Canadian Investment Regulatory Organization (CIRO) Brokers 2024

Do you want to day trade in Canada? Choose a broker regulated by the Canadian Investment Regulatory Organization (CIRO), a ‘green tier’ body in DayTrading.com’s Regulation & Trust Rating, for a secure experience.

Immerse yourself in our choice of the best CIRO-regulated brokers to find the right trading platform for your needs. We’ve checked that every provider is authorized in CIRO’s database of ‘Dealers We Regulate‘.

Best CIRO Brokers

After years of testing and retesting, we've determined these 1 CIRO-authorized trading platforms are the top choices in December 2024, offering a secure environment for active Canadian traders at every level:

-

1

Interactive Brokers

Interactive Brokers

Ratings/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5

$0$1001:50FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFMStocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, CryptocurrenciesTrader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentralCheque, ACH Transfer, Wire Transfer, Automated Customer Account Transfer Service, TransferWise, Debit CardUSD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF

Here is a summary of why we recommend these brokers:

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

CIRO Brokers Comparison

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- IBKR continues to deliver unmatched access to global stocks with tens of thousands of equities available from 100+ market centres in 24 countries, most recently the Saudi Stock Exchange.

- While primarily geared towards experienced traders, IBKR has made moves to broaden its appeal in recent years, reducing its minimum deposit from $10,000 to $0.

- There's a vast library of free or paid third-party research subscriptions catering to all types of traders, plus you can enjoy commission reimbursements from IBKR if you subscribe to Toggle AI.

Cons

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

Methodology

To find the top trading platforms regulated by the CIRO, we:

- Took our developing library of 216 brokers to find those claiming CIRO regulation.

- Punched their details into CIRO’s portal of ‘Dealers We Regulate’ to confirm they are actually authorized.

- Used the results plus findings from our hands-on tests and 200+ data entries to rank the top CIRO brokers.

How Can I Check If My Broker Is CIRO-regulated?

It takes just a few minutes to check if a broker is CIRO-regulated by following these simple steps:

- Visit CIRO’s Official Website: Head to the website of the Canadian Investment Regulatory Organization (CIRO). CIRO maintains an up-to-date list of all regulated firms and advisors so you can easily verify if an online broker is registered with them.

- Use The “Dealers We Regulate” Tool: CIRO provides a search tool on its website where you can look up a broker’s name or firm to confirm their registration status. This tool will show details about the broker’s licensing, status, and any disciplinary actions taken.

- Check For Disclosures And Certificates: In our experience, regulated brokers often display their CIRO membership details on their website, usually in the footer or an “About Us” section. You should also find clear disclosures that confirm CIRO regulation.

- Verify Through The Canadian Securities Administrators (CSA): CIRO operates under the umbrella of the CSA, which also maintains a national registration search tool. You can use the CSA’s website to cross-check a broker’s registration status, especially if you want additional verification.

- Contact CIRO Directly: If you have trouble finding your brokerage, you can reach out to CIRO’s customer support for assistance (the secure form is easy to use). They can confirm if a broker is regulated and provide additional information about their status.

Broker Check Example

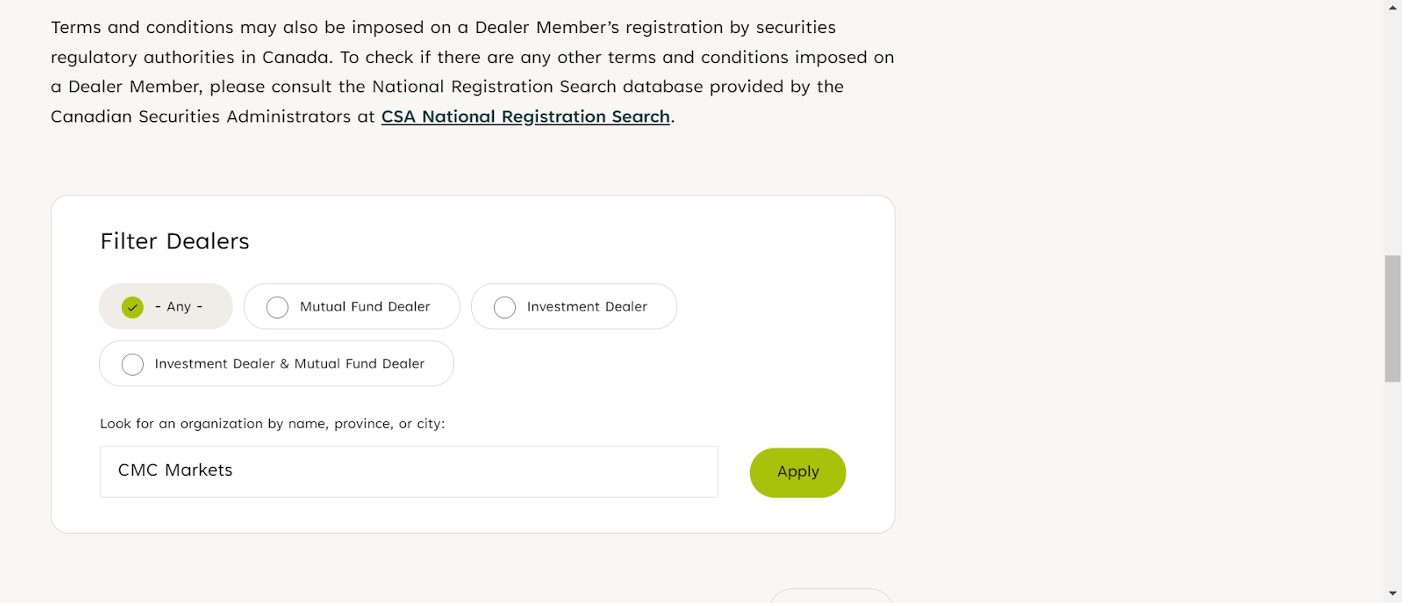

I’ll show you how I checked CMC Markets is indeed authorized by the CIRO.

Since 1989, CMC has been offering retail clients access to financial markets. In 2000, it became a CFD broker and prides itself on its compliance across many global jurisdictions. Still, for peace of mind, I want to be certain it’s regulated in Canada…

First, I went to the CIRO website, as you can see below.

Next, I looked for the section titled “Dealers We Regulate”. This is usually located in the navigation menu or under the “Regulatory” section.

In the search tool, I entered “CMC Markets”. This should bring up a list of regulated firms with the same or similar names.

I looked through the search results to see if CMC Markets appeared, and it did.

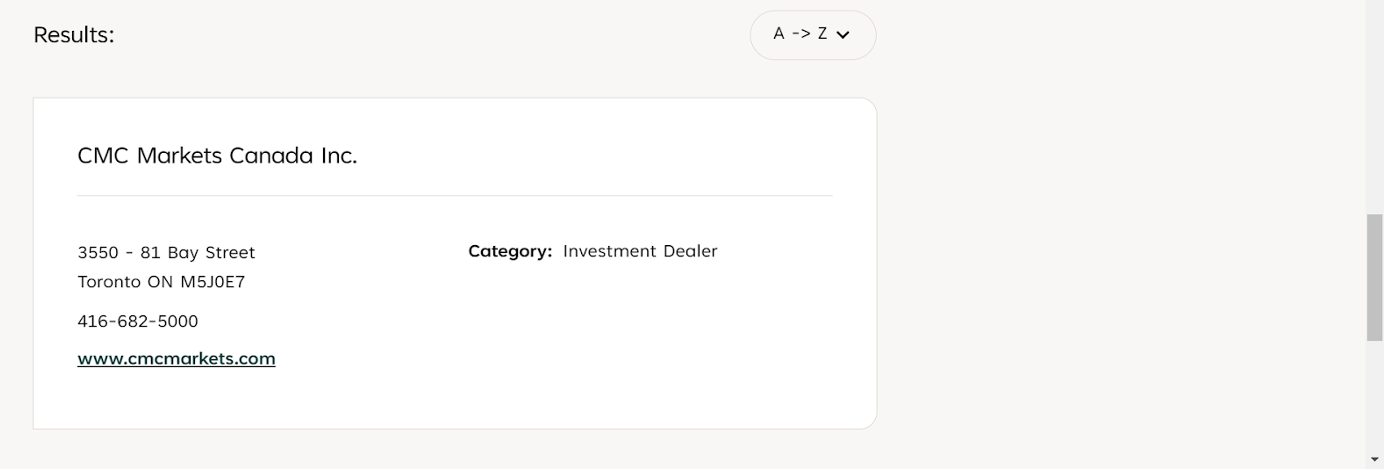

As you can see below, you should get details about their registration status, which may include: Registration number, Type of business (eg forex, CFD), and Status (active, suspended, etc).

I also clicked on the broker’s name for more detailed information, including any disciplinary actions, financial health reports, and compliance history.

For absolute certainty, I then verified CMC’s authorization details through external sources. I did this by entering CMC’s information in the Canadian Securities Administrators (CSA) website, which maintains a national registration search tool for additional verification.

What Is The CIRO?

The Canadian Investment Regulatory Organization, or CIRO, serves as Canada’s primary watchdog for investment dealers and marketplaces.

Formed by merging the Investment Industry Regulatory Organization of Canada (IIROC) and the Mutual Fund Dealers Association of Canada (MFDA) in 2023, CIRO’s primary goal is to safeguard investor interests while promoting a fair, transparent, and efficient financial market.

Here’s what CIRO focuses on:

- Investor Protection: CIRO ensures that brokers meet high ethical and operational standards, which helps protect active traders like me and you from fraud and misconduct.

- Market Integrity: CIRO promotes transparency and fairness by enforcing strict rules and performing regular inspections, which is crucial for market confidence.

- Financial Oversight: CIRO monitors the financial health of its regulated firms, ensuring they maintain the required levels of capital and liquidity. This oversight helps protect investors if a brokerage faces financial issues.

- Dispute Resolution: CIRO offers an impartial system for handling investor complaints, allowing day traders to address issues with their brokers without going through lengthy and painful legal processes.

What Powers Does CIRO Have?

CIRO has extensive powers to regulate, oversee, and enforce rules within Canada’s online trading industry:

- Rulemaking Authority: CIRO can set rules for brokers and investment firms, covering everything from ethical standards to operational requirements. These rules help ensure trading providers act in clients’ best interests and maintain transparency.

- Licensing and Registration: CIRO is responsible for registering investment dealers and advisors. If a firm or individual doesn’t meet CIRO’s standards, they can’t legally operate, which helps keep the industry clean and credible.

- Monitoring and Surveillance: CIRO actively monitors trading activities and financial transactions to detect suspicious behaviour, market manipulation, or insider trading. Through audits, surveillance, and ongoing reporting requirements, CIRO can spot and address risks early.

- Enforcement and Disciplinary Actions: When firms or individuals break the rules, CIRO can take corrective action, ranging from fines and suspensions to permanently banning brokers from the industry. This power is crucial for maintaining a level playing field and deterring misconduct.

- Investor Protection Fund: Through the Canadian Investor Protection Fund (CIPF), CIRO provides coverage up to CAD 1 million for investors if a broker goes bankrupt, offering a financial safety net that helps investors recover a portion of their assets in the case of firm insolvency.

- Complaint Resolution: CIRO has a formal system for resolving disputes between retail traders and brokers. It can conduct investigations, mediate issues, and enforce resolutions, giving investors a fair process to address grievances.

What Rules Must A CIRO Broker Follow?

A comprehensive set of rules binds CIRO-regulated brokers in Canada to maintain fairness, transparency, and integrity in their operations:

- Know Your Client (KYC): CIRO brokers must gather essential information about clients before trading on their behalf. This includes financial goals, risk tolerance, and investment knowledge to ensure suitable recommendations.

- Suitability of Investments: Brokers must ensure that any investments or trades they suggest align with the client’s financial profile and risk tolerance, even when clients request specific trades.

- Conflict of Interest Disclosure: Brokers must disclose potential conflicts of interest that could impact clients. This includes situations where brokers might benefit from recommending specific products or services.

- Client Relationship Documentation: CIRO brokers need to clearly document the client relationship, including fee structures, services offered, and risk factors. This ensures transparency and minimizes misunderstandings.

- Financial Reporting and Transparency: Brokers must provide clients with regular account statements and trade confirmations detailing all transactions, costs, and gains/losses. This keeps clients informed of the status of their investments.

- Capital and Financial Health Requirements: CIRO mandates that brokers maintain a minimum level of capital and liquidity to ensure financial stability. This rule helps protect client assets if a broker encounters financial issues.

- Cybersecurity and Data Protection: Brokers must take measures to safeguard client data and prevent cyber breaches. This includes adhering to specific data protection protocols and reporting any security incidents.

- Fair Dealing and Ethical Conduct: Brokers must prioritize clients’ best interests over personal or corporate gains. CIRO enforces strict ethical standards, requiring brokers to act honestly, fairly, and with integrity.

- Anti-Money Laundering (AML) Compliance: CIRO brokers must follow rigorous AML protocols, including client identification, monitoring for suspicious activities, and reporting as required by Canadian law.

- Leverage Limits: CIRO brokers must have leverage limits to protect retail traders from high-risk trades. This varies based on the volatility and risk of assets: typically 1:50 for major forex pairs, 1:20 for major indices, 1:10 for commodities, 1:5 for stocks and 1:2 or 1:3 for cryptocurrencies.

These rules collectively foster a secure, transparent, and ethical trading environment for investors in Canada, giving clients confidence in the brokers operating under CIRO’s regulatory framework.

Has CIRO Taken Action Against Brokers?

CIRO has significant “teeth” when enforcing its regulations. Here’s a list of forex or CFD brokers that CIRO has penalized over the years, along with the reasons for their punishments:

- FXCM Canada Ltd. Fine: $500,000. Reason: FXCM faced penalties for failing to adequately supervise its trading practices and providing misleading information about trading costs and potential client returns.

- OANDA Canada Corp. Fine: $300,000. Reason: OANDA was fined for deficiencies in its compliance program, including inadequate KYC procedures and not maintaining proper records related to client trades.

- Vantage FX. Fine: $150,000. Reason: Vantage was penalized for failing to ensure that its promotional materials accurately represented the risks involved in trading CFDs, leading to potential investor misunderstandings.

- IG Markets Ltd. Fine: $100,000. Reason: IG Markets was sanctioned for not adequately supervising its representatives and for deficiencies in its disclosure of risks related to CFD trading.

- AxiTrader. Fine: $50,000. Reason: Axi faced penalties for issues related to insufficient trading fees and commissions disclosure and not adequately addressing client complaints regarding their trading experience.

- City Index. Fine: $75,000. Reason: City Index was fined for misleading marketing practices that did not sufficiently disclose the risks associated with leveraged trading, including CFDs and forex.

Criticisms

Yet despite its proactive oversight of our industry, it’s not infallible.

One criticism surrounds potential conflicts of interest. As the organization is funded by its members and has many directors from licensed companies and entities, there is arguably cause for concern.

For example, how independent can the CIRO really be, and how robust will it be in terms of disciplining non-compliant firms?

This concern is backed up by common criticisms of the former IIROC and MDFA that relate to inconsistent enforcement actions. For instance, there have been times when the regulators have issued penalties that arguably did not correspond with the magnitude of the infraction or misconduct. This is in addition to instances where fines have been overturned completely.

So, while CIRO brokers are normally a safer bet than brokers that aren’t registered with the CIRO, we do not hold the financial body in the same regard as the very best regulators, such as the Financial Conduct Authority (FCA) in the UK.

Bottom Line

Taking over from the IIROC and MFDA, the CIRO is acting as an essential watchdog of online trading activities, enforcing standards that protect Canadian traders from fraud and ensuring that brokers operate with transparency and integrity.

Whether you’re an experienced trader or just starting, knowing CIRO’s regulatory framework helps foster a more secure trading environment. Always check a broker’s regulatory status and stay informed about your rights and protections as an investor.

To get started, turn to DayTrading.com’s selection of the top CIRO-regulated day trading platforms.

Article Sources

- Canadian Investment Regulatory Organization (CIRO)

- Dealers We Regulate - CIRO

- Canadian Investor Protection Fund (CIPF)

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com