Brokers With SAR Accounts

A Saudi riyal (SAR) trading account is denominated in Saudi Arabia’s currency. For Saudi traders, they offer straightforward account management while allowing you to store trading capital in a relatively stable, USD-pegged currency.

Discover our choice of the best brokers with SAR accounts, personally tested by our experts.

Best Brokers With SAR Accounts

Our evaluations show that these are the top 4 trading platforms that accept SAR accounts:

Here is a short overview of each broker's pros and cons

- Dukascopy - Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- OKX - OKX is a respected cryptocurrency firm, established in 2017, that offers a large suite of products, from mining pools to NFTs. Traders can access over 400 crypto tokens via OTC trading and derivatives. With an excellent web platform, developer tools and dynamic charts, OKX is a popular choice for technical traders.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

Brokers With SAR Accounts Comparison

| Broker | SAR Account | Minimum Deposit | Markets | Regulator |

|---|---|---|---|---|

| Dukascopy | ✔ | $100 | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | FINMA, JFSA, FCMC |

| Exness | ✔ | $10 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | CySEC, FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| OKX | ✔ | 10 USDT | Spot, futures, perpetual swaps, options | VARA |

| Swissquote | ✔ | $1,000 | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA |

Dukascopy

"If you’re an experienced trader, Dukascopy provides the tools you need: JForex for algorithmic strategies, competitive spreads from 0.1 pips, leverage up to 1:200, and the peace of mind of using a Swiss-regulated bank and broker."

Christian Harris, Reviewer

Dukascopy Quick Facts

| Bonus Offer | 10% Equity Bonus |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Regulator | FINMA, JFSA, FCMC |

| Platforms | JForex, MT4, MT5 |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:200 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, ZAR, TRY, SEK, NOK, DKK, CHF, HKD, SGD, PLN, CZK, AED, SAR, HUF, MXN |

Pros

- The proprietary JForex platform is highly advanced, offering tools for algorithmic trading, extensive charting, and access to deep liquidity for short-term traders.

- Dukascopy offers tight spreads starting from 0.1 pips, leverage up to 1:200 (depending on the jurisdiction), and volume-based commissions that reward high-frequency traders.

- Dukascopy is regulated by the Swiss Financial Market Supervisory Authority (FINMA) as both a broker and a bank, ensuring top-tier financial security and adherence to strict standards.

Cons

- Dukascopy's withdrawal fees are higher than most competitors we’ve tested, particularly for bank wire transfers, which may deter traders who require frequent access to their funds.

- While JForex is feature-rich, it has a steep learning curve, making it less suitable for beginner traders who might prefer simpler platforms.

- Some account types, such as the MT4/MT5 accounts, require a higher minimum deposit of $1,000, which may not be ideal for traders with smaller budgets.

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | CySEC, FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, DKK, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Fast and dependable 24/7 multilingual customer support via telephone, email and live chat based on hands-on tests.

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

- Highly competitive spreads, reduced for USOIL and BTCUSD in 2024, are available from 0 pips with low commissions from $2 per side.

Cons

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

- Retail trading services are unavailable in certain jurisdictions, such as the US and the UK, limiting accessibility compared to top-tier brokers like Interactive Brokers.

OKX

"OKX is a top pick for crypto traders looking for emerging coins and crypto projects to invest in. Traders can also make use of the broker's copy trading service and automated bots."

William Berg, Reviewer

OKX Quick Facts

| Bonus Offer | $10 in BTC |

|---|---|

| Demo Account | Yes |

| Instruments | Spot, futures, perpetual swaps, options |

| Regulator | VARA |

| Platforms | AlgoTrader, Quantower |

| Minimum Deposit | 10 USDT |

| Minimum Trade | Variable |

| Account Currencies | USD, EUR, GBP, INR, JPY, SGD, RUB, AED, SAR |

Pros

- There's a vast developer lab plus access to a marketplace of pre-built trading bots with auto-arbitrage

- In 2025, OKX secured a MiFID II license, enabling it to offer regulated derivatives products across Europe, providing peace of mind

- Active traders can expect competitive maker and taker fees, from 0.02% and 0.05%, respectively

Cons

- The firm offers limited regulatory oversight, though this is common among crypto brokers

- The broker's platform and features may be complex for novices

- The quality of customer support was inconsistent based on testing

Swissquote

"Swissquote is an excellent choice for active traders looking for a customizable platform, such as its CXFD, which integrates Autochartist for automated chart analysis to aid trading decisions. However, its average fees and steep $1,000 minimum deposit might make it less accessible for beginner traders."

Christian Harris, Reviewer

Swissquote Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) |

| Regulator | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA |

| Platforms | CFXD, MT4, MT5, AutoChartist, TradingCentral |

| Minimum Deposit | $1,000 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:100 (Retail), 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, ZAR, TRY, SEK, NOK, CHF, HKD, SGD, PLN, AED, SAR, HUF, THB, QAR, MXN |

Pros

- Swissquote supports powerful platforms for day trading, such as MetaTrader 4/5 and its own CFXD (previously known as Advanced Trader) which impressed during testing with customizable layouts and access to advanced charting tools and technical indicators.

- Swissquote is built for fast-paced trading strategies like day trading, scalping and high-frequency trading with 9ms average execution speeds, a 98% fill ratio, and FIX API.

- Swissquote provides advanced research services like Autochartist for technical analysis and integration of real-time news from Dow Jones. Its proprietary Market Talk videos and Morning News reports deliver expert analysis daily, appealing to active traders.

Cons

- Unlike brokers such as eToro with social trading features, Swissquote lacks tools for community engagement or copying successful traders, limiting its appeal for those who value peer-to-peer learning.

- Analysis shows Swissquote’s fees are on the high side, with forex spreads starting at 1.3 pips on Standard accounts, compared to 0.0 pips at brokers like Pepperstone or IC Markets. Transaction fees for non-Swiss stocks and ETFs can also add up for frequent traders.

- Swissquote primarily caters to pro and high-net-worth clients, with high minimum deposit requirements (eg $1,000 for Standard accounts), making it less suited for smaller traders who can find higher leverage at the growing number of brokers with no minimum deposit.

How Did We Choose The Best Brokers?

To uncover the best trading platforms with SAR accounts we:

- Examined our 223-strong database of online trading platforms and brokers

- Focused on all those that offer an account denominated in Saudi riyals

- Ranked them by their overall rating, derived from 100+ data points and hands-on tests

What Is An SAR Account?

An SAR account is a trading account where the balance, trades and funding transactions are handled in Saudi riyals.

Since your cash and traded assets are displayed in SAR, you can easily manage your profit and loss statements in your home currency.

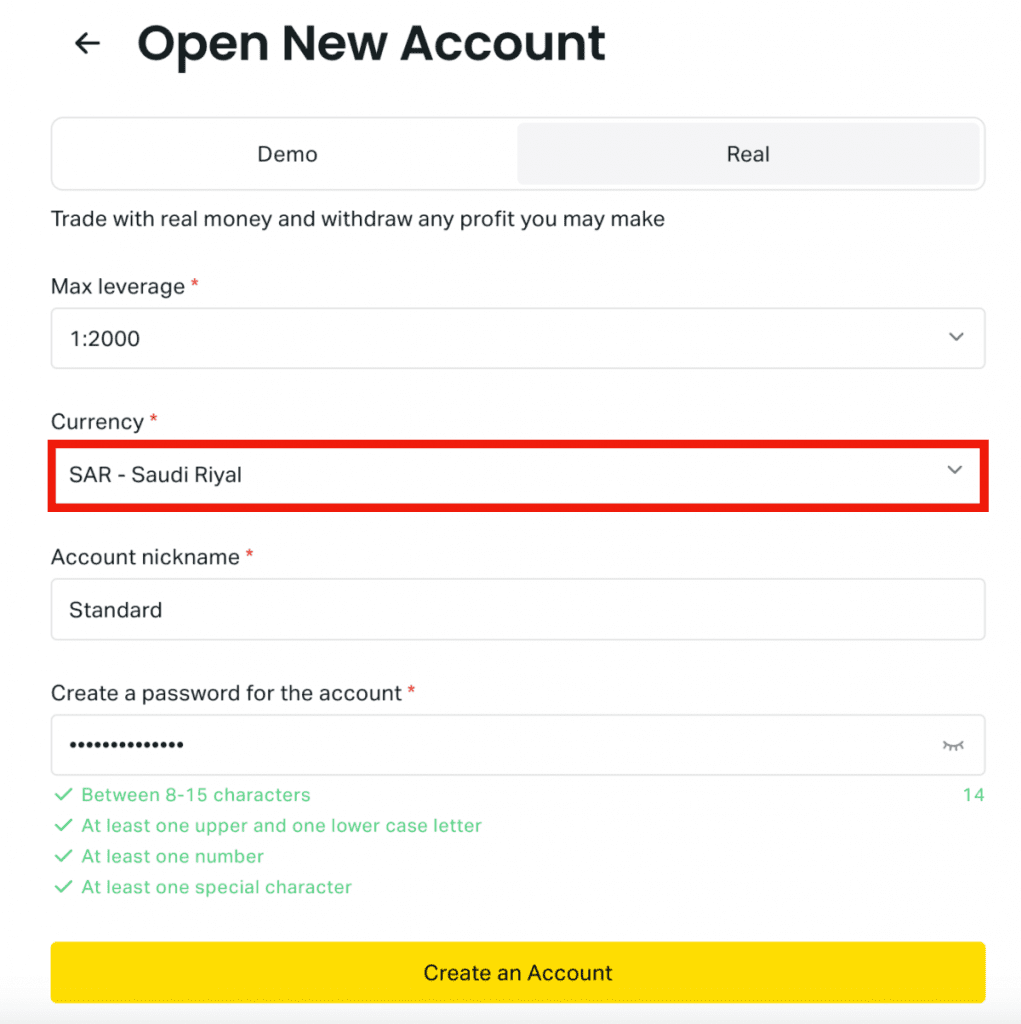

Below you can see an example where I opened an SAR account with Exness:

Do I Need An SAR Trading Account?

An SAR account may be suitable if:

- You live in Saudi Arabia and hold or save money in SAR because it’s more cost-efficient to hold an account in your local currency.

- You frequently trade regional markets like Middle Eastern oil company stocks, since the SAR is strongly aligned with oil prices.

- You are an overseas trader seeking to diversify your portfolio by holding capital in a relatively strong US-pegged currency.

How Can I Check If A Broker Offers An Account In Saudi Riyals?

You can follow these straightforward steps which we also took to ensure our recommended platform offers a SAR account:

- Navigate to the account types page on the broker’s website to find the selection of base currencies.

- Check that ‘SAR’ is available as a supported currency in Saudi Arabia.

- Register for an account and choose ‘SAR’ as your base currency.

Pros & Cons Of SAR Trading Accounts

Pros

- SAR accounts are subject to fewer or no currency conversion fees for Saudi clients – a notable advantage for active traders who carry out frequent transactions.

- The Saudi riyal’s peg to the US dollar and the nation’s control over global oil reserves means that the SAR remains relatively stable and can offer a degree of protection against exchange rate volatility.

- We’ve found brokers with SAR accounts often tailor their services to Saudi traders, for example, by providing local customer support and Islamic accounts (both available at Exness).

Cons

- SAR accounts are still uncommon and only account for less than 1% of brokers that we’ve evaluated, giving you a much smaller choice of high-quality trading platforms to choose from.

- Our experience shows that stocks listed on the Tadawul Saudi Stock Exchange are not widely available at most brokers – a notable drawback for Saudi traders looking to trade domestic equities in a SAR-based trading account.

- Trading other international assets, such as US stocks, may be subject to conversion fees if your account is in SAR. IG, for example, charges 0.8%.

FAQ

Which Is The Best Broker With An SAR Account?

You can refer to our ranking of the best trading platforms with SAR accounts, which have been thoroughly tested by our experts.

How Much Does It Cost To Open A Trading Account Based In Saudi Riyals?

Based on our tests, you will need up to 250 USD (approximately 937 SAR) to open a live trading account. That said, many beginner-friendly brokers require much less, including Exness with just 10 USD (around 37 SAR).

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com