Financial Market Supervisory Authority (FINMA) Brokers 2025

The Financial Market Supervisory Authority (FINMA) oversees brokers and trading platforms in Switzerland.

Despite criticism that it didn’t do enough to prevent the 2023 collapse of Credit Suisse and no powers to issue fines, FINMA remains a ‘green-tier’ regulator in our Regulation & Trust Rating, with strong safeguards for traders.

Delve into DayTrading.com’s selection of the best brokers regulated by Swiss FINMA. We’ve verified that every platform is authorized on FINMA’s database of Banks and Securities Firms.

Top FINMA Brokers

After our latest hands-on tests in April 2025, these 4 FINMA-regulated trading platforms are superior:

Here is a short summary of why we think each broker belongs in this top list:

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy - Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

- Saxo Bank - Saxo Markets is a multi-award-winning trading brokerage, investment firm and regulated bank. With a huge 72,000+ trading instruments, plus investment products and managed portfolios, clients have no shortage of opportunities. The trusted brand also offers transparent pricing and top-tier regulatory protection from 10+ agencies including FINMA, FCA & ASIC.

FINMA Brokers Comparison

| Broker | Regulated by FINMA | CHF Account | Minimum Deposit | Markets |

|---|---|---|---|---|

| Interactive Brokers | ✔ | ✔ | $0 | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Dukascopy | ✔ | ✔ | $100 | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Swissquote | ✔ | ✔ | $1,000 | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) |

| Saxo Bank | ✔ | ✔ | - | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures, options, warrants, bonds, ETFs |

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- The TWS platform has clearly been built for intermediate and advanced traders and comes with over 100 order types and a reliable real-time market data feed that rarely goes offline.

- With low commissions, tight spreads and a transparent fee structure, IBKR delivers a cost-effective environment for short-term traders.

- There's a vast library of free or paid third-party research subscriptions catering to all types of traders, plus you can enjoy commission reimbursements from IBKR if you subscribe to Toggle AI.

Cons

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

Dukascopy

"If you’re an experienced trader, Dukascopy provides the tools you need: JForex for algorithmic strategies, competitive spreads from 0.1 pips, leverage up to 1:200, and the peace of mind of using a Swiss-regulated bank and broker."

Christian Harris, Reviewer

Dukascopy Quick Facts

| Bonus Offer | 10% Equity Bonus |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Regulator | FINMA, JFSA, FCMC |

| Platforms | JForex, MT4, MT5 |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:200 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, ZAR, TRY, SEK, NOK, DKK, CHF, HKD, SGD, PLN, CZK, AED, SAR, HUF, MXN |

Pros

- Dukascopy offers tight spreads starting from 0.1 pips, leverage up to 1:200 (depending on the jurisdiction), and volume-based commissions that reward high-frequency traders.

- Dukascopy is regulated by the Swiss Financial Market Supervisory Authority (FINMA) as both a broker and a bank, ensuring top-tier financial security and adherence to strict standards.

- Dukascopy features some of the best research we’ve seen, even a professional TV studio in Geneva covering financial news, market analysis, and daily insights from professionals.

Cons

- While Dukascopy provides some educational resources and 24/7 support, the complexity of its platforms and tools required extensive testing and may overwhelm newer traders.

- Dukascopy's withdrawal fees are higher than most competitors we’ve tested, particularly for bank wire transfers, which may deter traders who require frequent access to their funds.

- Some account types, such as the MT4/MT5 accounts, require a higher minimum deposit of $1,000, which may not be ideal for traders with smaller budgets.

Swissquote

"Swissquote is an excellent choice for active traders looking for a customizable platform, such as its CXFD, which integrates Autochartist for automated chart analysis to aid trading decisions. However, its average fees and steep $1,000 minimum deposit might make it less accessible for beginner traders."

Christian Harris, Reviewer

Swissquote Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) |

| Regulator | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA |

| Platforms | CFXD, MT4, MT5, AutoChartist, TradingCentral |

| Minimum Deposit | $1,000 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:100 (Retail), 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, ZAR, TRY, SEK, NOK, CHF, HKD, SGD, PLN, AED, SAR, HUF, THB, QAR, MXN |

Pros

- Swissquote supports powerful platforms for day trading, such as MetaTrader 4/5 and its own CFXD (previously known as Advanced Trader) which impressed during testing with customizable layouts and access to advanced charting tools and technical indicators.

- Swissquote is built for fast-paced trading strategies like day trading, scalping and high-frequency trading with 9ms average execution speeds, a 98% fill ratio, and FIX API.

- Swissquote is highly trusted owing to its position as a bank, its listing on the Swiss stock exchange, and authorization from trusted bodies like FINMA in Switzerland, FCA in the UK, and CSSF in Luxembourg.

Cons

- Swissquote primarily caters to pro and high-net-worth clients, with high minimum deposit requirements (eg $1,000 for Standard accounts), making it less suited for smaller traders who can find higher leverage at the growing number of brokers with no minimum deposit.

- Unlike brokers such as eToro with social trading features, Swissquote lacks tools for community engagement or copying successful traders, limiting its appeal for those who value peer-to-peer learning.

- Analysis shows Swissquote’s fees are on the high side, with forex spreads starting at 1.3 pips on Standard accounts, compared to 0.0 pips at brokers like Pepperstone or IC Markets. Transaction fees for non-Swiss stocks and ETFs can also add up for frequent traders.

Saxo Bank

"Saxo is best for active traders and high-volume investors with an unrivalled selection of instruments alongside premium market research and fee rebates. The 190 currency pairs with tight spreads also make Saxo great for forex traders."

Tobias Robinson, Reviewer

Saxo Bank Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures, options, warrants, bonds, ETFs |

| Regulator | DFSA, MAS, FCA, SFC, FINMA, AMF, CONSOB |

| Platforms | TradingView, ProRealTime |

| Minimum Trade | Vary by asset |

| Leverage | 1:30 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, SEK, DKK, CHF |

Pros

- Low fees with premium account tiers

- Powerful proprietary trading platforms with comprehensive charting packages and advanced analysis tools

- High-level research hub with curated market research, plus unique insights with 'Outrageous Predictions'

Cons

- High funding requirements for the trading accounts

- Clients from some jurisdictions not accepted including the US and Belgium

- Access to Level 2 pricing requires a subscription

Methodology

To list the top brokers regulated in Switzerland, we:

- Used our library comprising 223 brokers to identify those professing to be regulated by FINMA.

- Ran their details through FINMA’s online register to check they were authorized.

- Ranked them by their overall rating, blending 200+ data points with the direct experiences of our testers.

How Can I Check If A Broker Is Regulated By FINMA?

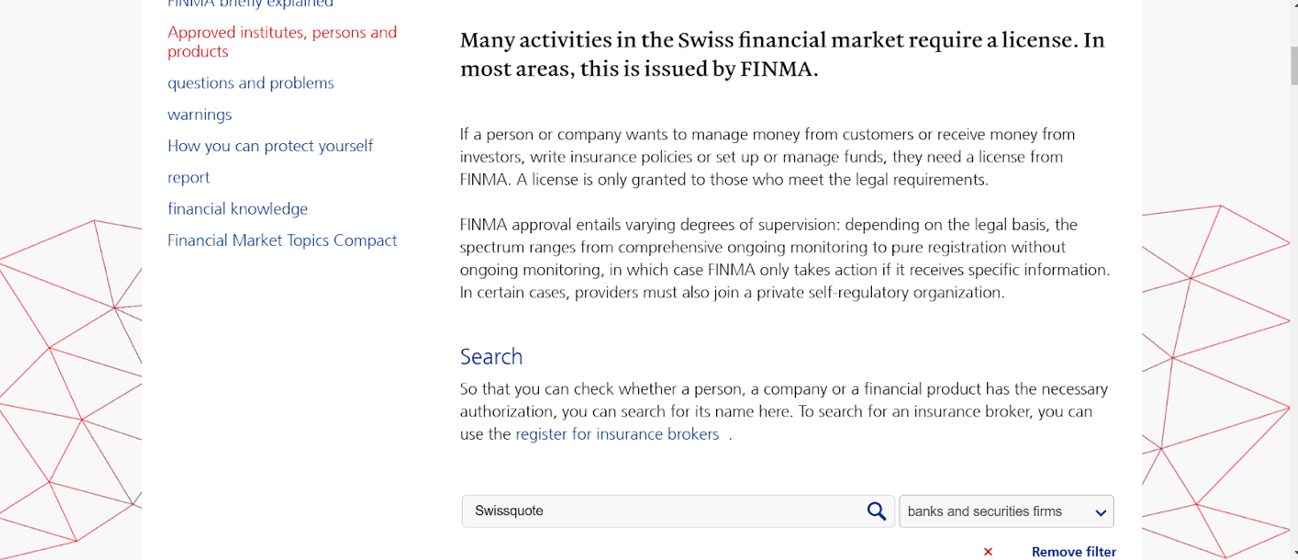

Verifying if a broker is FINMA-regulated is an essential step to ensure your funds and trades are secure. Here’s a step-by-step guide to check a broker’s regulatory status with FINMA, using Swissquote as an example.

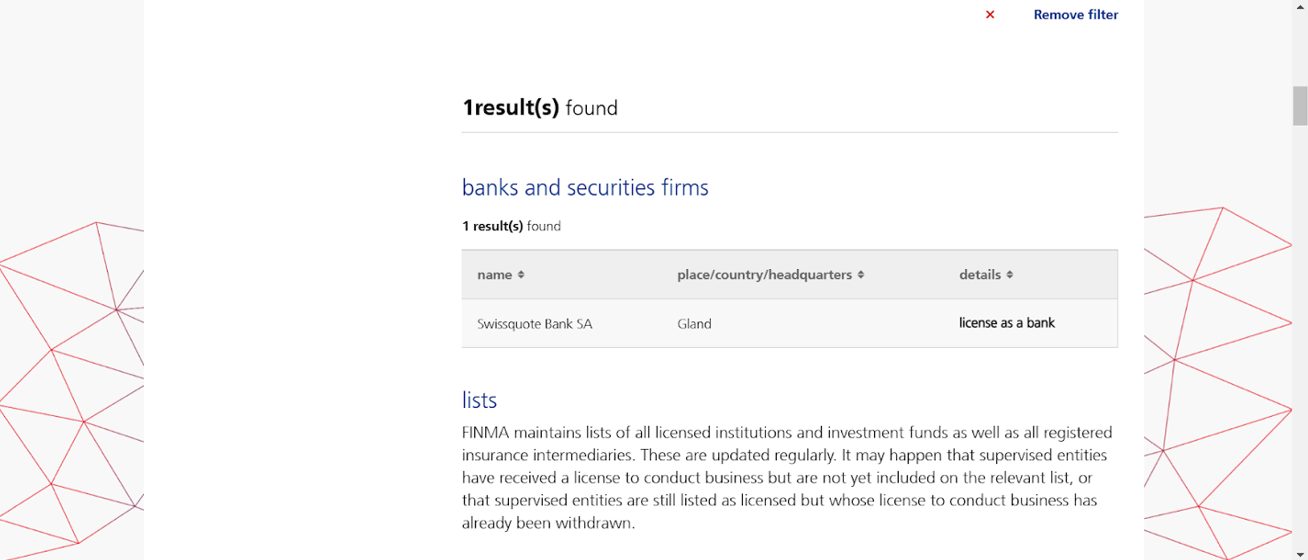

Swissquote Group Holding SA is a Swiss banking group that provides online financial and trading services. The Group’s shares have been listed on the SIX Swiss Exchange under the SQN ticker since 29 May 2000.

It has all the hallmarks of an incredibly successful broker, with strict compliance and regulation in many jurisdictions worldwide. Its headquarters are located in Gland, Switzerland.

On its website, Swissquote Bank Ltd. states that it holds a banking licence issued by its supervisory authority, the Swiss Financial Market Supervisory Authority (FINMA), and is a member of the Swiss Bankers Association (SBA).

1. Visit The FINMA Website

Go to FINMA’s official website: www.finma.ch.

FINMA maintains a public database of all regulated financial institutions and intermediaries.

2. Access The Authorised Or Registered Institutes, Persons And Products Section

On the home page’s top navigation, navigate to the section dedicated to supervised institutions, titled Approval.

Hover over the approval button, and you will see a mega navigation with the section titled Authorised or Registered Institutes, Persons, and Products Section.

Look for the FINMA Public Register, which contains all entities licensed by FINMA.

3. Search For The Broker

Enter the broker’s name or company registration number in the search bar. For example, I typed Swissquote Bank Ltd.

Be precise with the spelling of the broker’s name to avoid missing results.

4. Verify Licensing Details

If the broker is FINMA-regulated, their details will appear in the search results.

For example, once I located Swissquote in the results, I confirmed the following:

- Name: Ensuring the broker’s full name matches its official website and communications.

- License Type: Checking the details for a banking or securities trading license, which is standard for Swissquote.

- Address: Verifying that the address aligns with Swissquote’s official office location in Switzerland.

5. Cross-Check On The Broker’s Website

Legitimate brokers often mention their FINMA license number or reference their regulation status on their official website, usually in the footer or “About Us” section.

For example, I visited Swissquote’s official website (www.swissquote.com) and located their regulatory disclosures. I then confirmed that their FINMA license details matched the information in the FINMA Public Register.

6. Watch For Red Flags

- Unlisted Broker: If the broker doesn’t appear in the FINMA database, it’s not regulated by FINMA.

- Mismatch In Details: If the broker’s information doesn’t align with the FINMA listing, it could be a fraudulent claim of regulation.

7. Contact FINMA For Confirmation

If you’re unsure, you can directly contact FINMA via their official contact channels. Provide the broker’s details and request verification of their regulatory status.

What Is FINMA’s Goal?

FINMA’s purpose extends beyond regulation; it serves as the cornerstone of Switzerland’s financial system, fostering trust and resilience across the industry.

Its primary purpose can be understood through five key dimensions:

- Strengthening Trust in the Financial System – FINMA ensures that Switzerland remains a global leader in financial integrity. By enforcing compliance with national and international laws, it cultivates trust among investors, institutions, and the broader public, both domestically and internationally.

- Protecting Market Participants – One of FINMA’s core missions is safeguarding the interests of individuals and businesses that interact with financial institutions. This includes:

- Ensuring banks, insurance companies, and financial service providers operate responsibly and remain solvent.

- Protecting consumers from fraudulent activities, excessive risks, or financial misconduct.

- Promoting Financial Stability – As a regulator, FINMA mitigates risks that could threaten the entire financial ecosystem. This involves:

- Supervising critical institutions, such as banks and insurers, to ensure they are well-capitalized and can withstand economic shocks.

- Implementing recovery and resolution plans to address potential crises with minimal disruption.

- Facilitating a Transparent and Competitive Market – FINMA fosters a fair playing field by preventing practices like insider trading, market manipulation, or money laundering. It ensures all participants adhere to the rules, promoting healthy competition and innovation without compromising integrity.

- Adapting to Emerging Trends and Challenges – In today’s fast-evolving financial landscape, FINMA stays proactive by addressing challenges like digital assets, fintech innovations, and cybersecurity threats. Its purpose includes fostering sustainable growth while managing risks associated with new technologies and global market trends.

Who Is FINMA Answerable To?

FINMA operates as an independent authority, but it’s not entirely on its own – it’s answerable to the Swiss government and, ultimately, the Swiss public.

Here’s how it fits into the bigger picture:

- The Swiss Federal Government – While FINMA is independent in its day-to-day operations, it answers to the Federal Department of Finance (FDF) when it comes to overarching strategies and accountability. The FDF oversees FINMA’s adherence to its legal mandate, ensuring it aligns with Switzerland’s broader financial and economic policies.

- The Swiss Parliament – FINMA also reports to the Swiss Parliament. It provides detailed annual reports to demonstrate how it has fulfilled its responsibilities. This transparency ensures lawmakers – and, by extension, the public – can scrutinise its performance.

- Swiss Laws and Regulations – FINMA is bound by the laws outlined in the Swiss Financial Market Supervision Act (FINMASA) and related regulations. These laws clearly define its duties, powers, and limitations.

- Public Accountability – Although FINMA doesn’t answer directly to the public, its work is inherently tied to protecting the public’s interest. By maintaining financial stability, ensuring transparency, and enforcing fair practices, FINMA is indirectly answerable to every individual and business relying on a trustworthy Swiss financial system.

FINMA’s independence is critical to its effectiveness, allowing it to act without political interference.However, its accountability to the government, parliament, and legal framework ensures its actions align with the nation’s goals and the public’s trust.

What Rules Must FINMA-Regulated Brokers Follow?

Brokers regulated by FINMA must adhere to a range of rules to safeguard the Swiss financial sector and its participants, including active traders.

FINMA brokers also normally have to be registered as banks, requiring higher levels of financial transparency and capital requirements than alternative trading jurisdictions.

Brokers must:

- Prioritise clients’ best interests and avoid conflicts of interest. For example, market-making brokers cannot manipulate market conditions to benefit themselves at traders’ expense.

- Provide compensation through esisuisse, insuring traders against losses of up to CHF 100,000 should a broker face insolvency issues.

- Adhere to strict anti-money laundering (AML) rules, verifying their clients’ identities and monitoring transactions to detect suspicious activities.

- Evaluate the suitability of financial products before executing orders, ie taking into account day traders’ risk tolerance.

- Clearly communicate the risks of financial products, key for short-term traders where the risk of losses is high.

- Offer clients full access to their account details, ensuring traders always know their positions and balances.

- Not use client funds for operating purposes like most heavily regulated jurisdictions.

- Routinely submit financial statements, risk assessments and other info to FINMA.

- Demonstrate they have sufficient starting capital, at least CHF 1,500,000.

- Be based in Switzerland to secure a license from FINMA.

- Execute trades fairly and at the best available market prices.

- Have a robust system in place for handling client complaints.

What Powers Does FINMA Have?

The array of financial services laws empower FINMA to act against non-compliant financial services providers and online brokers with the Administrative Procedure Act (APA) laying out the respective process.

Chief tools at its disposal include its warning list, with FINMA regularly adding unauthorized trading platforms, for example, MarginsTrade and Pocket Measure.

It can also take precautionary measures, where it can appoint investigating agents to clarify facts, implement measures and even act in place of management.

Alternatively, FINMA can mandate internal processes be followed, restrict certain trading activities and require management changes. Additionally, FINMA can ban unauthorized firms from continuing to deal in financial securities.

Yet unlike prominent regulators such as the FCA and ASIC, FINMA cannot issue fines.

Enforcement Actions

FINMA has taken various enforcement actions against financial firms over the years, demonstrating its ability to effectively regulate and supervise the Swiss financial market.

Here are some notable examples:

Credit Suisse

- Background: FINMA had extensively supervised Credit Suisse over the years, particularly following multiple scandals and risk management failures. FINMA has imposed a series of measures to address deficiencies, such as reprimands, restrictions on business activities, and mandates for increased capital and liquidity buffers.

- Key Actions: In response to ongoing issues like poor governance and inadequate risk management, FINMA conducted 43 preliminary investigations and filed 16 criminal charges. In addition, the regulator forced the bank to adjust its strategy and governance structures multiple times. Despite these measures, Credit Suisse’s collapse in 2023 highlighted the limits of FINMA’s supervisory tools in such a large-scale crisis.

Swiss Banks And Anti-Money Laundering (AML) Violations

- Background: FINMA has cracked down on several Swiss financial institutions for breaches of AML regulations. For instance, in 2019, FINMA imposed sanctions on Swiss banks for failing to take adequate steps to prevent money laundering activities.

- Key Actions: The regulator required several banks to improve their AML practices. In some cases, it issued public reprimands, and in more severe cases, imposed fines and even banned certain activities to ensure better compliance with international financial crime prevention standards.

HSBC Breach Of Due Diligence

- Background: FINMA took action against HSBC Private Bank Switzerland over a “serious breach” in PEP due diligence. The division is said to have engaged in two high-risk business relationships, for which it executed several high-risk transactions totalling over $300 million between 2002 and 2015.

- Key Actions: The Swiss Financial Market Supervisory Authority (FINMA) has taken action against the Swiss arm of HSBC’s private banking division after dealing with two politically exposed persons (PEPs) allegedly violating the country’s financial market law.

The Case Of Julius Baer (2018)

- Background: Swiss bank Julius Baer faced scrutiny from FINMA for its involvement in illicit practices, particularly about clients involved in corrupt activities and tax evasion.

- Key Actions: FINMA imposed regulatory measures on Julius Baer, including an order to strengthen its compliance systems, particularly in AML and client due diligence. The bank was also required to ensure more robust controls and reporting mechanisms.

FINMA has also been ramping up its responses to concerned investors. In 2023, it replied to over 7,000 enquiries (up from 6,000 in 2022), with 1,600 complaints relating to “unauthorized financial market participants, who had frequently misled their investors about being located in Switzerland or about possessing a FINMA licence.”

It also maintains a warning list of over 1,575 unlicensed providers.

Bottom Line

If you’re a Swiss trader, signing up with a FINMA-regulated broker should provide peace of mind that the trading firm is held to a high level of financial transparency.

That said, very few brokers are regulated by FINMA (less than 5% we’ve evaluated), reducing your choice.

Also, Swiss-regulated brokers cannot protect against the risk that you could lose the money you deposit, especially with fast-paced strategies like day trading. So only risk what you can afford to lose.

To get started, check out DayTrading.com’s pick of the top FINMA brokers in Switzerland.

Article Sources

- Financial Market Supervisory Authority (FINMA)

- Warning List - FINMA

- Authorized Banks and Securities Firms - FINMA

- Financial Markets Laws - FINMA

- Administrative Procedure Act (APA) - FINMA

- Reporting an Incident - FINMA

- 2023 Annual Reports - FINMA

- Swiss Financial Watchdog Calls For Stronger Powers After Credit Suisse Crash - Bloomberg

- esisuisse

- Federal Department of Finance (FDF)

- Swiss Financial Market Supervision Act (FINMASA)

- Swiss Bankers Association (SBA)

- Swissquote Group Holding SA

- SIX Swiss Exchange SQN Ticker - Investing.com

- Federal Department of Finance (FDF)

- FINMA publishes report and lessons learned from the Credit Suisse crisis - FINMA

- Money laundering: FINMA concludes final proceedings connected with Venezuela

- FINMA takes action against HSBC Private Bank Switzerland over “serious breach” in PEP due diligence - Fintech Futures

- Julius Baer Probed by Regulator Finma Over Signa Risk Lapses - SwissInfo

- Violations of anti-money laundering regulations: FINMA investigated responsibility of Julius Baer managers - FINMA

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com