Brokers With CNY Accounts

The Chinese yuan (CNY), the main unit of China’s renminbi (RMB), is an attractive currency for trading accounts.

Supervised by the People’s Bank of China (PBoC), the country’s central bank, the CNY is often seen as a global trade currency due to China’s massive economy and role as a leading exporter.

Jump into DayTrading.com’s choice of the best brokers offering CNY trading accounts.

Best Brokers With CNY Accounts

Our latest tests point to these 4 brokers that support CNY accounts being the best:

Here is a short summary of why we think each broker belongs in this top list:

- AZAforex - Established in 2016, AZAforex is an offshore broker offering short-term trading on 235+ global financial markets, including through binary options with payouts of up to 90%. Three accounts (Start, Pro and VIP) offer unique features, but all provide access to the broker’s Mobius Trader 7 platform, which has benefited from performance upgrades over the years.

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- easyMarkets - Established in 2001, easyMarkets has made for a name for itself as a trusted, fixed spread broker. Improvements to its tools over the years, from adding the MetaTrader suite and TradingView to enhancing its exclusive risk management tools like dealCancellation, mark it out from the competition.

- JustMarkets - JustMarkets is a multi-asset broker with both CySEC-regulated and offshore branches. Offering ultra-low spreads, copy-trading services, 170+ tradeable instruments and MetaTrader support, JustMarkets has a lot to offer both beginner and experienced traders.

Brokers With CNY Accounts Comparison

| Broker | CNY Account | Minimum Deposit | Markets | Regulator |

|---|---|---|---|---|

| AZAforex | ✔ | $1 | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Binary Options | GLOFSA |

| Exness | ✔ | $10 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | CySEC, FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| easyMarkets | ✔ | $25 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | CySEC, ASIC, FSCA, FSC, FSA |

| JustMarkets | ✔ | $1 | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures | CySEC, FSA |

AZAforex

"AZAforex is best suited to active traders looking to make all-or-nothing bets on global markets through binary options and those looking for high leverage up to 1:1000 in return for weak regulatory safeguards."

Christian Harris, Reviewer

AZAforex Quick Facts

| Bonus Offer | 25% Crypto Deposit Bonus, 120% Loyalty Bonus, 30% Spread Rebate |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Binary Options |

| Regulator | GLOFSA |

| Platforms | Mobius Trader 7 |

| Minimum Deposit | $1 |

| Minimum Trade | 0.0001 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, MYR, IDR, CHF, RUB, THB, VND, UAH, CNY |

Pros

- AZAforex supports a huge and growing variety of payment methods, including bank transfers, credit/debit cards, e-wallets, and cryptocurrencies, providing flexibility for funding and withdrawals. This variety accommodates traders from different regions and preferences.

- Few brokers offer binary options as part of their portfolio. Still, AZAforex includes them, allowing you to speculate on short-term price movements with fixed risk and reward up to 90%.

- AZAforex provides high leverage of up to 1:1000, allowing for potentially greater returns with smaller capital. While this comes with increased risk, it's an attractive feature if you are an experienced trader looking for aggressive growth strategies.

Cons

- While functional during testing, the Mobius Trader 7 platform is proprietary and not widely used by other brokers. This creates risks of potential price manipulation or discrepancies in market data, as there's no external verification like with MetaTrader or cTrader.

- AZAforex offers basic trading guides and a blog but lacks robust educational tools such as video tutorials, webinars, or interactive learning resources. This makes it less appealing for beginners who need comprehensive learning support. A lot of the content is outdated, too.

- AZAforex still operates without regulation from a recognized financial authority, which raises concerns about transparency, fund safety, and accountability. You may have no recourse in disputes, making it riskier than regulated brokers.

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | CySEC, FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, DKK, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Exness was the first brokerage to pass the $1 trillion and $2 trillion marks in monthly trading volumes, highlighting its legitimacy.

- Excellent range of account types for all experience levels, including Cent, Pro plus the introduction of Raw Spread, ideal for day traders.

- Improved execution speeds, now averaging under 25ms, offer optimal conditions for short-term traders.

Cons

- Retail trading services are unavailable in certain jurisdictions, such as the US and the UK, limiting accessibility compared to top-tier brokers like Interactive Brokers.

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

easyMarkets

"easyMarkets provides fixed spreads starting at 0.7 pips, making it an excellent choice for beginners seeking predictable trading costs. After adding a Bitcoin-based account, it’s also a stand-out option for crypto-focused traders who want to deposit, trade, and withdraw in digital currencies."

Christian Harris, Reviewer

easyMarkets Quick Facts

| Bonus Offer | 50% Deposit Bonus Or Up To A $2000 Tradable Bonus |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | CySEC, ASIC, FSCA, FSC, FSA |

| Platforms | easyMarkets App, Web Platform, MT4, MT5, TradingView, TradingCentral |

| Minimum Deposit | $25 |

| Minimum Trade | 0.01 lots |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, ZAR, TRY, SEK, NOK, CHF, HKD, SGD, PLN, CZK, MXN, CNY |

Pros

- easyMarkets takes risk management seriously, with negative balance protection plus guaranteed stop losses and its dealCancellation (enhanced in 2024 to include periods of 1, 3, or 6 hours) in the Web Trader.

- With 20+ years in the industry, multiple awards, and authorization from two ‘green tier’ regulators, easyMarkets continues to earn its reputation as a secure broker for active traders.

- easyMarkets added Bitcoin as a base currency in 2019. This marks it out against most of the market and eliminates the need to convert crypto to fiat, reducing conversion fees and simplifying management for crypto-focused traders.

Cons

- easyMarkets does not offer a zero-spread account like Pepperstone, which can be a drawback for day traders and high-frequency traders who require minimal transaction costs.

- easyMarkets is falling behind by not providing the copy trading features you get at category leader eToro, which are popular among beginners looking to follow the strategies of experienced traders.

- While easyMarkets provides solid educational resources for beginners, they fall short for advanced traders. The Academy offers well-structured courses and engaging gamification, but the overall content lacks depth.

JustMarkets

"With some of the most affordable pricing in the game and access to the powerful MT4 and MT5 platforms, JustMarkets is a good choice for any investor."

Tobias Robinson, Reviewer

JustMarkets Quick Facts

| Bonus Offer | $30 No Deposit Bonus |

|---|---|

| Demo Account | Yes |

| Instruments | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures |

| Regulator | CySEC, FSA |

| Platforms | MT4, MT5 |

| Minimum Deposit | $1 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:3000 |

| Account Currencies | USD, EUR, GBP, ZAR, MYR, IDR, AED, NGN, THB, VND, KWD, CNY |

Pros

- Multiple accounts to suit different strategies and experience levels

- Low minimum deposit

- Welcome bonus for new traders

Cons

- Limited availability with clients not accepted from the US, UK, Japan, Germany and other countries

- Non-forex asset list is light with just 65 stocks plus a handful of indices and commodities

How Did We Choose The Best Brokers?

We have compiled a list of top-tier CNY brokers following a comprehensive evaluation process:

- We leveraged our evolving database spanning hundreds of brokerages, ensuring we bring you up-to-date information.

- We eliminated any providers that did not meet our standards for offering CNY-denominated accounts.

- We used a scoring system that ranked each platform on 100+ quantitative metrics and qualitative evaluations.

What Is A CNY Account?

A CNY account is a trading account where deposits, withdrawals, and trades are processed in the Chinese yuan.

They open up a world of opportunities in the Chinese market, potentially diversifying your portfolio and capitalizing on the growth of the Chinese economy by providing direct market access, reducing transaction costs, hedging currency risk, and offering the potential for capital appreciation.

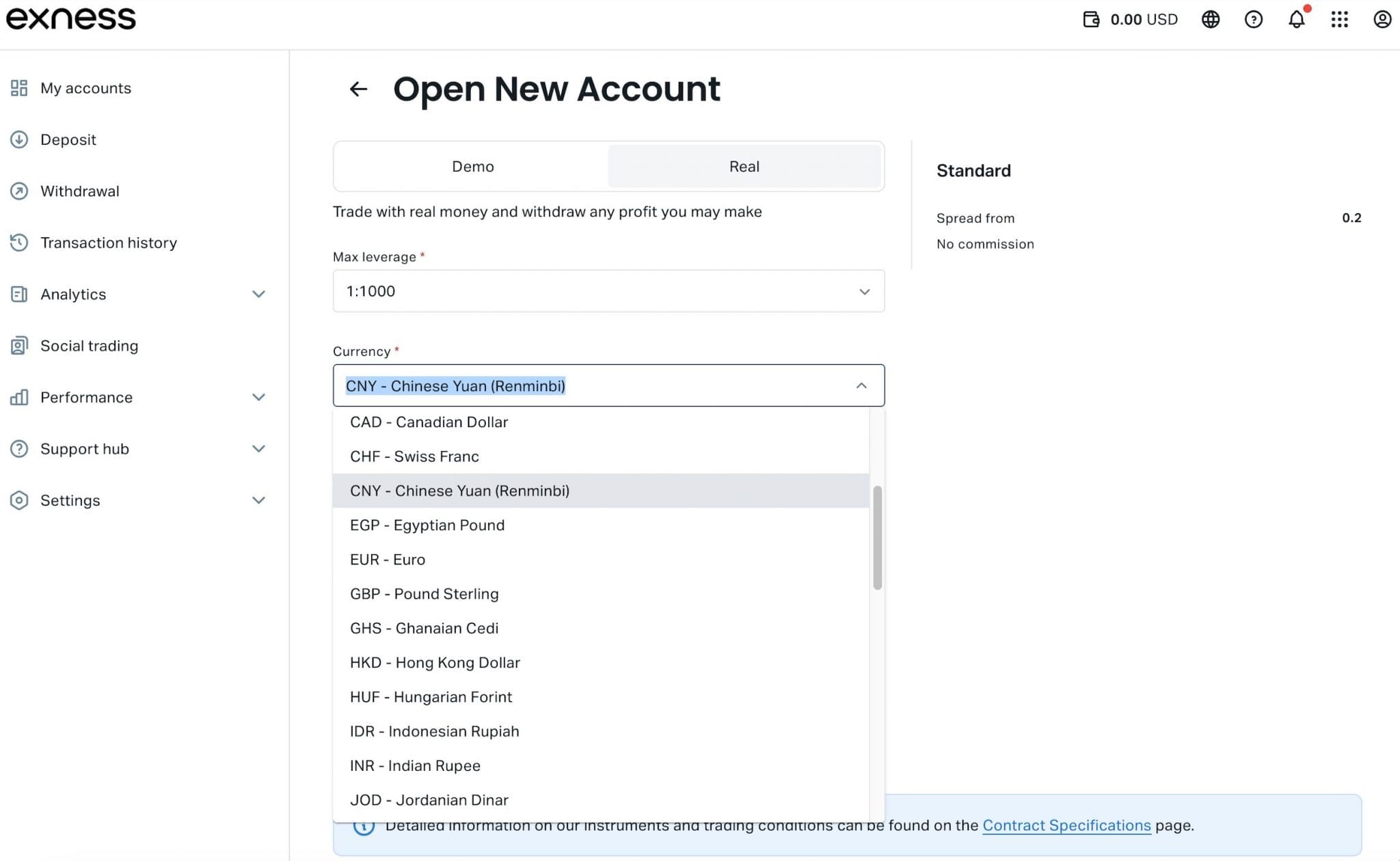

Once you have chosen a trading provider, opening a CNY account is extremely straightforward.To show you how it works, you can see below where I simply had to select ‘CNY’ from the list of available currencies while configuring my Exness account.

Do I Need A CNY Trading Account?

A CNY trading account could be right for you, if:

- You want a direct gateway to the vibrant Chinese stock market. With a CNY account, you can often seamlessly trade various Chinese financial instruments, such as stocks, commodities, and derivatives, on the Shanghai Stock Exchange (SSE) and the Shenzhen Stock Exchange (SZSE).

- You’re a Chinese trader who wants to mitigate the potential negative impact of currency fluctuations on your trading profits. You may be less exposed to the risk of exchange rate volatility. This can be particularly advantageous during periods of economic uncertainty or market volatility.

- You’re a Chinese resident looking for hassle-free tax reporting. CNY trading accounts streamline the accounting process and simplify tax obligations by eliminating the need to track and report foreign exchange gains or losses. This can save you time, effort, and potential costs associated with complex tax calculations.

How Can I Check If A Broker Offers An Account In Chinese Yuan?

You can typically check if a brokerage supports a CNY trading account by following these steps:

- Navigate to the ‘Account Options’ area of the broker’s website. Within this, you will often find a list of supported currencies for different account types. If you can’t, contact the firm’s customer support team.

- Verify that your trading account supports CNY as the base currency. This will ensure seamless transactions and accurate pricing in the Chinese currency.

- Choose CNY when configuring your account. Bear in mind that you may not be able to change your account currency once it’s selected, as is the case at Exness.

Pros & Cons Of CNY Trading Accounts

Pros

- By trading directly in CNY, you can avoid frequent conversions from other currencies, saving on exchange fees and reducing exposure to fluctuations in exchange rates.

- With a CNY account, you can often gain exposure to the Chinese economy. This adds a layer of geographic and currency diversification to your investment portfolio, which can improve risk management and returns.

- Payments and trades with Chinese entities are often settled faster, improving transaction efficiency and reducing delays in settlement times.

Cons

- Our investigations show the yuan is not as widely supported in trading accounts as major currencies like the USD, limiting its use for international transactions outside China.

- Certain yuan-denominated assets may have lower liquidity compared to more global markets, making it harder to quickly enter or exit positions without affecting prices, potentially impacting the returns of day trading strategies.

- Managing a CNY-based account, particularly in cross-border investments, can involve navigating complex tax regulations and potential regulatory hurdles.

FAQ

Which Is The Best Broker With A CNY Account?

Explore DayTrading.com’s pick of the best CNY trading platforms. These providers cater to the specific needs of traders in the dynamic Chinese market.

How Much Does It Cost To Open A Trading Account Based In Chinese Yuan?

While the typical minimum deposit for a CNY account is up to USD 250 (approximately CNY 1,775) from our investigations, some brokers offer more accessible options.

Exness, for instance, stands out with a starting deposit of only USD 10 (around CNY 70). This lower entry point makes Exness a particularly attractive choice for beginners or investors with limited capital.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com