Capital Markets Authority (CMA) Brokers 2026

Kenya’s Capital Markets Authority (CMA) was established in 1989 as a statutory agency under the Capital Markets Act Cap 485A. Operating under the National Treasury, the CMA’s primary mandate is to promote market integrity, protect traders, and foster fair and efficient capital markets in Kenya.

The CMA licenses and oversees various trading brokers, ensuring they comply with the legal and regulatory framework. A growing number of brokers have sought authorization from the CMA in recent years, including IC Markets and Pepperstone, as Kenya emerges as the leading centre for forex and CFD brokers in Africa.

We’ve assigned the CMA ‘yellow-tier’ status in line with our Regulation & Trust Rating, meaning it provides “strong investor protection”, especially for Kenyan traders, though it’s not as robust as ‘green-tier’ regulators.

We’ve pinpointed the best brokers regulated by the CMA. Our experts have verified the credentials of every recommended platform on the regulator’s List of Licensees.

Best CMA Brokers

After extensive hands-on testing, these 6 CMA-regulated trading platforms stand out from the pack:

-

1

Exness

Exness -

2

IC Markets

IC Markets -

3

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Pepperstone75-95% of retail investor accounts lose money when trading CFDs -

4

Ingot Brokers

Ingot Brokers -

5

FP Markets

FP Markets -

6

FXTM

FXTM

Here is a short summary of why we think each broker belongs in this top list:

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

- Ingot Brokers - Ingot Brokers is a multi-regulated brokerage established in 2006. The broker offers CFD trading opportunities on 1000+ instruments including forex, stocks, indices, commodities and cryptocurrencies. The broker supports the MetaTrader 4 and MetaTrader 5 platforms and offers both raw spreads and commission-free account options.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to day traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- FXTM - FXTM is a forex and CFD broker established in 2011 and operating across four continents. The company is secure and regulated by leading authorities, including the FCA. Offering 1,000+ markets and three account types, they cater to all levels of trader.

CMA Brokers Comparison

| Broker | Minimum Deposit | Markets | Platforms | Leverage |

|---|---|---|---|---|

| Exness | Varies based on the payment system | CFDs on Forex, Stocks, Indices, Commodities, Crypto | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral | 1:Unlimited |

| IC Markets | $200 | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Pepperstone | $0 | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower | 1:30 (Retail), 1:500 (Pro) |

| Ingot Brokers | $10 | CFDs, Commodities, Stocks, Indices, ETFs, Forex, Cryptocurrencies | MT4, MT5 | 1:500 |

| FP Markets | $40 | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | Iress, MT4, MT5, cTrader, TradingView, AutoChartist, TradingCentral | 1:30 (UK), 1:500 (Global) |

| FXTM | $200 | CFDs, Forex, Commodities, Indices, Stocks, Crypto | FXTM Trader, MT4, MT5 | 1:3000 |

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Improved execution speeds, now averaging under 25ms, offer optimal conditions for short-term traders.

- Highly competitive spreads, reduced for USOIL and BTCUSD in 2024, are available from 0 pips with low commissions from $2 per side.

- Excellent range of account types for all experience levels, including Cent, Pro plus the introduction of Raw Spread, ideal for day traders.

Cons

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

- Retail trading services are unavailable in certain jurisdictions, such as the US, UK and EU, limiting accessibility compared to top-tier brokers like Interactive Brokers.

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, CMA, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Markets offers fast and dependable 24/5 support based on firsthand experience, particularly when it comes to accounts and funding issues.

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

Cons

- There are fees for certain withdrawal methods, including a $20 wire charge, which can eat into profits, especially for frequent withdrawals.

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Pepperstone boasts impressive execution speeds, averaging around 30ms, facilitating fast order processing and execution that’s ideal for day trading.

- Pepperstone has greatly improved the deposit and withdrawal experience in recent years, adding Apple Pay and Google Pay in 2025, as well as PIX and SPEI for clients in Brazil and Mexico in 2024.

- There’s support for a range of industry-leading charting platforms including MT4, MT5, TradingView, and cTrader, catering to various short-term trading styles, including algo trading.

Cons

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers who focus on this area, with no option to invest in real coins.

Ingot Brokers

"Ingot Brokers is a good choice for day traders looking for a no-frills broker with a wide range of instruments. Experienced traders will appreciate access to the advanced MT5 platform, although beginners may be disappointed in the lack of educational resources."

William Berg, Reviewer

Ingot Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Commodities, Stocks, Indices, ETFs, Forex, Cryptocurrencies |

| Regulator | ASIC, FSCA, JSC, FSA, CMA |

| Platforms | MT4, MT5 |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, AUD |

Pros

- The low $100 minimum deposit and the option to trade with zero commissions will appeal to newer traders

- Multiple free payment methods are available, including bank transfers and crypto payments

- Ingot Brokers holds multiple regulatory licenses, including one from the top-tier regulator, ASIC

Cons

- The broker’s educational resources and market research trail most competitors

- The range of 30+ currency pairs is below the industry average and won’t be sufficient for serious forex traders

- The ECN account offers fewer assets than the other account types

FP Markets

"FP Markets strikes an ideal balance between affordability and quality for active traders. They’ve managed to keep trading costs low while expanding their investment offering, charting tools, and research features, all while providing excellent support you can rely on for urgent trading queries."

Christian Harris, Reviewer

FP Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Regulator | ASIC, CySEC, FSA, CMA |

| Platforms | Iress, MT4, MT5, cTrader, TradingView, AutoChartist, TradingCentral |

| Minimum Deposit | $40 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (UK), 1:500 (Global) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- FP Markets offers a superb selection of tradable assets, especially since expanding its suite of commodities and supporting over 10,000 stocks.

- FP Markets has a seamless onboarding experience, standing out with crypto deposits and over 10 base currencies, catering to global traders.

- FP Markets has integrated top-notch research tools from Trading Central and Autochartist, helping traders identify short-term opportunities based on chart patterns, indicators, and other technical factors.

Cons

- FP Markets trails the best MetaTrader brokers, despite offering a Trader's Toolbox on MT4, just 130 instruments are available, limiting opportunities for serious traders, especially compared to Pepperstone with its 1,300 assets.

- FP Markets’ Iress platform is only available to clients in Australia. It also primarily emphasizes stock trading over forex trading, and data fees can accumulate rapidly unless you're an active trader or maintain a high-balance account.

- While pricing in the Raw account is excellent, spreads in the Standard account trail the cheapest brokers with a 1.1-pip average spread on the EUR/USD compared to the 0.8-pip average at IC Markets.

FXTM

"FXTM is ideal for experienced day traders with account options designed for short-term strategies, even winning DayTrading.com's 'Best ECN Account' award, alongside tight spreads that have been reduced and VPS support for algorithmic trading. "

Christian Harris, Reviewer

FXTM Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Commodities, Indices, Stocks, Crypto |

| Regulator | FCA, FSC, CMA |

| Platforms | FXTM Trader, MT4, MT5 |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:3000 |

| Account Currencies | USD, EUR, GBP, NGN |

Pros

- FXTM’s UK entity offers excellent client protections, notably industry beating coverage up to $1 million per client and segregated accounts, enhancing security for traders with large balances.

- FXTM’s Advantage and Advantage Plus accounts offer tight spreads (from 0.0 pips) and low or no commissions, designed for short-term traders looking to minimize costs.

- FXTM supports a terrific range of payment methods, especially local options in Africa and Asia like M-Pesa and TC Pay Wallet. And with e-wallet withdrawals processed in as little as 30 minutes, this suits traders who require quick access to funds.

Cons

- FXTM Invest was an easy to use copy trading app that provided detailed performance stats and risk scores for Strategy Managers, but it was discontinued in 2024, leaving hands-off traders with limited opportunities.

- FXTM only offers MetaTrader 4/5 for desktop trading, with no proprietary platform like eToro for a customized trading experience. MT4/5 is feeling increasingly outdated for active traders.

- FXTM charges a $10 inactivity fee after only three months of no trading - shorter than many brokers, which can be frustrating for those who don’t trade continuously.

Methodology

To identify the top brokers regulated in Kenya, we:

- Scoured our directory of 140 brokers to find those who claim to be regulated by the CMA.

- Put their company credentials through the List of Licensees to verify they were authorized.

- Ranked them by their rating, combining 100+ data entries with the observations of our testers.

How Can I Check A Broker Is Regulated By The CMA?

Confirming whether a broker is regulated by the CMA is straightforward:

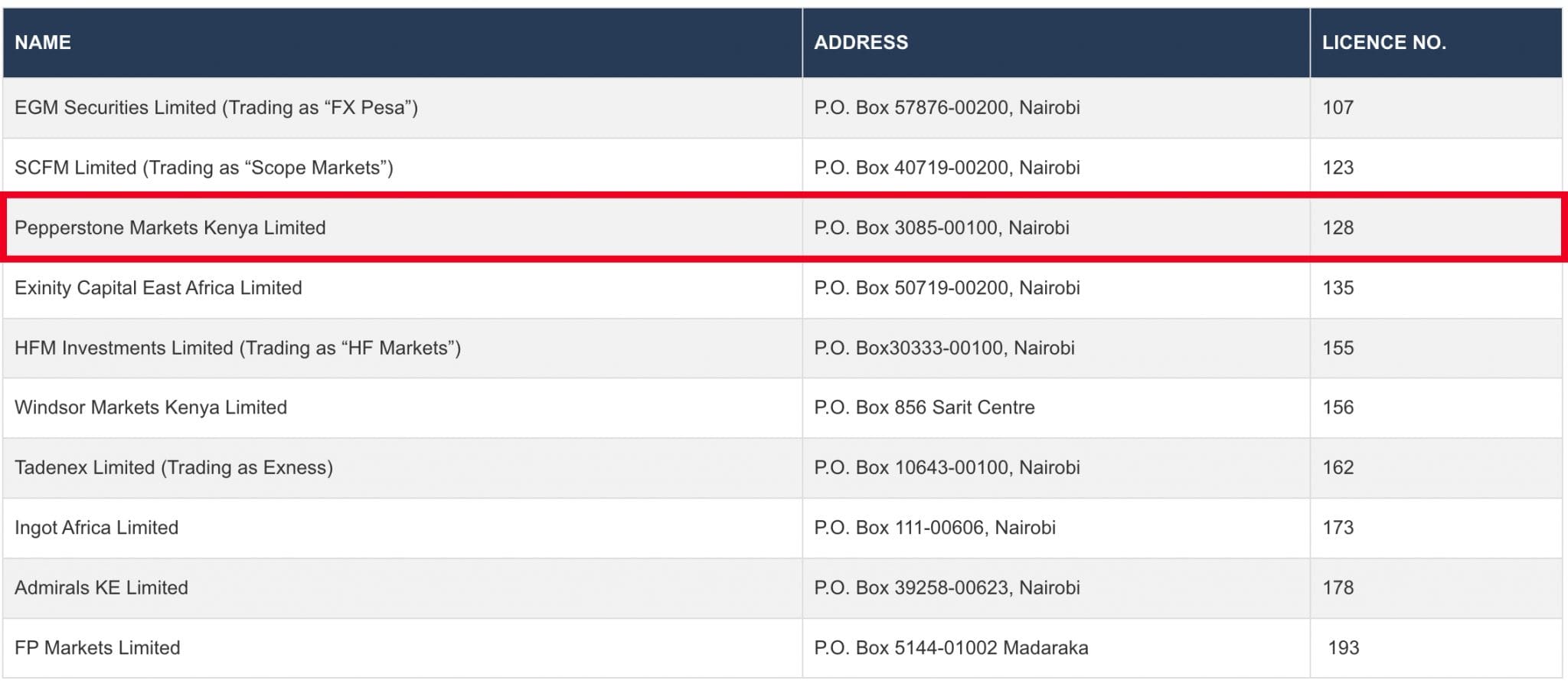

- Navigate to the CMA’s List of Licensees.

- Expand the drop-down section ‘NON-DEALING ONLINE FOREIGN EXCHANGE BROKER.’

- View regulated broker details, including company and trading name, registered address, and license number.

To show you how this works in practice, below are the results of a search I did to check that Pepperstone, a terrific broker for day trading featuring lightening-fast execution and razor-sharp spreads, is authorized to operate in Kenya.

What Rules Must CMA-Regulated Brokers Follow?

Brokers in Kenya must obtain a license from the CMA to operate legally in the country. The licensing process is rigorous and ensures that brokers meet high financial stability, integrity, and competence standards.

It involves a thorough review of the broker’s financial records, operational structure, and business practices. The CMA also conducts background checks on the broker’s key personnel to ensure they have the necessary qualifications and experience.

At the time of writing, the CMA has licensed 10 non-dealing forex brokers to operate in Kenya, with the largest brands including firms like Pepperstone and FP Markets. That said, the List of licensed brokers fluctuates as the CMA grants new licenses and revokes non-compliant ones.

The CMA establishes clear criteria for online brokers seeking a Kenyan license. The fundamental rules and requirements that CMA-regulated brokers must follow encompass financial stability, operational structure, and responsible business practices:

- The CMA has a minimum capital adequacy requirement set at 30 million Kenya shillings, ensuring brokers possess sufficient financial resources to operate responsibly.

- All licensed brokers must maintain a physical presence within Kenya to facilitate oversight, with nearly every CMA-regulated broker we’ve evaluated maintaining an office in the capital, Nairobi.

- The CMA mandates qualified leadership with a solid financial background, promoting responsible management of client funds.

- Obtaining a CMA license can take several months, reflecting the thoroughness of the CMA’s review process.

- Regulations dictate that all business in Kenya is conducted in the local currency, the Kenyan shilling.

Yet while the CMA provides strong trader protections, especially for Kenyan traders, it’s not yet as robust as other prominent regulators, such as the FCA in the UK or ASIC in Australia.Its shortcomings centre around its relatively limited resources to enforce rules, sometimes slow and inconsistent penalties, and the country’s less developed financial markets.

What Powers Does The CMA Have?

The CMA plays a vital role in safeguarding Kenyan traders. They achieve this by recommending that new traders only participate with brokers licensed by the CMA.

The CMA’s regulations extend to Kenyan soil, and some offshore brokers continue to solicit Kenyan investors despite needing a CMA license. While these overseas brokers might be regulated elsewhere, the CMA has advised many times over the years against using them due to the lack of CMA oversight.

The CMA actively monitors and enforces compliance among licensed brokers. In recent years, it has taken several enforcement actions, including imposing fines and penalties on brokers who violate regulatory requirements.

For instance, In October 2018, Kenyan authorities issued a cease and desist order to Pesos Capital Markets Limited. The order alleged that the firm was operating as a fund manager and an online foreign exchange dealer without the necessary licenses required by the Capital Markets Act.

Public notices and investor alerts are regularly issued to inform the public about unlicensed entities and potential scams.

Bottom Line

The CMA is the guardian of Kenya’s capital markets, ensuring their integrity and fostering growth. This includes regulating brokers to promote fair and transparent practices.

The CMA implements a licensing process that only qualified firms can pass. They maintain constant vigilance through ongoing monitoring of licensed brokerages, ensuring adherence to regulations. Additionally, the CMA can take decisive enforcement against any broker violating the established rules.

When choosing a CMA-licensed broker, you benefit from the CMA’s regulations to safeguard Kenyan traders. Trading with an unlicensed broker removes these protections, leaving Kenyan traders with limited avenues to seek compensation or resolve disputes.

Article Sources

- Capital Markets Authority (CMA)

- The National Treasury

- Annual Report for 2022 - CMA

- List of licensees - CMA

- Regulatory Framework - CMA

- Capital Markets Act (Cap 485A) - Kenya Law

- Kenya’s CMA Warns of Rise in Unlicensed Online Forex Trading - CGTN Africa

- Kenya’s Regulator tightens Surveillance on Rogue Stock Brokerage firms - The Kenyan Wall Street

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com