Best Brokers With Cent Accounts In 2025

A cent account is a type of trading account where your balance is based in cents rather than dollars. For example, if you deposit $5, it will show as ¢500 in your trading platform.

They are tailored for beginners who often want to trade forex with less financial risk, acting as a stepping stone between demo accounts and regular accounts. They can also be used to test various day trading strategies.

Unlock DayTrading.com’s pick of the best brokers with cent accounts. Each provider has been handpicked following in-depth tests of their cent account offering and trading experience.

5 Best Brokers With Cent Accounts In 2025

Following our first-hand assessments, these 5 cent account forex brokers stand above the rest:

- Vantage: Growing Vantage Academy. Low fees with spreads from 0.0. Unlimited $100k demo.

- RoboForex: USD and EU cent accounts. Intuitive R WebTrader. Smooth transition to standard account.

- FBS: Trusted and CySEC-regulated. Cent trading calculator. Terrific education via guides, videos & courses.

- JustMarkets: MT4 platform with tutorials. VPS for testing Expert Advisors (EAs). Up to 1:500 leverage.

- InstaForex: Lowest $1 minimum deposit. Choice of two cent accounts. Huge variety of trading tools.

Comparison of Top Brokers With Cent Accounts

| Vantage | RoboForex | FBS | JustMarkets | InstaForex | |

|---|---|---|---|---|---|

| Cent Account Currencies | USD | USD/EUR | USD/EUR | USD | USD/EUR |

| Minimum Deposit | $50 | $10 | €10 | $10 | $1 |

| Number of Assets | 90+ | 50+ | 45+ | 70+ | 300+ |

| Minimum Spread | 0.0 | 1.3 | 0.5 | 0.3 | 0.0 |

| Platforms | MT4, MT5 | MT4, MT5, R WebTrader | MT5 | MT4, MT5 | MT4, MT5 |

| Demo Cent Account | No | No | Yes | Yes | No |

| Regulator* | CIMA, FSCA, VFSA | IFSC | CySEC | FSA, FSC, FSCA | BVI FSC |

*Regulators for the relevant entities offering cent accounts.

1. Vantage

Why We Chose It

Vantage earned its place as the ‘best broker with a cent account’ after delivering the full package for beginners and short-term traders looking to test strategies.

You can open a cent account with a $50 deposit, the demo environment has zero restrictions, and the broker’s educational offering has come on leaps and bounds.

Pros

- Beginners can toggle between the affordable cent account and the $100k-bank rolled demo account with no expiry – a far cry from the 30- or 60-day limit we see at most alternatives, so you can develop your skills with no time pressure.

- The Vantage Academy is packed: Courses for beginners (I love the 8-step FX course which takes <90 minutes), articles split into 12 filterable categories, webinars, eBooks, and most recently Vantage View, which in partnership with Bloomberg, breaks down market events to help you identify opportunities.

- We scored Vantage 4.4/5 for its fees, with spreads from 0.0 but averaging 0.2 on EUR/USD during our latest tests delivering a low-cost environment for active traders. There’s also no inactivity charge penalizing casual traders.

Cons

- While you can still trade major markets with significant volume and volatility, such as forex, gold, silver and oil, Vantage’s cent account offers a slim-lined selection of around 90 assets compared to the 1000+ in its other accounts.

- Although affordable for most beginners, the $50 minimum deposit in Vantage’s cent account is higher than our other top picks, notably InstaForex with its $1 minimum investment, potentially deterring traders with limited capital.

- Vantage’s TradingView-powered ProTrader platform (I love the design and workspace) isn’t available for cent account holders – only MT4 and MT5 are supported, which could feel overwhelming for newer traders.

2. RoboForex

Why We Chose It

RoboForex nabbed second place with its accessible cent account, denominated in USD or EUR, and a low starting investment of $10.

It has one of the smoothest sign-ups we’ve been through, its array of platforms (MT4, MT5, R WebTrader) trumps peers, and its huge suite of assets in the standard account means it offers continuity when you’re ready to upgrade from cent trading.

Pros

- RoboForex is one of the few cent brokers to offer denominations in dollars or euros, making it accessible to European and global traders. The sign-up process is also a breeze – you can configure your cent account in <15 mins.

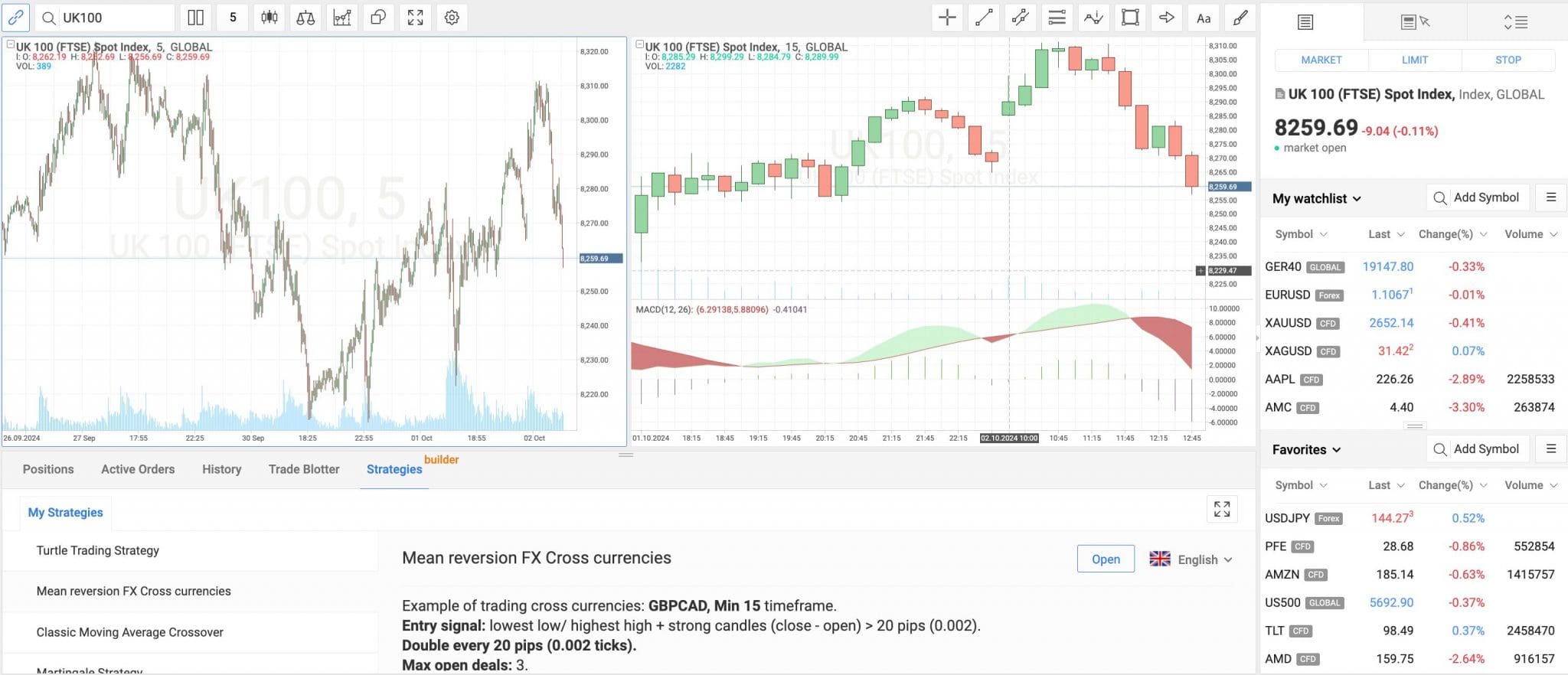

- The R WebTrader platform has been built with beginner traders in mind, sporting a clean interface and value-add extras, notably news alerts and technical forecasts. I particularly love ‘Strategies Builder’ – a unique feature that helps beginners develop strategies.

- Despite offering a modest approximately 50 assets in the cent account (including 28 FX pairs and metals), RoboForex’s full suite of 12,000+ assets (stocks, indices, futures, metals, energies, commodities, currencies, ETFs) provides diverse opportunities once you transition to a standard account.

Cons

- RoboForex only scored 3/5 in our Regulation & Trust Rating with its license from the ‘red tier’ FSC in Belize, reducing investor protection. As a comparison, Vantage’s cent account is regulated by the ‘yellow tier’ FSCA in South Africa.

- Although the commission-free pricing model in the cent account will appeal to beginners looking for simple pricing, spreads come in higher than alternatives based on tests. The 1.2 pips on EUR/USD trails the 0.7 at 3rd place FBS.

- There’s work to do to bring RoboForex’s education on par with 1st place Vantage, a downside given cent account holders are often novice traders. I’d really like to see more on technical analysis given its role in day trading.

3. FBS (EU)

Why We Chose It

FBS scooped a podium finish for its cent trading account, provided through its CySEC-regulated entity, earning the trust of our experts.

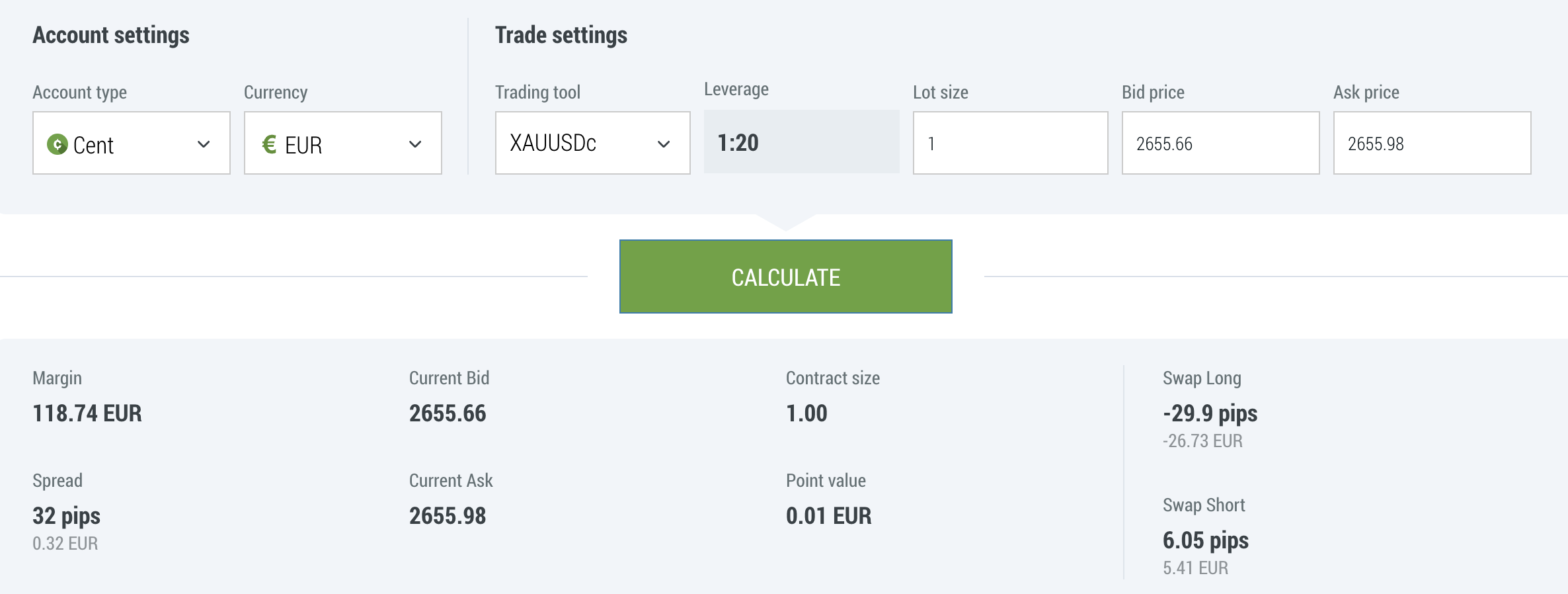

You need just €10 to open a cent account in USD or EUR, and then you get access to competitive fees, with spreads from 0.7 pips, terrific education and unique tools, notably a cent account calculator to help you plan trades.

Pros

- FBS delivers comprehensive educational tools, trailing only Vantage. What’s great is the variety of formats, from email courses and guidebooks to video tutorials and webinars, so you can digest information in a way that suits you. The latest Forex Intensive course is also a valuable addition for new FX traders.

- We scored FBS 4.3/5 for Regulation & Trust thanks to its authorization from the ‘green tier’ CySEC in Cyprus, making it a safer option than RoboForex for European traders. Cent account holders could get up to €20,000 through the Investor Compensation Fund should the firm go bankrupt.

- FBS provides terrific tools to enhance the cent trading experience. What I like best is the forex calculator that can be filtered to your cent account settings, helping you grasp the fees and margin requirements for different trades.

Cons

- FBS is failing to provide fresh market analytics, which could help traders identify opportunities. During testing, its ‘Fundamental Analysis’ hadn’t been updated since 2022 and its ‘Technical Analysis’ since 2023. In comparison, 1st place Vantage is delivering daily updates in its ‘Market News and Analytics’.

- FBS only supports MetaTrader 5 (MT5), which is confusing given that the workspace and charting package will overwhelm many new traders. I prefer RoboForex’s WebTrader for beginners, which is why it muscled into 2nd place.

- FBS offers the slimmest market offering in its cent account of every broker in our toplist, with just 28 currency pairs, 4 metals, 11 indices and 5 energies. The lack of stocks, in particular, will deter some traders.

4. JustMarkets

Why We Chose It

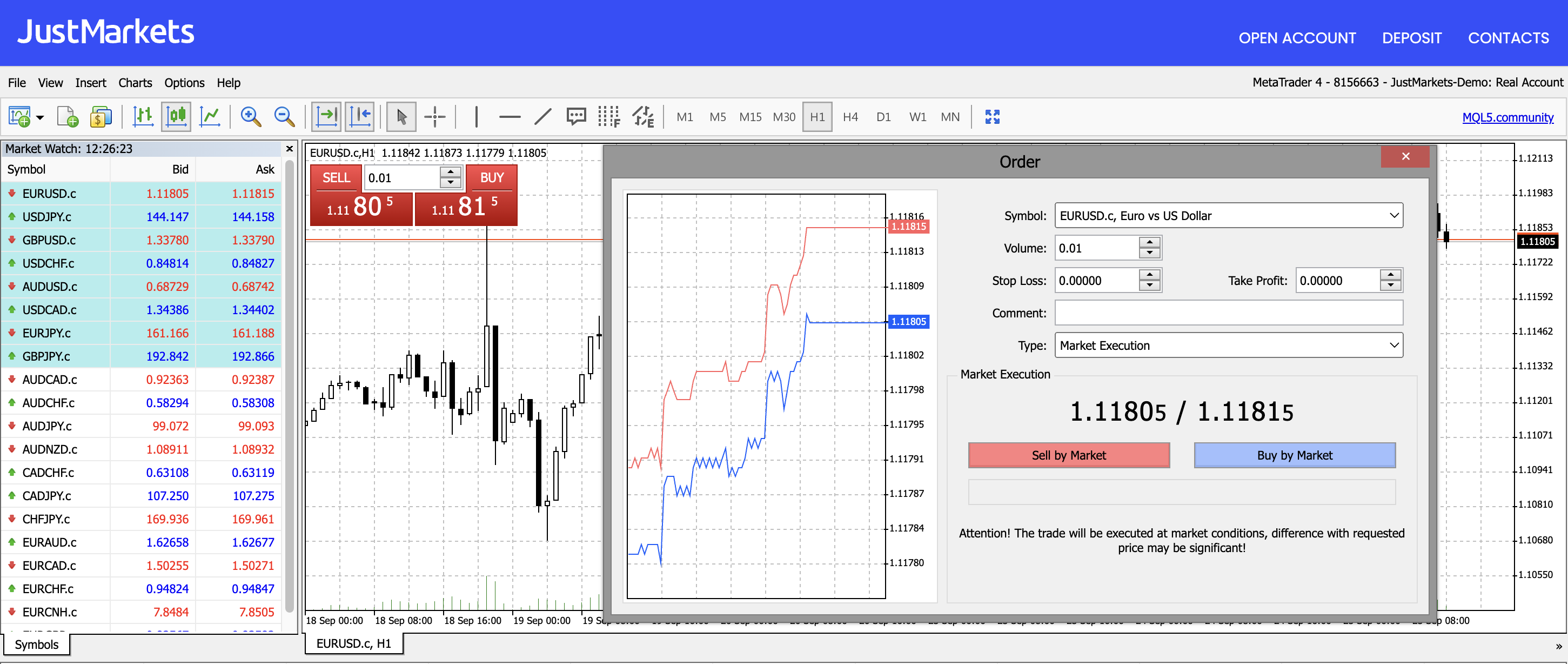

JustMarkets is an excellent cent account broker for traders familiar with the MetaTrader 4 (MT4) platform, though MT5 isn’t available for cent trading.

The $10 deposit is affordable for novice traders, while it stands out with high leverage up to 1:500 and a virtual private server (VPS) for testing algo strategies.

Pros

- The cent account has a low $10 entry barrier with 100x reduced denomination and tight spreads from 0.3 pips with zero commissions, making it excellent for testing strategies on forex and metals with less financial risk.

- JustMarkets is great for traders used to MT4, available on desktop, web and mobile. The broker also offers handy MT4 platform tutorials to help you get the most out of the software, though MT5 isn’t available with the cent account.

- The VPS service, which reduces downtime between the terminal and servers and ensures optimal execution speeds, makes JustMarkets ideal if you want to develop automated trading strategies through Expert Advisors (EAs).

Cons

- JustMarkets’ analysis tools, which could help you discover opportunities trails brokers like Vantage. The ‘Market Overview’ and ‘Daily Forecast’ are of some use, but the text-heavy format is dry and having them integrated directly into the platform would create a more seamless user experience.

- Despite some education, such as trading articles and a handful of videos, there’s little to upskill new traders, especially compared to FBS. I’d like to see more webinars, eBooks and interactive learning through quizzes.

- The cent account offers a reasonable 70+ markets (FX and metals), but the 170+ markets in the standard account fall way below RoboForex’s 12,000+ assets, limiting its long-term appeal if you want to build a diverse portfolio.

5. InstaForex

Why We Chose It

InstaForex earned the final spot in our recommendations for its $1 minimum deposit (the lowest we’ve seen) and its choice of two cent accounts with different pricing structures to suit beginners through to advanced traders.

Both MT4 and MT5 are available, alongside extensive research tools and unique extras like trading contests where you can test your skills against peers.

Pros

- Traders can choose between the Cent Standard or the Cent Eurica accounts. Both are denominated in USD or EUR, but Standard uses a commission-free model (attractive to beginners) and Eurica uses low spreads with a commission (popular with experienced traders).

- Both cent accounts offer the lowest minimum deposit we’ve seen in the industry. At just $1, InstaForex is an obvious choice for beginners. Lot sizes also go as low as 0.0001, allowing you to practice setups with minimal cash.

- InstaForex offers the most diversity, though not necessarily quality, in terms of analysis tools and trading features, with educational materials, YouTube video analysis, trading contests and VPS hosting, catering to all types of traders.

Cons

- Despite some pages on its website suggesting it does, InstaForex doesn’t offer a demo account (I checked with support). This is vital for aspiring traders looking to move between paper trading and live trading in cents, and it’s offered at every alternative in our top picks apart from RoboForex.

- InstaForex is great if you want to deposit and withdraw in cryptos (BTC, ETH, LTC, USDT) but it lacks many traditional transfer solutions like Skrill and Neteller, which you can find at Vantage, FBS and RoboForex.

- For years InstaForex has needed to streamline the user experience. It still has the most cluttered collection of tools which will give beginners a headache looking for say the ‘Knowledge Base’ or even details on the cent account.

Methodology

- We filtered our database spanning hundreds of online brokers, narrowing the list to those offering cent-denominated trading accounts, relevant to small-scale or beginner traders.

- We verified that each broker is trusted by looking at regulations, records and reputations. For example, FBS is CySEC-regulated, with traders potentially getting up to €20,000 through the ICF in the event of insolvency.

- We favored brokers with a range of markets and checked if cent accounts had restrictions. For example, RoboForex provides 50+ FX pairs and metals for cent trading and 12,000+ in its standard accounts.

- We prioritized brokers with low-cost trading on popular assets, such as EUR/USD. Vantage stood out with ultra-tight 0.2-pip spreads and zero commissions, making it a top choice for cost-conscious cent traders.

- We evaluated the charting tools available, which are crucial for analyzing small pip movements. For example, RoboForex’s web platform stood out for its usability and reliability.

- We assessed the funding options available to traders with cent accounts. Most allow opening cent accounts for under $100, while InstaForex excelled with its $1 minimum.

What Is A Cent Trading Account?

A cent account is a special type of trading account where your balance and trades are based in cents rather than dollars. It means you can trade financial markets, often forex, with much smaller position sizes.

For day traders specifically, they provide an opportunity to practice short-term trading strategies in real time without risking substantial capital.

You can experiment with position sizing techniques, test critical risk management tools like stop-loss orders and take-profit levels more freely, and learn to manage multiple fast-paced positions.

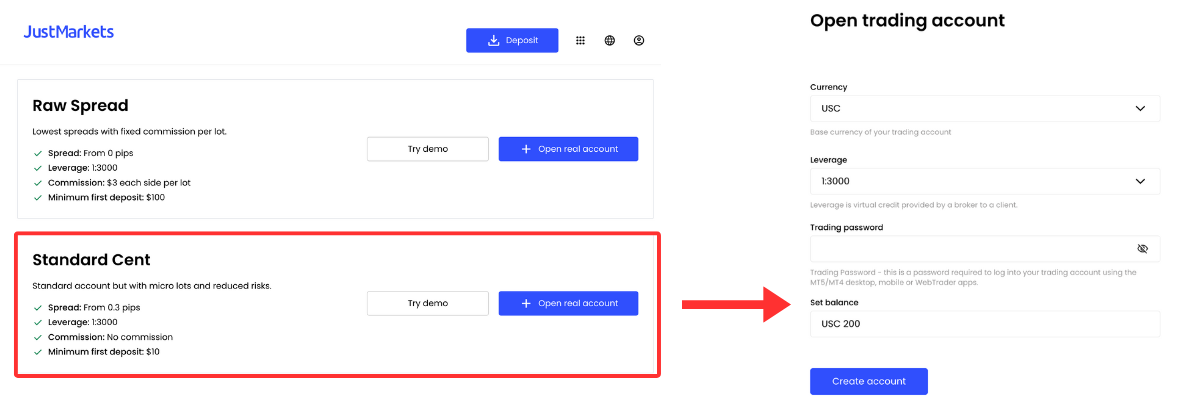

As you can see below, I opened a demo cent trading account at JustMarkets.It took me just a few minutes and several simple steps to get up and running with $2, or in this case, ¢200.

Do I Need A Cent Account?

You may want to choose a cent trading account if you fall into one of these four buckets:

- You’re new to day trading: Cent accounts let you practice short-term strategies under live market conditions, helping you learn the fast-paced nature of day trading without heavy financial exposure.

- You’re testing new strategies: If you’re experimenting with, for example, high-frequency or scalping trading systems, cent accounts allow you to fine-tune your setups in a live environment without risking large sums.

- You want to manage risk closely: A cent account limits your potential losses since you’re working with much smaller amounts, making it easier to recover from mistakes.

- You need a low-stakes way to transition to live trading: If you’ve been trading on a demo account, a cent account provides an excellent bridge to trading with real money, helping you adjust psychologically to the pressures of real-money trading.

Pros & Cons Of Cent Trading Accounts

Pros

- Micro-scale trading: Executing trades in very small position sizes allows for more precise risk control and experimentation.

- Emotional conditioning: Trading with real money, even if it’s in cents, can help you build emotional resilience without significant financial exposure.

- Testing environment: Cent accounts are an optimal environment for day traders to test active trading strategies like scalping.

- Affordability: With minimum deposits as low as $1, or 100 cents, they allow beginners and those with limited trading capital to trade in live markets.

- Realistic market conditions: Unlike demo accounts, cent accounts give you direct exposure to live real-money trading challenges, notably slippage and execution, but without huge financial exposure.

Cons

- Limited profits: The micro-scale structure of cent accounts means even successful day trading strategies may return modest gains, possibly slowing your portfolio growth.

- Narrow instruments: Cent account brokers generally offer a much narrower selection of instruments mainly comprising forex pairs than standard accounts.

- Higher costs: To make up for smaller transaction sizes, brokers may charge wider spreads which can seriously hit the profitability of day trading strategies.

- Overtrading temptation: The low-stakes environment could encourage some active traders to overtrade and develop poor habits that catch you out when you upgrade to a standard account.

- Platform restrictions: Brokers often provide a narrower range of trading platforms to cent account holders from our evaluations, Vantage’s ProTrader platform isn’t available for instance.

FAQ

Which Is The Best Broker With A Cent Trading Account?

Based on our hands-on tests, the best broker with a cent trading account in 2025 is Vantage. It’s trusted by our experts, offers 90+ instruments that you can trade in cents, and delivers fantastic educational tools for beginners.

Runners-up based on our latest evaluations are RoboForex, FBS, JustMarkets and InstaForex.

How Much Does It Cost To Open A Cent Trading Account?

From our analysis, most trading platforms require up to $100, or ¢10,000, to open a cent account.

However, some providers stand out as low-cost options, notably InstaForex which requires just $1, or ¢100, to open its Cent Standard or Cent Eurica accounts.