Best Day Trading Platforms and Brokers in Canada 2026

The best day trading brokers in Canada offer high-quality charting platforms, competitive pricing, margin trading and fast execution.

Many firms are regulated by the Canadian Investment Regulatory Organization (CIRO) and offer tailored conditions for Canadian day traders, including live accounts denominated in the Canadian Dollar (CAD). They also provide access to popular markets such as the Toronto Stock Exchange (TSX) and currency pairs like the USD/CAD.

Here you will find the best brokers for day trading in Canada. Each platform accepts Canadian investors and has been tested rigorously by our experts using demo or real-money accounts.

Best 6 Platforms For Day Trading In Canada

After evaluating hundreds of online platforms, these are the top 6 brokers for day trading in Canada:

-

1

FXCC

FXCC -

2

IC Markets

IC Markets -

3

Eightcap71% of retail traders lose money when trading CFDs

Eightcap71% of retail traders lose money when trading CFDs -

4

Fusion Markets

Fusion Markets -

5

Qtrade

Qtrade -

6

AvaTrade

AvaTrade

Here is a summary of why we recommend these brokers in February 2026:

- FXCC - FXCC is an established broker that’s been offering low-cost online trading since 2010. Registered in Nevis and regulated by the CySEC, it stands out for its ECN trading conditions, no minimum deposit and smooth account opening that takes less than 5 minutes.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- Eightcap - Eightcap is a multi-regulated forex and CFD broker established in Australia in 2009. The broker has proven popular with active day traders, providing 800+ instruments with tight spreads and notable improvements in recent years, integrating the leading TradingView platform, alongside AI-powered financial calendars and algo trading tools with zero coding experience required.

- Fusion Markets - Fusion Markets is an online broker established in 2017 and regulated by the ASIC, VFSC and FSA. It is best known for its low-cost forex and CFD trading, although its multiple account types and copy trading solutions cater to a range of traders. New clients can sign up and start trading in 3 easy steps.

- Qtrade - Qtrade is an award-winning Canadian financial services firm that offers a selection of investing accounts with $8.75 and $6.95 stocks, mutual fund trades and 100+ commission-free ETFs. This is a long-running brand that is well regarded in Canada, where many investors choose it to build their savings account or pension pot. QTrade is also highly trusted and authorized by the Canadian Investment Regulatory Organization (CIRO).

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

Best Day Trading Platforms and Brokers in Canada 2026 Comparison

| Broker | CAD Account | CIRO Regulated | Minimum Deposit | Markets | Platforms | Leverage |

|---|---|---|---|---|---|---|

| FXCC | - | - | $0 | CFDs, Forex, Indices, Commodities, Crypto | MT4, MT5 | 1:500 |

| IC Markets | ✔ | - | $200 | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Eightcap | ✔ | - | $100 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | MT4, MT5, TradingView | 1:500 |

| Fusion Markets | ✔ | - | $0 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | MT4, MT5, cTrader, TradingView, DupliTrade | 1:500 |

| Qtrade | ✔ | ✔ | $0 | Stocks, ETFs, Bonds, Mutual Funds, Options, GICs | TradingCentral | - |

| AvaTrade | ✔ | ✔ | $300 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade | 1:30 (Retail) 1:400 (Pro) |

FXCC

"FXCC continues to prove itself an excellent option for forex day traders with an extensive range of 70+ currency pairs, ultra-tight spreads from 0.0 pips during testing, and high leverage up to 1:500 in the ECN XL account. "

Jemma Grist, Reviewer

FXCC Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Indices, Commodities, Crypto |

| Regulator | CySEC |

| Platforms | MT4, MT5 |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP |

Pros

- There are no restrictions on short-term trading strategies like day trading and scalping

- There are no deposit fees except industry-standard mining charges on cryptos, which is advantageous for active traders

- FXCC has added MT5, and in our hands-on tests, it matched MT4’s trading conditions with fast execution, enhanced charting, and depth of market tools.

Cons

- There is a threadbare selection of research tools like Trading Central and Autochartist, value-add features available at category leaders like IG

- High withdrawal fees may catch out unsuspecting traders, including a significant $45 charge for bank wire payments

- FXCC’s MetaTrader-only offering is a drawback compared to many alternatives, notably AvaTrade which provides five platforms to suit different trader preferences

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, CMA, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

- IC Markets secured DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its seamless, industry-leading MetaTrader integration, refined over years to maximize the platform experience.

- IC Markets offers fast and dependable 24/5 support based on firsthand experience, particularly when it comes to accounts and funding issues.

Cons

- There are fees for certain withdrawal methods, including a $20 wire charge, which can eat into profits, especially for frequent withdrawals.

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

Eightcap

"Eightcap delivers in every area for day traders with a growing selection of charting platforms, education via Labs, and AI-powered tools. Now sporting 120+ crypto CFDs, it's also become a stand-out choice for crypto trading, winning our 'Best Crypto Broker' award two years in a row."

Christian Harris, Reviewer

Eightcap Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, FCA, CySEC, SCB |

| Platforms | MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SGD |

Pros

- Having excelled across all key areas for day traders, Eightcap outperformed every competitor to win our 'Best Overall Broker' award for 2024, also securing our 'Best Crypto Broker' title for 2025 and 'Best TradingView Broker' for 2025.

- After bolstering its roster in 2021, Eightcap offers one of the most extensive selections of cryptocurrency CFDs in the market, with crypto/fiat pairs, crypto/crypto pairs, plus crypto indices for broader exposure to the market.

- Eightcap stands out with a selection of powerful trading tools and resources, including MT4 and MT5, and more recently the 100-million strong social trading network TradingView.

Cons

- Despite a useful library of educational guides and e-books in Labs, Eightcap still trails IG’s comprehensive toolkit for aspiring traders with its dedicated IG Academy app and 18 course categories.

- The demo account expires after 30 days and can only be extended upon request - a notable inconvenience compared to the likes of XM with its unlimited demo mode.

- Eightcap needs to continue bolstering its suite of 800+ instruments to match category leaders like Blackbull Markets with its 26,000+ assets, featuring a particularly weak selection of commodities.

Fusion Markets

"Fusion Markets is a standout option for forex traders looking for excellent pricing with spreads near zero, industry-low commissions and recently TradingView integration. It’s a particularly good broker for Australian traders where the company is headquartered and regulated by the ASIC."

Jemma Grist, Reviewer

Fusion Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, VFSC, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, DupliTrade |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Fusion Markets is set up to support algo traders with a sponsored VPS solution and a 25% discount if you opt for the NYC Servers VPS for MT4 or cTrader.

- Fusion Markets continues to impress with its pricing that provides tight spreads with below-average commissions that will appeal to active day traders.

- The market analysis features, Market Buzz and Analyst Views, are great tools for discovering opportunities and conveniently integrated into the client dashboard.

Cons

- There is no proprietary trading platform or app built with beginners in mind, a notable drawback compared to AvaTrade.

- While the selection of currency pairs trumps most rivals, the broker's alternative investment offering is average with no stock CFDs beyond the US.

- The demo account expires after 30 days, limiting its potential as a useful trading tool alongside a real-money account.

Qtrade

"Qtrade is a good match for Canadian traders who are looking for a reputable and regulated broker to make longer-term investments as well as leveraged trades."

William Berg, Reviewer

Qtrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, ETFs, Bonds, Mutual Funds, Options, GICs |

| Regulator | CIRO |

| Platforms | TradingCentral |

| Minimum Deposit | $0 |

| Minimum Trade | Variable |

| Account Currencies | USD, CAD |

Pros

- Qtrade’s new Options Lab, built with Trading Central provides trading ideas that match your goals, risk level, and experience - head to Investment Tools > Options Lab.

- Qtrade has teamed up with PersonaFin to launch “My News” - an AI-powered, personalized newsfeed built around your interests. Get timely insights from premium sources, discover trending topics fast, and explore smarter with AI-driven search.

- Alongside 100+ commission-free ETFs, Qtrade has slashed its options fees, now coming in at $0.75 per options contract (down from $1.00).

Cons

- Commissions of $8.75 per equity can stack up for active stock traders, reducing its suitability for day traders.

- The transfer out fee is a nuisance and traders should be wary of the CAD to USD exchange charge.

- Although Qtrade has added support for Interac e-Transfer, it still offers relatively limited funding options with no credit/debit card deposits.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Minimum Deposit | $300 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

Cons

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

How To Choose A Day Trading Broker In Canada

Based on our extensive experience in the industry, there are several factors to consider before registering with a day trading broker:

Choose A Regulated And Trusted Platform

Choosing a trusted brokerage will ensure you are protected from unfair trading practices and scams, some of which have been prevalent in Canada.

One example is the Alberta couple who operated a fake investment company and defrauded victims out of $1.3 million. Fernando Honorate de Silva Fagundes and his wife, Emilia Alas-As Elansin, used a phoney investment course to lure victims based in Alberta and British Columbia.

We therefore always check whether brokers are regulated by trusted authorities, such as the Canadian Investment Regulatory Organization (CIRO), which subject firms to strict monitoring and audit procedures.

We also look out for a long track record, a strong reputation and positive client reviews, especially in cases where a CIRO license isn’t present.

- Interactive Brokers continues to lead as one of the most heavily regulated firms that accept Canadian day traders. The broker has a long 40+ year history and is licensed by the CIRO, among other Green Tier authorities.

Choose A Broker With Competitive Day Trading Fees

It’s important to choose a broker with low trading and non-trading fees. Active day traders, in particular, are likely to accrue more transaction costs which can eat into profits.

We ensure that brokers offer competitive pricing for traders, including low spreads on popular assets like USD/CAD as well as non-trading fees like deposit and withdrawal charges.

In cases where higher costs are incurred, we consider the overall quality of the broker’s services along with the day trading tools provided to justify such expenses.

- Forex.com is one of the lowest-cost brokers based on our extensive testing, with forex spreads as low as 2.2 pips on USD/CAD, plus zero commissions and no deposit or withdrawal fees.

Choose A Broker With High-Quality Charting Platforms

Trading on a stable and reliable charting platform is key for day traders who typically require a range of technical tools for uncovering short-term market opportunities.

During our hands-on tests, we look out for high-quality and varied analysis tools suitable for all trading styles and experience levels. A selection of basic technical indicators such as moving averages, as well as more sophisticated solutions such as Ichimoku Cloud, will serve both beginners and seasoned analysts.

- Forex.com maintains its position as a top day trading broker, thanks to the availability of feature-rich charting platforms, MT4 and TradingView, plus additional tools for varied requirements, including Trading Central and SMART Signals.

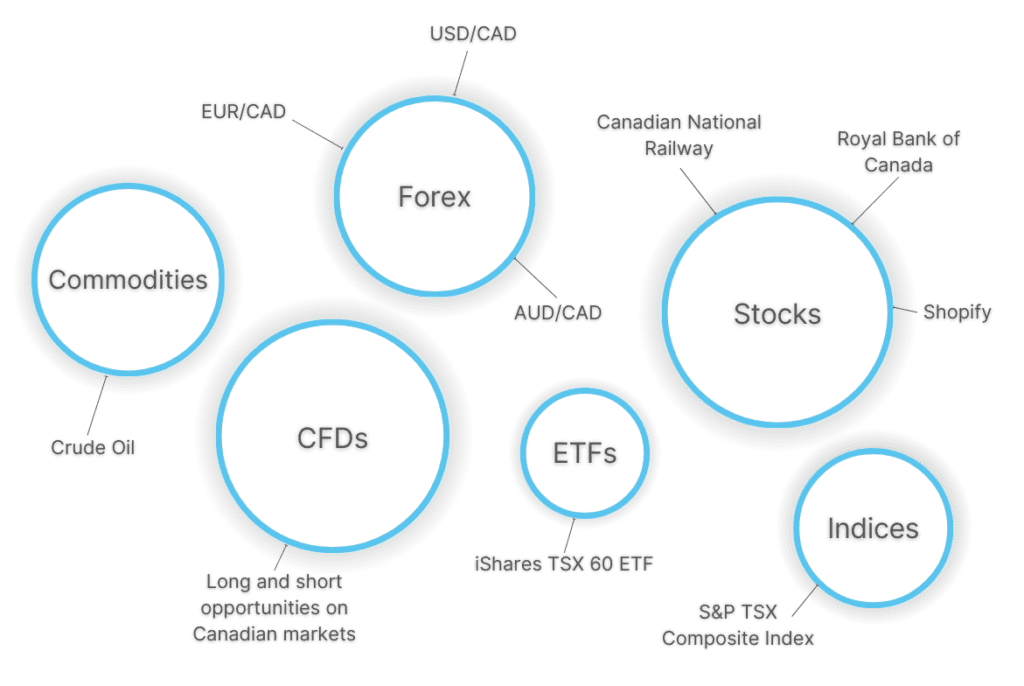

Choose A Broker With Diverse Market Coverage

The best online brokers in Canada offer access to a generous range of markets, including popular assets like USD/CAD, EUR/CAD or the Toronto Stock Exchange (TSX).

Most day traders aim to build a diversified trading portfolio, so we look for traditional short-term assets, alongside emerging investments that are popular in Canada, such as Cannabis stocks.

We also assess the availability of specific short-term trading vehicles, including contracts for difference (CFDs) which allow you to speculate on rising and falling prices without owning the underlying security.

- Interactive Brokers continues to offer an unmatched range of assets, with thousands of instruments from over 100 global market centers, including the Canadian Securities Exchange (CSE).

Choose A Broker With High-Quality Order Execution

Registering with a broker that delivers fast execution is vital for day trading strategies. Intraday traders require optimum conditions to secure the best chances of success, which means no latency or slippage.

The best brokers in Canada will ideally meet our execution speed benchmark of <100 milliseconds and deliver a high rate of order fulfilment.

Bear in mind that other factors can also affect execution quality, including the order size and the type of asset being traded.

For example, a large order may take more time to fill. Conversely, more liquid assets are typically easier to execute at favorable prices.

Choose A Broker That Supports Leverage And Margin Trading

Leverage trading allows you to boost your earnings with only a small initial outlay. Choosing a broker that offers sensible and flexible leverage is important for experienced day traders looking to increase their purchasing power.

For example, a broker may offer you 1:50 leverage (or 2% margin requirement) on the USD/CAD forex pair, which means if you deposit an initial sum of $1000, you have $50,000 to trade with.

However, it’s important to remember that your risk of losses also increases, so a solid risk management strategy is key. It’s also worth checking your broker’s individual margin rules.

- AvaTrade is a leading day trading platform offering transparent margin requirements. For example, the USD/CAD pair is offered with a 1.5% margin.

Choose A Broker With An Accessible Minimum Deposit

Choosing a broker with an accessible minimum deposit will ensure that you can start trading in line with your budget and financial situation. This is particularly vital for beginners with limited trading capital.

Most Canadian brokers require an initial deposit of <$500, though many of the brokers that we’ve personally tested go even lower.

- AvaTrade is a great option for Canadians since it offers a CAD account with an accessible starting deposit of 300 CAD.

Methodology

To find the best day trading platforms in Canada, we used both quantitative data and qualitative insights from our rigorous broker reviews, focusing on several factors:

- We confirmed that the broker accepts Canadian day traders.

- We checked whether the brokerage is regulated by a trusted authority, such as the CIRO.

- We prioritized brokers with competitive day trading fees.

- We favored brokers that deliver high-quality charting tools for short-term strategies.

- We checked for a wide range of assets and prioritized those with access to Canadian markets.

- We paid attention to the broker’s execution quality, including speeds and pricing.

- We focused on brokers with transparent margin and leverage requirements.

- We ensured all day trading platforms offer an accessible minimum deposit.

FAQ

Which Day Trading Brokers Accept Clients From Canada?

You can refer to our list of the best day trading brokers in Canada, many of which hold several top-tier licenses, including from the CIRO, and offer a range of assets popular in Canada.

How Much Capital Do I Need To Start Day Trading In Canada?

Most platforms that accept Canadian clients require a first deposit between $0 and $500.

We recommend that beginners opt for a low minimum deposit broker and trade only in small amounts to start with.

Who Regulates Day Trading Brokers In Canada?

The Canadian Investment Regulatory Organization (CIRO) is the authority responsible for licensing investment firms in Canada.

The CIRO works closely with Canada’s provincial umbrella organization, the Canadian Securities Administrators (CSA), which oversees the regulation of capital markets in the 10 provinces and 3 territories of Canada.

You can check your broker’s details on both the CSA and the CIRO registers.

Recommended Reading

Article Sources

- Canadian Investment Regulatory Organization (CIRO)

- Canadian Securities Administrators (CSA)

- Canadian Securities Exchange (CSE)

- Toronto Stock Exchange (TSX)

- Canadian Trading Scam

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com