National Commission for Companies and the Stock Exchange (CONSOB) Brokers 2025

In Italy, the National Commission for Companies and the Stock Exchange (CONSOB) – known locally as the Commissione Nazionale per le Società e la Borsa – is tasked with regulating the country’s financial markets and issuing licences to brokers.

Alongside the European Securities and Markets Association (ESMA), CONSOB sets the rules for financial services companies. It also serves a supervisory role and slaps penalties on brokers who flout regulations.

Italy’s regulator is classified as a ‘green-tier’ regulator under our Regulation & Trust Rating. As a consequence, day traders who deal in the Mediterranean country can expect robust protection from bad actors.

Explore the best brokers that are regulated by CONSOB. We have verified that they are listed on the organization’s Register of Investment Firms (or Albo delle Imprese di Investimento, in local parlance).

Best CONSOB Brokers

Our tests reveal these 1 CONSOB-regulated trading platforms are a cut above the rest:

Here is a short overview of each broker's pros and cons

- Saxo Bank - Saxo Markets is a multi-award-winning trading brokerage, investment firm and regulated bank. With a huge 72,000+ trading instruments, plus investment products and managed portfolios, clients have no shortage of opportunities. The trusted brand also offers transparent pricing and top-tier regulatory protection from 10+ agencies including FINMA, FCA & ASIC.

CONSOB Brokers Comparison

| Broker | Minimum Deposit | Markets | Platforms | Leverage |

|---|---|---|---|---|

| Saxo Bank | - | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures, options, warrants, bonds, ETFs | TradingView, ProRealTime | 1:30 |

Saxo Bank

"Saxo is best for active traders and high-volume investors with an unrivalled selection of instruments alongside premium market research and fee rebates. The 190 currency pairs with tight spreads also make Saxo great for forex traders."

Tobias Robinson, Reviewer

Saxo Bank Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures, options, warrants, bonds, ETFs |

| Regulator | DFSA, MAS, FCA, SFC, FINMA, AMF, CONSOB |

| Platforms | TradingView, ProRealTime |

| Minimum Trade | Vary by asset |

| Leverage | 1:30 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, SEK, DKK, CHF |

Pros

- High-level research hub with curated market research, plus unique insights with 'Outrageous Predictions'

- Powerful proprietary trading platforms with comprehensive charting packages and advanced analysis tools

- The ISA account is highly accessible and flexible with no entry or exit fees

Cons

- Access to Level 2 pricing requires a subscription

- High funding requirements for the trading accounts

- Clients from some jurisdictions not accepted including the US and Belgium

Methodology

To identify the top brokers that are regulated by CONSOB, we:

- Examined our database of 223 brokers to locate those claiming to be regulated by CONSOB.

- Used CONSOB’s online database to confirm they are indeed regulated in Italy.

- Ranked them by their rating, blending the findings of our investment experts with 100+ data points.

How Can I Check If A Broker Is Regulated By CONSOB?

Through its Register of Investment Firms, CONSOB provides – in the form of various separate lists – a database of financial firms that are authorized to trade in Italy. These are organized according to where the firm is located, and whether it operates branches in the country.

CONSOB provides an up-to-date list warning list of companies found to have acted unlawfully, as well as a searchable archive for traders to peruse. It handily provides reports from supervisory authorities all over the globe as well as its own.

Unfortunately, the regulator doesn’t provide an easy-to-navigate broker search facility for quick results. But with some light detective work, it’s still possible to get the answers you need.

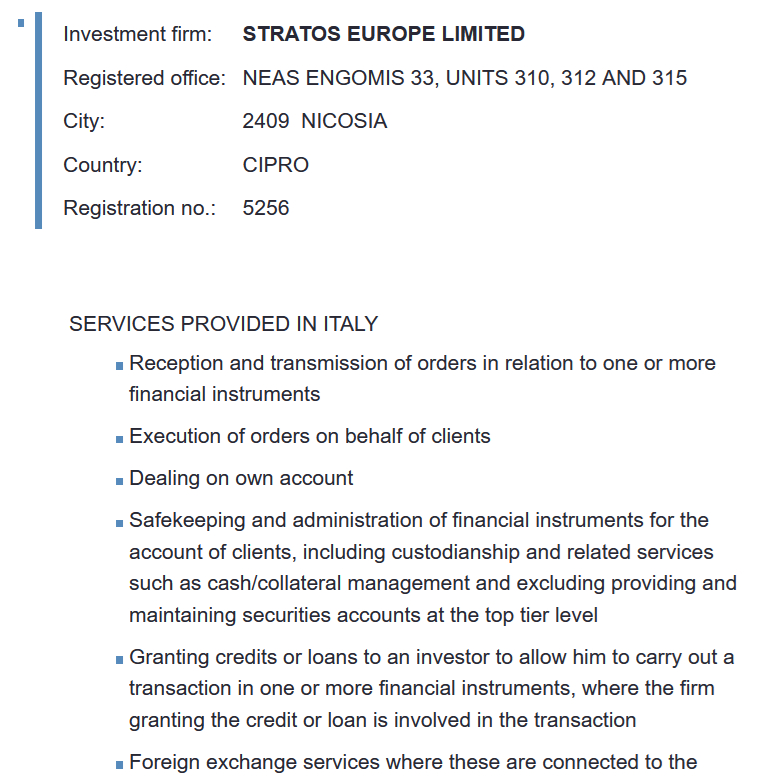

Within a few minutes, I was able to confirm that FXCM is approved to do business in Italy. I opened the Register of Investment Firms, then clicked on each of the lists and searched for ‘Stratos Europe Limited’ (the company that operates under the trade name FXCM).

After some brief research, I found the broker on the list of investment firms authorized in other EU states without branches in Italy. The document provides the broker’s address and a rundown of services it is allowed to provide.

Day traders in Italy can also use brokers that are registered in other parts of the European Economic Area, or EEA. This territory comprises all 27 European Union (EU) countries and four European Free Trade Association (EFTA) nations. This concept – commonly known as ‘passporting’ – works in accordance with the free movement of goods and services under the single market.

What Rules Must CONSOB-Regulated Brokers Follow?

Online brokers must adhere to Italy’s strict regulatory system if they wish to set up shop and remain in operation. They must meet criteria set by CONSOB and by ESMA, a body that governs financial services across all EU states.

Regulations are greatly influenced by the Markets in Financial Instruments Directive II (MiFID II). This framework was introduced at the EU level to improve the transparency, stability and functionality of financial markets, and to bolster protections for traders and investors.

Under MiFID II rules, brokers must:

- Strive to achieve the best possible results for their clients, taking into account items like dealing costs, trading speed, and the probability of execution and settlement.

- Clearly communicate the risks associated with their products, and ensure that advertising is not misleading as to the returns a trader can expect to make.

- Restrict leverage to 1:30 for major forex pairs (like the EUR/USD and USD/JPY), and 1:20 for other currency pairings.

- Offer negative balance protection to prevent retail investors from going into debt when using leveraged products.

- Close a trader’s position if the value of their trading account falls below 50% of the required margin to keep their leveraged positions open. This is known as margin close-out.

- Use segregated accounts to protect customers’ assets in the event that the trading firm goes bust.

- Separate charges for research and transactions, thus providing better price transparency for customers and reducing the risk of overcharging.

- Provide regular and detailed trading data to regulators, which helps lawmakers to better identify and crack down on market manipulation.

Bottom Line

Ensuring that the broker you choose is authorized to trade is essential regardless of what territory you’re based in. Fortunately, traders in Italy can have confidence that they are well protected if they use a trading platform approved by the country’s CONSOB.

However, investors should be mindful that fraudulent parties are still in operation. Additionally, day trading as an occupation is naturally risky, so never speculate with money that you can’t afford to lose.

Article Sources

- Commissione Nazionale per le Società e la Borsa (CONSOB)

- Investment Firms - CONSOB

- Register of Investment Firms (Albo delle Imprese di Investimento) - CONSOB

- List of investment firms authorized in other EU states without branches in Italy - CONSOB

- Warnings - CONSOB

- European Economic Area (EEA) - Eurostat

- What is ‘passporting’ and why does it matter? – UK Finance

- European Securities and Markets Association (ESMA)

- MiFID II - ESMA

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com