National Securities Market Commission (CNMV) Brokers 2025

The Comisión Nacional del Mercado de Valores (CNMV), or National Securities Market Commission, is the regulatory authority overseeing the securities markets in Spain, including online brokers.

Spain’s well-regarded financial watchdog fosters a stable trading environment, earning it ‘green-tier’ status in our Regulation & Trust Rating. The CNMV enforces the European Union’s Markets in Financial Instruments Directive (MiFID II), ensuring a consistent regulatory framework that benefits institutions and retail investors.

The Spanish financial watchdog is known for its proactive approach to protecting retail traders. They regularly issue warnings about unauthorized entities operating in the market. Notable examples include exposing a clone of the popular investment firm eToro and calling attention to unlicensed companies in the FX/CFD sector.

Discover the best brokers regulated by the CNMV. We’ve personally verified that every trading platform listed is authorized on the Register of Authorized Entitie, either as a domestic brokerage or a foreign investment firm providing trading services through the EU’s passporting scheme.

Best CNMV Brokers

Following personal testing, these 1 CNMV-regulated trading platforms outshine the competition:

Here is a short summary of why we think each broker belongs in this top list:

- eToro - eToro is a top-rated multi-asset platform which offers trading services in thousands of CFDs, stocks and cryptoassets. Launched in 2007, the brand has millions of active traders globally and is authorized by tier one regulators, including the FCA and CySEC. The brand is particularly popular for its comprehensive social trading platform. Crypto Trading is offered via eToro USA LLC; Investments are subject to market risk, including the possible loss of principal. CFDs are not available in the US Cryptoasset investing is highly volatile and unregulated in the UK and some EU countries. No consumer protection. Tax on profits may apply. 51% of retail accounts lose money.

CNMV Brokers Comparison

| Broker | Minimum Deposit | Markets | Platforms | Leverage |

|---|---|---|---|---|

| eToro | $100 | Stocks, ETFs, Options, Crypto | eToro Web, CopyTrader, TradingCentral | 1:30 EU |

eToro

"eToro's social trading platform leads the pack with a terrific user experience and active community chat that can help beginners find opportunities. There are also competitive fees on thousands of CFDs and real stocks, plus excellent rewards for experienced strategy providers."

Christian Harris, Reviewer

eToro Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, ETFs, Options, Crypto |

| Regulator | FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF |

| Platforms | eToro Web, CopyTrader, TradingCentral |

| Minimum Deposit | $100 |

| Minimum Trade | $10 |

| Leverage | 1:30 EU |

| Account Currencies | USD, EUR, GBP |

Pros

- There's a comprehensive online training academy with accessible resources, from bitesize articles to comprehensive courses.

- Charts are powered by TradingView and offer strong technical analysis features, including 9 chart types and over 100 indicators.

- Top copy traders can receive annual payments up to 1.5% of assets under copy in the broker's Popular Investor Program.

Cons

- There is a $30 minimum withdrawal amount and a $5 fee, which will affect novices with low capital.

- The lack of additional charting platforms like MT4 will reduce the appeal for seasoned day traders accustomed to using third-party software.

- There are limited contact methods aside from the in-platform live chat.

Methodology

To identify the top brokers regulated in Spain, we:

- Searched our database of 223 brokers to pinpoint those claiming to be regulated by the CNMV.

- Inputted their credentials through the Spanish regulator’s public register to verify they were authorized.

- Ranked them by their rating, considering 100+ data points alongside the personal findings of our testers.

How Can I Check A Broker Is Regulated By The CNMV?

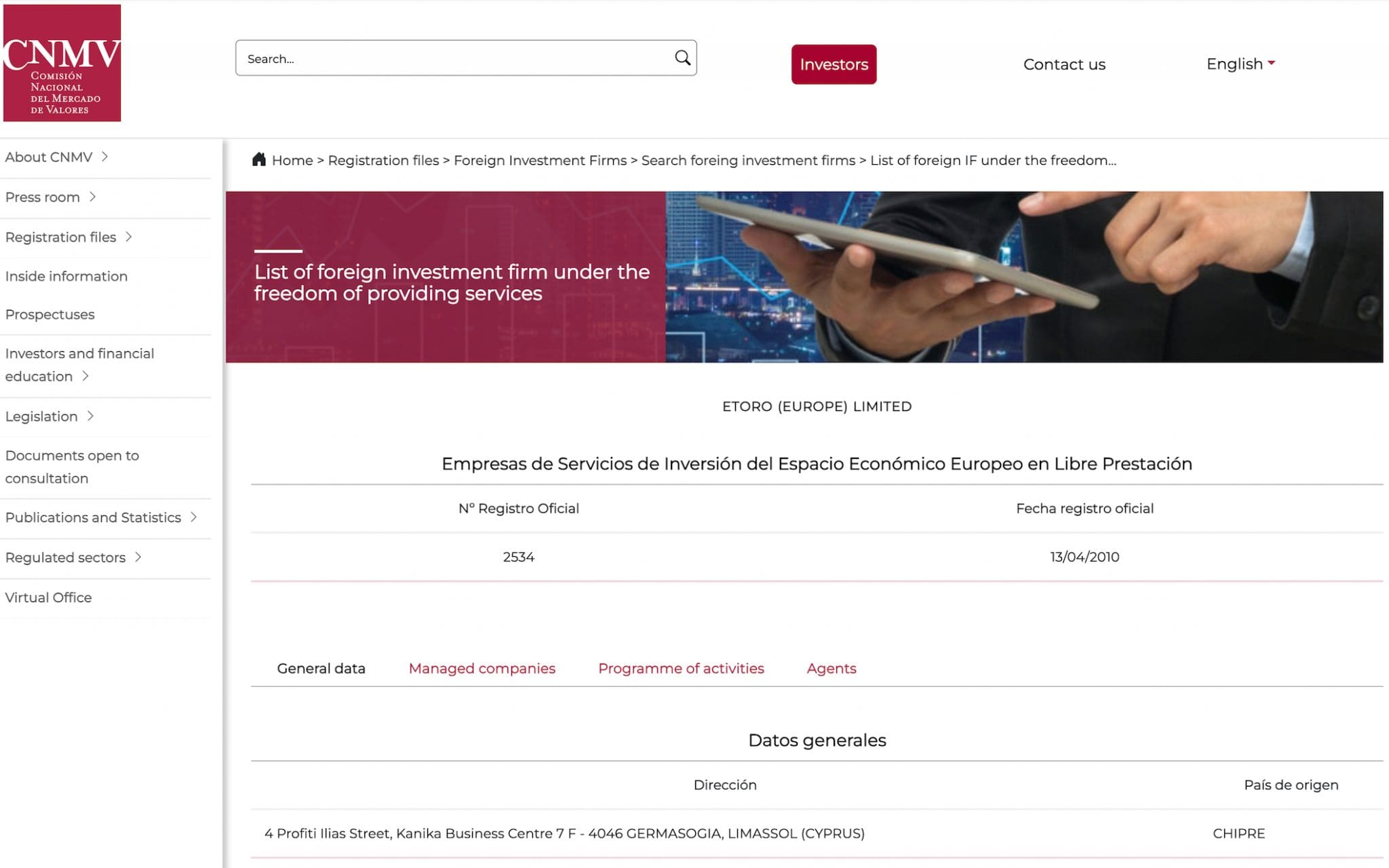

Checking a broker is regulated by the CNMV is straightforward:

- Navigate to the CNMV’s Register of Authorized Entitie.

- Enter the broker’s name in the search box and click the ‘Search’ button.

- Click on the search result to check broker details, such as full trading name, registered address, and a description of investment services and activities.

To show you how this works, below is the result of a search I ran on eToro (which offers the best copy trading platform I’ve used), showing that the CNMV authorizes the broker.

It took me less than two minutes so it’s a quick and easy check that any day trader can make before depositing funds.

What Rules Must CNMV-Regulated Brokers Follow?

The CNMV regulates a significant number of domestic and international brokers. Several dozen brokers are authorized to operate in Spain during our latest check.

Here are some fundamental rules and requirements that CNMV-regulated brokers must follow:

- Brokers must obtain a license from the CNMV before they can operate in Spain. This involves demonstrating adequate financial resources, organizational structure, and compliance systems.

- Brokers must maintain a minimum level of capital to cover their operational risks and ensure financial stability. This includes meeting specific capital ratios and maintaining adequate liquidity.

- Brokers must implement robust risk management frameworks to identify, monitor, and mitigate potential risks associated with their activities.

- Before offering investment services, brokers must assess whether the products suit the client based on their knowledge, experience, financial situation, and investment objectives.

- Brokers are required to implement AML policies, including thorough customer due diligence to verify the identity of their clients and assess the risk of money laundering and terrorist financing.

- Brokers must regularly submit financial statements and relevant reports to the CNMV to demonstrate their financial health and operational integrity.

- Brokers must establish and maintain internal compliance programs to ensure adherence to all regulatory requirements. This includes regular audits, training programs for staff, and mechanisms for reporting and addressing compliance issues.

In July 2023, the CNMV implemented stricter regulations governing the marketing, distribution, and sale of CFDs (contracts for difference) to retail investors. These new rules significantly limit CFD marketing efforts directed at the general public through channels like sales agents, call centers, event sponsorships, or celebrity endorsements.

The CNMV views these measures as necessary safeguards, building on previous restrictions enacted in Spain (2019) and by the pan-European regulatory body, the European Securities and Markets Authority (ESMA), in 2018.

What Powers Does The CNMV Have?

The CNMV actively monitors compliance and enforces regulations through various measures, including fines and sanctions. It imposes substantial monetary fines on brokers for regulatory breaches, such as inadequate risk disclosures and failure to comply with reporting requirements.

The CNMV regularly publishes enforcement statistics detailing the number of actions taken, the types of breaches addressed, and the fines imposed.

The CNMV has been actively imposing fines on entities for various regulatory violations in recent years. In 2022, the CNMV intensified its enforcement activities, closing 19 disciplinary cases and issuing 45 fines totaling €6.387 million, an increase of 34% compared to the previous year. These penalties were mainly due to violations such as insider trading, market manipulation, and failure to report significant holdings.

Another example is the CNMV fined Azora Gestión SGIIC €90,000 for submitting incomplete financial information related to the annual accounts, statement of reserves, and periodic reports for their company Lazora, covering the years 2014 to 2017.

Bottom Line

The CNMV plays a crucial role in regulating brokers in Spain, ensuring they operate with transparency, integrity, and financial stability.

Through rigorous authorization processes, ongoing supervision, and robust enforcement actions, the CNMV maintains exceptionally high standards in the industry, protecting Spanish retail traders and fostering a stable financial market.

Explore our pick of the top brokers regulated in Spain to find the right trading platform for your needs.

Article Sources

- National Securities Market Commission (CNMV)

- Markets in Financial Instruments Directive (MiFID II)

- Register of Authorized Entities - CNMV

- Enforcement Actions and Sanctions - CNMV

- Warnings (unauthorised firms and other entities) - CNMV

- Fines on entities for various regulatory violations - EL PAÍS

- CNMV fined Azora Gestión SGIIC €90,000 - Brainsre.news

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com