Brokers With HKD Accounts

The Hong Kong dollar (HKD) is pegged to the US dollar (USD), offering stability and reduced currency volatility, making it an appealing choice for traders in Hong Kong to base their trading accounts.

The Linked Exchange Rate System (LERS) has been a cornerstone of Hong Kong’s monetary policy since 1983. It maintains a stable exchange rate between the HKD and the USD, keeping it within a narrow band of HKD 7.75 to USD 7.85.

Explore DayTrading.com’s best brokers with HKD accounts based on our experts’ in-depth evaluations.

Best Brokers With HKD Accounts

After hands-on tests, these are the 6 top brokers that support HKD accounts:

Here is a short summary of why we think each broker belongs in this top list:

- Dukascopy - Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- OANDA US - OANDA is a popular brand offering exceptional execution, low deposit requirements and advanced charting and trading platform features. The top-rated brand has over 25 years of experience and is regulated by trusted agencies, including the NFA/CFTC. Around the clock support is available for short-term traders, alongside flexible contract sizes and automated trade executions.

- Moomoo - Moomoo is an SEC-regulated app-based investment platform that offers a straightforward and affordable way to invest in Chinese, Hong Kong, Singaporean, Australian and US stocks, ETFs and other assets. Margin trading is available and the brand offers a zero-deposit account as well as several bonuses.

- Gemini - Gemini is a cryptocurrency exchange set up in 2014 by the Winklevoss brothers, known for their early involvement in Facebook. The exchange is among the world’s 20 largest and most popular. Gemini clients can trade and stake 110+ cryptocurrencies, with derivatives trading available in some jurisdictions, an advanced proprietary platform and additional features including an NFT marketplace.

- Zacks Trade - Zacks Trade is a FINRA-regulated US broker offering trading on stocks, ETFs, cryptocurrencies, bonds and more through a proprietary terminal. The broker is geared toward active traders and offers very affordable fees on most assets as well as an app and a vast amount of market data.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

Brokers With HKD Accounts Comparison

| Broker | HKD Account | Minimum Deposit | Markets | Regulator |

|---|---|---|---|---|

| Dukascopy | ✔ | $100 | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | FINMA, JFSA, FCMC |

| OANDA US | ✔ | $0 | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) | NFA, CFTC |

| Moomoo | ✔ | $0 | Stocks, Options, ETFs, ADRs, OTCs | SEC, FINRA, MAS, ASIC, SFC |

| Gemini | ✔ | $0 | Cryptos | NYDFS, MAS, FCA |

| Zacks Trade | ✔ | $2500 | Stocks, ETFs, Cryptos, Options, Bonds | FINRA |

| IC Markets | ✔ | $200 | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | ASIC, CySEC, FSA, CMA |

Dukascopy

"If you’re an experienced trader, Dukascopy provides the tools you need: JForex for algorithmic strategies, competitive spreads from 0.1 pips, leverage up to 1:200, and the peace of mind of using a Swiss-regulated bank and broker."

Christian Harris, Reviewer

Dukascopy Quick Facts

| Bonus Offer | 10% Equity Bonus |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Regulator | FINMA, JFSA, FCMC |

| Platforms | JForex, MT4, MT5 |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:200 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, ZAR, TRY, SEK, NOK, DKK, CHF, HKD, SGD, PLN, CZK, AED, SAR, HUF, MXN |

Pros

- Dukascopy is regulated by the Swiss Financial Market Supervisory Authority (FINMA) as both a broker and a bank, ensuring top-tier financial security and adherence to strict standards.

- Dukascopy features some of the best research we’ve seen, even a professional TV studio in Geneva covering financial news, market analysis, and daily insights from professionals.

- Dukascopy offers tight spreads starting from 0.1 pips, leverage up to 1:200 (depending on the jurisdiction), and volume-based commissions that reward high-frequency traders.

Cons

- Some account types, such as the MT4/MT5 accounts, require a higher minimum deposit of $1,000, which may not be ideal for traders with smaller budgets.

- While JForex is feature-rich, it has a steep learning curve, making it less suitable for beginner traders who might prefer simpler platforms.

- Dukascopy's withdrawal fees are higher than most competitors we’ve tested, particularly for bank wire transfers, which may deter traders who require frequent access to their funds.

OANDA US

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Regulator | NFA, CFTC |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, HKD, SGD |

Pros

- OANDA is a reliable, trustworthy and secure brand with authorization from tier-one regulators including the CFTC

- Beginners can get started easily with $0 minimum initial deposit

- The proprietary OANDA web platform continues to deliver a highly competitive charting environment, including 65+ technical indicators powered by TradingView

Cons

- The range of day trading markets is limited to forex and cryptos only

- There's only a small range of payment methods available, with no e-wallets supported

- It's a shame that customer support is not available on weekends

Moomoo

"Moomoo remains an excellent choice for new and intermediate stock traders who want to build a diverse investment portfolio. What really stands out is the broker's user-friendly app and the low trading fees."

Jemma Grist, Reviewer

Moomoo Quick Facts

| Bonus Offer | Get up to 15 free stocks worth up to $2000 |

|---|---|

| Demo Account | Yes |

| Instruments | Stocks, Options, ETFs, ADRs, OTCs |

| Regulator | SEC, FINRA, MAS, ASIC, SFC |

| Platforms | Desktop Platform, Mobile App |

| Minimum Deposit | $0 |

| Minimum Trade | $0 |

| Leverage | 1:2 |

| Account Currencies | USD, HKD, SGD |

Pros

- It is reassuring that Moomoo holds licenses with the US Securities and Exchange Commission (SEC) and the Monetary Authority of Singapore (MAS), among others

- There are reduced options contract fees from $0.65 to $0

- Moomoo's analytics and insights are impressive and detailed compared to other brands

Cons

- There is no negative balance protection, which is a common safety feature at top-tier-regulated brokers

- It's a shame that there is no 2 factor authentication (2FA), despite the other security features on offer

- There is no phone or live chat support - common options at most other brokers

Gemini

"Gemini’s ActiveTrader platform and TradingView integration make it a good choice for serious crypto traders seeking a reliable charting environment, though we were disappointed by some unnecessary fees and previous security breaches."

Michael MacKenzie, Reviewer

Gemini Quick Facts

| Demo Account | No |

|---|---|

| Instruments | Cryptos |

| Regulator | NYDFS, MAS, FCA |

| Platforms | ActiveTrader, AlgoTrader, TradingView |

| Minimum Deposit | $0 |

| Minimum Trade | 0.00001 BTC |

| Account Currencies | USD, EUR, GBP, CAD, AUD, HKD, SGD |

Pros

- The exchange ensures high security standards with 2FA a requirement for all crypto investors

- The TradingView integration delivers top-quality tools, including backtesting and algo trading capabilities

- The trading app features a user-friendly, modern design and intuitive interface, with an excellent range of charting tools for day traders

Cons

- Some larger coins by market cap are not available to buy through Gemini

- The 'convenience fee' for using the mobile app seems arbitrary and makes it inefficient to use this feature

- The exchange has a history of concerning incidents including the collapse of its Earn program and a phishing breach

Zacks Trade

"Zacks Trade will suit active day traders with experience using powerful platforms. Fees and margin rates are low while the market research is excellent."

Tobias Robinson, Reviewer

Zacks Trade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, ETFs, Cryptos, Options, Bonds |

| Regulator | FINRA |

| Platforms | Own |

| Minimum Deposit | $2500 |

| Minimum Trade | $3 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, TRY, SEK, NOK, DKK, CHF, HKD, SGD, RUB, PLN, CZK, HUF |

Pros

- 20+ account denominations

- Demo account

- Customizable proprietary trading platform and mobile app

Cons

- No forex, commodities or futures trading

- Shortcomings regarding platform loading times and technical glitches

- Withdrawal fees apply if removing funds more than once per month

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, FSA, CMA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

- IC Markets secured DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its seamless, industry-leading MetaTrader integration, refined over years to maximize the platform experience.

Cons

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

- There are fees for certain withdrawal methods, including a $20 wire charge, which can eat into profits, especially for frequent withdrawals.

How Did We Choose The Best Brokers?

To determine the top trading platforms offering HKD accounts, we followed a comprehensive evaluation process:

- Leveraged our vast directory of 223 online brokers and trading platforms.

- Filtered for the platforms that support Hong Kong dollar accounts.

- Assigned a rating to each platform based on quantitative data (100+ points) and qualitative assessments from our testing.

What Is A HKD Account?

A HKD account is a trading account whose base currency is Hong Kong dollars.

This account type offers a range of benefits, including the ability to avoid currency conversion fees, mitigate exchange rate risk, and efficiently deal in local assets like stocks and IPOs.

This convenience makes it an ideal choice for active traders involved in Hong Kong’s financial markets.

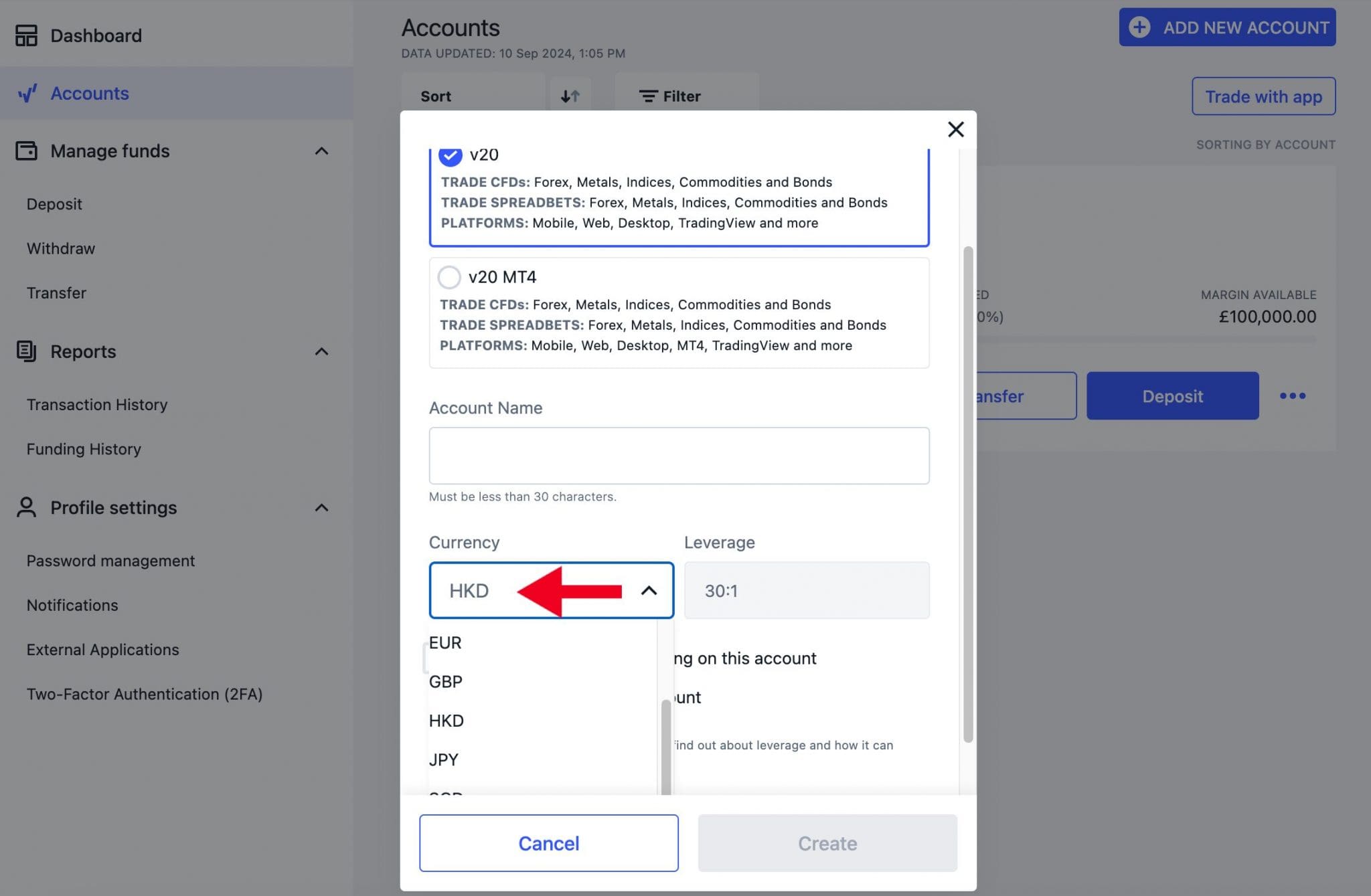

This is what my OANDA trading account looks like, denominated in HKD.In my account settings, I simply selected ‘HKD’ from the list of base currencies.

Do I Need A HKD Trading Account?

Consider a HKD trading account if:

- You live in Hong Kong. With a HKD account, tax reporting is easier as you don’t need to track foreign exchange gains or losses, making accounting more straightforward.

- You frequently trade HKD-denominated assets, such as stocks on the Hong Kong Stock Exchange (HKEX), and want to eliminate fees associated with currency conversion.

- You want to avoid exposure to foreign exchange risks that could impact profits when trading Hong Kongese securities or converting to other currencies.

How Can I Check If A Broker Offers An Account In Hong Kong Dollars?

To check whether an online broker or trading platform supports a HKD account, follow these simple steps:

- Look for the ‘Account Options’ section on the broker’s website to find the currencies you can use for your trading account.

- Confirm that ‘HKD’ is listed as a supported base currency for your trading account.

- Sign up for a trading account and specify ‘HKD’ as your base currency.

Pros & Cons Of HKD Trading Accounts

Pros

- Hong Kong-based day traders can avoid fees and risks associated with exchanging currencies, mainly when trading HKD-denominated assets, leading to cost savings.

- A HKD account provides seamless trading on the HKEX and allows easy participation in Hong Kong IPOs and other local investment opportunities.

- The HKD’s peg to the USD offers exchange rate stability, reducing currency volatility and minimizing forex-related risks.

Cons

- A HKD account is primarily suited for trading in Hong Kong markets, and converting funds to other currencies for international trades may incur additional costs and delays.

- Many brokers do not offer stocks listed on the HKEX, which can disadvantage HKD account holders who want to avoid currency conversion fees when trading securities denominated in different currencies.

- The HKD’s peg to the USD means the US Federal Reserve influences interest rates and monetary policy, which could impact local investments even if unrelated to Hong Kong’s economic conditions.

FAQ

Which Is The Best Broker With A HKD Account?

Our experts have rigorously tested the best day trading platforms with HKD accounts.

Explore our curated list of the best trading platforms with HKD accounts to find the perfect fit for your trading needs.

How Much Does It Cost To Open A Trading Account Based In Hong Kong Dollars?

If you want to start trading with HKD, you’ll be pleased to know that many brokers require a minimum deposit of up to USD 250 (approximately HKD 1,950).

But there are exceptions. IG, for instance, has a much lower entry barrier with no minimum deposit, making it an ideal choice for beginners seeking a HKD-based trading account.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com