Best Brokers That Reimburse Transfer Fees 2026

If you’re looking to move funds from one brokerage account to another using an Automated Customer Account Transfer (ACAT) or similar, you can save on the fees for doing so (often $50 to $250) by choosing the right broker.

Enter DayTrading.com’s best brokers for reimbursing transfer fees, hand-picked by experts. We evaluated each provider’s reimbursement terms and checked they deliver a terrific environment for investors at every level.

Top Brokers That Reimburse Transfer Fees in 2026

Although there are many providers in the market, as of February 2026, we’re only comfortable recommending these 2 brokerages if you want a reimbursement on your account transfer fees:

- Firstrade: Low reimbursement barrier. 13,200+ investment products. $0 commission on trades.

- Qtrade: $1 discounts on stock trades. Excellent investing platform. 30-day portfolio simulator.

Comparison of Top Brokerages That Reimburse Account Transfer Fees

| Firstrade | QTrade | |

|---|---|---|

| Transfer-Out Reimbursement Value | Up to $250 (transfers of $2,500+) | Up to $150 (transfers of $15,000+) |

| Reimbursement Credit Date | Within 30 days of the transfer | Within 60 days of the transfer |

| Transfer-In Fee | None | None |

| Applicable Accounts | Regular Investment, Traditional IRA, Roth IRA, Rollover IRA | RSP, TFSA, RESP, Margin, Cash |

| Regulator | FINRA in US | CIRO in Canada |

1. Firstrade

Why We Chose It

Firstrade secured our top spot with its market-leading transfer terms.

The threshold for the $250 reimbursement is low and payments are made promptly within 30 days, making it great for active investors and those with less capital.

And with no transfer-in fees or commissions, plus a range of accounts, cost-conscious investors get the full package.

Pros

- You can be credited up to $250 on transfers of $2,500 upwards, which is much lower than most alternatives we assessed (for example Robinhood requires north of $7,500). Also, Firstrade pays out the reimbursement faster than most peers (within 30 days, compared to 60 days at Qtrade).

- The broker offers additional promotions for those transferring a large amount of assets, including wire rebates of up to $25 per wire when you transfer $10,000 or more from your bank account to Firstrade.

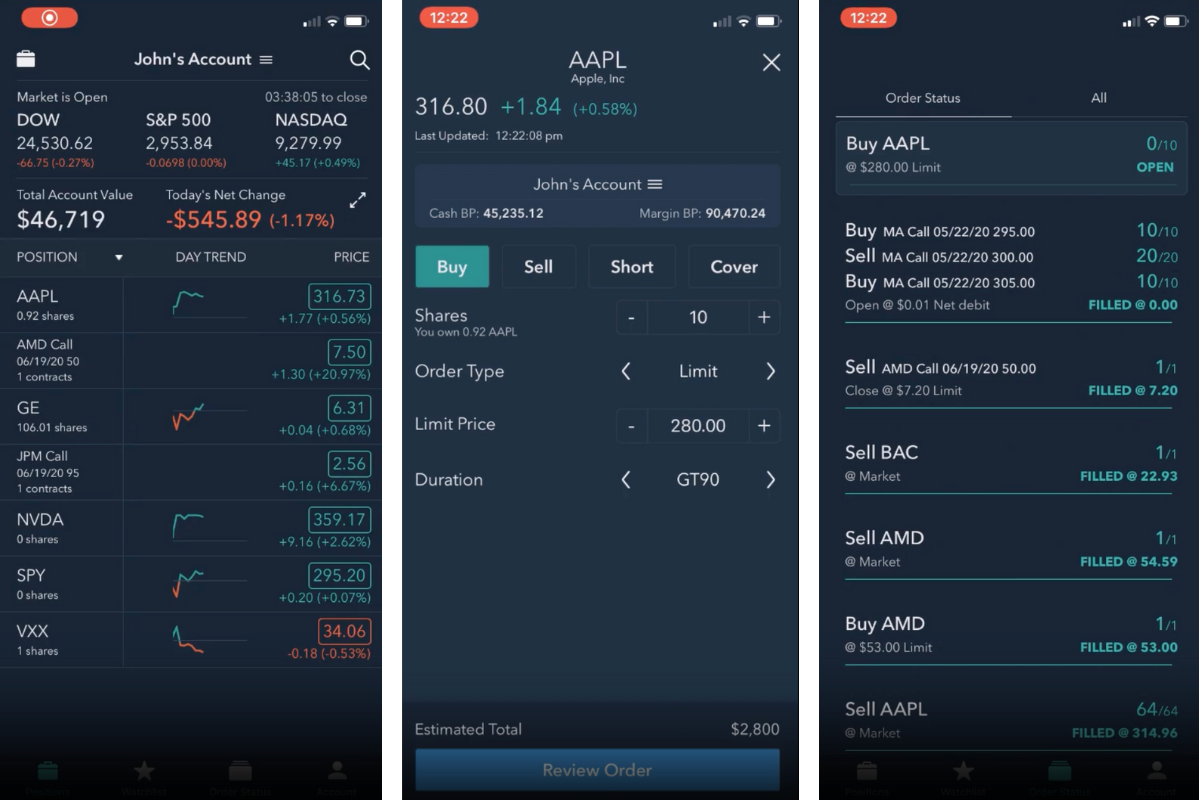

- There’s a wide range of investment products to build your portfolio, including 11,000+ mutual funds, plus thousands of ETFs, stocks and options – all available to buy and sell on a desktop or mobile platform which we love.

- Firstrade delivers a low-cost environment across the board, with no commission on stocks, ETFs, options and mutual funds, and zero maintenance fee on retirement accounts. And there’s no inactivity charge, so casual investors aren’t penalized.

Cons

- Firstrade doesn’t offer round-the-clock customer support, which could be a drawback if you experience an issue with an incoming transfer. This could potentially delay how quickly you receive the reimbursement.

- The broker’s margin rate of 13.25% for balances up to $24,999 trails other brokerages we’ve evaluated. For example, Moomoo offers an ultra-low rate of 6.8% for the same balance range.

- There are other funding fees to be aware of, including $25 on domestic wire withdrawals and $75 to transfer assets to another brokerage via ACAT, though these remain lower than other firms we’ve tested.

- Firstrade doesn’t offer a demo mode to explore the features of its investment accounts. This would benefit investors like me who like to test-drive brokerages before committing to a potentially time-consuming transfer.

2. Qtrade

Why We Chose It

Qtrade just misses out on the top spot in our rankings with a slightly tighter $150 reimbursement.

However, we loved the provider’s educational resources during our latest tests, which highlight the firm’s commitment to self-directed investors.

Paired with the broker’s feature-rich app, Qtrade delivers a great solution for the increasing number of investors who prefer to analyze stocks from their palms.

Pros

- After registering with Qtrade, you can transfer an account in just a few steps using its e-Transfer service. The reimbursement process thereafter is also so easy, only requiring uploading your statement from the transferring broker.

- Extra perks are available for investors aged 18 to 30 who transfer $50+ in a month, including lower commissions on stocks, mutual funds and ETFs at $7.75 (at least a $1 saving per trade based on our tests). You also get no quarterly admin fees, amounting to potential further savings of $100 per year.

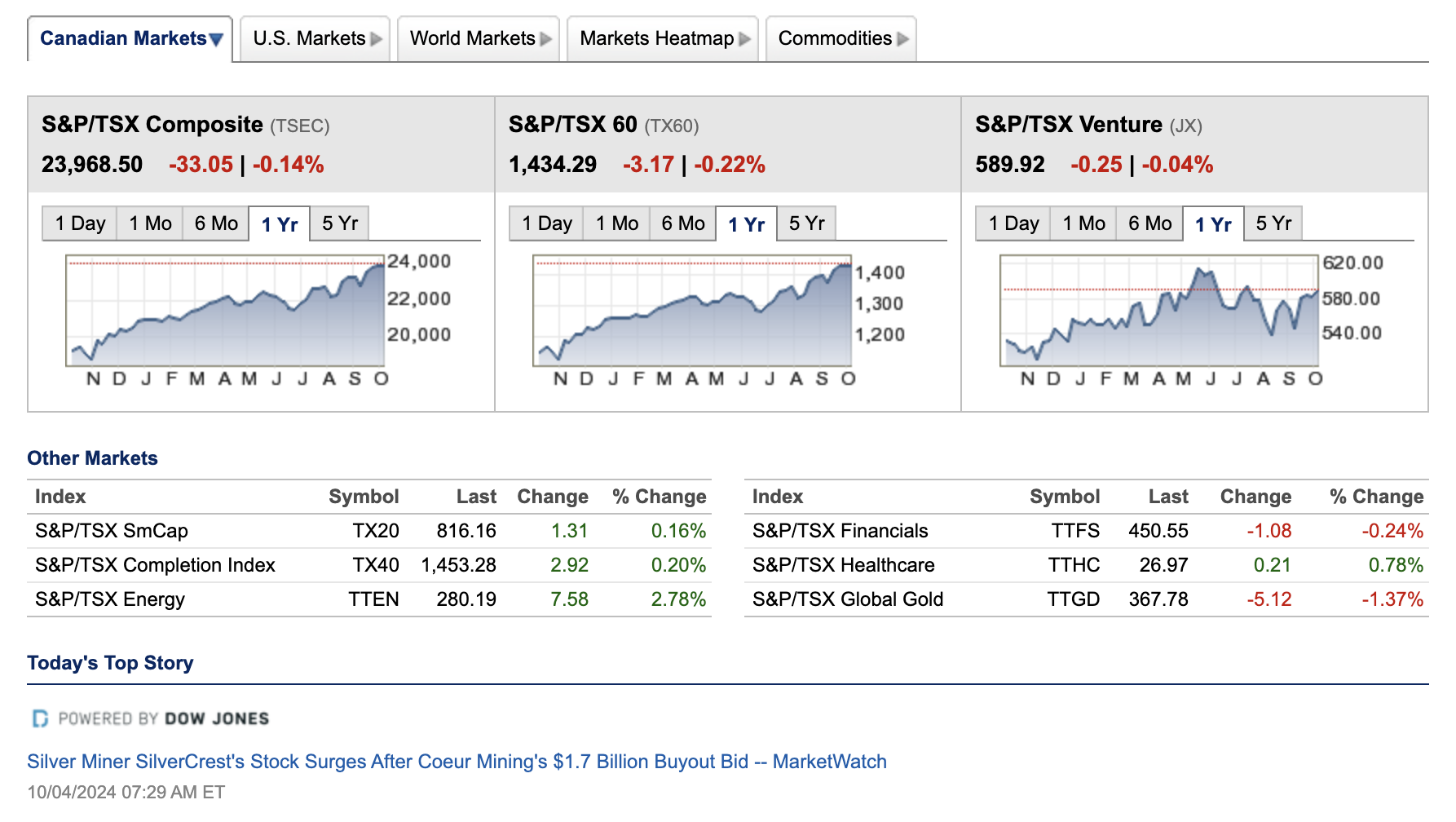

- Qtrade is clearly more geared towards DIY investing than many peers, offering a 30-day demo which allows you to research and analyze stocks, test screeners and manage watchlists. The platform is also feature-rich and includes first-rate tools like Morningstar analysis and news from Dow Jones.

- Qtrade offers tailored resources for both new and experienced investors, including comprehensive articles on how to plan and maximize your investments. There are also free downloadable investment guides, as well as weekly market updates, catering to traders with various goals.

Cons

- Qtrade charges higher overall fees compared to alternatives based on our investigations. For example, transferring your assets out of Qtrade costs $150 for outbound transfers (double what Firstrade charges), whilst administration fees come in at $25 per quarter which penalizes lower equity accounts.

- Qtrade focuses primarily on self-directed investing, with no managed portfolios or investment advisors, so individuals who prefer a solely hands-off or blended approach aren’t catered for.

- Despite focusing mainly on DIY investing, the demo account is only for exploration purposes and doesn’t let you place simulated trades. This is a drawback when compared to other stock brokers that offer demo accounts, notably Interactive Brokers.

- Although the broker targets younger clients and self-directed investors, customer support is limited compared to providers like Webull. Qtrade is only available on weekdays between 8.30 am and 8.00 pm ET, with no option to get quick help via live chat.

Our Methodology

- We searched our database of 140 online brokers, extracting all those that reimburse broker-to-broker transfer fees using ACATS or similar.

- We evaluated the reimbursement value offered by each broker, alongside any additional cost-saving opportunities through investment promotions and rebates.

- We favored providers with low investment and account management fees, allowing active and passive investors to maximize their savings.

- We prioritized brokerages with a wide range of investment products and accounts, including equities, funds, retirement accounts and self-directed investing.

- We examined the broker’s customer support in the event of any transfer issues, including methods of contact and opening times.

What Is A Reimbursement Fee?

A reimbursement fee when transferring funds between brokerages is a charge that a broker may apply to cover the costs associated with processing the transfer.

Some receiving brokers reimburse all or a portion of the transfer-out fees charged by the sending broker, representing a cost saving.

For example, if you transfer $10,000 from Broker A to Broker B, and Broker A typically charges a $100 reimbursement fee, switching to a provider that reimburses transfer fees could save you that amount.

How Does A Transfer Fee Reimbursement Work?

The process can vary slightly between brokerages, but you typically need to provide your broker with proof of the transfer from the sending broker. Payment timescales can differ depending on your country of residence and the company’s transaction processes.

As an example, here’s how it works at Qtrade:

- Contact the broker you are transferring assets from and request a copy of your statement that shows the transfer charge to Qtrade.

- Print, sign and mail the statement to Qtrade, quoting your new Qtrade account number.

- Once approved, payment of the reimbursement (up to $150 for transfer values of $15,000 or more) will be applied as credit within 60 days of the transfer.

Bear in mind that the initial broker-to-broker transfer via ACAT (or similar method) can take days or even weeks to complete, depending on your jurisdiction, the type of account, and the investment products you hold.For example, in the US, transfers may only take up to 8 business days for a standard investment account, while in Canada, transfers can take up to 6 weeks from the sending account.

Would I Benefit From A Transfer Fee Reimbursement?

Getting a reimbursement on a transfer fee is a great perk for any trader and investor, but particularly if:

- You are a new investor or an individual with less trading capital, and you’re looking to save on administration costs (since these can accumulate quickly).

- You are an experienced investor looking to consolidate multiple portfolios and don’t want to pay the transfer-out fee for each account.

FAQ

Which Is The Best Broker That Reimburses Transfer Fees?

Based on our hands-on evaluations, the best brokerage that reimburses transfer fees in 2026 is Firstrade.

Firstrade pays out up to $250 with a low transfer threshold of $2,500+. There’s also a fantastic range of investments and savings accounts, which you can manage in a user-friendly desktop or mobile app, while its trading fees are some of the lowest we have seen.

Our runner-up is Qtrade, which is geared towards self-directed investors, offering a great investment app with a range of third-party analysis tools and screeners.

How Much Does It Cost To Transfer Assets To Another Broker?

Typical transfer-out fees range from $0 to $250 based on our investigations.

However, this can vary depending on the brokerages that you are transferring out of and into. Many firms do not charge for incoming transfers, and reimburse transfer fees from your previous broker.