated brokerage for their trading activities, and none are more so than IG, which scooped DayTrading.com’s ‘safest broker‘ title for 2025.

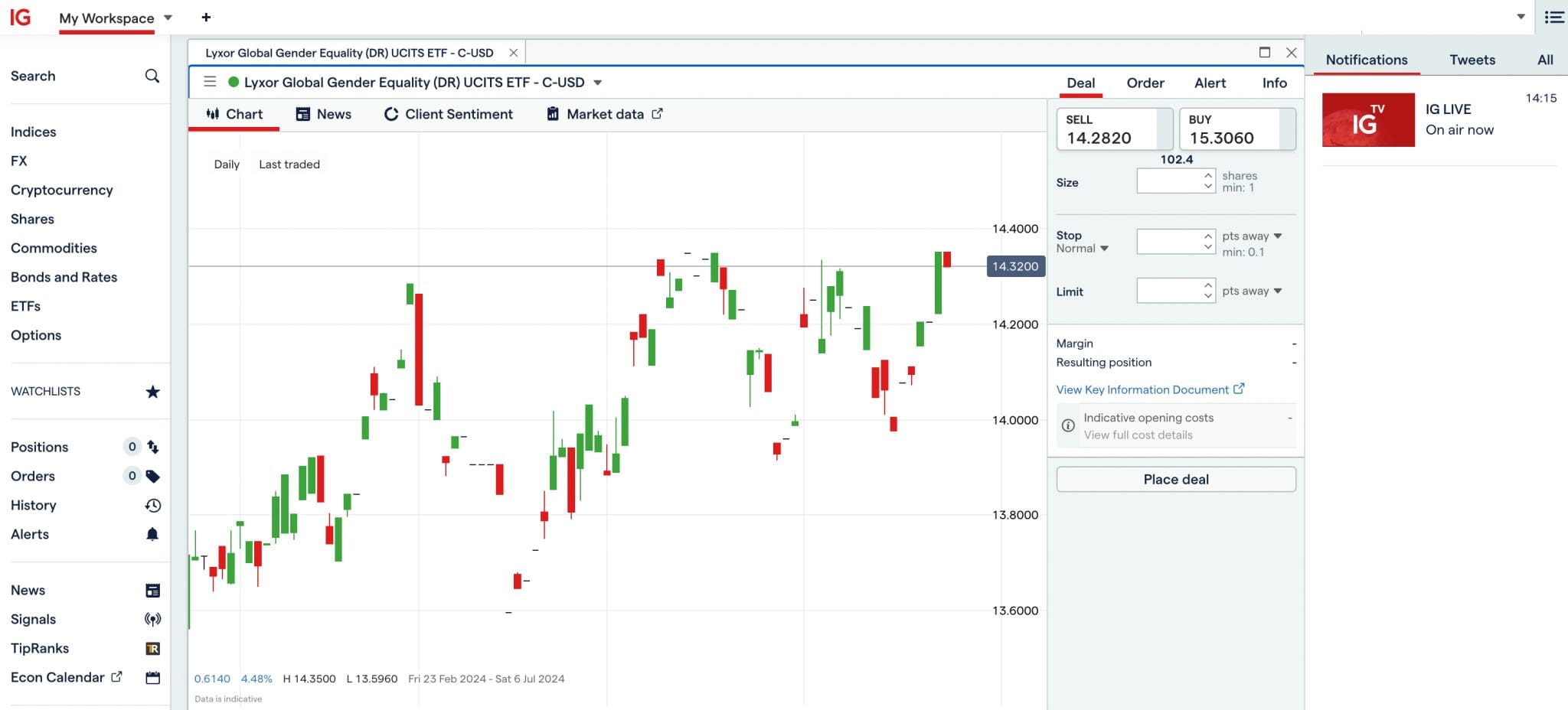

- Women can invest in thousands of financial markets, including socially responsible investments like the AllShare ESG Climate UCITS ETF and the Global Gender Equality UCITS ETF.

- IG clearly considers the needs of female investors, with valuable resources for beginners and seasoned traders, including insights on female leaders, women’s attitudes to investing and gender pay gap reports.

Cons

- The IG Community, where you could search for topics focused on women in investing (I found a host of tips and insights from female traders in the discussions), has been closed down. The forum was also less user-friendly than the social trading network of our runner-up, eToro.

- Unlike category leader Ellevest, customer support at IG is average for women following testing. Advisors are more focused on general trading queries than wealth management or investing, which may not align with some women’s long-term financial goals.

- Although it doesn’t kick in for two years, there is a $12 inactivity fee at IG, which may deter casual female investors and new traders. As a comparison, Interactive Brokers does not charge an inactivity fee.

2. eToro

Why We Chose It

eToro has revolutionized the online trading experience with an award-winning social community and best-in-class networking opportunities that break down entry barriers for women traders.

There is a vast selection of education suitable for all experience levels and an extensive suite of socially responsible assets across various timeframes, catering to the preferences of many female traders.

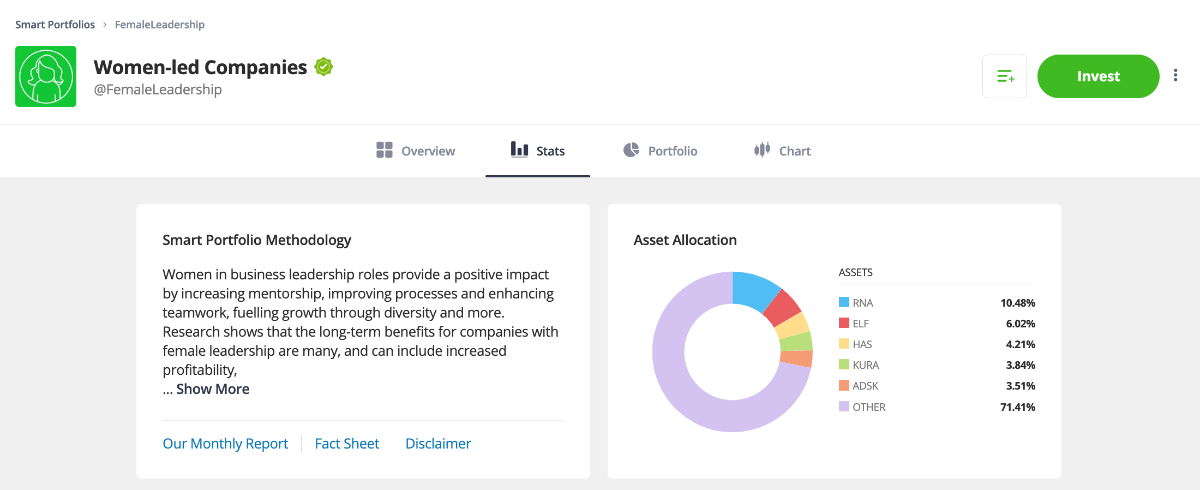

There’s even a Smart Portfolio formed of female-led stocks with positive year-to-date returns during our latest tests.

Pros

- eToro trumps the competition with its intuitive copy trading platform – perfect for aspiring female traders. The integrated social feed, in particular, is a terrific feature not commonly found and allows you to connect with successful investors – I’ve found dozens of established female traders on the platform.

- With 6000+ markets including forex, equities, crypto and even NFTs, traders have ample opportunities to build a diverse portfolio. Plus, there’s a range of ESG investments, notably the ‘Women-Led Companies’ portfolio.

- There’s a superb selection of engaging learning materials, including podcasts with female leaders – I especially loved the one with Sanja Kon (VP of Circle) who discusses women’s empowerment in the finance industry.

Cons

- Unlike Interactive Brokers, eToro doesn’t offer bespoke advice for traders, or for women looking for support on long-term investments, potentially making it better for short-term traders.

- Despite a comprehensive training academy, there are few resources tailored for female investors. Ellevest, on the other hand, offers a superior variety of curated materials for women with specific investment goals.

- eToro could do more to customize the trading platform for women. In particular, I’d like to see an option to filter copy traders by gender and more in-house research into the trading habits of its female clients.

3. Interactive Brokers

Why We Chose It

Interactive Brokers’ trading and investment services are almost unmatched, with access to 150 global markets from 34 countries, including responsible investment portfolios.

The broker also offers one of the best learning academies we’ve seen, including investment webinars for women.

Additionally, you get access to reliable support through Interactive Advisors, a premium level of support rarely found at competitors, plus best-in-class trading platforms for trading forex, CFDs and real shares.

Pros

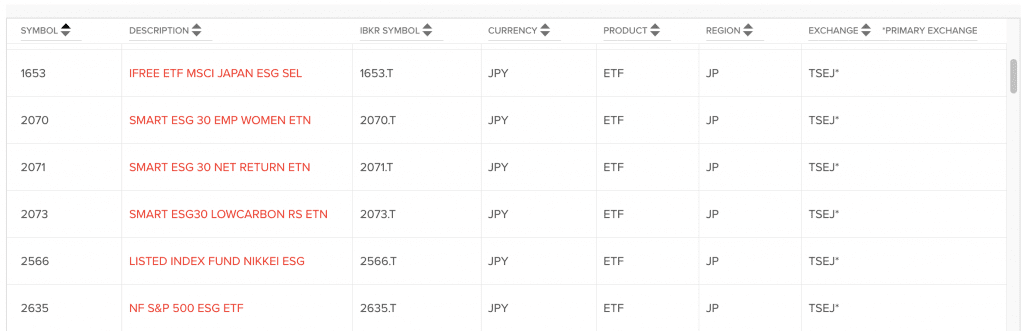

- Interactive Brokers offers an impressive range of instruments catering to various trading styles, covering everything from ESG funds and shares in women-led businesses, to 2024 additions like European equity derivatives on CBOE Europe Derivatives (CEDX).

- The IB Academy is comprehensive, offering an array of resources including podcasts, webinars and articles with market insights. Topics are diverse and include ‘Women In Finance’, ESG and technology.

- Interactive Brokers offers a specialized investment service, Interactive Advisors, which offers unlimited support and advice from human experts – a breath of fresh air when so many brokers are turning to frustrating AI-powered chatbots. Women can request tailored investments through this service too.

Cons

- With extensive markets, tools, and resources alongside a complex pricing structure, Interactive Brokers has the steepest learning curve versus the alternatives we’ve evaluated. Aspiring traders may feel overwhelmed and could find alternatives like IG more user-friendly.

- Despite offering some of the best educational materials we’ve seen, not many are specifically tailored to women. And while the ‘Women In Finance’ webinar has the potential to be an excellent value-add, it’s not hosted regularly with only a handful to choose from during our latest round of testing.

- After many hours evaluating the Trader Workstation (TWS), it’s clear it’s not geared towards newer traders with a whopping 338 different columns available for tailored watchlists and customization required. As a female investing enthusiast who’s tested countless platforms over the years, I know many beginners will struggle to get to grips with it, especially compared to eToro.

4. CMC Markets

Why We Chose It

CMC Markets offers an impressive range of trading opportunities catering to various goals, with both CFD and investment accounts available. Women can access 12,000+ financial assets, including ESG investments, share baskets and a market-leading range of 300+ forex pairs.

That said, the standout feature is CMC Markets’ vast education and research hub, including a proprietary trading and investment magazine with terrific insights from women in the financial services industry.

Pros

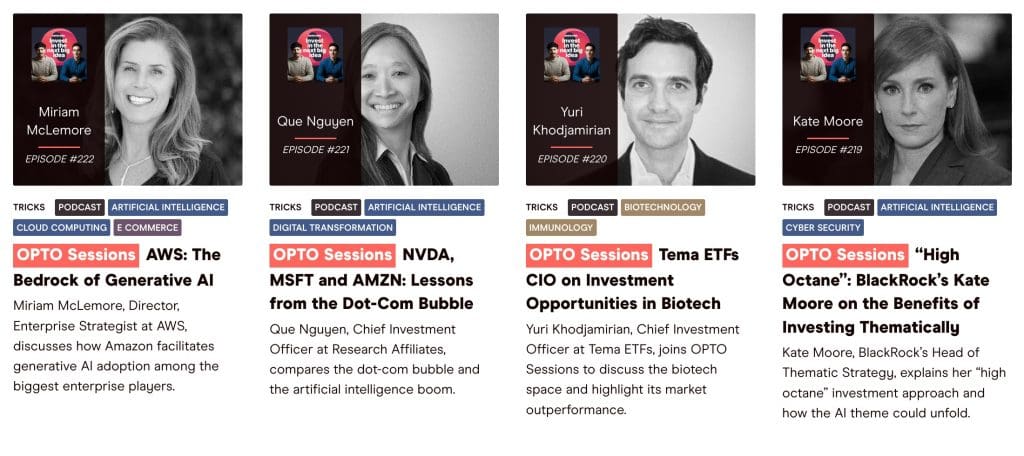

- CMC Markets is one of the few brokers that distributes its own investment magazine, Opto. The Learn Hub also includes a dedicated ESG section, plus podcasts with female analysts and popular topics like ‘social media’ and ‘health/wellness’, which may appeal to aspiring investors.

- CMC Markets’ platforms are tailored to all experience levels. CFD traders benefit from a user-friendly and feature-rich proprietary mobile app, whilst the CMC Invest app features integrated bite-size research from Finimize, making it a superb choice for up-and-coming traders.

- With access to over 12,000+ markets across all trading accounts, active traders won’t be restricted. There’s also a fantastic selection of ESG investments for women, notably the ALPS Clean Energy ETF, and the SPDR SSGA Gender Diversity Index ETF.

Cons

- Despite offering one of the best learning hubs I’ve seen, it’s a shame that there’s no dedicated section for women in investing. Ellevest is a better option if you want female-led and tailored resources.

- Although CMC Markets offers reliable support via telephone and email, there’s no direct advice service for longer-term investors, the primary investment horizon that women are interested in. In contrast, Interactive Brokers offers unlimited support through their investment service.

- One thing I really miss at CMC is an online community through the app or web platform, which would place it alongside category leaders like eToro. That said, it’s somewhat reassuring to see the broker is active on social media and occasionally participates in networking events.

5. Ellevest

Why We Chose It

Ellevest offers an exclusively female-led and female-focused investment service including a vast educational library, an engaging community and personalized human support.

There are also superb investment opportunities with a heavy focus on ESG products for socially conscious female investors.

Founded in 2014 by Wall Street’s “most powerful woman”, Sallie Krawcheck, and regulated by the SEC and FINRA in the US, Ellevest is also highly trusted.

Pros

- With women’s unique circumstances, earnings and motivations, Ellevest’s resources are tailored towards issues like the gender pay gap, longer life spans and career breaks. For dedicated investors looking to learn on the go, these resources are also available via the mobile app.

- Ellevest is a top pick if you’re interested in ESG investments, with more than half of your portfolio comprising socially responsible ETFs and funds. They’ve truly tapped into what matters to many female investors.

- Ellevest offers terrific online networking opportunities through their active social media pages and events. I found some particularly useful information on Ellevest’s LinkedIn, including webinars, collaboration events, and CEO talks.

Cons

- Despite being active on social media, Ellevest doesn’t offer a proprietary online community for women to ask advice, share ideas and collaborate on investment strategies. In contrast, eToro clients can connect via the integrated social feed.

- Although Ellevest offers investment opportunities built specifically for women, there are no short-term trading products like CFDs, limiting its appeal to day traders. IG is a superior option for women seeking more fast-paced strategies like day trading.

- Although Ellevest has proven popular with female investors in the US, securing $2 billion in assets under management (AUM) by 2024, it’s yet to open its doors to women in other countries, while both IG and Interactive Brokers accept female investors from dozens of other countries, as well as the US.

How We Chose The Best Brokers For Women

To find the best brokers for women, we:

- Pinpointed the most important considerations for female traders and investors.

- Ranked a selection of trusted brokers from 1 to 5 in each category (1 being low, 5 being high).

- Hand-picked the best ones based on our analysis and personal observations during testing.

What To Look For In A Broker

While in many ways, what you need as a broker is the same regardless of whether you’re a man or woman, for example you need a regulated broker you can trust, there are areas that may be more important to women:

Tailored Resources & Services

Finding a brokerage that offers services suited to your financial goals is essential. For example, if you’re a younger female investor, having access to engaging learning materials can help build your confidence and understanding of the financial markets.

Some brokers also offer tailored resources and trading tips, focusing on important issues that affect a woman’s ability to invest in the same capacity as men – for example, the gender pay gap, longer life spans and caregiving responsibilities.

We’ve highlighted the notable resources available at our recommended trading platforms below.

| IG | eToro | Interactive Brokers | CMC Markets | Ellevest | |

|---|---|---|---|---|---|

| Communities & Networking | IG community forum (temporarily closed) | Social trading platform | IB community forum | LinkedIn community and events | LinkedIn community and events |

| Education Resources | Female leaders reports, women in investing research, gender pay gap reports | Podcasts with female leaders | ’Women In Finance’ webinar, ESG market commentary | Opto Magazine, ESG insights, Trading and investment education | Women and Money articles, Investment tips, Savings and retirement advice |

Female-Focused Products

Look for trading products or services that specifically cater to women’s short-term or long-term financial goals.

Many of the best trading platforms for women offer investments not commonly found elsewhere, such as ESG-focused assets which allow you to invest in social and environmental causes. This might include ETFs comprising women-led companies, or green energy companies.

We’ve highlighted the trading products available at our recommended trading platforms below.

| IG | eToro | Interactive Brokers | CMC Markets | Ellevest | |

|---|---|---|---|---|---|

| Assets | Forex, CFDs, Real Stocks, Options, Futures, Crypto, Spread Betting | Forex, CFDs, Real Stocks, Futures, Crypto, Smart Portfolios, NFTs | Forex, CFDs, Real Stocks, Options, Futures, Funds, Bonds, Crypto | Forex, CFDs, Real Stocks, Treasuries, Custom Indices, Spread Betting | Real Stocks & ETFs |

| ESG Markets | Yes | Yes | Yes | Yes | Yes |

User-Friendly Trading Tools

Choosing a broker with an accessible and user-friendly platform is particularly important for aspiring female investors looking for a smooth entry into the trading world.

With many female investors from Generation Z, you may also want to look for an intuitive trading app which can make it straightforward for tech-savvy investors to trade on the go.

We’ve highlighted the trading platforms and apps at our recommended brokers below.

| IG | eToro | Interactive Brokers | CMC Markets | Ellevest | |

|---|---|---|---|---|---|

| Platforms | Web, ProRealTime, L2 Dealer, MT4 | eToro Web, CopyTrader | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, AlgoTrader, OmniTrade | CMC Web, MT4, CMC Invest App | Ellevest App |

| Mobile Trading App | Yes | Yes | Yes | Yes | Yes |

Personalized Support

You may want a broker that offers personalized investment advice via human experts. With around 68% of women saving for retirement, long-term investment support is particularly valuable for many.

This is especially important when we’ve observed a decline in the quality of customer support at online brokers in recent years, with more brokers introducing extremely frustrating, AI-enabled chatbots that often struggle to provide tailored guidance or resolve issues urgently.

We’ve highlighted the availability of human investment support at our recommended trading platforms below.

| IG | eToro | Interactive Brokers | CMC Markets | Ellevest | |

|---|---|---|---|---|---|

| Human Investment Support | Yes | No | Yes | No | Yes |

| Customer Support Rating | 4.5/5 | 3.5/5 | 3/5 | 4.5/5 | 4.5/5 |

FAQ

Which Is The Best Broker For Women?

The best broker for women in 2025 is IG. This brokerage excels in all categories that are important to female investors, offering both short-term and long-term trading products, tailored resources for women, socially responsible investments, and reliable human support following hands-on tests.

The runners-up based on our evaluations are eToro, Interactive Brokers, CMC Markets, and Ellevest.

Article Sources

- Women In Investing - Fidelity Investments Study

- Women In Investing Research - Motley Fool

- Women Prefer Values-Based Investing - CNBC

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com