New Zealand Financial Markets Authority (FMA) Brokers 2026

Once a relatively lax regulatory jurisdiction, attracting online trading scams, New Zealand overhauled its financial regulatory framework in 2011, introducing the Financial Markets Authority, or FMA.

New Zealand’s FMA now enforces strict rules for brokers, maintains a list of more than 195 unregistered firms, takes legal action against violators – notably handing out a $900,000 fine to Tiger Brokers – and frequently issues warnings for online investors, with over 600 alerts published.

Explore the best brokers regulated by New Zealand’s FMA. We’ve personally checked every platform recommended is authorized on the FMA’s Financial Services Register.

Top New Zealand FMA Brokers

These 6 FMA-regulated trading platforms stand out as the best for day traders:

-

1

BlackBull

BlackBull -

2

Plus50080% of retail CFD accounts lose money.

Plus50080% of retail CFD accounts lose money. -

3

Axi

Axi -

4

CMC Markets68% of retail CFD accounts lose money.

CMC Markets68% of retail CFD accounts lose money. -

5

MultiBank FX

MultiBank FX -

6

TMGM

TMGM

Here is a short summary of why we think each broker belongs in this top list:

- BlackBull - BlackBull is a New Zealand-based CFD broker providing diverse trading opportunities on over 26,000 instruments. After undergoing a rebrand in 2023, it now sports a modern look and feel complete with professional-grade trading tools and ultra-fast execution speeds averaging 20ms.

- Plus500 - Established in 2008 and headquartered in Israel, Plus500 is a prominent brokerage that boasts over 25 million registered traders in over 50 countries. Specializing in CFD trading, the company offers an intuitive, proprietary platform and mobile app. It maintains competitive spreads and does not charge commissions or deposit or withdrawal fees. Plus500 also continues to shine as one of the most trusted brokers with licenses from reputable regulators, including the FCA, ASIC and CySEC.

- Axi - Established in 2007, Axi is a multi-regulated forex and CFD broker that has made strides to improve its trading experience over the years, from expanding its suite of stocks and upgrading the Axi Academy to launching its own copy trading app.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

- MultiBank FX - MultiBank FX is an established broker offering forex and CFD products since 2005. With 20,000+ instruments, plenty of local payment methods and 24/7 multilingual customer support, the broker is a popular choice among traders globally. New clients can also access a variety of bonus offers and access the hugely popular MT4 and MT5 trading platforms.

- TMGM - TMGM is an ASIC-regulated forex and CFD broker with a vast range of tradeable assets covering forex, stock, index, crypto and commodity markets. The account types on offer provide a flexible choice between no commission or zero spreads, with competitive pricing all-round.

New Zealand FMA Brokers Comparison

| Broker | Regulated by FMA | NZD Account | Minimum Deposit | Markets |

|---|---|---|---|---|

| BlackBull | ✔ | ✔ | $0 | CFDs, Stocks, Indices, Commodities, Futures, Crypto |

| Plus500 | ✔ | - | $100 | CFDs on Forex, Stocks, Indices, Commodities, ETFs, Options, Crypto |

| Axi | ✔ | - | $0 | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| CMC Markets | ✔ | ✔ | $0 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting |

| MultiBank FX | ✔ | - | $50 | Forex, CFDs, indices, shares, metals, commodities, cryptocurrencies |

| TMGM | ✔ | ✔ | $100 | CFDs, Stocks, Energies, Indices, Metals, Cryptos, Forex |

BlackBull

"After improving its trading infrastructure with Equinix servers in New York, London, and Tokyo, reducing latency for traders, BlackBull is an obvious choice if you want to day trade stock CFDs with ECN pricing."

Christian Harris, Reviewer

BlackBull Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Stocks, Indices, Commodities, Futures, Crypto |

| Regulator | FMA, FSA |

| Platforms | BlackBull Invest, BlackBull CopyTrader, MT4, MT5, cTrader, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, ZAR, SGD |

Pros

- BlackBull is a much greater fit for aspiring traders following the overhaul of its ECN Prime account, now featuring improved spreads averaging 0.16 on EUR/USD and a more accessible minimum deposit of $0 compared to the old $2,000.

- BlackBull offers every ingredient for day traders; fast execution speeds of <100ms, leverage up to 1:500, and tight spreads from 0.0 pips.

- BlackBulls’s research is superb, especially the daily ‘Trading Opportunities’ articles that break down complex market movements into easy-to-understand insights, making it simpler to capitalize on emerging trends.

Cons

- Although the Education Hub now features improvements like webinars and tutorials, the courses we’ve explored need more focus on explaining the wider economic factors influencing prices.

- Unlike most top brokers, BlackBull charges an irritating $5 withdrawal fee, which can detract from the overall cost-effectiveness, especially for active traders who frequently move funds.

- Despite a growing selection of 26,000+ assets, including additions to its Asia Pacific indices, they are mainly stocks with an average selection of currency pairs and indices.

Plus500

"Plus500 offers a super-clean experience for traders with a CFD trading platform that sports a modern design and dynamic charting. That said, the broker’s research tools are limited, fees trail the cheapest brokers, and there’s room for enhancement in its educational resources."

Christian Harris, Reviewer

Plus500 Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, ETFs, Options, Crypto |

| Regulator | FCA, ASIC, CySEC, DFSA, MAS, FSA, FSCA, FMA, EFSA |

| Platforms | WebTrader, App |

| Minimum Deposit | $100 |

| Minimum Trade | Variable |

| Leverage | Yes |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, CZK |

Pros

- Plus500 provides a specialized WebTrader platform designed explicitly for CFD trading, offering a clean and uncluttered interface

- The broker offers low commission trading on a diverse range of markets, minimizing additional fees while appealing to established traders

- Plus500 has recently bolstered its suite of short-term trading products, including introducing VIX options with enhanced volatility and extended hours trading on 7 stock CFDs

Cons

- The absence of social trading means users can’t follow and replicate the trades of experienced traders

- Algo trading and scalping are not supported, which may deter some day traders

- Plus500’s lack of support for MetaTrader or cTrader charting tools might be a deal breaker for advanced day traders looking for familiarity

Axi

"Axi is a stand-out option if you want to day trade forex on the MetaTrader 4 platform thanks to the broker’s growing selection of 70+ currency pairs, the MT4 NextGen upgrade, and tight spreads from just 0.2 pips if you opt for the Pro account."

Christian Harris, Reviewer

Axi Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, ASIC, FMA, DFSA, SVGFSA |

| Platforms | Axi Copy Trading, MT4, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CHF, PLN |

Pros

- Axi offers a terrific MT4 experience, enhanced with the NextGen plug-in for advanced order management and analytics, and complete with low execution latency of approximately 30ms.

- Advanced traders can now sign up for the Axi Select funded trader program through the broker’s offshore entity, providing funding up to $1 million with a 90% profit share.

- The growing educational resources in the Axi Academy, including free eBooks, video tutorials and notably interactive quizzes, are excellent for supporting beginner traders.

Cons

- Axi still has our confidence but issues with the ASIC and FMA in recent years mean it needs to continue providing a secure environment while adhering to licensing conditions.

- Despite bolstering its stock CFDs in US, UK and EU markets, it’s still nowhere near as extensive as firms like BlackBull which offer thousands of equities for diverse opportunities.

- Axi is falling behind by only offering MT4 when many rivals now support MT5, cTrader, TradingView and proprietary software for a slicker experience with more advanced tools.

CMC Markets

"With advanced charting tools and an extensive range of tradable CFDs, including an almost unrivalled selection of currencies and custom indices, CMC Markets provides a fantastic online platform for traders of all levels. "

Christian Harris, Reviewer

CMC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting |

| Regulator | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Platforms | Web, MT4, TradingView |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SEK, NOK, SGD, PLN |

Pros

- The CMC web platform delivers a fantastic user experience with advanced charting tools for day trading and customizable features, catering to both beginners and experienced traders. MT4 (but not MT5) and TradingView (added in 2025) are also supported.

- We've bumped up its 'Assets & Markets' rating after almost monthly product additions in early 2025, from extended hours trading on US stocks to new share CFDs.

- CMC Markets is heavily regulated by reputable financial authorities and maintains its stellar reputation, helping to ensure a secure and trustworthy trading environment.

Cons

- An inactivity fee of $10 per month is applied after 12 months of inactivity, which may deter casual investors.

- Despite improvements, the web platform still requires enhancements to make it as intuitive to trade on as software from rivals like IG.

- While CMC offers an above-average suite of assets, there is no support for trading real stocks and UK clients can’t trade cryptocurrencies.

MultiBank FX

"MultiBank FX is a great option for active forex traders with 55 currency pairs, spreads from 0.0 pips and high leverage up to 1:500."

Tobias Robinson, Reviewer

MultiBank FX Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, indices, shares, metals, commodities, cryptocurrencies |

| Regulator | SCA, MAS, CySEC, ASIC, AUSTRAC, BaFin, FMA, FSC, CIMA, TFG, VFSC |

| Platforms | MultiBank-Plus, MT4, MT5, cTrader |

| Minimum Deposit | $50 |

| Minimum Trade | 0.1 Lots |

| Leverage | 1:500 |

Pros

- MultiBank has a global presence with 10+ regulatory licenses, including ASIC (Australia) and MAS (Singapore), boosting its trust score

- MultiBank is expanding its presence in the Middle East with an Abu Dhabi office and stock CFDs from the Dubai Financial Market (DFM) and Abu Dhabi Securities Exchange (ADX)

- There's MAM, PAMM and FIX API access for high-volume or pro traders, plus EAs and VPS hosting for algorithmic trading, making it a solid broker for serious traders

Cons

- The education and market research from MultiBank still needs work, trailing the best brokers in this category like IG and XTB

- The $5,000 minimum deposit required to access the tightest ECN spreads makes for a high entry barrier for many retail traders

- MultiBank charges a $60 monthly inactivity fee, which is significantly higher than the industry average from our broker tests

TMGM

"TMGM is a great all-round choice thanks to its huge range of assets, diverse account types and platform choices, plus competitive pricing."

Tobias Robinson, Reviewer

TMGM Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Stocks, Energies, Indices, Metals, Cryptos, Forex |

| Regulator | ASIC, FMA, VFSC |

| Platforms | MT4, MT5, TradingView, TradingCentral |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD |

Pros

- Free VPS for automated trading

- Good range of rewards and bonuses offered through a points-based loyalty system

- Well-regulated and reputable brand with a solid client base

Cons

- $30 fee levied monthly on accounts which are inactive for 6 months or have a balance below $500

- Shares are only available on the IRESS account, and not tradeable via MT4 and MT5

Methodology

To pinpoint the top brokers regulated in New Zealand, our experts:

- Leveraged our directory of 140 brokers to find those claiming to be authorized by the FMA

- Entered their details in the FMA’s register to confirm they were licensed in New Zealand

- Sorted them by their rating, combining 100+ quantitative entries with our qualitative findings

How Can I Check A Broker Is Regulated In New Zealand?

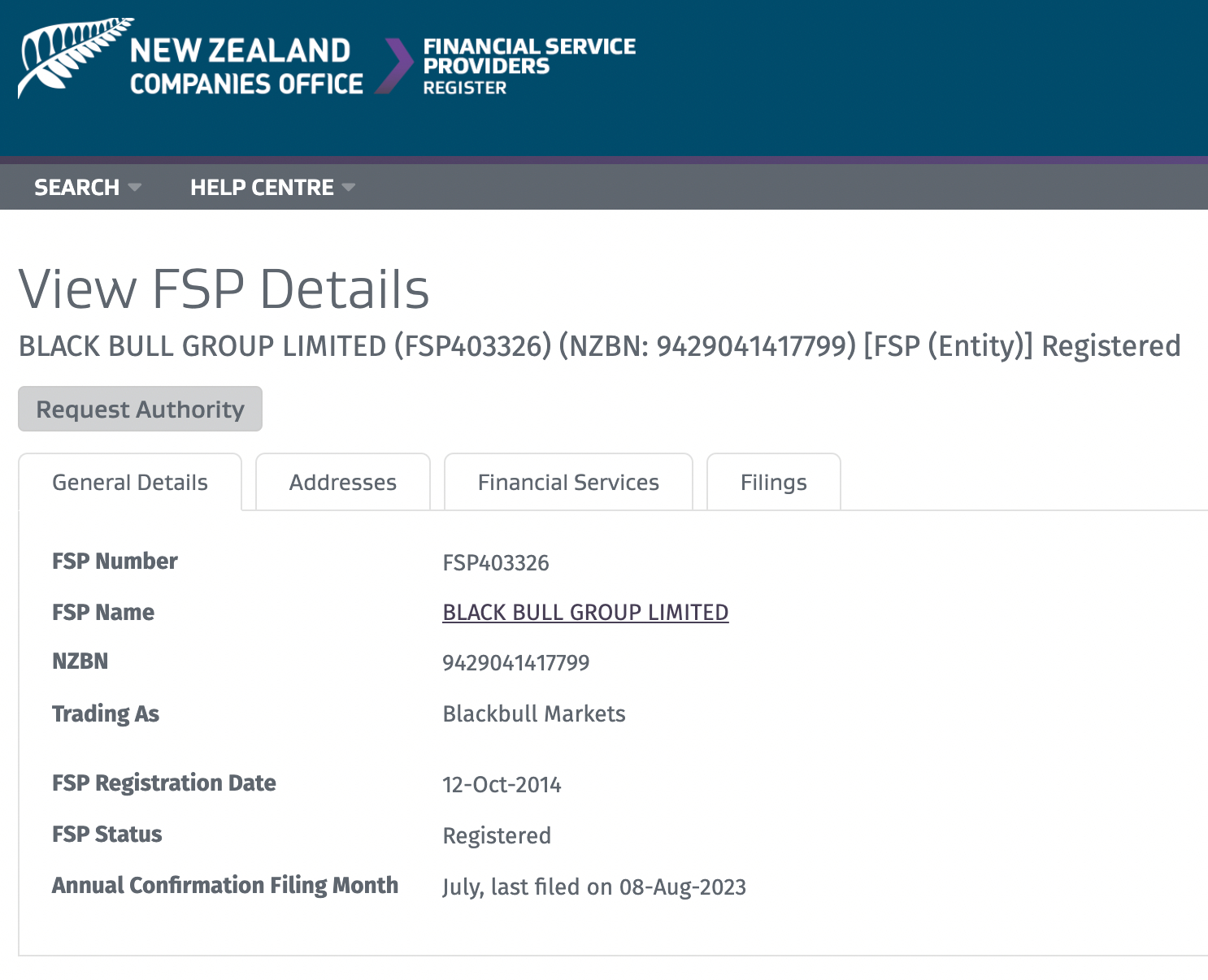

You can check whether a broker is regulated by the FMA by following these three steps, which we took to verify the credentials of every recommended platform:

- Open the FMA’s Financial Services Register

- Type in the broker’s name, FSP number or NZBN number (usually found in the footer of brokers’ websites) and click ‘search’

- Click on the returned results to check their status is listed as ‘Registered’ and to view details like ‘Registration Date’ and ‘Financial Services’

As an example, you can see I verified that BlackBull Markets is regulated by the FMA below.

New Zealand-based BlackBull continues to offer the best selection of instruments I’ve seen after years testing online brokers, with 26,000+ tradable assets on powerful charting platforms.

With execution speeds averaging less than 20 milliseconds combined with ECN pricing delivering spreads from 0.0 pips, BlackBull delivers one of the most optimal environments for day trading I’ve experienced.

What Rules Must FMA-Regulated Brokers Follow?

The New Zealand Financial Markets Authority (Te Mana Tātai Hokohoko in Maori) has strengthened its Broker Obligations over the years. Among the key requirements and safeguards for traders include:

- Brokers must meet minimum capital requirements, typically NZ$1 million, aligning with rules in the European Union.

- Brokers must be part of the Financial Dispute Resolution Service (FDRS), providing a mechanism to settle disputes between brokerages and traders.

- Brokers must not offer leverage trading beyond 1:500, noticeably higher than tightly regulated trading jurisdictions like Australia and the UK where it’s 1:30.

- Brokers must maintain segregated accounts to keep client money and company capital separate.

- Brokers must provide negative balance protection so traders can’t lose more than their deposit.

- Brokers must have an office and at least one director based in New Zealand.

- Brokers must process KYC and AML checks from their New Zealand office.

- Brokers must register as a Financial Services Provider (FSP).

What Powers Do the FMA Have?

Brokers that fail to follow the FMA’s rules risk legal consequences, with New Zealand’s regulator demonstrating a willingness to take proactive action against various trading platforms in recent years.

- The FMA can issue public warnings about unregistered brokers and firms potentially operating trading scams. For example, in 2024 it issued a warning about Prospero Markets after learning it was offering CFD trading products (popular with day traders) without an FSP license.

- The FMA can issue fines and deregister non-compliant brokers. For example, in a high-profile case in 2023, it fined Tiger Brokers $900,000 for “multiple AML/CFT Act breaches”.

- The FMA can educate investors about the risks of online trading and fraudulent platforms. For example, it operates social media channels, notably X (formerly Twitter) and YouTube, teams up with partners like KiwiSaver, and runs campaigns on trending topics, such as ethical investing.

Bottom Line

New Zealand has stepped up its regulatory oversight of online brokers in recent years, with its FMA now on an equal footing with financial bodies like the ASIC in Australia.

For New Zealand residents, opening an account with an FMA-regulated broker is highly advisable. This should give you confidence that the brokerage can be trusted and operates a fair and transparent trading environment.

Still, it’s important to note online trading remains risky, regardless of whether your broker is regulated in New Zealand or not. You risk losing all the New Zealand Dollars you invest.

Article Sources

- New Zealand Financial Markets Authority (FMA)

- Licensed and Reported Entities - FMA

- Unregistered Businesses - FMA

- Warnings and Alerts - FMA

- $900,000 Tiger Brokers Fine - FMA

- Broker Obligations - FMA

- Report A Scam - FMA

- Prospero Markets Warning - FMA

- Ethical Investing Campaign - FMA

- FMA - X

- FMA - YouTube

- KiwiSaver

- Financial Dispute Resolution Service (FDRS)

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com