Best Regulated Brokers 2026

Only trade with the best regulated brokers – anything less is a risk. A trusted license ensures security, fair trading conditions, and scam protection. We’ve verified the regulatory credentials of every trading platform below.

Top 6 Regulated Brokers 2026

Our tests show these 6 regulated brokers and trading platforms are the best in February 2026:

-

1

Interactive BrokersRegulated by: FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM

Interactive BrokersRegulated by: FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM -

2

NinjaTraderRegulated by: NFA, CFTC

NinjaTraderRegulated by: NFA, CFTC -

3

eToro USARegulated by: SEC, FINRAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USARegulated by: SEC, FINRAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

4

Plus500USRegulated by: CFTC, NFATrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USRegulated by: CFTC, NFATrading in futures and options involves the risk of loss and is not suitable for everyone. -

5

OANDA USRegulated by: NFA, CFTCCFDs are not available to residents in the United States.

OANDA USRegulated by: NFA, CFTCCFDs are not available to residents in the United States. -

6

FOREX.comRegulated by: NFA, CFTC

FOREX.comRegulated by: NFA, CFTC

Why Are These The Best Regulated Brokers?

Here’s a quick rundown on why these regulated brokers made the cut:

- Interactive Brokers is the best regulated broker in 2026 - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- NinjaTrader - NinjaTrader is a US-headquartered and regulated brokerage that specializes in futures trading. There are three pricing plans to suit different needs and budgets, as well as ultra-low margins on popular contracts. The brand's award-winning charting software and trading platform also offers a high-degree of customization and superb technical analysis features.

- eToro USA - eToro is a social investing platform that offers short-term and long-term trading on stocks, ETFs, options and crypto. The broker is well-known for its user-friendly community-centred platform and competitive fees. With FINRA and SIPC oversight and millions of users across the world, eToro is still one of the most respected brands in the industry. eToro securities trading is offered by eToro USA Securities, Inc.

- Plus500US - Plus500US is a well-established broker that entered the US market in 2021. Authorized by the CFTC and NFA, it provides futures trading on forex, indices, commodities, cryptocurrencies, and interest rates. With a 10-minute sign-up, a manageable $100 minimum deposit, and a straightforward web platform, Plus500 continues to strengthen its offering for traders in the US.

- OANDA US - OANDA is a popular brand offering exceptional execution, low deposit requirements and advanced charting and trading platform features. The top-rated brand has over 25 years of experience and is regulated by trusted agencies, including the NFA/CFTC. Around the clock support is available for short-term traders, alongside flexible contract sizes and automated trade executions.

- FOREX.com - Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

Compare The Top Regulated Brokers On Key Metrics

Find the right regulated brokerage for you with our comparison of key features:

| Broker | Regulators | Instruments | Platforms | Minimum Deposit |

|---|---|---|---|---|

| Interactive Brokers | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | $0 |

| NinjaTrader | NFA, CFTC | Futures, Forex, Stocks, Options, Commodities, Futures, Crypto (non-futures depend on provider) | NinjaTrader Desktop, Web & Mobile, eSignal | $0 |

| eToro USA | SEC, FINRA | Stocks, Options, ETFs, Crypto | eToro Trading Platform & CopyTrader | $100 |

| Plus500US | CFTC, NFA | Futures on Cryptocurrencies, Metals, Agriculture, Forex, Interest rates, Energy, Equity Index future contracts | WebTrader, App | $100 |

| OANDA US | NFA, CFTC | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) | OANDA Trade, MT4, TradingView, AutoChartist | $0 |

| FOREX.com | NFA, CFTC | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto | WebTrader, Mobile, MT4, MT5, TradingView | $100 |

How Safe Are These Regulated Trading Providers?

See how secure the top regulated brokers are and how they safeguard your funds:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| Interactive Brokers | ✘ | ✔ | ✔ | |

| NinjaTrader | ✘ | ✘ | ✘ | |

| eToro USA | ✘ | ✘ | ✔ | |

| Plus500US | ✘ | ✘ | ✔ | |

| OANDA US | ✘ | ✘ | ✘ | |

| FOREX.com | ✘ | ✔ | ✔ |

Compare Mobile Trading

Here's how these regulated trading apps measure up for mobile users:

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Interactive Brokers | iOS & Android | ✔ | ||

| NinjaTrader | iOS & Android | ✘ | ||

| eToro USA | iOS & Android | ✘ | ||

| Plus500US | iOS & Android | ✘ | ||

| OANDA US | iOS & Android | ✘ | ||

| FOREX.com | iOS & Android | ✘ |

Are The Top Regulated Brokers Good For Beginners?

As well as a secure, regulated broker, beginners should look for key features that new traders need:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | $100 | ||

| NinjaTrader | ✔ | $0 | 0.01 Lots | ||

| eToro USA | ✔ | $100 | $10 | ||

| Plus500US | ✔ | $100 | Variable | ||

| OANDA US | ✔ | $0 | 0.01 Lots | ||

| FOREX.com | ✔ | $100 | 0.01 Lots |

Are The Top Regulated Brokers Good For Advanced Traders?

Experienced traders know regulation is just one piece of the puzzle, alongside key features for pros:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | ✔ | ✘ | 1:50 | ✔ | ✔ |

| NinjaTrader | NinjaScript or via Automated Trading Interface | ✘ | ✘ | ✘ | 1:50 | ✔ | ✘ |

| eToro USA | ✘ | ✘ | ✘ | ✘ | - | ✔ | ✔ |

| Plus500US | - | ✘ | ✘ | ✘ | Variable | ✔ | ✘ |

| OANDA US | Expert Advisors (EAs) on MetaTrader | ✘ | ✔ | ✘ | 1:50 | ✔ | ✘ |

| FOREX.com | Expert Advisors (EAs) on MetaTrader | ✔ | ✔ | ✘ | 1:50 | ✔ | ✘ |

Compare The Ratings Of The Top Regulated Trading Platforms

Explore how the top regulated day trading platforms compare in every vital area based on our hands-on tests:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| Interactive Brokers | |||||||||

| NinjaTrader | |||||||||

| eToro USA | |||||||||

| Plus500US | |||||||||

| OANDA US | |||||||||

| FOREX.com |

Compare Trading Fees

Fees can significantly impact your costs - here’s how the top regulated providers compare on pricing:

| Broker | Cost Rating | Fixed Spreads | Inactivity Fee |

|---|---|---|---|

| Interactive Brokers | ✘ | $0 | |

| NinjaTrader | ✘ | $25 | |

| eToro USA | ✔ | $10 | |

| Plus500US | ✘ | $0 | |

| OANDA US | ✘ | $0 | |

| FOREX.com | ✘ | $15 |

How Popular Are These Regulated Trading Brokers?

Many traders gravitate toward the regulated brokers with the highest client sign-ups:

| Broker | Popularity |

|---|---|

| Plus500US | |

| Interactive Brokers | |

| eToro USA | |

| NinjaTrader | |

| FOREX.com |

Why Trade With Regulated Interactive Brokers?

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- The TWS platform has clearly been built for intermediate and advanced traders and comes with over 100 order types and a reliable real-time market data feed that rarely goes offline.

- With low commissions, tight spreads and a transparent fee structure, IBKR delivers a cost-effective environment for short-term traders.

- The new IBKR Desktop platform takes the best of TWS while adding bespoke tools like Option Lattice and Screeners with MultiSort to create a genuinely impressive trading experience for day traders at every level.

Cons

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

Why Trade With Regulated NinjaTrader?

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures, Forex, Stocks, Options, Commodities, Futures, Crypto (non-futures depend on provider) |

| Regulator | NFA, CFTC |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD |

Pros

- Low fees are offered, with $50 day trading margins & commissions from $.09 per micro contract

- Traders can get free platform access and trade simulation capabilities in the unlimited demo

- NinjaTrader continues to deliver comprehensive charting software for active day traders with bespoke technical indicators and widgets

Cons

- There is a withdrawal fee on some funding methods

- Non forex and futures trading requires signing up with partner brokers

- The premium platform tools come with an extra charge

Why Trade With Regulated eToro USA?

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, ETFs, Crypto |

| Regulator | SEC, FINRA |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Minimum Trade | $10 |

| Account Currencies | USD |

Pros

- A free demo account means new users and prospective day traders can try the broker risk-free

- The broker's Academy offers comprehensive learning materials for beginners to advanced-level investors

- Investors can access Smart Portfolios for a more hands-off approach, covering a range of sectors and markets such as renewable energy and artificial intelligence

Cons

- The proprietary terminal doesn't support trading bots and there are no additional stock market analysis tools

- There's no MetaTrader 4 platform integration for traders who are accustomed to using third-party charting tools

- Average fees may cut into the profit margins of day traders

Why Trade With Regulated Plus500US?

"Plus500US stands out as an excellent choice for beginners, offering a very user-friendly platform, low day trading margins, and access to the Futures Academy to enhance trading skills. Its powerful tools and reliable service helped it scoop second place in DayTrading.com's annual 'Best US Broker' award."

Michael MacKenzie, Reviewer

Plus500US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures on Cryptocurrencies, Metals, Agriculture, Forex, Interest rates, Energy, Equity Index future contracts |

| Regulator | CFTC, NFA |

| Platforms | WebTrader, App |

| Minimum Deposit | $100 |

| Minimum Trade | Variable |

| Leverage | Variable |

| Account Currencies | USD |

Pros

- The trading app provides a terrific user experience with a modern design, a clean layout and mobile-optimized charts

- The straightforward account structure, pricing model and web platform offer an easier route into futures trading than rivals like NinjaTrader

- Plus500 is a publicly traded company with a good reputation, over 24 million traders, and a sponsor of the Chicago Bulls.

Cons

- Although support response times were fast during tests, there is no telephone assistance

- The proprietary platform is user-friendly but lacks advanced technical analysis tools found in third-party solutions like MetaTrader 4

- Plus500US does not offer social trading capabilities, a feature available at alternatives like eToro US which could strengthen its offering for aspiring traders

Why Trade With Regulated OANDA US?

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Regulator | NFA, CFTC |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, AUD, JPY, CHF, HKD, SGD |

Pros

- The broker's API facilitates access to 25 years of deep historical data and rates from 200+ currencies

- Day traders can enjoy fast and reliable order execution

- OANDA is a reliable, trustworthy and secure brand with authorization from tier-one regulators including the CFTC

Cons

- There's only a small range of payment methods available, with no e-wallets supported

- It's a shame that customer support is not available on weekends

- The range of day trading markets is limited to forex and cryptos only

Why Trade With Regulated FOREX.com?

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Regulator | NFA, CFTC |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

Cons

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

How Did We Choose The Best Regulated Brokers?

To find the best regulated trading brokers, we:

- Took our database comprizing 140 online brokers and trading platforms;

- Pinpointed those that are regulated after verifying their credentials on the respective regulator’s databases;

- Sorted them by their rating which balances 200+ data entries with the personal observations of our testers.

All Regulators

- Australian Securities and Investments Commission (ASIC) Brokers 2026

- Canadian Investment Regulatory Organization (CIRO) Brokers 2026

- Capital Markets Authority (CMA) Brokers 2026

- Central Bank of Ireland (CBI) Brokers 2026

- Commodity Futures Trading Commission (CFTC) Brokers 2026

- Cyprus Securities and Exchange Commission (CySEC) Brokers 2026

- Dubai Financial Services Authority (DFSA) Brokers 2026

- European Securities and Markets Authority (ESMA) Brokers 2026

- Federal Financial Supervisory Authority (BaFin) Brokers 2026

- Financial Conduct Authority (FCA) Brokers 2026

- Financial Industry Regulatory Authority (FINRA) Brokers 2026

- Financial Market Supervisory Authority (FINMA) Brokers 2026

- Financial Markets Authority (AMF) Brokers 2026

- Financial Sector Conduct Authority (FSCA) Brokers 2026

- Financial Service Board (FSB) Brokers 2026

- Financial Supervision Authority (KNF) Brokers 2026

- Japan Financial Services Agency (FSA) Brokers 2026

- Monetary Authority of Singapore (MAS) Brokers 2026

- National Commission for Companies and the Stock Exchange (CONSOB) Brokers 2026

- National Futures Association (NFA) Brokers 2026

- National Securities Market Commission (CNMV) Brokers 2026

- Netherlands Authority for the Financial Markets (AFM) Brokers 2026

- New Zealand Financial Markets Authority (FMA) Brokers 2026

- Securities And Exchange Board Of India (SEBI) Brokers 2026

- Securities and Exchange Commission of Brazil (CVM) Brokers 2026

- Securities And Futures Commission Of Hong Kong (SFC) Brokers 2026

- The Securities Commission Malaysia (SC) Brokers 2026

- US Securities and Exchange Commission (SEC) Brokers 2026

- Vanuatu Financial Services Commission (VFSC) Brokers 2026

Do I Need A Regulated Broker?

Yes. If you want to trade on a secure trading platform then selecting a regulated broker is a no-brainer.

Sometimes traders may opt for an unregulated broker to access trading promotions or high leverage that aren’t permitted in tightly regulated jurisdictions, but we do not recommend this, especially for newer traders.

There are three key reasons why you should choose a regulated broker:

- Protection: Many regulators require authorized brokers to provide retail traders with access to compensation in the event the firm is unable to meet its financial obligations, negative balance protection to prevent traders losing more than their deposited funds, and to operate segregated accounts so client funds cannot be misused. For example, the Securities Investor Protection Corporation (SIPC) in the US provides up to $500,000 per person and the Financial Services Compensation Scheme (FSCS) in the UK provides up to £85,000.

- Transparency: Regulators normally require brokers to be transparent about trading fees, order execution, and risks, all of which are critical considerations for day traders. For example, in the European Union (EU), regulated brokers are required to publish the percentage of losing traders on their website, especially when using complex products like contracts for difference (CFDs), which are popular with active traders.

- Security: Regulated brokers are often required to implement systems to protect your data, notably encryption protocols and security audits. For example, the ASIC in Australia requires multi-factor authentication for digital transactions while the FCA in the UK requires brokers to adhere to strict rules under the General Data Protection Regulation (GDPR).

For these reasons, I only deposit funds with regulated brokers. As a UK-based investor, this means I hold my capital with FCA-regulated trading platforms.

Are All Brokers Created Equal?

Where things get slightly tricky is that simply choosing any ‘regulated broker’ isn’t enough.

This is because not all regulatory bodies offer the same levels of protection. There is a common misconception that financial agencies supervise brokers across numerous jurisdictions. However, often regulatory remit is limited to those brokers with a license issued within the regulator’s jurisdiction.

Therefore, bodies outside your financial jurisdiction may not provide such extensive legal recourse should there be an issue, be it access to investor compensation or formal dispute channels. For example, the JFSA in Japan offers up to ¥10,000,000 per investor through its Investor Protection Fund (IPF), however it’s primarily available to residents.

Equally, financial agencies enforce varying degrees of regulations. For instance, all FCA brokers must segregate trader’s funds. Whereas offshore bodies like the FSC of Mauritius may not enforce this regulation. Furthermore, FCA brokers must automate and process client withdrawals promptly, while offshore brokers have been known to delay withdrawals, which can be extremely frustrating.

To help you understand which regulators are ‘good’ and crucially – which aren’t, we’ve drawn upon our collective decades working in the trading industry and personal experiences using various trading platforms to classify regulators based on the level of protection they provide:

- Green Tier: These regulators provide the strongest investor safeguards and actively oversee authorized brokers. Notable examples include the SEC in the US, FCA in the UK and ASIC in Australia.

- Yellow Tier: These regulators still provide strong investor safeguards and monitor authorized brokers but not always to the same degree as ‘green tier’ regulators. Notable examples include the FSCA in South Africa, the SEBI in India, and the DFSA in Dubai which is becoming increasingly popular as established brokers like Plus500 have been looking to expand their presence in the Middle East.

- Orange Tier: These regulators provide limited investor safeguards and scrutiny of authorized brokers, requiring caution before signing up. Notable examples include the BMA in Bermuda, the BOB in Botswana and the BCE in Ecuador.

- Red Tier: These regulators provide little to no investor safeguards and we consider them high-risk. Notable examples include the VFSC in Vanuatu, the FSA in Seychelles, and the SCB in the Bahamas.

I recommend extreme caution when dealing with brokers registered with ‘red tier’ regulators. They are sometimes used by scammers to strip traders of any legal protections they may be afforded in well-regulated regions.In one high-profile case, the bad actors behind trading firm EverFX, convinced aspiring investors to move their funds to offshore entities where there was little to zero regulatory oversight.

The global scamming network is estimated to have made off with up to an eye-watering $1 billion.

How Can I Check If My Broker Is Regulated?

Checking whether a broker is regulated is incredibly straightforward, with an increasing number of financial bodies operating digital, publicly accessible databases where you can input a trading firm’s details.

You’ll normally need to follow a few simple steps:

- Navigate to the respective regulator’s database (usually searchable on the agency’s website)

- Enter the broker’s company name or license number (often found at the bottom of the broker’s website)

- Read the search results to confirm they are authorized (check which investment services and where they are permitted to do business)

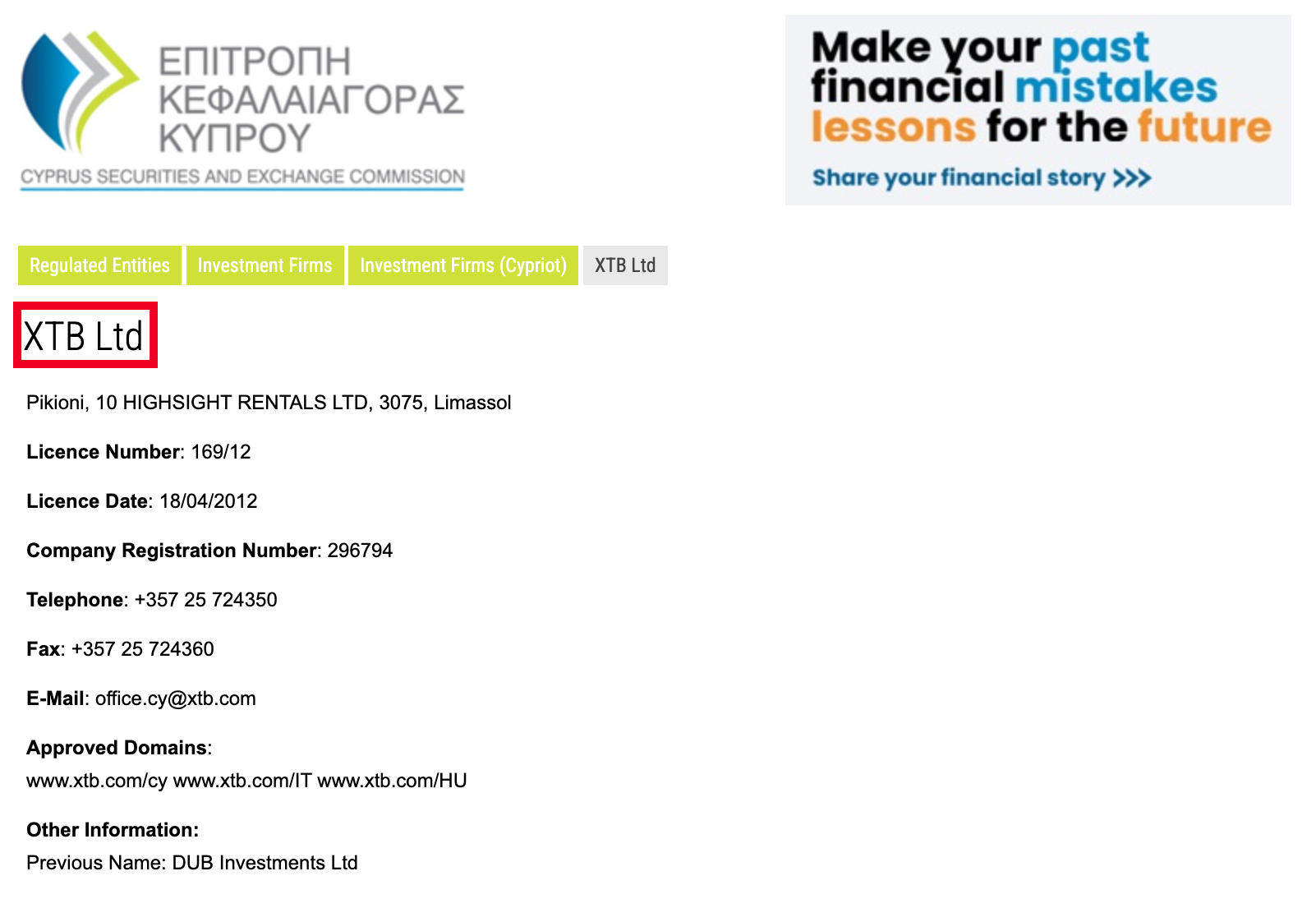

I have personally checked the regulatory details of hundreds of brokers on countless regulators’ databases, from the US and UK to Europe, Australia and beyond.To show you how it’s done, below you can see the results of a search I ran on XTB, which claimed to be authorized by the CySEC.

Bottom Line

Choosing a regulated trading platform should be your first priority. It’s a win-win for both traders and brokers.

For traders, it’s the best indication a firm can be trusted to operate in a fair manner. For brokers, regulatory oversight helps build a solid reputation and reduces the need to constantly try and undercut competitors in areas like leverage limits.

Picking a regulated broker is also especially important given the increasing sophistication of trading scams we’ve been witnessing with alarm in recent years, capitalizing on the growing class of ‘finfluencers’ and interest in artificial intelligence (AI).

Use our list of top regulated day trading platforms to be sure a broker is regulated.

FAQ

What Is Trading Regulation?

Regulatory bodies and watchdogs supervise financial markets and online brokers. They enforce a range of rules and regulations to protect retail traders.

The Markets in Financial Instruments Directive (MiFID), since replaced by MiFID II, is the closest the world has got to an overarching regulatory system. It was brought into the UK in 2007 and has been the bedrock of Europe’s financial regulatory systems since.

What Is A Regulated Broker?

Regulated brokers receive a license to operate within that jurisdiction, so long as they adhere to specific rules and regulations, often designed to protect retail traders and the functioning of financial markets.

What Is An Unregulated Broker?

Unregulated brokers operate without having to adhere to a set of guidelines. Arguably, therefore, they do not have the same interest in safeguarding your interests. This allows them to offer attractive features like high leverage and welcome bonuses, but the catch is limited legal protection for your funds.

Which Is The Best Regulated Broker?

Use our list of the top regulated brokers to find a trading platform that best suits your needs. Our experts have independently verified the regulatory credentials of every broker recommended.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com