Brokers With IDR Accounts

The Indonesian rupiah (IDR) is the official currency of Indonesia. It is abbreviated as ‘Rp’ and issued by Bank Indonesia. IDR accounts are an obvious choice for Indonesian traders looking for convenient deposits.

Having a trading account in IDR could also be helpful if you are looking to capitalize on Indonesia’s emerging market potential, especially oil and palm oil, and opportunities for gains in currency trading.

Discover DayTrading.com’s selection of the top brokers with Indonesian rupiah accounts.

Best Brokers With IDR Accounts

Following our extensive evaluations, these are the 4 top brokers supporting IDR accounts:

Here is a short overview of each broker's pros and cons

- AZAforex - Established in 2016, AZAforex is an offshore broker offering short-term trading on 235+ global financial markets, including through binary options with payouts of up to 90%. Three accounts (Start, Pro and VIP) offer unique features, but all provide access to the broker’s Mobius Trader 7 platform, which has benefited from performance upgrades over the years.

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- Quotex - Established in 2019, Quotex is a binary broker that offers 400+ assets, including forex, stocks, indices, commodities, and cryptocurrencies. The platform emphasizes user-friendly features, complete with short-term contracts that span 5 seconds to 4 hours alongside payouts that can reach 95%.

- JustMarkets - JustMarkets is a multi-asset broker with both CySEC-regulated and offshore branches. Offering ultra-low spreads, copy-trading services, 170+ tradeable instruments and MetaTrader support, JustMarkets has a lot to offer both beginner and experienced traders.

Brokers With IDR Accounts Comparison

| Broker | IDR Account | Minimum Deposit | Markets | Regulator |

|---|---|---|---|---|

| AZAforex | ✔ | $1 | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Binary Options | GLOFSA |

| Exness | ✔ | $10 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | CySEC, FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Quotex | ✔ | $10 | Binary Options on Stocks, Indices, Forex, Commodities, Cryptos | - |

| JustMarkets | ✔ | $1 | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures | CySEC, FSA |

AZAforex

"AZAforex is best suited to active traders looking to make all-or-nothing bets on global markets through binary options and those looking for high leverage up to 1:1000 in return for weak regulatory safeguards."

Christian Harris, Reviewer

AZAforex Quick Facts

| Bonus Offer | 25% Crypto Deposit Bonus, 120% Loyalty Bonus, 30% Spread Rebate |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Binary Options |

| Regulator | GLOFSA |

| Platforms | Mobius Trader 7 |

| Minimum Deposit | $1 |

| Minimum Trade | 0.0001 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, MYR, IDR, CHF, RUB, THB, VND, UAH, CNY |

Pros

- AZAforex provides high leverage of up to 1:1000, allowing for potentially greater returns with smaller capital. While this comes with increased risk, it's an attractive feature if you are an experienced trader looking for aggressive growth strategies.

- AZAforex supports a huge and growing variety of payment methods, including bank transfers, credit/debit cards, e-wallets, and cryptocurrencies, providing flexibility for funding and withdrawals. This variety accommodates traders from different regions and preferences.

- Few brokers offer binary options as part of their portfolio. Still, AZAforex includes them, allowing you to speculate on short-term price movements with fixed risk and reward up to 90%.

Cons

- AZAforex offers basic trading guides and a blog but lacks robust educational tools such as video tutorials, webinars, or interactive learning resources. This makes it less appealing for beginners who need comprehensive learning support. A lot of the content is outdated, too.

- While functional during testing, the Mobius Trader 7 platform is proprietary and not widely used by other brokers. This creates risks of potential price manipulation or discrepancies in market data, as there's no external verification like with MetaTrader or cTrader.

- AZAforex still operates without regulation from a recognized financial authority, which raises concerns about transparency, fund safety, and accountability. You may have no recourse in disputes, making it riskier than regulated brokers.

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | CySEC, FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, DKK, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Fast and dependable 24/7 multilingual customer support via telephone, email and live chat based on hands-on tests.

- Excellent range of account types for all experience levels, including Cent, Pro plus the introduction of Raw Spread, ideal for day traders.

- Exness was the first brokerage to pass the $1 trillion and $2 trillion marks in monthly trading volumes, highlighting its legitimacy.

Cons

- Retail trading services are unavailable in certain jurisdictions, such as the US and the UK, limiting accessibility compared to top-tier brokers like Interactive Brokers.

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

Quotex

"Quotex is ideal for binary traders looking to make short-term trades on global markets with above-average payouts of up to 95% and a platform that’s regularly improved, features daily trading signals, and proved intuitive for new users during testing. "

Christian Harris, Reviewer

Quotex Quick Facts

| Bonus Offer | 30% Deposit Bonus |

|---|---|

| Demo Account | Yes |

| Instruments | Binary Options on Stocks, Indices, Forex, Commodities, Cryptos |

| Platforms | Web Platform |

| Minimum Deposit | $10 |

| Minimum Trade | $1 |

| Account Currencies | USD, EUR, GBP, INR, JPY, MYR, IDR, RUB, BRL, NGN, THB, VND, UAH |

Pros

- Quotex lets you start trading with just $10, making it accessible for beginners and those wanting to test the platform with minimal risk. Withdrawals also start from $10, allowing easy access to funds.

- The web-based platform and app are intuitive based on our hands-on tests, with a clean design and simple order execution. They include multiple indicators and built-in trading signals, making them practical solutions for both beginners and more experienced traders.

- A free demo account with $10,000 in virtual funds lets new traders practice strategies and test the platform without risking real money. It's an excellent tool for beginners to gain experience.

Cons

- Customer service is only available via email and social media, which can lead to slow response times in our experience. Competitors like Videforex provide 24/7 live chat and phone support, ensuring you get help quickly during technical or withdrawal problems.

- Quotex is an offshore broker operating in a jurisdiction known for loose regulatory oversight. Unlike regulated brokers, it does not offer the same level of investor protection, dispute resolution, or fund security, making it riskier.

- Quotex offers few market analysis tools and lacks real-time financial news, economic calendars, or in-depth research reports. Educational resources, such as courses, webinars, and expert insights, are also absent, making it less ideal for beginners.

JustMarkets

"With some of the most affordable pricing in the game and access to the powerful MT4 and MT5 platforms, JustMarkets is a good choice for any investor."

Tobias Robinson, Reviewer

JustMarkets Quick Facts

| Bonus Offer | $30 No Deposit Bonus |

|---|---|

| Demo Account | Yes |

| Instruments | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures |

| Regulator | CySEC, FSA |

| Platforms | MT4, MT5 |

| Minimum Deposit | $1 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:3000 |

| Account Currencies | USD, EUR, GBP, ZAR, MYR, IDR, AED, NGN, THB, VND, KWD, CNY |

Pros

- Low minimum deposit

- Tight spreads from 0 pips

- 170+ trading instruments

Cons

- Non-forex asset list is light with just 65 stocks plus a handful of indices and commodities

- Limited availability with clients not accepted from the US, UK, Japan, Germany and other countries

How Did We Choose The Best Brokers?

To pinpoint the top IDR trading platforms, we followed a meticulous selection process:

- We utilized our directory spanning hundreds of brokers, ensuring we provide you with up-to-date information.

- We eliminated any firms that didn’t meet our stringent requirements for offering IDR-denominated accounts.

- We used a scoring system that evaluates platforms on 100+ quantitative metrics and qualitative assessments.

What Is An IDR Account?

An IDR trading account is based in the Indonesian rupiah. This means deposits, withdrawals and trading transactions are processed in IDR.

They can be a valuable tool for diversifying your portfolio and capitalizing on the growth of the Indonesian economy, potentially reducing transaction costs, hedging currency risk, and providing the potential for capital appreciation.

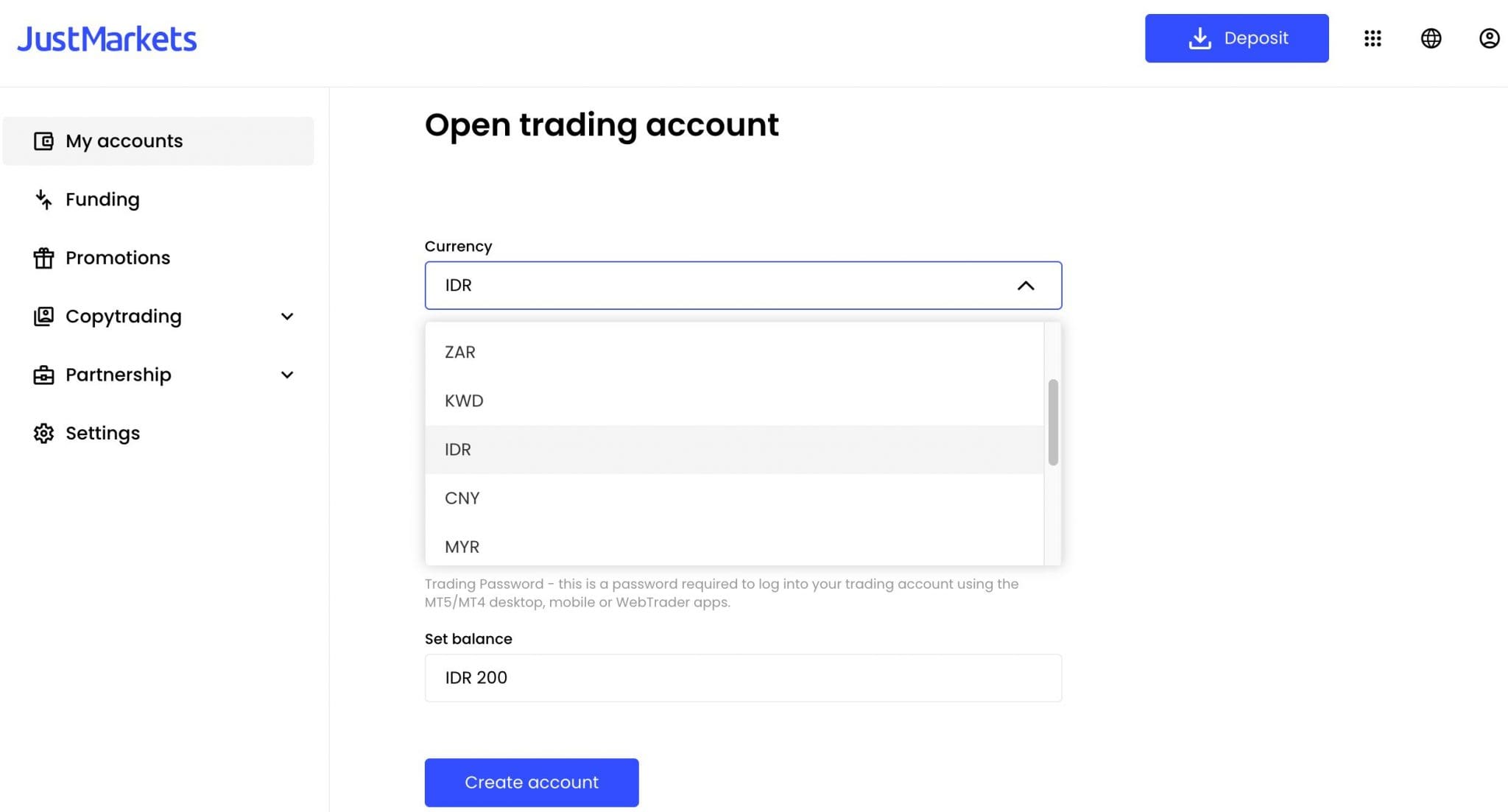

Setting up an IDR trading account is a straightforward process. Once you’ve completed the necessary identity and address verification, you’re ready to start trading.To illustrate, here’s a snapshot of my account at JustMarkets, where I selected ‘IDR’ from the ‘Currency’ menu.

Do I Need An IDR Trading Account?

IDR trading accounts may be suitable for certain types of traders:

- For traders based in Indonesia, an IDR account can offer a substantial advantage regarding tax reporting. They streamline the accounting process and simplify tax obligations by eliminating the need to track and report foreign exchange gains or losses.

- An IDR account may provide access to the vibrant Indonesian stock market, though this is rare based on our assessments. You may be able to more easily trade various Indonesian financial instruments, such as stocks, commodities, and derivatives on the Indonesia Stock Exchange (IDX).

- For some traders, concentrating on domestic Indonesian assets may mitigate the potential adverse effects of currency fluctuations on trading profits. This is particularly beneficial during times of economic uncertainty or market instability.

How Can I Check If A Broker Offers An Account In Indonesian Rupiah?

Follow this three-step process to confirm whether a broker supports an Indonesian rupiah trading account:

- Navigate to the ‘Account Options’ section of a trading provider’s website or app. Here, you’ll often find a list of supported currencies for various account types. If not, reach out to the customer support team.

- Ensure that your trading account supports ‘IDR’ as the base currency, allowing you to execute trades smoothly in IDR.

- Create a trading account and select ‘IDR’ as your base currency. Fail to select IDR at the setup stage and you may not be able to change the account’s base currency further down the line.

Pros & Cons Of IDR Trading Accounts

Pros

- Trading directly in IDR can eliminate the need for constant currency conversions. This not only helps you save on exchange fees but also minimizes the risk of fluctuating exchange rates, potentially providing a more cost-effective trading experience for Indonesians.

- IDR accounts may give you access to the Indonesian economy, offering geographic and currency diversification within your portfolio. This can enhance your risk management strategy and potentially boost returns by spreading exposure across different markets and currencies.

- An IDR account may allow quicker payment and trade settlements with Indonesian entities, enhancing transaction efficiency and minimizing delays.

Cons

- IDR accounts are extremely rare – supported by less than 5% of the brokers we’ve evaluated. Opting for a trading platform with a USD account will give you more options that may better align with your trading goals.

- The IDR tends to be more volatile than major currencies like USD and EUR due to its sensitivity to global commodity prices and economic shifts in emerging markets. Significant currency fluctuations, especially during economic instability, can affect the value of your trading account.

- An IDR-based account is ideal for managing transactions and assets priced in IDR. However, it may limit access to international stocks, bonds, or financial products traded in other currencies.

- If you intend to trade assets not denominated in IDR, you may have to convert IDR to other currencies. This can expose you to the risks of foreign exchange volatility and conversion costs, especially when the IDR is experiencing fluctuations.

FAQ

Which Is The Best Broker With An IDR Account?

Our team of experts has thoroughly analyzed the top trading platforms that offer IDR accounts.

Leverage our list to find the perfect platform that aligns with your day trading requirements.

How Much Does It Cost To Open A Trading Account Based In Indonesian Rupiah?

Based on our investigations, the standard minimum deposit for IDR trading is typically up to USD 250, which is approximately IDR 3,837,215. However, certain brokers provide more affordable options.

One notable example is JustMarkets, which offers a significantly lower minimum deposit of just USD 10 (roughly IDR 153,525). This makes it an appealing option, especially for beginners or traders with limited funds.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com