Central Bank of Ireland (CBI) Brokers 2025

The Central Bank of Ireland (CBI) plays a crucial role in Ireland’s financial landscape, particularly in regulating brokers. This regulation is of significant importance to Irish traders, as it ensures a secure trading environment.

Brokers operating in Ireland must adhere to a comprehensive regulatory framework established by the CBI, with the agency earning ‘green tier’ status in our Regulation & Trust Rating. This framework incorporates the Markets in Financial Instruments Directive (MiFID) set by the European Union (EU), ensuring firms comply with stringent standards for investor protection.

The CBI is an active regulator, taking action against breaches and maintaining a growing warning list of over 880 investment firms that are unauthorized in Ireland.

We’ve identified the best brokers regulated by the CBI after personally verifying their credentials on the regulator’s Register of Authorized Firms.

Best CBI Brokers

Following testing, these 2 CBI-regulated trading platforms emerged as the best:

Here is a short summary of why we think each broker belongs in this top list:

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

CBI Brokers Comparison

| Broker | Minimum Deposit | Markets | Platforms | Leverage |

|---|---|---|---|---|

| Interactive Brokers | $0 | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | 1:50 |

| AvaTrade | $100 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade | 1:30 (Retail) 1:400 (Pro) |

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- Interactive Brokers has been named Best US Broker for 2025 by DayTrading.com, recognizing its long-standing commitment to US traders, ultra-low margin rates, and global market access at minimal cost.

- While primarily geared towards experienced traders, IBKR has made moves to broaden its appeal in recent years, reducing its minimum deposit from $10,000 to $0.

- The new IBKR Desktop platform takes the best of TWS while adding bespoke tools like Option Lattice and Screeners with MultiSort to create a genuinely impressive trading experience for day traders at every level.

Cons

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Bonus Offer | 20% Welcome Bonus up to $10,000 |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

Cons

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

Methodology

To identify the top brokers regulated in Ireland, we:

- Scanned our database of 223 brokers to identify those who claim to be regulated by the CBI

- Ran their company credentials through the CBI’s public register to verify they were authorized

- Ordered them by their rating, combining 100+ data points with the findings of our testers

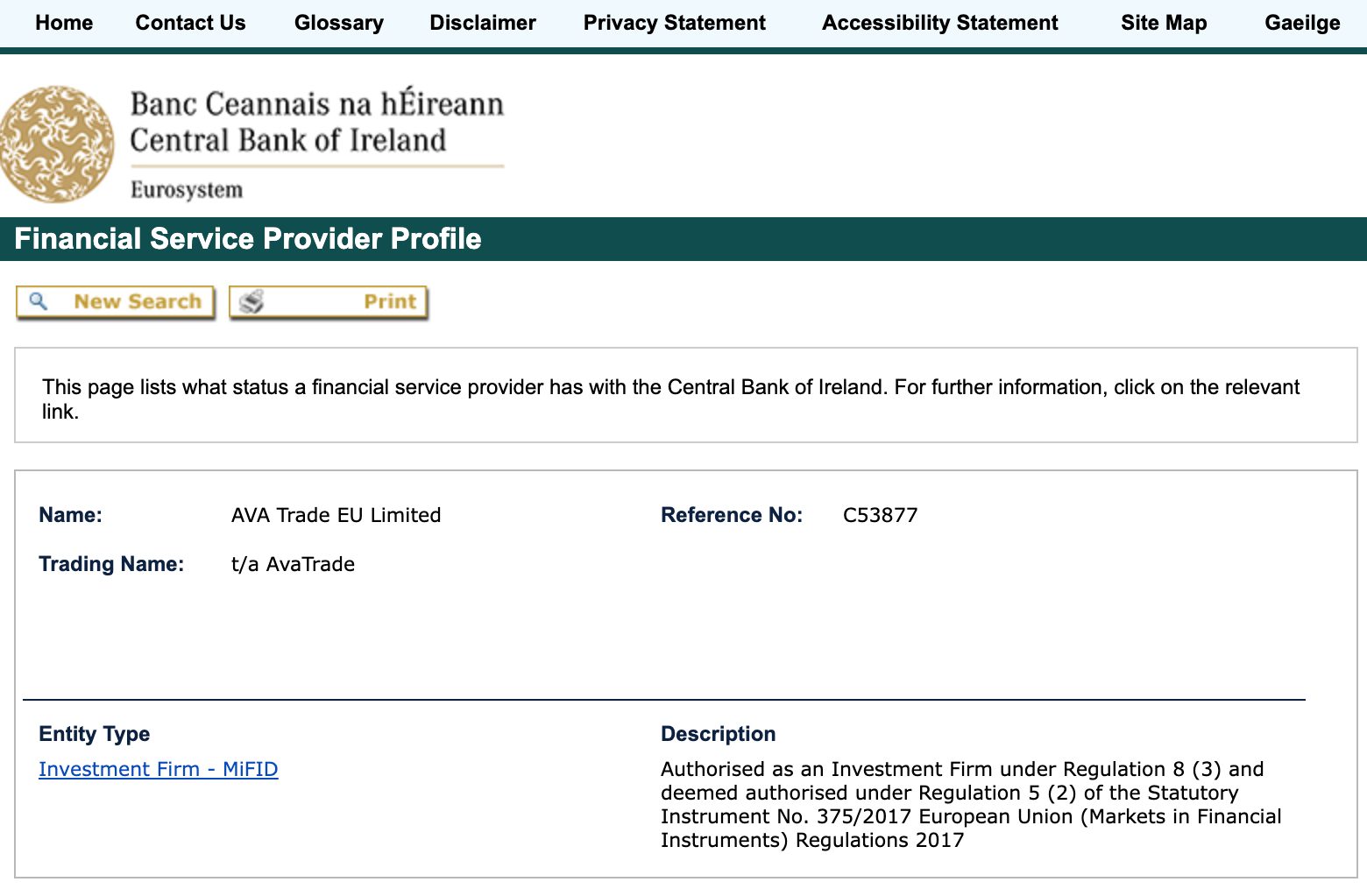

How Can I Check A Broker Is Regulated By The CBI?

Checking a broker is regulated by the CBI is straightforward:

- Navigate to the CBI’s Register of Authorized Firms

- Enter the broker’s name in the search box and click the ‘Search’ button

- Click on the search result to check broker details, such as full trading name, entity type, and description

Below is the result of a search I ran on AvaTrade (which supports the excellent DupliTrade copy trading platform), showing that the broker is authorized .

It took me less than two minutes to check they were indeed regulated in Ireland, so it’s an easy check for any day trader to run.

What Rules Must CBI-Regulated Brokers Follow?

The CBI imposes comprehensive rules and regulations on brokers operating under its jurisdiction. These rules are designed to ensure that trading platforms operate with integrity, maintain financial stability, and protect the interests of their clients.

Here are the fundamental rules and requirements that CBI-regulated brokers must follow:

- Brokers must maintain sufficient capital to cover their operational risks. The minimum capital requirements depend on the size and nature of the business.

- Effective risk management systems must be in place to identify, assess, and mitigate risks associated with their operations, for example, through stress testing.

- Brokers are required to execute client orders on the most favorable terms available and publish details of how they will do that, which is beneficial for day traders who require high-quality order execution.

- Client funds must be kept separate from the broker’s funds through segregated accounts to protect clients in case of broker insolvency.

- Brokers must provide traders with clear, accurate, and comprehensive information about their services, including risks, costs, and potential conflicts of interest.

- Brokers must ensure that their financial products suit their clients, considering their knowledge, experience, financial situation, and investment objectives.

- Advertising and promotional materials must be truthful, not misleading, and provide a fair representation of the products and services offered.

- Transactions must be monitored continuously for suspicious activity, and any transactions must be reported to the relevant authorities.

- Brokers must submit regular reports to the CBI, including financial statements, risk assessments, and compliance reports.

- Brokers must disclose significant information publicly, including financial performance and any material changes to their operations or management.

- Brokers must have robust procedures to handle client complaints efficiently and effectively.

The CBI maintains compliance by imposing substantial monetary fines, public reprimands, and operational restrictions on brokers who fail to meet regulations. These penalties are a strong deterrent against regulatory breaches, safeguarding active traders and upholding market integrity.

What Powers Does The CBI Have?

The CBI is not just a passive regulator but an active enforcer. It monitors compliance and takes swift enforcement actions against brokers who breach regulations. These actions can include fines, sanctions, and even license revoking, ensuring a secure trading environment for Irish traders.

For example, on 27 February 2024, the CBI fined Goodbody Stockbrokers Unlimited Company (Goodbody) €1,225,000 for “failing to put in place an effective trade surveillance framework to monitor, detect and report suspicious orders and transactions about market abuse in the period July 2016 to January 2022, some five and a half years.” Goodbody admitted to the breach.

When failures occur, the CBI expects firms to be accountable for regulatory breaches.

The CBI also often issues public statements highlighting enforcement actions, deterring other market participants. These statements detail the nature of the breach and the penalties imposed.

Bottom Line

For Irish traders seeking a secure trading environment, prioritizing brokers regulated by the CBI is a wise choice. The CBI enforces strict financial transparency standards, offering robust security and protection for your investments.

However, the number of CBI-regulated forex brokers is very limited compared to other parts of Europe, including the UK and Cyprus, potentially restricting your choice.

It’s also important to remember that even CBI regulation doesn’t eliminate inherent trading risks. Fast-paced strategies like day trading can still lead to losses. Always adhere to the golden trading rule: only risk what you can afford to lose.

Article Sources

- Central Bank of Ireland (CBI)

- Register of Authorized Firms - CBI

- Enforcement Actions - CBI

- Regulation Guidelines - CBI

- Goodbody Stockbrokers fined €1,225,000 - CBI

- Markets in Financial Instruments Directive (MiFID)

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com