Best Brokers For Professional Traders 2025

Experienced traders can qualify for a professional trading account, with more attractive account conditions than their retail counterparts, in return for a larger deposit and fewer safeguards. We have compiled a list of the best brokers for professional traders, taking into account key factors such as:

- The minimum deposit

- The maximum leverage

- The fees and rebates

- The personalized support

- The exclusive perks

Best Brokers For Professional Traders 2025

These are the 6 best professional trading accounts based on our latest findings:

Why Are These Brokers the Best for Professional Traders?

Here’s why we believe these brokers are the top contenders for pro traders:

- FOREX.com is the best broker for professional traders in 2025 - The FOREX.com pro account is a good option for active traders with one-on-one priority support, deep liquidity, and reimbursed bank transfer fees. The broker also offers up to 4.5% APY interest on daily available margin balances up to $500K, with a further 1.5% on $500K+. Discounted commissions are also available up to $40 per million.

- OANDA US - OANDA US offers a popular professional trading account with oversight from the NFA. Clients can get lower fees with up to $15 per million rebates or spreads from 0.1 pips with a $3.50 commission per side. A free VPS is also available to pro traders.

- AvaTrade - The AvaTrade professional account offers high leverage up to 1:400 on forex and 1:25 on cryptocurrencies. Over 1250 instruments are available alongside lower fixed spreads of 0.6 pips on forex. Traders get a choice of proprietary and third-party software and can get started with an accessible deposit of $100.

- IC Markets - IC Markets is a true ECN broker with an excellent professional trading account. Over 2000 instruments are offered, including 60 forex pairs. Ultra-tight spreads are available with a $3.50 commission, though cTrader offers a $3 commission. Pro clients also retain negative balance protection. On the downside, there is no rebate program.

- Pepperstone - Pepperstone offers a top-rated professional trading account with leverage up to 1:500 and over 1200 CFDs. The Active Trader Program offers competitive cash rebates up to 30% (index and commodities) and $3 per lot (forex), while the Razor account provides spreads from 0.0 pips with a tight commission of $3.50 per side. Fast execution speeds of around 30ms will also appeal to high-volume day traders.

- Fusion Markets - Fusion Markets offers a Pro account for eligible traders with high leverage up to 1:500, a dedicated account manager and a queue jump if they need support. Pro traders are not entitled to negative balance protection.

Compare the Top Brokers For Pro Traders on Key Attributes

Find the perfect broker based on the key aspects that matter to professional traders:

| Broker | Fast Execution | VPS | Minimum Deposit | Leverage | Platforms | Automated Trading | Instruments | Regulators |

|---|---|---|---|---|---|---|---|---|

| FOREX.com | ✔ | ✔ | $100 | 1:50 | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral | Expert Advisors (EAs) on MetaTrader | Forex, Stocks, Futures, Futures Options | NFA, CFTC |

| OANDA US | ✔ | ✘ | $0 | 1:50 | OANDA Trade, MT4, TradingView, AutoChartist | Expert Advisors (EAs) on MetaTrader | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) | NFA, CFTC |

| AvaTrade | ✔ | ✘ | $100 | 1:30 (Retail) 1:400 (Pro) | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade | Expert Advisors (EAs) on MetaTrader | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM |

| IC Markets | ✔ | ✔ | $200 | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower | Expert Advisors (EAs) on MetaTrader, cBots on cTrader, Myfxbook AutoTrade | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | ASIC, CySEC, FSA, CMA |

| Pepperstone | ✔ | ✔ | $0 | 1:30 (Retail), 1:500 (Pro) | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower | Expert Advisors (EAs) on MetaTrader | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Fusion Markets | ✔ | ✔ | $0 | 1:500 | MT4, MT5, cTrader, TradingView, DupliTrade | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | CFDs, Forex, Stocks, Indices, Commodities, Crypto | ASIC, VFSC, FSA |

How Safe Are These Brokers With Pro Accounts?

Do our top brokers for pro traders offer security measures to keep large account balances safe?

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| FOREX.com | ✘ | ✔ | ✘ | |

| OANDA US | ✔ | ✘ | ✘ | |

| AvaTrade | ✘ | ✔ | ✔ | |

| IC Markets | ✘ | ✔ | ✔ | |

| Pepperstone | ✘ | ✔ | ✔ | |

| Fusion Markets | ✘ | ✔ | ✔ |

Compare Mobile Trading

Are these brokers good for sophisticated traders dealing on mobiles?

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| FOREX.com | iOS & Android | ✘ | ||

| OANDA US | iOS & Android | ✘ | ||

| AvaTrade | iOS & Android | ✘ | ||

| IC Markets | iOS & Android | ✘ | ||

| Pepperstone | iOS & Android | ✘ | ||

| Fusion Markets | iOS & Android | ✘ |

Compare the Ratings of Top Brokers With Pro Trading Accounts

Compare top brokers for pro traders with insights from our in-depth ratings:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| FOREX.com | |||||||||

| OANDA US | |||||||||

| AvaTrade | |||||||||

| IC Markets | |||||||||

| Pepperstone | |||||||||

| Fusion Markets |

Compare Trading Fees

Over time, trading fees add up, especially for professional traders making large, frequent transactions. Here’s how our leading brokers for pro traders compare on costs:

| Broker | Cost Rating | Fixed Spreads | Inactivity Fee |

|---|---|---|---|

| FOREX.com | ✘ | $15 | |

| OANDA US | ✘ | $0 | |

| AvaTrade | ✔ | $50 | |

| IC Markets | ✘ | $0 | |

| Pepperstone | ✔ | $0 | |

| Fusion Markets | ✘ | $0 |

How Popular Are These Brokers With Pro Trading Accounts?

Many seasoned traders prefer brokers that lead the pack in client sign-ups:

| Broker | Popularity |

|---|---|

| Pepperstone | |

| FOREX.com | |

| AvaTrade | |

| IC Markets | |

| Fusion Markets |

Why Open A Professional Trading Account with FOREX.com?

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Bonus Offer | Active Trader Program With A 15% Reduction In Costs |

|---|---|

| Demo Account | Yes |

| Instruments | Forex, Stocks, Futures, Futures Options |

| Regulator | NFA, CFTC |

| Platforms | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- Alongside a choice of leading platforms, FOREX.com offers a superb suite of supplementary tools including Trading Central research, SMART Signals pattern scanner, trading signals, and strategy builders.

- The in-house Web Trader continues to shine as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

Cons

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- Funding options are limited compared to leading alternatives like IC Markets and don’t include many popular e-wallets, notably UnionPay and POLi.

- Despite increasing its range of instruments, FOREX.com's product portfolio is still limited to forex and CFDs, so there are no options to invest in real stocks, real ETFs or real cryptocurrencies.

Why Open A Professional Trading Account with OANDA US?

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Regulator | NFA, CFTC |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, HKD, SGD |

Pros

- The broker's API facilitates access to 25 years of deep historical data and rates from 200+ currencies

- Seasoned day traders can access industry-leading tools, including an MT4 premium upgrade and advanced charting provided by MotiveWave

- Beginners can get started easily with $0 minimum initial deposit

Cons

- There's only a small range of payment methods available, with no e-wallets supported

- It's a shame that customer support is not available on weekends

- The range of day trading markets is limited to forex and cryptos only

Why Open A Professional Trading Account with AvaTrade?

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Bonus Offer | 20% Welcome Bonus up to $10,000 |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- AvaTrade continues to enhance its suite of products, recently through AvaFutures, providing an alternative vehicle to speculate on over 35 markets with low day trading margins.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

Cons

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

Why Open A Professional Trading Account with IC Markets?

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, FSA, CMA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

- IC Markets offers fast and dependable 24/5 support based on firsthand experience, particularly when it comes to accounts and funding issues.

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

Cons

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

- While IC Markets offers a selection of metals and cryptos for trading via CFDs, the range is not as extensive as brokers like eToro, limiting opportunities for traders interested in these asset classes.

Why Open A Professional Trading Account with Pepperstone?

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Pepperstone boasts impressive execution speeds, averaging around 30ms, facilitating fast order processing and execution that’s ideal for day trading.

- Pepperstone emerges as a low-cost broker, especially for serious day traders with spreads from 0.0 in the Razor account and rebates up to 30% (index and commodities) and $3/lot (forex) through the Active Trader program.

- Pepperstone has scooped multiple DayTrading.com annual awards over the years, most recently 'Best Overall Broker' in 2025 and 'Best Forex Broker' runner up in 2025.

Cons

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers such as eToro, with no option to invest in real coins.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

Why Open A Professional Trading Account with Fusion Markets?

"Fusion Markets is a standout option for forex traders looking for excellent pricing with spreads near zero, industry-low commissions and recently TradingView integration. It’s a particularly good broker for Australian traders where the company is headquartered and regulated by the ASIC."

Jemma Grist, Reviewer

Fusion Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, VFSC, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, DupliTrade |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Fusion Markets is set up to support algo traders with a sponsored VPS solution and a 25% discount if you opt for the NYC Servers VPS for MT4 or cTrader.

- Fusion Markets offers best-in-class support with very fast, friendly and helpful responses during tests and no frustrating automated chatbot to navigate.

- The market analysis features, Market Buzz and Analyst Views, are great tools for discovering opportunities and conveniently integrated into the client dashboard.

Cons

- The demo account expires after 30 days, limiting its potential as a useful trading tool alongside a real-money account.

- Traders outside of Australia must sign up with weakly regulated global entities with limited safeguards and no negative balance protection.

- There is no proprietary trading platform or app built with beginners in mind, a notable drawback compared to AvaTrade.

How To Choose A Pro Trading Account Provider

Based on our tests and research, the top professional trading accounts offer low deposits, high leverage, tight spreads, fee rebates, advanced tools, and priority support.

We unpack these comparison factors and our methodology in more detail below.

Minimum Deposit

While professional traders tend to have more capital than retail investors, a lower minimum deposit still makes a broker more accessible.

Our team compare the initial deposit requirements at different pro trading accounts to find the brands with the most straightforward funding requirements.

- AvaTrade requires a reasonable $100 deposit to get started with its professional trading account.

Leverage

Brokers tend to offer higher leverage in their professional trading accounts from our investigations.

For example, while in the EU, UK and Australia, leverage is generally capped at 1:30 for retail traders, pro traders can access rates in excess of 1:400.

Fees

Fees are particularly important for professional traders who often employ highly leveraged strategies with very tight margins.

We consider brokers with low, raw spreads as the most suitable for professional traders. As well as the tightest spreads, we also assess the round-turn commission, and any additional fees such as charges for account maintenance, withdrawals, and third-party tools.

- IC Markets offers tight spreads from 0.0 pips alongside a $3.50 commission. You can also lower the commission to $3.00 on cTrader.

Rebates

The level of rebates and volume requirements can have a significant impact on the bottom line of a high-volume trader.

As a result, we evaluate the discounts available in professional trading accounts.

- Pepperstone offers rebates on trading fees starting from 15% for traders with a volume from £20–£99 million, rising to 20% from £100–£199 million, 25% up to £299 million, and a tailored rate thereafter.

Support

The best brokers for professional traders offer dedicated account managers with priority support and shorter queue times.

This is because any downtime could effectively stop you from doing your day job, and an issue with your platform or funding method could scupper a carefully planned position or lead to heightened losses.

- OANDA stands out for its personal relationship manager on-hand to support with queries.

Tools

Professional traders can benefit from specialized tools to help execute strategies.

These can include Virtual Private Servers (VPS), which facilitate 24-hour access to financial markets with reduced latency. These are especially useful for algorithmic trading, and are frequently used in conjunction with MetaTrader’s Expert Advisors.

- XM offers a free VPS when you trade five round-turn lots per month and have an account balance of $5,000 – achievable criteria for high-volume pro traders.

How To Qualify For A Professional Trading Account

The key difference between professional and retail trading accounts is that the former are normally only available to traders who meet certain criteria, whereas the latter are available to most adults who want to trade online.

The criteria to become a professional trader varies between regulators and brokers, but usually includes:

- Demonstrating you have experience with relevant derivative products for at least one year

- Evidencing that you have completed suitably sized trades at least 10 times per quarter over the last year

- Holding a significant financial portfolio of at least €500,000

Brokers for professional traders normally only require two of these three criteria to be fulfilled. This means they can accommodate both working professionals who can prove they frequently make trades, and experienced retail traders who can show they have sufficient capital and are actively trading with large amounts.

FAQ

What Is A Professional Trading Account?

Professional trading accounts are offered by some brokers and provide specialized trading terms for high-volume traders.

Importantly, pro trading accounts differ from retail trading accounts by offering higher leverage, lower spreads, fee rebates, advanced tools and dedicated support.

Can Anyone Open A Professional Trading Account?

Whereas retail trading accounts are available to most adults with the required documents and initial deposit, professional trading accounts are reserved for proven traders who meet certain criteria.

Criteria can vary depending on the regulator and broker, but applicants usually have to show they have experience in relevant trading products (e.g. forex and CFDs), a track record of placing large and frequent trades (e.g. at least 10 per quarter for the last 4 quarters), and/or a sufficiently-sized financial portfolio (e.g. upwards of €500,000).

What Are The Benefits Of A Professional Trading Account?

Pro traders are not restricted to the lower rates of leverage that top-tier regulators usually stipulate for retail investors – normally around 1:30. As a result, a regulated, reliable broker can offer professional clients up to 1:500 or more.

Professional clients usually execute a much higher volume of trades, and thus they are generally afforded more competitive fees with tighter spreads and lower commissions. Rebates are also common through schemes that offer greater discounts the more you trade.

Many brokers for professional traders will offer clients one-to-one, personalized account support, to ensure they can get the most out of their platforms and services.

Professional trading accounts often have access to the best tools and features a brokerage offers. This can include free access to or reimbursement for Virtual Private Servers (VPS).

What Are The Risks Of A Professional Trading Account?

Professional traders are not covered by the same safeguards imposed by regulators to protect retail traders. This means you may waive negative balance protection and restrictions on high-risk products like cryptocurrency.

Brokers for professional traders also require larger sums of upfront investment. These can take the form of higher minimum deposits and ongoing monthly trading volume requirements.

Are There Alternatives To Professional Trading Accounts?

Funded trading accounts are an attractive alternative for retail traders who want to make a step up from their standard trading accounts but do not meet the criteria to count as professionals.

A funded trading account allows traders to earn money from the profits of trades they make from capital provided by a prop firm. Most brokers with funded accounts require traders to complete a trading challenge to prove their skills, and then supply them with a set amount of starting capital that the traders can increase by meeting profit targets.

What Brokers Do Professional Traders Use?

Our team have ranked the best brokerages for professional traders. In running our comparison, we took into account multiple factors, from leverage, support, tools and fee rebates, to the safeguards you may have to give up, including negative balance protection and access to investor compensation schemes.

What Trading Platform Do Professional Traders Use?

MetaTrader 4 (MT4) is the independent trading platform most commonly used by professional traders. It has been around for a long time and is still the most popular, despite the later released MetaTrader 5. MetaTrader 4 offers technical indicators, charts and automated trading support, while also being very customizable.

Some brokers have proprietary trading platforms that are good enough for many professional traders. See our list of top brokers for trading professionals above for options.

Article Sources

- AvaTrade - Professional Trading Account Requirements

- Pepperstone - Professional Trading Account Requirements

- IC Markets - Professional Trading Account Requirements

- IG - Professional Trading Account Requirements

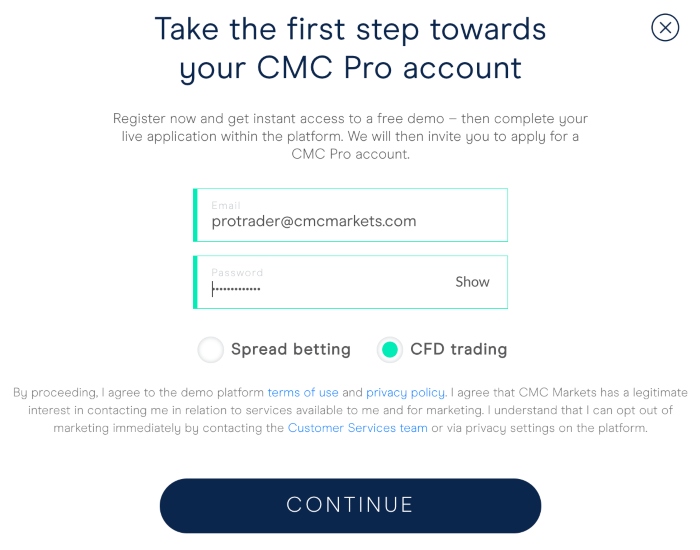

- CMC Markets - Professional Trading Account Requirements

- Forex.com - Professional Trading Account Requirements

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com