Securities and Exchange Commission of Brazil (CVM) Brokers 2025

The Securities and Exchange Commission (Comissão de Valores Mobiliários, or CVM) is the primary regulatory body overseeing the securities market in Brazil, including the activities of stock exchanges, public companies, financial intermediaries, and online traders.

Established in 1976, the CVM is an independent agency operating under the Central Bank of Brazil. It plays a crucial role in ensuring Brazil’s financial markets’ integrity, transparency, and efficiency.

In addition to overseeing the B3 stock exchange and over-the-counter markets, the CVM is a staunch defender of investors’ rights. It acts as a shield, protecting traders from fraudulent securities issuance and illegal market activities, earning it ‘yellow-tier’ status in our Regulation & Trust Rating.

However, the CVM does not maintain a public directory of authorized brokers. Instead, we’ve listed the top brokers operating internationally and who are regulated by other reputable financial bodies.

Best Regulated Brokers For Brazilian Traders

Following hands-on testing, these 6 regulated trading platforms emerged as the best:

This is why we think these brokers are the best in this category in 2025:

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Gemini - Gemini is a cryptocurrency exchange set up in 2014 by the Winklevoss brothers, known for their early involvement in Facebook. The exchange is among the world’s 20 largest and most popular. Gemini clients can trade and stake 110+ cryptocurrencies, with derivatives trading available in some jurisdictions, an advanced proprietary platform and additional features including an NFT marketplace.

- Kraken - Kraken is a leading cryptocurrency exchange with a proprietary trading terminal and a list of 220+ tradeable crypto tokens. Up to 1:5 leverage is available with stable rollover fees on spot crypto trading and up to 1:50 on futures. The exchange also supports crypto staking and has an interactive NFT marketplace.

- Coinbase - Launched in 2012 as a platform enabling users to buy and sell Bitcoin via bank transfers, Coinbase has emerged as a crypto behemoth, expanding its services to include 240+ crypto assets, developing sophisticated trading platforms for retail investors, listing on the US Nasdaq, and securing licenses with multiple regulators.

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

Brokers Comparison

| Broker | Minimum Deposit | Markets | Platforms | Leverage |

|---|---|---|---|---|

| Interactive Brokers | $0 | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | 1:50 |

| Gemini | $0 | Cryptos | ActiveTrader, AlgoTrader, TradingView | - |

| Kraken | $10 | Cryptos | AlgoTrader, Quantower | - |

| Coinbase | $0 | Crypto | Coinbase, Advanced Trade, Wallet, NFT | - |

| Exness | $10 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral | 1:Unlimited |

| Pepperstone | $0 | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower | 1:30 (Retail), 1:500 (Pro) |

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- There's a vast library of free or paid third-party research subscriptions catering to all types of traders, plus you can enjoy commission reimbursements from IBKR if you subscribe to Toggle AI.

- The new IBKR Desktop platform takes the best of TWS while adding bespoke tools like Option Lattice and Screeners with MultiSort to create a genuinely impressive trading experience for day traders at every level.

- Interactive Brokers has been named Best US Broker for 2025 by DayTrading.com, recognizing its long-standing commitment to US traders, ultra-low margin rates, and global market access at minimal cost.

Cons

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

Gemini

"Gemini’s ActiveTrader platform and TradingView integration make it a good choice for serious crypto traders seeking a reliable charting environment, though we were disappointed by some unnecessary fees and previous security breaches."

Michael MacKenzie, Reviewer

Gemini Quick Facts

| Demo Account | No |

|---|---|

| Instruments | Cryptos |

| Regulator | NYDFS, MAS, FCA |

| Platforms | ActiveTrader, AlgoTrader, TradingView |

| Minimum Deposit | $0 |

| Minimum Trade | 0.00001 BTC |

| Account Currencies | USD, EUR, GBP, CAD, AUD, HKD, SGD |

Pros

- The trading app features a user-friendly, modern design and intuitive interface, with an excellent range of charting tools for day traders

- The exchange ensures high security standards with 2FA a requirement for all crypto investors

- Crypto perpetual futures are available in many jurisdictions with up to 1:100 leverage

Cons

- There is no practice profile or demo account for prospective traders

- The 'convenience fee' for using the mobile app seems arbitrary and makes it inefficient to use this feature

- Some larger coins by market cap are not available to buy through Gemini

Kraken

"Kraken will suit traders looking for a diverse list of cryptos including Bitcoin and a good security track record."

William Berg, Reviewer

Kraken Quick Facts

| Bonus Offer | Lower fees when trading volume exceeds $50,000 in 30 days |

|---|---|

| Demo Account | Yes |

| Instruments | Cryptos |

| Regulator | FCA, FinCEN, FINTRAC, AUSTRAC, FSA |

| Platforms | AlgoTrader, Quantower |

| Minimum Deposit | $10 |

| Minimum Trade | Variable |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF |

Pros

- Excellent range of 220+ more established cryptocurrencies

- Low exchange fees on Kraken Pro

- Mobile investing

Cons

- Does not support many newer altcoins

- Does not accept fiat deposits

- Slow verification times

Coinbase

"Coinbase is ideal for beginners looking for an intuitive platform to buy and sell a wide variety of cryptocurrencies, with robust security and regulatory compliance. However, its fees are higher compared to competitors in our tests, and it’s not as tailored for short-term traders."

Christian Harris, Reviewer

Coinbase Quick Facts

| Demo Account | No |

|---|---|

| Instruments | Crypto |

| Regulator | FinCEN, FCA, CBoI, MAS, OAM, DNB, BdE |

| Platforms | Coinbase, Advanced Trade, Wallet, NFT |

| Minimum Deposit | $0 |

| Minimum Trade | $2 |

| Account Currencies | USD, EUR |

Pros

- There are platforms for all levels: beginners can use the simple Coinbase app, while Advanced Trade provides lower fees and pro-level tools.

- Coinbase Advanced bolstered its leveraged trading offering with two new futures products ion 2025: Natural Gas (NGS) - 1,000 MMBtu per contract with up to 11x leverage, and Cardano (ADA) futures - 1,000 ADA per contract with up to 5x leverage.

- Coinbase supports 240+ cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and more recently listed altcoins like $Trump, giving early access to emerging tokens.

Cons

- There are woeful research tools; Advanced Trade has TradingView charts but lacks features like news feeds, economic calendars, and AI market insights.

- Frustrating customer support during testing, with most help options hidden behind login, making it tough for locked-out users or non-account holders to get assistance.

- High crypto fees based on tests, especially compared to competitors like Kraken and BitMEX, and notably on the standard dealing platform.

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | CySEC, FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, DKK, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Highly competitive spreads, reduced for USOIL and BTCUSD in 2024, are available from 0 pips with low commissions from $2 per side.

- Exness was the first brokerage to pass the $1 trillion and $2 trillion marks in monthly trading volumes, highlighting its legitimacy.

- Improved execution speeds, now averaging under 25ms, offer optimal conditions for short-term traders.

Cons

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Now offering spread betting through TradingView, Pepperstone provides a seamless, tax-efficient trading experience with advanced analysis tools.

- Pepperstone has greatly improved the deposit and withdrawal experience in recent years, adding Apple Pay and Google Pay in 2025, as well as PIX and SPEI for clients in Brazil and Mexico in 2024.

- There’s support for a range of industry-leading charting platforms including MT4, MT5, TradingView, and cTrader, catering to various short-term trading styles, including algo trading.

Cons

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers such as eToro, with no option to invest in real coins.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

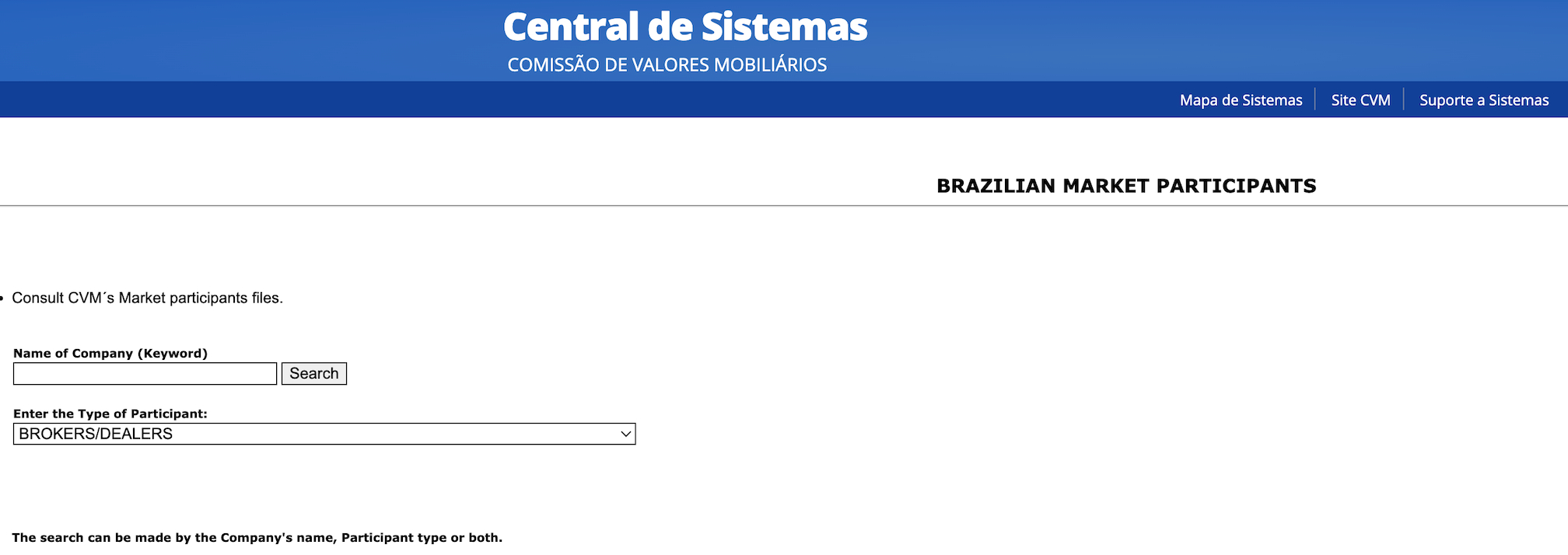

How Can I Check A Broker Is Regulated By The CVM?

While the CVM is the regulatory authority for online brokers in Brazil, verifying their authorization can be more complex than in some other jurisdictions.

Unlike some regulators, such as the FCA in the UK or CySEC in Europe, the CVM does not maintain a publicly accessible list of licensed brokers and trading platforms.

Instead, you can inquire about a broker’s authorization status through a formal request to the CVM. We have submitted a request to the CVM to enquire about authorized brokers and will update this page with our findings when we receive a response.

What Rules Must CVM-Regulated Brokers Follow?

Only authorized institutions can trade foreign exchange and derivatives in Brazil, according to Law 6,385/76.

While the law doesn’t explicitly classify forex as a security, it mandates CVM oversight for “the issuance and distribution of other derivative contracts, regardless of the underlying asset.” This effectively brings forex trading under the CVM’s regulatory umbrella.

Here are some fundamental rules and requirements that CMV-regulated brokers must follow:

- Brokers must be registered with the CVM and comply with its regulatory requirements to operate legally in Brazil.

- All foreign exchange transactions must be conducted through institutions authorized by the Central Bank of Brazil.

- Brokers must submit regular reports to the CVM detailing their financial status, client transactions, and other relevant information.

- CVM mandates that brokers implement robust risk management systems to protect clients’ funds and ensure market stability.

- Brokers must provide transparent information to clients about the risks associated with online trading and the costs involved.

What Powers Does The CVM Have?

The CVM wields broad authority to not only establish market regulations but also investigate, prosecute, and penalize violations.

When suspicions arise, the CVM can launch an investigation, gathering information, testimonies, and evidence to pinpoint the source of illegal activity. Throughout this process, those accused retain full rights to defend themselves in court.

In 2020, the CVM demonstrated its commitment to maintaining the market’s integrity by cracking down on unauthorized trading activity. It issued a ‘Stop Order’ against Pepperstone Group, an Australian broker, for allegedly operating in Brazil without authorization, reassuring the market of its vigilance.

Bottom Line

Brazilian laws do not explicitly prohibit online trading, but domestic broker options are limited. The CVM doesn’t provide a list of authorized brokers, either, meaning Brazilian traders often seek trustworthy brokers regulated overseas.

Fortunately, many leading players accept and cater to Brazilian clients with Portuguese language support and websites. Additionally, the convenience of using a broker that accepts deposits in Brazilian real (BRL) is a factor to consider for many day traders in Brazil.

Article Sources

- Securities and Exchange Commission (Comissão de Valores Mobiliário)

- Central Bank of Brazil

- B3 stock exchange

- CVM Regulatory Framework

- Market participants files - CVM

- LAW 6.385 (7 DECEMBER 1976) - CVM

- 'Stop Order' against Pepperstone Group - Reuters

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com