Financial Markets Authority (AMF) Brokers 2025

In France, the Financial Markets Authority (AMF) – known locally as the Autorité des Marchés Financiers – regulates the country’s financial system and authorizes the activities of online brokers.

The AMF is considered a ‘green-tier’ regulator under our Regulation & Trust Rating, meaning that day traders can expect a high level of protection. Helpfully for investors, it regularly updates a warning list of unauthorized brokers that traders should avoid.

The French regulator is also relatively active, making 17 enforcement decisions in 2023, resulting in total financial penalties of €34.94 million. It also settled 10 cases which generated another $1.35 million in fines.

Here you’ll find a selection of the best brokers regulated by the AMF. Each one can be found on REGAFI’s database of authorized companies.

Best AMF Brokers

Following testing, these 2 AMF-regulated trading platforms stood out from the crowd:

Here is a short summary of why we think each broker belongs in this top list:

- eToro - eToro is a top-rated multi-asset platform which offers trading services in thousands of CFDs, stocks and cryptoassets. Launched in 2007, the brand has millions of active traders globally and is authorized by tier one regulators, including the FCA and CySEC. The brand is particularly popular for its comprehensive social trading platform. Crypto Trading is offered via eToro USA LLC; Investments are subject to market risk, including the possible loss of principal. CFDs are not available in the US Cryptoasset investing is highly volatile and unregulated in the UK and some EU countries. No consumer protection. Tax on profits may apply. 51% of retail accounts lose money.

- Saxo Bank - Saxo Markets is a multi-award-winning trading brokerage, investment firm and regulated bank. With a huge 72,000+ trading instruments, plus investment products and managed portfolios, clients have no shortage of opportunities. The trusted brand also offers transparent pricing and top-tier regulatory protection from 10+ agencies including FINMA, FCA & ASIC.

AMF Brokers Comparison

| Broker | Minimum Deposit | Markets | Platforms | Leverage |

|---|---|---|---|---|

| eToro | $100 | Stocks, ETFs, Options, Crypto | eToro Web, CopyTrader, TradingCentral | 1:30 EU |

| Saxo Bank | - | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures, options, warrants, bonds, ETFs | TradingView, ProRealTime | 1:30 |

eToro

"eToro's social trading platform leads the pack with a terrific user experience and active community chat that can help beginners find opportunities. There are also competitive fees on thousands of CFDs and real stocks, plus excellent rewards for experienced strategy providers."

Christian Harris, Reviewer

eToro Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, ETFs, Options, Crypto |

| Regulator | FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF |

| Platforms | eToro Web, CopyTrader, TradingCentral |

| Minimum Deposit | $100 |

| Minimum Trade | $10 |

| Leverage | 1:30 EU |

| Account Currencies | USD, EUR, GBP |

Pros

- There's a comprehensive online training academy with accessible resources, from bitesize articles to comprehensive courses.

- eToro is a world-renowned brand with top-tier global regulation and a 25M+ user community.

- The broker's services are great for beginners, with commission-free stock trading, a low minimum deposit and an unlimited demo.

Cons

- There are no guaranteed stop loss orders which would be a useful risk management feature for beginners.

- There is a $30 minimum withdrawal amount and a $5 fee, which will affect novices with low capital.

- The lack of additional charting platforms like MT4 will reduce the appeal for seasoned day traders accustomed to using third-party software.

Saxo Bank

"Saxo is best for active traders and high-volume investors with an unrivalled selection of instruments alongside premium market research and fee rebates. The 190 currency pairs with tight spreads also make Saxo great for forex traders."

Tobias Robinson, Reviewer

Saxo Bank Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures, options, warrants, bonds, ETFs |

| Regulator | DFSA, MAS, FCA, SFC, FINMA, AMF, CONSOB |

| Platforms | TradingView, ProRealTime |

| Minimum Trade | Vary by asset |

| Leverage | 1:30 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, SEK, DKK, CHF |

Pros

- The ISA account is highly accessible and flexible with no entry or exit fees

- Powerful proprietary trading platforms with comprehensive charting packages and advanced analysis tools

- Heavily regulated and trustworthy brand based in Switzerland

Cons

- Access to Level 2 pricing requires a subscription

- Clients from some jurisdictions not accepted including the US and Belgium

- High funding requirements for the trading accounts

Methodology

To locate the top brokers that are regulated in France, we:

- Consulted our database of 223 brokers to identify those claiming to be authorized by the AMF.

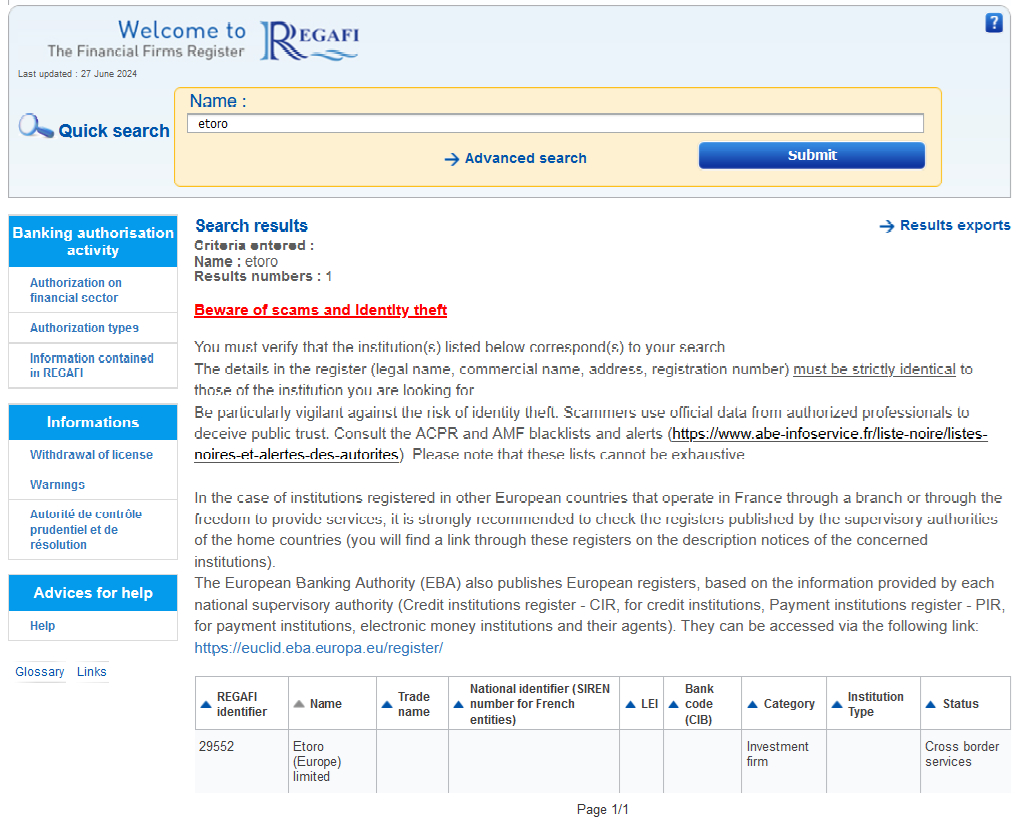

- Punched their details into the regulator’s online search facility to confirm their credentials.

- Blended the findings of our hands-on testers with 100+ data points to compile a list of the best brokers.

How Can I Check If A Broker Is Regulated By AMF?

There are three simple steps you can take to ascertain whether a broker has AMF authorization:

- Go to REGAFI’s register of approved financial companies.

- Type the broker’s name into the search field.

- If the company appears, click on the details in the ‘REGAFI Identifier’ or ‘Name’ fields to see additional details (like business address and regulated activities).

Here you can see the results of a search I ran on eToro, revealing that the company is AMF-authorized through the EU’s cross border initiative.

What Rules Must AMF-Regulated Brokers Follow?

Online brokers in France must follow a strict framework of rules designed to protect retail investors and the broader financial system.

France’s membership of the European Union means that the AMF follows many requirements demanded by the European Securities and Markets Association (ESMA).

One important piece of legislation is the Markets in Financial Instruments Directive II (MiFID II), which was introduced in 2018 to safeguard investors and boost the efficiency, transparency and strength of financial markets across the European Union.

Key rules that brokers regulated in France must follow include:

- Brokers must fairly advertise trading products, and clearly display client fees.

- Customer leverage (or borrowed funds) must not exceed 1:30 for major currency pairings, and 1:20 for all other forex crosses.

- Companies must offer negative balance protection, which prevents retail investors from losing more money than they have deposited, as well as margin close-outs, where positions are shut when a trader’s margin falls below 50% of the initial required amount.

- Brokers should establish rules that allow them to prevent, identify and manage conflicts of interest.

- Brokerages must adhere to minimum capital requirements of €750,000.

- Customers’ funds must be segregated from the brokers’ operating funds, thus protecting clients’ money in the event of corporate insolvency.

- Brokers should provide adequate information on the broader risks of online trading.

The AMF can issue financial penalties, and/or suspend or revoke a trading platform’s authorization to deal if they violate regulations.

Bottom Line

A strict regulatory regime makes France a great place for day traders to set up shop. But as with any territory, investors need to be on the lookout for fraudulent actors. The AMF says that 15% of the French population have been victims of a financial scam at one time or another.

It’s therefore important that traders only use a brokerage that has regulatory approval to do business. This can be checked in just a few minutes through the AMF website. Alternatively, use our list of the best brokers regulated in France.

Article Sources

- Financial Markets Authority (AMF)

- Warning List – AMF

- AMF publishes its 2023 Annual Report - AMF

- Register of Financial Agents (REGAFI)

- General regulation of the AMF into force since 01/01/2024 - AMF

- European Securities and Markets Association (ESMA)

- MiFID II - ESMA

- French AMF Slaps €300K Fine on Polish Broker XTB – Finance Magnates

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com