Brokers With NZD Accounts

An NZD trading account is denominated in New Zealand’s currency, making it more convenient and affordable for Kiwis to trade the financial markets. An NZD account also means you can hold your trading funds in a relatively stable currency managed by the Reserve Bank of New Zealand (RBNZ).

Discover the best brokers with NZD accounts, personally tested by our experts.

Best Brokers With NZD Accounts

Our tests show that these are the top 6 brokers that support NZD accounts:

Here is a short overview of each broker's pros and cons

- Dukascopy - Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- AZAforex - Established in 2016, AZAforex is an offshore broker offering short-term trading on 235+ global financial markets, including through binary options with payouts of up to 90%. Three accounts (Start, Pro and VIP) offer unique features, but all provide access to the broker’s Mobius Trader 7 platform, which has benefited from performance upgrades over the years.

- Zacks Trade - Zacks Trade is a FINRA-regulated US broker offering trading on stocks, ETFs, cryptocurrencies, bonds and more through a proprietary terminal. The broker is geared toward active traders and offers very affordable fees on most assets as well as an app and a vast amount of market data.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- IC Trading - IC Trading is part of the established IC Markets group. Built for serious traders, it boasts some of the most competitive spreads, reliable order execution, and advanced trading tools. The catch is that it’s registered in the offshore financial centre of Mauritius, enabling it to offer high leverage but in a weakly regulated trading setting.

Brokers With NZD Accounts Comparison

| Broker | NZD Account | Minimum Deposit | Markets | Regulator |

|---|---|---|---|---|

| Dukascopy | ✔ | $100 | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | FINMA, JFSA, FCMC |

| AZAforex | ✔ | $1 | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Binary Options | GLOFSA |

| Zacks Trade | ✔ | $2500 | Stocks, ETFs, Cryptos, Options, Bonds | FINRA |

| IC Markets | ✔ | $200 | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | ASIC, CySEC, FSA, CMA |

| Exness | ✔ | $10 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | CySEC, FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| IC Trading | ✔ | $200 | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures | FSC |

Dukascopy

"If you’re an experienced trader, Dukascopy provides the tools you need: JForex for algorithmic strategies, competitive spreads from 0.1 pips, leverage up to 1:200, and the peace of mind of using a Swiss-regulated bank and broker."

Christian Harris, Reviewer

Dukascopy Quick Facts

| Bonus Offer | 10% Equity Bonus |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Regulator | FINMA, JFSA, FCMC |

| Platforms | JForex, MT4, MT5 |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:200 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, ZAR, TRY, SEK, NOK, DKK, CHF, HKD, SGD, PLN, CZK, AED, SAR, HUF, MXN |

Pros

- The proprietary JForex platform is highly advanced, offering tools for algorithmic trading, extensive charting, and access to deep liquidity for short-term traders.

- Dukascopy offers tight spreads starting from 0.1 pips, leverage up to 1:200 (depending on the jurisdiction), and volume-based commissions that reward high-frequency traders.

- Dukascopy features some of the best research we’ve seen, even a professional TV studio in Geneva covering financial news, market analysis, and daily insights from professionals.

Cons

- While JForex is feature-rich, it has a steep learning curve, making it less suitable for beginner traders who might prefer simpler platforms.

- While Dukascopy provides some educational resources and 24/7 support, the complexity of its platforms and tools required extensive testing and may overwhelm newer traders.

- Some account types, such as the MT4/MT5 accounts, require a higher minimum deposit of $1,000, which may not be ideal for traders with smaller budgets.

AZAforex

"AZAforex is best suited to active traders looking to make all-or-nothing bets on global markets through binary options and those looking for high leverage up to 1:1000 in return for weak regulatory safeguards."

Christian Harris, Reviewer

AZAforex Quick Facts

| Bonus Offer | 25% Crypto Deposit Bonus, 120% Loyalty Bonus, 30% Spread Rebate |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Binary Options |

| Regulator | GLOFSA |

| Platforms | Mobius Trader 7 |

| Minimum Deposit | $1 |

| Minimum Trade | 0.0001 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, MYR, IDR, CHF, RUB, THB, VND, UAH, CNY |

Pros

- Few brokers offer binary options as part of their portfolio. Still, AZAforex includes them, allowing you to speculate on short-term price movements with fixed risk and reward up to 90%.

- AZAforex supports a huge and growing variety of payment methods, including bank transfers, credit/debit cards, e-wallets, and cryptocurrencies, providing flexibility for funding and withdrawals. This variety accommodates traders from different regions and preferences.

- AZAforex provides high leverage of up to 1:1000, allowing for potentially greater returns with smaller capital. While this comes with increased risk, it's an attractive feature if you are an experienced trader looking for aggressive growth strategies.

Cons

- AZAforex offers basic trading guides and a blog but lacks robust educational tools such as video tutorials, webinars, or interactive learning resources. This makes it less appealing for beginners who need comprehensive learning support. A lot of the content is outdated, too.

- AZAforex still operates without regulation from a recognized financial authority, which raises concerns about transparency, fund safety, and accountability. You may have no recourse in disputes, making it riskier than regulated brokers.

- While functional during testing, the Mobius Trader 7 platform is proprietary and not widely used by other brokers. This creates risks of potential price manipulation or discrepancies in market data, as there's no external verification like with MetaTrader or cTrader.

Zacks Trade

"Zacks Trade will suit active day traders with experience using powerful platforms. Fees and margin rates are low while the market research is excellent."

Tobias Robinson, Reviewer

Zacks Trade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, ETFs, Cryptos, Options, Bonds |

| Regulator | FINRA |

| Platforms | Own |

| Minimum Deposit | $2500 |

| Minimum Trade | $3 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, TRY, SEK, NOK, DKK, CHF, HKD, SGD, RUB, PLN, CZK, HUF |

Pros

- Demo account

- 20+ account denominations

- Regulated by FINRA with access to the Securities Investor Protection Corporation

Cons

- High minimum requirement of $2,500

- Withdrawal fees apply if removing funds more than once per month

- No MT4 or MT5 platform integration

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, FSA, CMA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

- IC Markets offers fast and dependable 24/5 support based on firsthand experience, particularly when it comes to accounts and funding issues.

Cons

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

- While IC Markets offers a selection of metals and cryptos for trading via CFDs, the range is not as extensive as brokers like eToro, limiting opportunities for traders interested in these asset classes.

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | CySEC, FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, DKK, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Highly competitive spreads, reduced for USOIL and BTCUSD in 2024, are available from 0 pips with low commissions from $2 per side.

- Excellent range of account types for all experience levels, including Cent, Pro plus the introduction of Raw Spread, ideal for day traders.

- Improved execution speeds, now averaging under 25ms, offer optimal conditions for short-term traders.

Cons

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

- Retail trading services are unavailable in certain jurisdictions, such as the US and the UK, limiting accessibility compared to top-tier brokers like Interactive Brokers.

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

IC Trading

"With superior execution speeds averaging 40 milliseconds, deep liquidity, and powerful charting software, IC Trading delivers an optimal trading environment tailored for scalpers, day traders, and algorithmic traders. "

Christian Harris, Reviewer

IC Trading Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures |

| Regulator | FSC |

| Platforms | MT4, MT5, cTrader, AutoChartist, TradingCentral |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- The simplified and digital account opening process saves time and effort, allowing traders to start trading sooner without extensive paperwork, taking just minutes during testing.

- IC Trading provides industry-leading spreads, including 0.0-pip spreads on major currency pairs such as EUR/USD, making it ideal for day traders.

- Trading Central and Autochartist are valuable tools for in-depth technical summaries and actionable trading ideas and are accessible from within the account area or the cTrader platform.

Cons

- The educational resources are greatly in need of improvement, unless you navigate to the IC Markets website, posing a limitation for beginners in search of a comprehensive learning journey, especially compared to category leaders like eToro.

- Despite being part of the trusted IC Markets group, IC Trading is authorized by a weak regulator - the FSC of Mauritius, with limited financial transparency and regulatory safeguards.

- Customer support performed woefully during testing with multiple attempts to connect via live chat and no one available to assist, plus unanswered emails, raising concerns about its ability to address urgent trading concerns.

How Did We Choose The Best Brokers?

To identify the best NZD brokers, we:

- Searched our database of 223 online brokers and trading platforms

- Selected all those that offer accounts denominated in New Zealand dollars (NZD)

- Ranked them based on their overall rating which considers 100+ data points and hands-on tests

What Is An NZD Account?

An NZD account is a trading account where your transactions and trades are handled in New Zealand dollars.

This offers more convenience for Kiwis looking to manage their accounts and view profit and loss statements in their home currency.

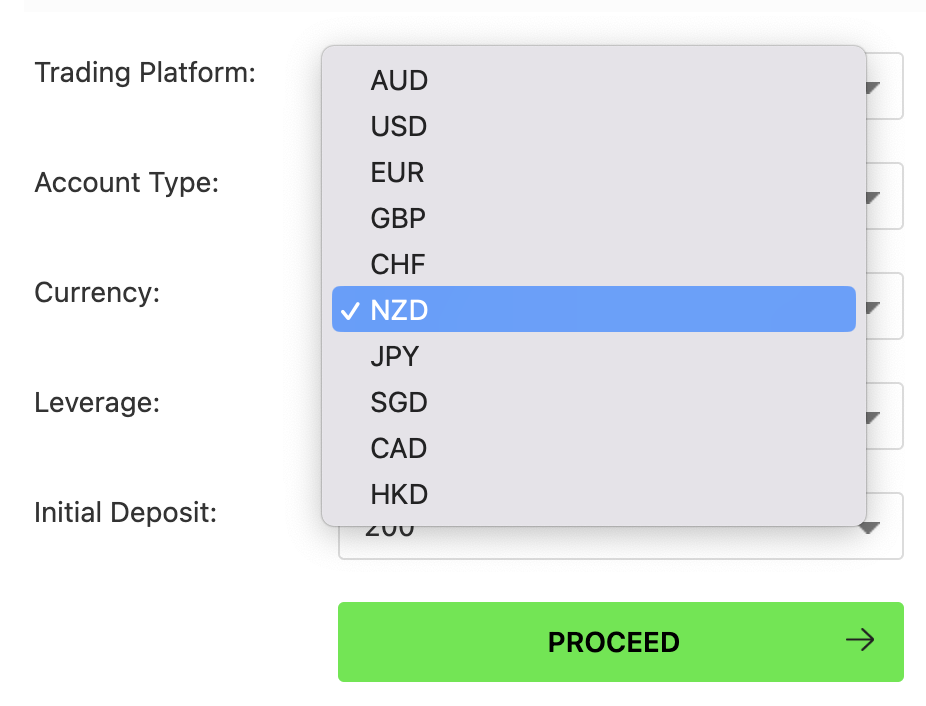

Below you can see where I opened an account in NZD at IC Markets:

Do I Need An NZD Trading Account?

There are several reasons you may want to open an account in NZD:

- If you live in New Zealand and you hold or save money in NZD, an NZD account will help to reduce conversion fees.

- If you frequently trade local markets like stocks listed on the New Zealand Exchange (NZX), then funding your account in NZD is more cost-effective.

- If you are an overseas trader looking to diversify your portfolio, the NZD is a good choice as it’s one of the most stable in the world.

How Can I Check If A Broker Offers An Account In New Zealand Dollars?

You can follow these steps which we took to ensure each of our recommended brokers offers an NZD account:

- Go to the broker’s website and navigate to the account types page

- Check that NZD is listed as a supported account currency

- Register for an account and select NZD as your base currency

Pros & Cons Of NZD Trading Accounts

Pros

- NZD accounts can reduce currency conversion fees if you wish to trade NZD-based instruments, which is especially important for active traders.

- The New Zealand currency is the 10th most traded in the world and one of the most stable, so holding your funds in it can protect you, to a degree, against fluctuations in currency values.

- Brokers with NZD accounts often tailor their services to local traders by providing access to NZD currency pairs like USD/NZD, analysis on New Zealand markets, and holding a license with the New Zealand Financial Markets Authority (FMA).

Cons

- NZD accounts are not as widely offered as USD, EUR or GBP accounts, so you may have fewer brokers to choose between, though there remain good options.

- In recent years, the NZD has weakened due to interest rate hikes being halted by the RBNZ as reported by Forbes, making it a less attractive investment for traders.

- Stocks on the New Zealand Exchange (NZX) are not widely offered, so you may have limited choice if you primarily want to trade local stocks.

FAQ

Which Is The Best Broker With An NZD Account?

See our list of the best brokers with NZD accounts to find the right broker for you. All have been rigorously examined by our experts.

How Much Does It Cost To Open A Trading Account Based In New Zealand Dollars?

The account opening deposit will depend on the broker, but this requirement does not usually exceed 250 USD (approximately 405 NZD) based on our tests.

That said, many beginner-friendly brokers require much less, including XM where you only need $5 to get started.

Article Sources

- Reserve Bank of New Zealand (RBNZ)

- New Zealand Exchange (NZX)

- Top 10 Most Traded Currencies In The World - IG

- New Zealand Economy Weakens NZD - Forbes

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com