National Futures Association (NFA) Brokers 2025

If you’re day trading in the US, consider a broker regulated by the National Futures Association (NFA), a ‘green tier’ body in DayTrading.com’s Regulation & Trust Rating that provides excellent investor safeguards.

Established in 1981, the NFA plays a pivotal role in maintaining market integrity, enforcing strict regulatory standards, ensuring investor protection, resolving disputes, and promoting financial education.

Brokers regulated by the NFA are held to these high standards, offering traders enhanced transparency. If their actions threaten customers or the integrity of the markets, the NFA promptly takes appropriate action.

Immerse yourself in our choice of the top NFA-regulated brokers operating within the US. We’ve thoroughly confirmed that each recommended platform is officially registered with the NFA.

Best NFA Brokers

As of our latest tests in April 2025, these 4 NFA-regulated day trading platforms are the best picks:

Here is a short overview of each broker's pros and cons

- Plus500 US - Plus500 is a well-established broker that entered the US market in 2021. Authorized by the CFTC and NFA, it provides futures trading on forex, indices, commodities, cryptocurrencies, and interest rates. With a 10-minute sign-up, a manageable $100 minimum deposit, and a straightforward web platform, Plus500 continues to strengthen its offering for traders in the US.

- NinjaTrader - NinjaTrader is a US-headquartered and regulated brokerage that specializes in futures trading. There are three pricing plans to suit different needs and budgets, as well as ultra-low margins on popular contracts. The brand's award-winning charting software and trading platform also offers a high-degree of customization and superb technical analysis features.

- FOREX.com - Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

- OANDA US - OANDA is a popular brand offering exceptional execution, low deposit requirements and advanced charting and trading platform features. The top-rated brand has over 25 years of experience and is regulated by trusted agencies, including the NFA/CFTC. Around the clock support is available for short-term traders, alongside flexible contract sizes and automated trade executions.

NFA Brokers Comparison

| Broker | Minimum Deposit | Markets | Platforms | Leverage |

|---|---|---|---|---|

| Plus500 US | $100 | Futures on Cryptocurrencies, Metals, Agriculture, Forex, Interest rates, Energy, Equity Index future contracts | WebTrader, App | - |

| NinjaTrader | $0 | Forex, Stocks, Options, Commodities, Futures, Crypto | NinjaTrader Desktop, Web & Mobile, eSignal | 1:50 |

| FOREX.com | $100 | Forex, Stocks, Futures, Futures Options | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral | 1:50 |

| OANDA US | $0 | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) | OANDA Trade, MT4, TradingView, AutoChartist | 1:50 |

Plus500 US

"Plus500 US stands out as an excellent choice for beginners, offering a very user-friendly platform, low day trading margins, and access to the Futures Academy to enhance trading skills. Its powerful tools and reliable service helped it scoop second place in DayTrading.com's annual 'Best US Broker' award."

Michael MacKenzie, Reviewer

Plus500 US Quick Facts

| Bonus Offer | Welcome Deposit Bonus up to $200 |

|---|---|

| Demo Account | Yes |

| Instruments | Futures on Cryptocurrencies, Metals, Agriculture, Forex, Interest rates, Energy, Equity Index future contracts |

| Regulator | CFTC, NFA |

| Platforms | WebTrader, App |

| Minimum Deposit | $100 |

| Minimum Trade | 0.0 Lots |

| Account Currencies | USD |

Pros

- The straightforward account structure, pricing model and web platform offer an easier route into futures trading than rivals like NinjaTrader

- Plus500 is a publicly traded company with a good reputation, over 24 million traders, and a sponsor of the Chicago Bulls, instilling a sense of trust

- Plus500 US excels for its low fees with very competitive day trading margins and no inactivity fees, live data fees, routing fees, or platform fees

Cons

- Although support response times were fast during tests, there is no telephone assistance

- Plus500 US does not offer social trading capabilities, a feature available at alternatives like eToro US which could strengthen its offering for aspiring traders

- While Plus500 US continues to broaden its investment offering, it's currently restricted to around 50+ futures with no stocks

NinjaTrader

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Stocks, Options, Commodities, Futures, Crypto |

| Regulator | NFA, CFTC |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD |

Pros

- You can get thousands of add-ons and applications from developers in 150+ countries

- Traders can get free platform access and trade simulation capabilities in the unlimited demo

- NinjaTrader is a widely respected and award-winning futures broker and is heavily authorized by the NFA and CFTC

Cons

- The premium platform tools come with an extra charge

- Non forex and futures trading requires signing up with partner brokers

- There is a withdrawal fee on some funding methods

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Bonus Offer | Active Trader Program With A 15% Reduction In Costs |

|---|---|

| Demo Account | Yes |

| Instruments | Forex, Stocks, Futures, Futures Options |

| Regulator | NFA, CFTC |

| Platforms | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

Cons

- Funding options are limited compared to leading alternatives like IC Markets and don’t include many popular e-wallets, notably UnionPay and POLi.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

OANDA US

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Regulator | NFA, CFTC |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, HKD, SGD |

Pros

- There's a strong selection of 68 currency pairs for dedicated short-term forex traders

- Beginners can get started easily with $0 minimum initial deposit

- OANDA is a reliable, trustworthy and secure brand with authorization from tier-one regulators including the CFTC

Cons

- There's only a small range of payment methods available, with no e-wallets supported

- The range of day trading markets is limited to forex and cryptos only

- It's a shame that customer support is not available on weekends

Methodology

To discover the top brokers authorized by the NFA, we:

- Reviewed our list of 223 brokers to identify those asserting NFA authorization.

- Checked their details against the NFA’s online registry to confirm their authorization.

- Integrated the findings of our hands-on tests and 200+ data points to develop a ranking of the best NFA-authorized brokers.

How Can I Check If A Broker Is Regulated By NFA?

Verifying that the NFA regulates a brokerage is a simple process we employ to assess the legitimacy of trading platforms operating in the US.

You can easily confirm this by following these three steps:

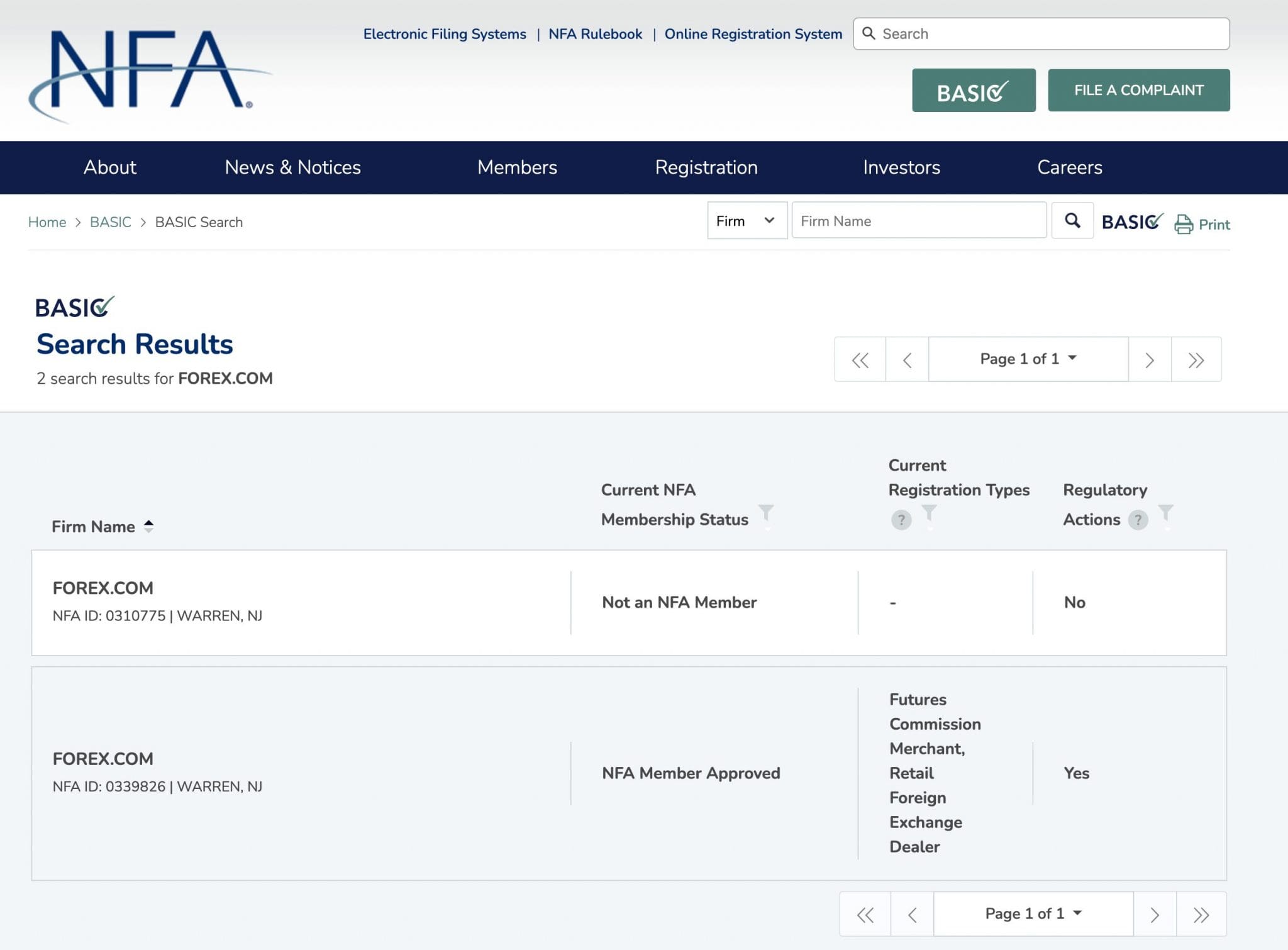

- Access the NFA’s ‘Background Affiliation Status Information Center (BASIC)‘ search on its website.

- Input the provider’s name into the search field.

- If needed, refine the search by ‘NFA ID’, ‘Individual’ or ‘Pool.’

To illustrate, I verified that FOREX.com, a popular US brokerage, is authorized by the NFA, as seen in the following screenshots.

What Rules Must NFA-Regulated Brokers Follow?

NFA-regulated brokers must adhere to strict rules to ensure transparency, fair practices, and the protection of clients in the financial markets.

Here are some of the main rules that brokers regulated by the NFA must follow:

- Risk Disclosure: Providers must clearly warn customers about the risks involved in trading, which are high, especially if you employ fast-paced strategies like day trading.

- Fair Conduct: Brokers must act ethically, avoiding false claims about profits or downplaying risks. Advertising must be truthful and not misleading.

- Capital Requirements: NFA-regulated US brokers have varying minimum adjusted net capital requirements. Forex Dealer Members (FDMs) must maintain $20 million, Futures Commission Merchants (FCMs) $1 million (or $20 million if also a swap dealer), and independent Introducing Brokers (IBs) $45,000. Guaranteed IBs are exempt from these requirements.

- Client Fund Segregation: Brokers must keep customer funds separate from company assets to safeguard them from misuse or loss.

- Anti-Fraud Measures: Providers are prohibited from engaging in fraudulent practices, including misleading promotions or unfair trade executions.

- Record-Keeping & Reporting: Firms must maintain detailed records of transactions and report regularly to regulators to ensure compliance and transparency.

- Know Your Customer (KYC) & Anti-Money Laundering (AML): Brokers must verify customer identities and monitor for suspicious activity, reporting potential money laundering.

- Supervision & Risk Management: Trading platforms must implement robust employee oversight systems and risk management policies to minimize market and operational risks.

- Leverage Limits: Restrictions on leverage to 1:50 (or a 2% margin) ensure that retail investors do not take on excessive risk that could lead to significant losses.

- Dispute Resolution: Brokers must participate in structured processes like arbitration or mediation to resolve client disputes fairly.

Online brokerages that do not adhere to these regulations may face enforcement action from the NFA, which could result in fines, penalties, or the loss of their license.

For example, StoneX was fined $100,000 for several violations, including improper handling of initial margin calculations and failing to maintain adequate risk management systems.

In a separate case, the NFA imposed penalties on Trinity Trading Group due to violations involving improper record-keeping and promotional practices that misrepresented profit potential without highlighting risks. The firm and its principal were barred from reapplying for NFA membership as part of the settlement.

Bottom Line

Choosing a firm authorized by the NFA is a no-brainer if you’re an active trader in the US.

The NFA’s role is to ensure that market participants – brokers and traders – operate within a fair, transparent, and regulated environment.

You can verify if the NFA regulates a broker in just a few minutes on the NFA’s website. Or, explore our list of the best day trading platforms regulated by the NFA.

While regulation provides a degree of protection, it’s essential to understand that online trading involves risks and a chance of losing all your invested US dollars.

Article Sources

- National Futures Association (NFA)

- Commodity Futures Trading Commission (CFTC)

- NFA's Background Affiliation Status Information Center (BASIC)

- NFA Enforcement And Registration Actions

- NFA Fines StoneX $100K For Multiple Violations

- NFA's Action Against Trinity Trading Group - TTP

- NFA's Rulebook Table Of Contents

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com