Brokers With SGD Accounts

A broker that supports a Singapore dollar (SGD) account is often the most convenient and affordable way for traders in Singapore to access the financial markets.

With an SGD account, you can manage your trading funds in a strong regional currency that is fairly stable and competitive, managed within a policy band against a basket of key partners’ currencies by the Monetary Authority of Singapore (MAS).

Explore the best brokers with SGD accounts, selected after extensive first-hand testing.

Best Brokers With SGD Accounts

These are the top 6 trading platforms supporting SGD accounts:

This is why we think these brokers are the best in this category in 2025:

- OANDA US - OANDA is a popular brand offering exceptional execution, low deposit requirements and advanced charting and trading platform features. The top-rated brand has over 25 years of experience and is regulated by trusted agencies, including the NFA/CFTC. Around the clock support is available for short-term traders, alongside flexible contract sizes and automated trade executions.

- Dukascopy - Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- Moomoo - Moomoo is an SEC-regulated app-based investment platform that offers a straightforward and affordable way to invest in Chinese, Hong Kong, Singaporean, Australian and US stocks, ETFs and other assets. Margin trading is available and the brand offers a zero-deposit account as well as several bonuses.

- Gemini - Gemini is a cryptocurrency exchange set up in 2014 by the Winklevoss brothers, known for their early involvement in Facebook. The exchange is among the world’s 20 largest and most popular. Gemini clients can trade and stake 110+ cryptocurrencies, with derivatives trading available in some jurisdictions, an advanced proprietary platform and additional features including an NFT marketplace.

- Zacks Trade - Zacks Trade is a FINRA-regulated US broker offering trading on stocks, ETFs, cryptocurrencies, bonds and more through a proprietary terminal. The broker is geared toward active traders and offers very affordable fees on most assets as well as an app and a vast amount of market data.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

Brokers With SGD Accounts Comparison

| Broker | SGD Account | Minimum Deposit | Markets | Regulator |

|---|---|---|---|---|

| OANDA US | ✔ | $0 | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) | NFA, CFTC |

| Dukascopy | ✔ | $100 | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | FINMA, JFSA, FCMC |

| Moomoo | ✔ | $0 | Stocks, Options, ETFs, ADRs, OTCs | SEC, FINRA, MAS, ASIC, SFC |

| Gemini | ✔ | $0 | Cryptos | NYDFS, MAS, FCA |

| Zacks Trade | ✔ | $2500 | Stocks, ETFs, Cryptos, Options, Bonds | FINRA |

| IC Markets | ✔ | $200 | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | ASIC, CySEC, FSA, CMA |

OANDA US

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Regulator | NFA, CFTC |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, HKD, SGD |

Pros

- The broker's API facilitates access to 25 years of deep historical data and rates from 200+ currencies

- There's a strong selection of 68 currency pairs for dedicated short-term forex traders

- OANDA is a reliable, trustworthy and secure brand with authorization from tier-one regulators including the CFTC

Cons

- It's a shame that customer support is not available on weekends

- There's only a small range of payment methods available, with no e-wallets supported

- The range of day trading markets is limited to forex and cryptos only

Dukascopy

"If you’re an experienced trader, Dukascopy provides the tools you need: JForex for algorithmic strategies, competitive spreads from 0.1 pips, leverage up to 1:200, and the peace of mind of using a Swiss-regulated bank and broker."

Christian Harris, Reviewer

Dukascopy Quick Facts

| Bonus Offer | 10% Equity Bonus |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Regulator | FINMA, JFSA, FCMC |

| Platforms | JForex, MT4, MT5 |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:200 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, ZAR, TRY, SEK, NOK, DKK, CHF, HKD, SGD, PLN, CZK, AED, SAR, HUF, MXN |

Pros

- Dukascopy offers tight spreads starting from 0.1 pips, leverage up to 1:200 (depending on the jurisdiction), and volume-based commissions that reward high-frequency traders.

- Dukascopy is regulated by the Swiss Financial Market Supervisory Authority (FINMA) as both a broker and a bank, ensuring top-tier financial security and adherence to strict standards.

- The proprietary JForex platform is highly advanced, offering tools for algorithmic trading, extensive charting, and access to deep liquidity for short-term traders.

Cons

- While Dukascopy provides some educational resources and 24/7 support, the complexity of its platforms and tools required extensive testing and may overwhelm newer traders.

- While JForex is feature-rich, it has a steep learning curve, making it less suitable for beginner traders who might prefer simpler platforms.

- Some account types, such as the MT4/MT5 accounts, require a higher minimum deposit of $1,000, which may not be ideal for traders with smaller budgets.

Moomoo

"Moomoo remains an excellent choice for new and intermediate stock traders who want to build a diverse investment portfolio. What really stands out is the broker's user-friendly app and the low trading fees."

Jemma Grist, Reviewer

Moomoo Quick Facts

| Bonus Offer | Get up to 15 free stocks worth up to $2000 |

|---|---|

| Demo Account | Yes |

| Instruments | Stocks, Options, ETFs, ADRs, OTCs |

| Regulator | SEC, FINRA, MAS, ASIC, SFC |

| Platforms | Desktop Platform, Mobile App |

| Minimum Deposit | $0 |

| Minimum Trade | $0 |

| Leverage | 1:2 |

| Account Currencies | USD, HKD, SGD |

Pros

- The broker offers access to extended pre-market trading hours

- Moomoo is a Member of FINRA and the Securities Investor Protection Corporation (SIPC), adding another level of security for prospective clients

- There are reduced options contract fees from $0.65 to $0

Cons

- It's a shame that there is no 2 factor authentication (2FA), despite the other security features on offer

- There is no phone or live chat support - common options at most other brokers

- There is no negative balance protection, which is a common safety feature at top-tier-regulated brokers

Gemini

"Gemini’s ActiveTrader platform and TradingView integration make it a good choice for serious crypto traders seeking a reliable charting environment, though we were disappointed by some unnecessary fees and previous security breaches."

Michael MacKenzie, Reviewer

Gemini Quick Facts

| Demo Account | No |

|---|---|

| Instruments | Cryptos |

| Regulator | NYDFS, MAS, FCA |

| Platforms | ActiveTrader, AlgoTrader, TradingView |

| Minimum Deposit | $0 |

| Minimum Trade | 0.00001 BTC |

| Account Currencies | USD, EUR, GBP, CAD, AUD, HKD, SGD |

Pros

- The exchange ensures high security standards with 2FA a requirement for all crypto investors

- The trading app features a user-friendly, modern design and intuitive interface, with an excellent range of charting tools for day traders

- There is a decent range of educational guides and tutorials suitable for beginners

Cons

- There are high fees for some funding methods including a 3.49% fee for card transactions

- The 'convenience fee' for using the mobile app seems arbitrary and makes it inefficient to use this feature

- There is no practice profile or demo account for prospective traders

Zacks Trade

"Zacks Trade will suit active day traders with experience using powerful platforms. Fees and margin rates are low while the market research is excellent."

Tobias Robinson, Reviewer

Zacks Trade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, ETFs, Cryptos, Options, Bonds |

| Regulator | FINRA |

| Platforms | Own |

| Minimum Deposit | $2500 |

| Minimum Trade | $3 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, TRY, SEK, NOK, DKK, CHF, HKD, SGD, RUB, PLN, CZK, HUF |

Pros

- Comprehensive research and data

- Customizable proprietary trading platform and mobile app

- Regulated by FINRA with access to the Securities Investor Protection Corporation

Cons

- No MT4 or MT5 platform integration

- High minimum requirement of $2,500

- Withdrawal fees apply if removing funds more than once per month

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, FSA, CMA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

- IC Markets secured DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its seamless, industry-leading MetaTrader integration, refined over years to maximize the platform experience.

Cons

- While IC Markets offers a selection of metals and cryptos for trading via CFDs, the range is not as extensive as brokers like eToro, limiting opportunities for traders interested in these asset classes.

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

How Did We Choose The Best SGD Brokers?

To find the best SGD brokers, we:

- Leveraged our database of 223 brokers

- Made a shortlist of brokers that support accounts in Singapore dollars

- Ranked them by examining more than 100 data points during exhaustive first-hand tests

What Is An SGD Account?

An SGD account is simply a trading account that uses Singapore dollars as the base currency.

Your deposits and withdrawals will be processed into SGD, and this is the currency that will be used when you open day trades and exit positions.

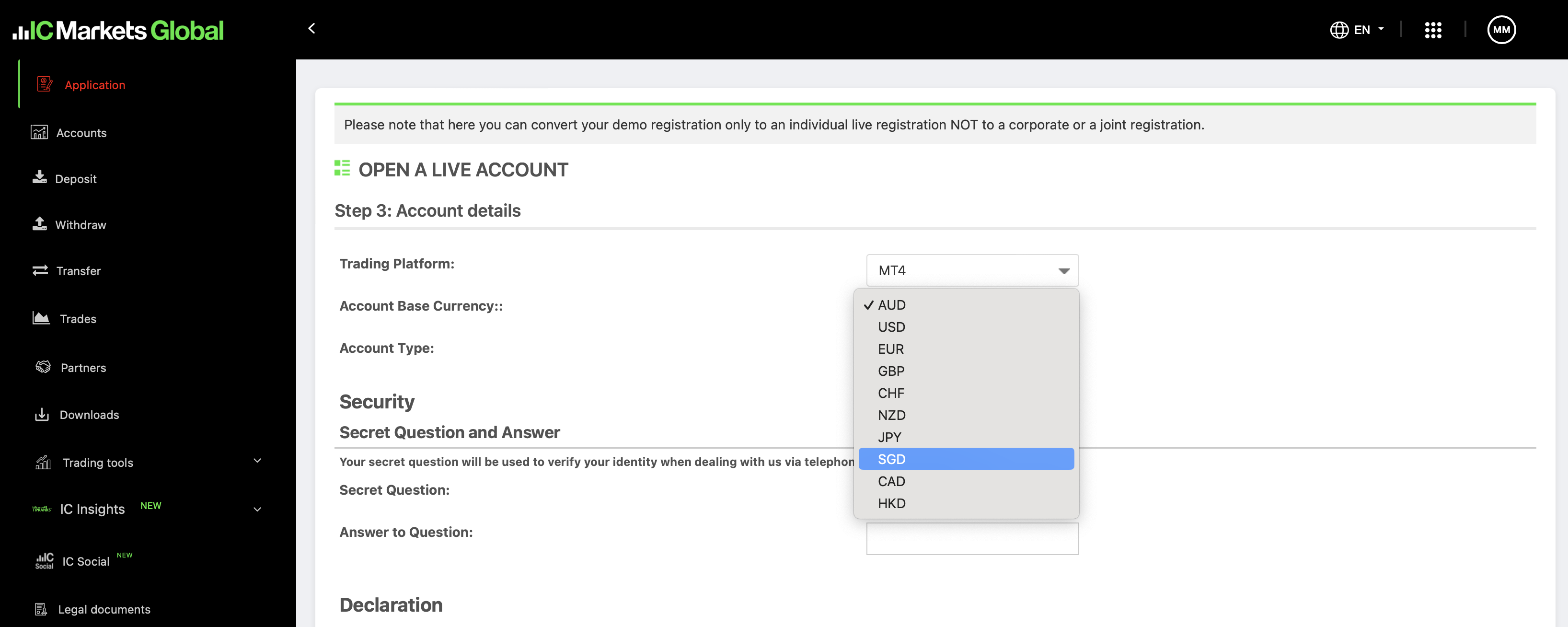

You can usually select SGD as an account currency when you open an account with a supporting broker. I opened an SGD account with IC Markets as you can see in the image below:

Do I Need An SGD Account?

You may want an account with SGD as a base currency for several reasons:

- If you live in Singapore and SGD is the main currency you earn and use, an SGD account is usually the most cost-effective as it cuts conversion fees.

- If you regularly trade stocks listed in Singapore like Wilmar International or Oversea-Chinese Bank, then it makes sense to fund your account with SGD since this is the currency used on this exchange.

- If you are looking to trade in various currencies for hedging purposes, SGD is a good bet as a relatively stable currency whose rate is loosely determined by a basket of other currencies.

How Can I Check If A Broker Offers An Account In Singapore Dollars?

We list the accepted account currencies of every broker we review, so you can quickly find brokers with SGD accounts here. Alternatively, follow these easy steps to check for yourself:

- Go to the broker’s website and navigate to the ‘account options’ setting.

- Find the scroll-down tab or list of accepted currencies and scroll down until you find SGD.

- Select SGD as the account currency when you open a live trading account.

Pros & Cons Of SGD Trading Accounts

Pros

- SGD accounts eliminate currency conversion fees if you have Singapore dollars and want to trade instruments on the Singapore Exchange.

- Traders based in Singapore will usually find it more convenient to fund and manage their trading account in their day-to-day currency.

- The Singapore dollar is considered among the world’s strongest and most stable, and the Monetary Authority of Singapore (MAS) allows it to float within the range defined by a basket of other currencies. This makes it a relatively secure currency to store funds in.

- If you file taxes in Singapore, maintaining an SGD account may streamline the reporting process as it may reduce the need to factor in various foreign exchange rate changes and fluctuations.

Cons

- Although SGD is quite popular and is supported by some top brokers, it is not as widely available as currencies like USD, EUR and GBP so you will have fewer day trading platforms to choose between.

- The ‘soft peg’ applied to SGD means it is unlikely to significantly appreciate in value against the USD or other major currencies.

- Stocks from the Singapore Exchange are not offered by most brokers, so you may have a relatively limited choice if that’s what you want to day trade.

FAQ

What Is The Best Broker With An SGD Account?

We’ve comprehensively reviewed the brokers that accept SGD accounts. Check our list to find the right platform for your needs.

How Much Does It Cost To Open A Trading Account Based In Singapore Dollars?

The amount you need to spend to open an SGD base account will depend on the broker. Of the hundreds of brokers we’ve tested, we’ve found that this amount is rarely higher than the 200 USD (around 270 SGD) minimum required by IC Markets.

However, note that many SGD brokers accept traders for considerably less than this. IG, for example, doesn’t require any minimum deposit to sign up, and you can register with XM with an initial deposit of just $5 (approximately 7 SGD).