Brokers With US Dollar Index

Brokers with the US Dollar Index (USDX) allow traders to speculate on the strength of the USD against a basket of foreign currencies. Managed by the Intercontinental Exchange (ICE), the USDX can be traded via various instruments depending on the trading platform, notably futures, options, and CFDs.

Discover the best brokers with the US Dollar Index, all personally tested by our experts.

Best Brokers For US Dollar Index

Following our first-hand evaluations, these are the top 6 trading platforms that offer the USDX:

-

1

DukascopyCurrency index: USD

DukascopyCurrency index: USD -

2

AvaTradeCurrency index: USD

AvaTradeCurrency index: USD -

3

XMCurrency index: USD

XMCurrency index: USD -

4

ExnessCurrency index: USD

ExnessCurrency index: USD -

5

PepperstoneCurrency index: USD, EUR, JPY81.8% of retail investor accounts lose money when trading CFDs

PepperstoneCurrency index: USD, EUR, JPY81.8% of retail investor accounts lose money when trading CFDs -

6

EightcapCurrency index: USD71% of retail traders lose money when trading CFDs

EightcapCurrency index: USD71% of retail traders lose money when trading CFDs

Here is a short overview of each broker's pros and cons

- Dukascopy - Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

- XM - XM is a globally recognized forex and CFD broker with 10+ million clients in 190+ countries. Since 2009, this trusted broker has been delivering low trading fees across its growing roster of 1000+ instruments. It’s also highly regulated, including by ASIC and CySEC and offers a comprehensive MetaTrader experience.

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

- Eightcap - Eightcap is a multi-regulated forex and CFD broker established in Australia in 2009. The broker has proven popular with active day traders, providing 800+ instruments with tight spreads and notable improvements in recent years, integrating the leading TradingView platform, alongside AI-powered financial calendars and algo trading tools with zero coding experience required.

Brokers With US Dollar Index Comparison

| Broker | Currency Indices | Minimum Deposit | Platforms | Regulator |

|---|---|---|---|---|

| Dukascopy | USD | $100 | JForex, MT4, MT5 | FINMA, JFSA, FCMC |

| AvaTrade | USD | $100 | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM |

| XM | USD | $5 | MT4, MT5, TradingCentral | ASIC, CySEC, DFSA, IFSC |

| Exness | USD | $10 | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral | CySEC, FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Pepperstone | USD, EUR, JPY | $0 | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Eightcap | USD | $100 | MT4, MT5, TradingView | ASIC, FCA, CySEC, SCB |

Dukascopy

"If you’re an experienced trader, Dukascopy provides the tools you need: JForex for algorithmic strategies, competitive spreads from 0.1 pips, leverage up to 1:200, and the peace of mind of using a Swiss-regulated bank and broker."

Christian Harris, Reviewer

Dukascopy Quick Facts

| Bonus Offer | 10% Equity Bonus |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Regulator | FINMA, JFSA, FCMC |

| Platforms | JForex, MT4, MT5 |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:200 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, ZAR, TRY, SEK, NOK, DKK, CHF, HKD, SGD, PLN, CZK, AED, SAR, HUF, MXN |

Currency Indices

Dukascopy only allows for trading on the USD currency index.

Pros

- The proprietary JForex platform is highly advanced, offering tools for algorithmic trading, extensive charting, and access to deep liquidity for short-term traders.

- Dukascopy is regulated by the Swiss Financial Market Supervisory Authority (FINMA) as both a broker and a bank, ensuring top-tier financial security and adherence to strict standards.

- Dukascopy features some of the best research we’ve seen, even a professional TV studio in Geneva covering financial news, market analysis, and daily insights from professionals.

Cons

- Some account types, such as the MT4/MT5 accounts, require a higher minimum deposit of $1,000, which may not be ideal for traders with smaller budgets.

- Dukascopy's withdrawal fees are higher than most competitors we’ve tested, particularly for bank wire transfers, which may deter traders who require frequent access to their funds.

- While Dukascopy provides some educational resources and 24/7 support, the complexity of its platforms and tools required extensive testing and may overwhelm newer traders.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Bonus Offer | 20% Welcome Bonus up to $10,000 |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Currency Indices

AvaTrade only allows for trading on the USD currency index.

Pros

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- AvaTrade continues to enhance its suite of products, recently through AvaFutures, providing an alternative vehicle to speculate on over 35 markets with low day trading margins.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

Cons

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Bonus Offer | $30 No Deposit Bonus When You Register A Real Account |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | ASIC, CySEC, DFSA, IFSC |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY |

Currency Indices

XM only allows for trading on the USD currency index.

Pros

- XM’s growing roster of 1,000+ instruments provides diverse short-term trading opportunities, with unique turbo stocks, fractional shares, and more recently thematic indices.

- XM’s customer support has delivered over years of testing, with 24/5 assistance in 25 languages, response times of <2 minutes and now a growing Telegram channel.

- XM’s Zero account is ideal for day trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, and no requotes or rejections.

Cons

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

- Although trusted and generally well-regulated, the XM global entity is registered with the weak IFSC regulator and UK clients are no longer accepted, reducing its market reach.

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | CySEC, FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, DKK, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Currency Indices

Exness only allows for trading on the USD currency index.

Pros

- Fast and dependable 24/7 multilingual customer support via telephone, email and live chat based on hands-on tests.

- Highly competitive spreads, reduced for USOIL and BTCUSD in 2024, are available from 0 pips with low commissions from $2 per side.

- Improved execution speeds, now averaging under 25ms, offer optimal conditions for short-term traders.

Cons

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Currency Indices

Pepperstone offers trading on these 3 currency indices: USD, EUR, JPY

Pros

- Now offering spread betting through TradingView, Pepperstone provides a seamless, tax-efficient trading experience with advanced analysis tools.

- Pepperstone has greatly improved the deposit and withdrawal experience in recent years, adding Apple Pay and Google Pay in 2025, as well as PIX and SPEI for clients in Brazil and Mexico in 2024.

- Pepperstone has scooped multiple DayTrading.com annual awards over the years, most recently 'Best Overall Broker' in 2025 and 'Best Forex Broker' runner up in 2025.

Cons

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers such as eToro, with no option to invest in real coins.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

Eightcap

"Eightcap delivers in every area for day traders with a growing selection of charting platforms, education via Labs, and AI-powered tools. Now sporting 120+ crypto CFDs, it's also become a stand-out choice for crypto trading, winning our 'Best Crypto Broker' award two years in a row."

Christian Harris, Reviewer

Eightcap Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, FCA, CySEC, SCB |

| Platforms | MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SGD |

Currency Indices

Eightcap only allows for trading on the USD currency index.

Pros

- Eightcap stands out with a selection of powerful trading tools and resources, including MT4 and MT5, the innovative algorithmic trading platform Capitalise.ai, and more recently the 100-million strong social trading network TradingView.

- Having excelled across all key areas for day traders, Eightcap outperformed every competitor to win our 'Best Overall Broker' award for 2024, also securing our 'Best Crypto Broker' title for 2025 and 'Best TradingView Broker' for 2025.

- After bolstering its roster in 2021, Eightcap offers one of the most extensive selections of cryptocurrency CFDs in the market, with crypto/fiat pairs, crypto/crypto pairs, plus crypto indices for broader exposure to the market.

Cons

- In spite of an increasing variety of tools, Eightcap doesn't offer industry favorites like Autochartist or Trading Central, which offer cutting-edge charting analytics, live news, and market insights for short-term traders.

- Eightcap needs to continue bolstering its suite of instruments to match category leaders like Blackbull Markets with its 26,000+ assets, featuring a particularly weak selection of commodities.

- The demo account expires after 30 days and can only be extended upon request - a notable inconvenience compared to the likes of XM with its unlimited demo mode.

Methodology

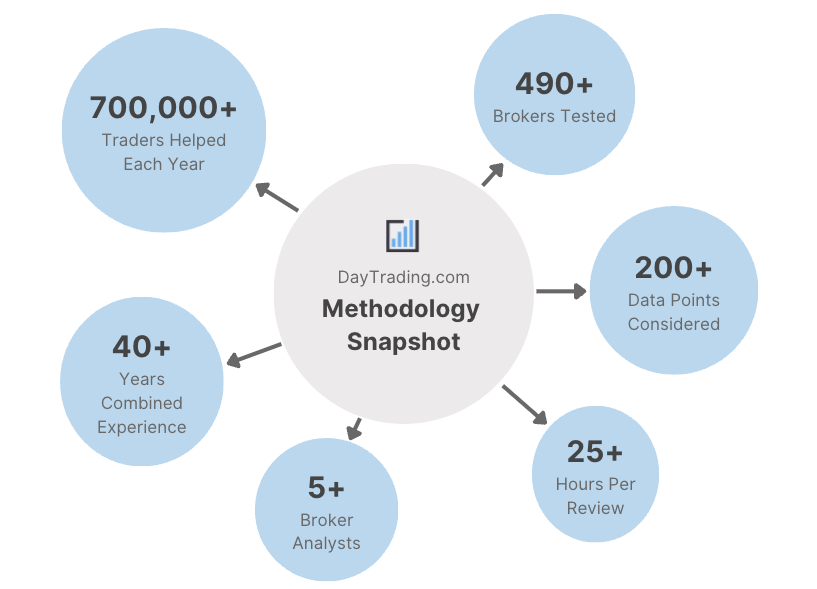

To identify the best trading platforms with USDX, we examined our database of 223 online brokers and pinpointed all those that facilitate trading on the US Dollar Index.

We then ranked them by their overall rating, blending over 100 data entries with our direct observations during testing. This revealed the trading platforms that go the extra mile for traders interested in the US Dollar index.

- We only recommended brokers that have earned our trust.

- We prioritized brokers with competitive trading fees.

- We checked each broker has correlating markets to the USDX.

- We ensured each broker offers excellent charting platforms.

- We examined each broker’s leverage and margin requirements.

How To Choose A Broker With The US Dollar Index

There are several factors we, and you, should consider when choosing a broker for US Dollar Index trading:

Choose A Trustworthy Broker

An established, regulated broker will help protect you from trading scams.

This is important given that the Commodity Futures Trading Commission (CFTC) has warned against the increase in foreign currency fraud in recent years, publishing tips on identifying potential signs of a scam. For example, fraudsters may use persuasion techniques to convince traders of ‘guaranteed’ gains and create a false sense of urgency to invest.

This is why we always verify the regulatory credentials of each broker that we test and assign each broker a score from 1 to 5 for ‘Regulation & Trust’, helping to keep your funds secure when trading the USDX and other financial markets.

- AvaTrade is highly trusted, with an excellent record spanning 15+ years and licenses from multiple ‘green tier’ authorities. It also offers robust safeguards, including negative balance protection, segregated accounts and a bespoke risk management tool, AvaProtect with up to $1M in insurance against trading losses.

Choose A Broker With Competitive Fees

Brokers with low trading fees on the USDX will help you maximize returns, especially for active traders.

That’s why we evaluate spreads, commissions and other charges when examining brokers, including recording fees on correlating markets, such as the EUR/USD.

We then assess non-trading fees, such as deposit/withdrawal charges, and weigh these against the overall service provided.

- Pepperstone continues to lead in this category, with spreads averaging 6.00 pips on the US Dollar Index and 0.10 pips on EUR/USD, plus access to a fantastic economic calendar for tracking financial announcements.

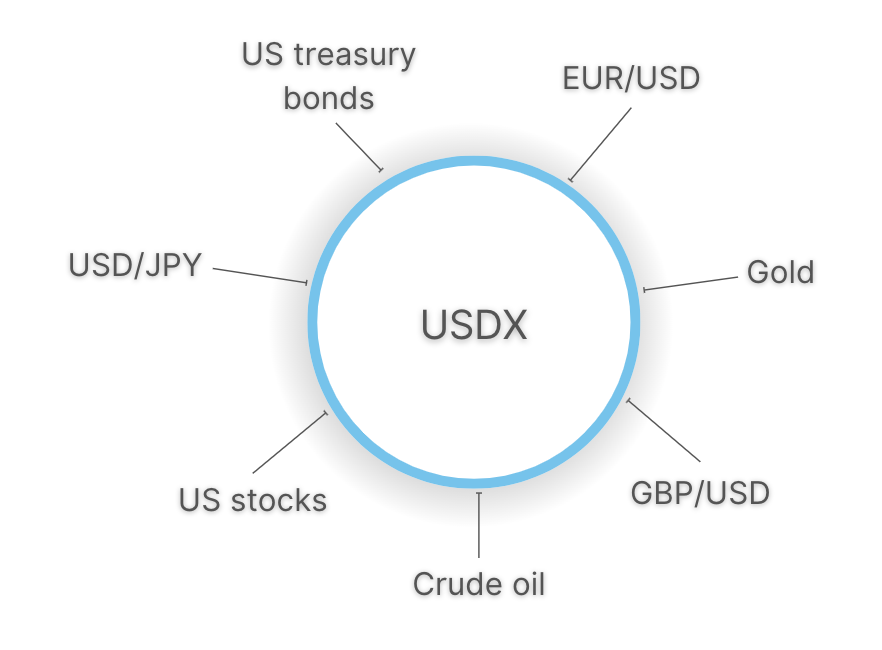

Choose A Broker With Correlating Markets

Traders may also be interested in a broker that provides access to other currencies within the USDX basket, providing alternative trading opportunities.

For example, the EUR/USD, which is available at all of our recommended brokers, is typically inversely related to the US Dollar Index.

Additionally, currency pairs where USD is the base or quote currency can also indicate a correlation with the USDX, such as USD/JPY or GBP/USD.

Other markets may also be of interest to USDX traders, such as commodities like gold (gold is quoted in dollars) as well as bonds (which are impacted by yield rates against the USD).

- IG is our top pick if you’re looking to trade the USDX alongside other relevant markets, including US bonds, gold, and USD currency pairs. I also love that you can follow announcements from the Federal Reserve Meeting in almost real-time through IG’s live market coverage.

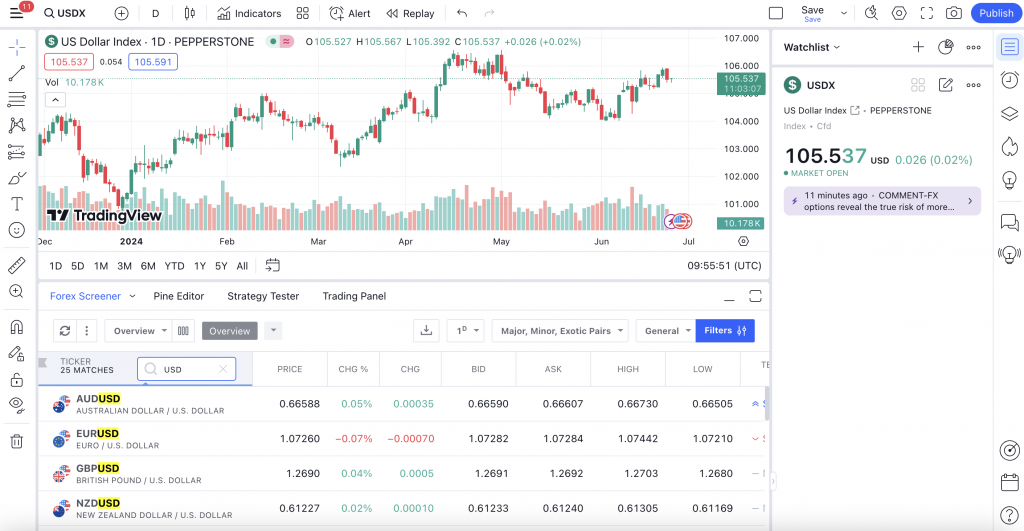

Choose A Broker With Excellent Platforms

Day traders speculating on the US Dollar Index will require a broker that offers a powerful charting platform to perform technical analysis.

Most brokers we test offer the MetaTrader 4 and MetaTrader 5 platforms. That said, I find the seamless navigation and integrated tools in TradingView far more appealing for active traders.

For example, you can use the integrated forex screener to analyze relevant currency pairs alongside your USDX chart, as you can see below.

Since the USDX is a popular macro indicator for the strength of the US Dollar, having access to excellent market research services like Trading Central can also be a value-add.

You may want a broker that provides interest rate updates from the Federal Reserve, as well as other relevant Central Banks, notably the European Central Bank as the EUR forms the largest weighting in the US Dollar Index.

- XM offers a superb selection of charting platforms for USDX traders, including MT4 and MT5. However, where it shines is its fantastic research tools, with trade ideas, technical summaries and news where you can search specifically for the US Dollar Index.

Choose A Broker With Clear Margin Requirements

Day traders, in particular, often trade the US Dollar Index with leverage, allowing them to maximize their potential gains using a small outlay.

This makes it important to choose a broker with clear margin requirements so you know what’s needed and what it costs, to borrow funds.

Crucially, brokers regulated by ‘green tier’ authorities like the FCA and CySEC cap leverage for retail investors at 1:30.

This means that if I were to put down $100 for a USDX CFD, the value of my position would be $3,000 (30 x $100).This means both my profits and losses will be multiplied by 30. As such, I recommend using risk management tools like stop-loss orders to close positions before large losses can accumulate.

- eToro offers leverage up to 1:10 on the US Dollar Index, with transparent margin requirements clearly displayed in the platform. You can also quickly and easily set stop loss and take profit parameters, while its social trading platform is world-leading and used for real-money trading by our team.

FAQ

Which Is The Best Broker With The US Dollar Index?

See our list of the best brokers with the USDX to find a suitable option based on your trading needs.

For example, Pepperstone offers some of the lowest fees on the USDX, while XM offers hourly technical summaries and sentiment data on the world’s most prominent currency index.

Article Sources

- USDX - Intercontinental Exchange (ICE)

- The US Dollar Index - Forbes

- Forex Trading Scam Warning - CFTC

- Federal Reserve Board

- European Central Bank (ECB)

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com